This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

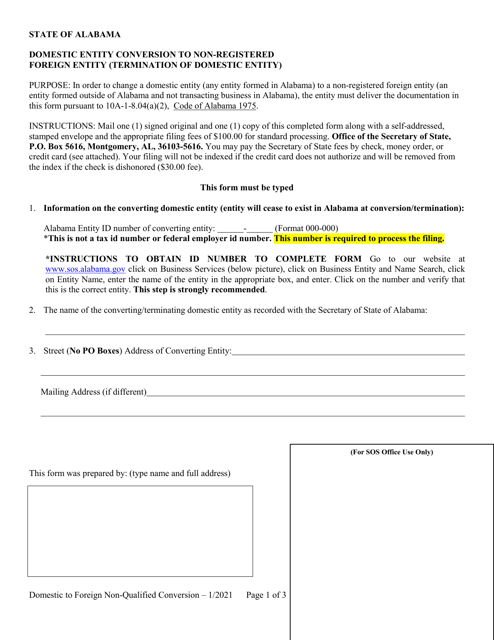

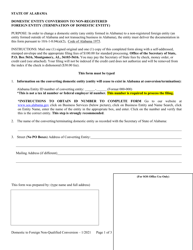

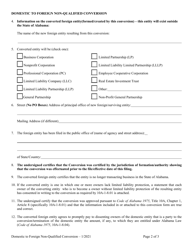

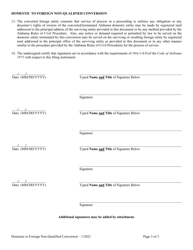

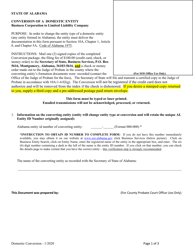

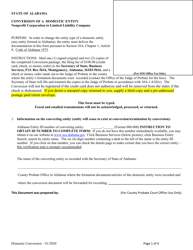

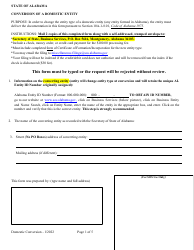

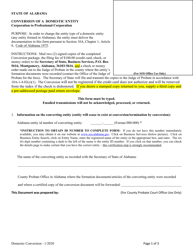

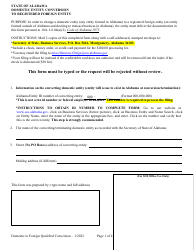

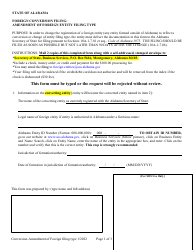

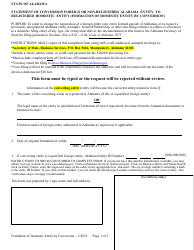

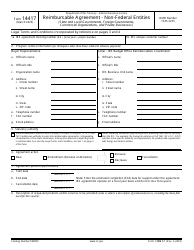

Domestic Entity Conversion to Non-registered Foreign Entity (Termination of Domestic Entity) - Alabama

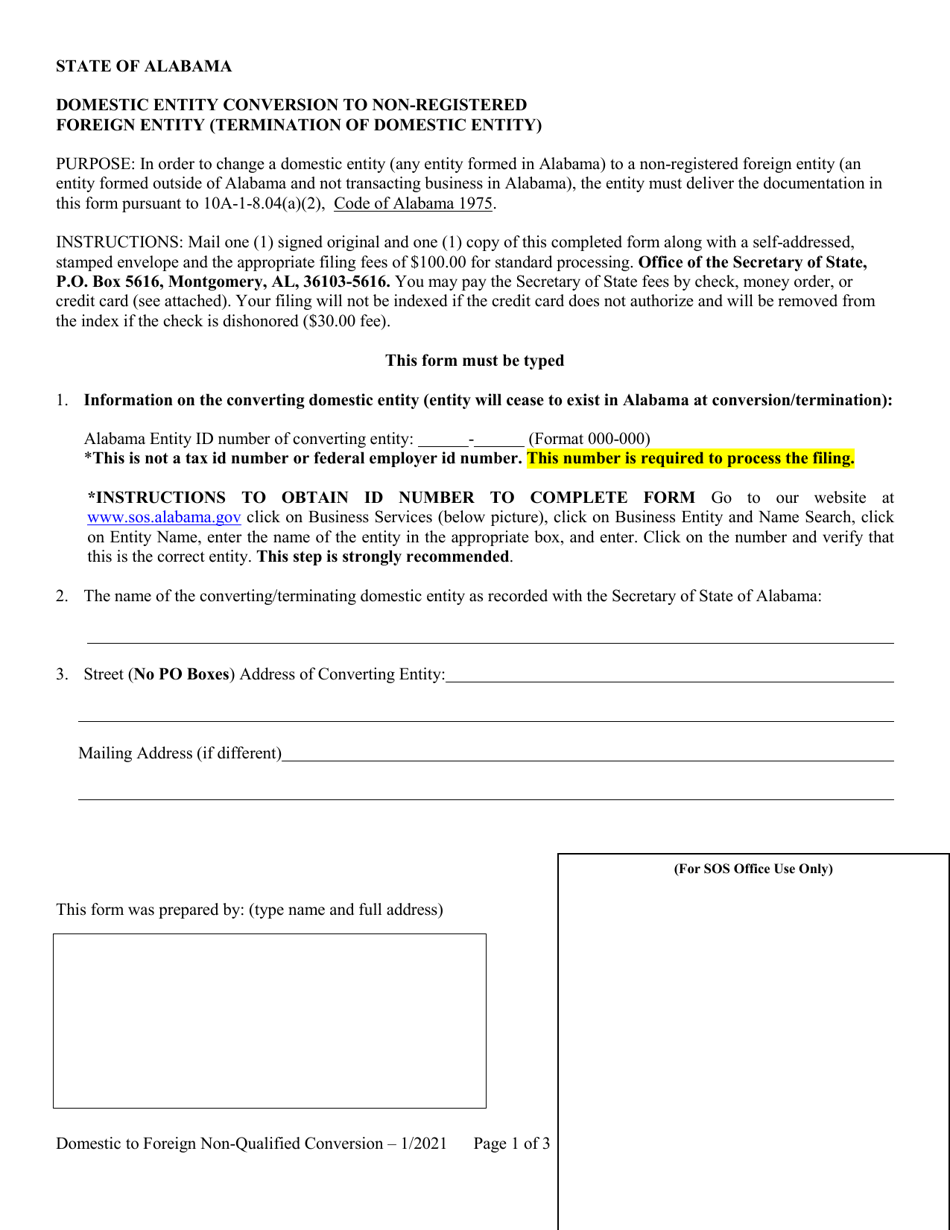

Domestic Entity Conversion to Non-registered Foreign Entity (Termination of Domestic Entity) is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is Domestic Entity Conversion to Non-registered Foreign Entity?

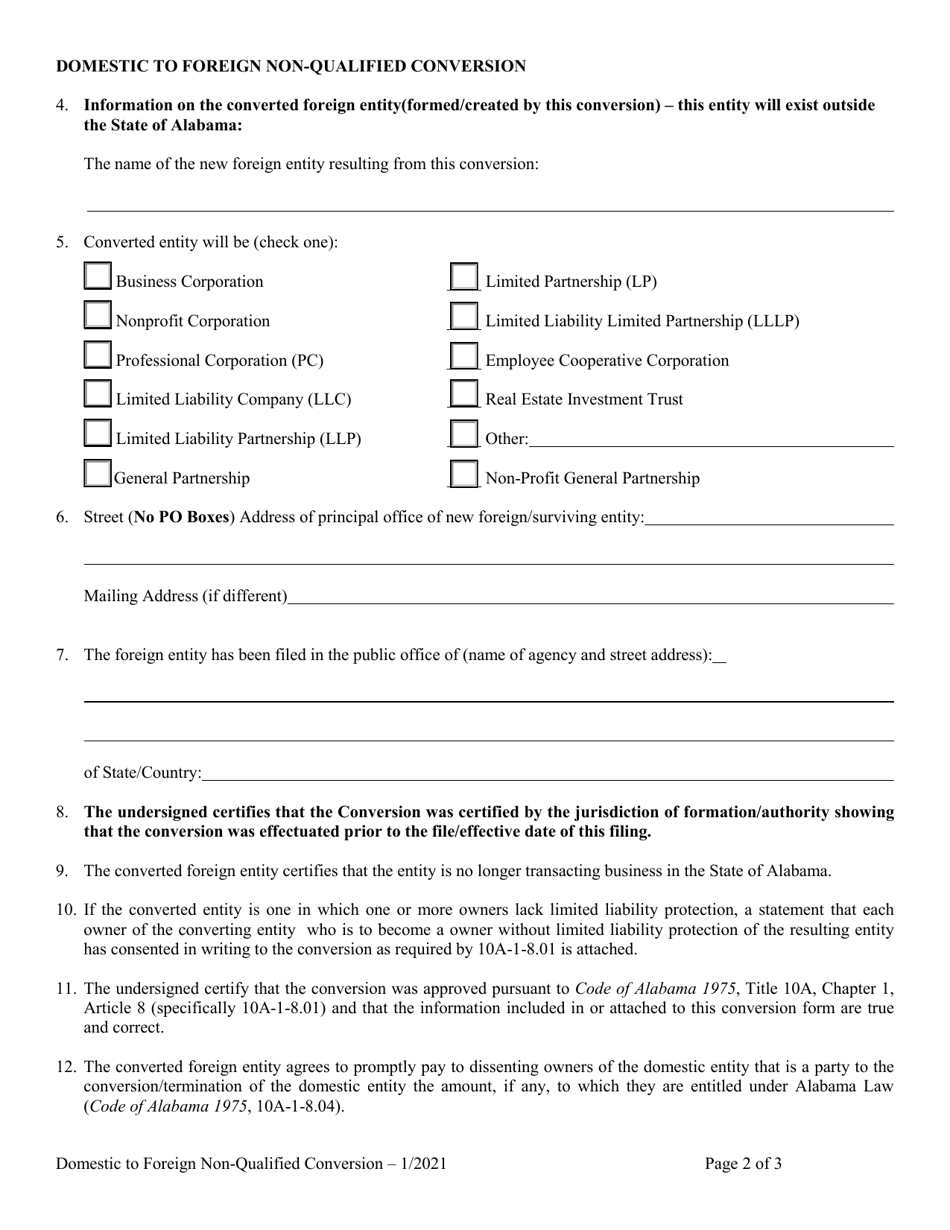

A: It is the process of converting a domestic business entity in Alabama into a non-registered foreign entity.

Q: Why would a domestic entity want to convert to a non-registered foreign entity?

A: There could be various reasons such as expanding operations into other states or countries, accessing international markets, or taking advantage of different tax structures.

Q: What is the process for converting a domestic entity to a non-registered foreign entity in Alabama?

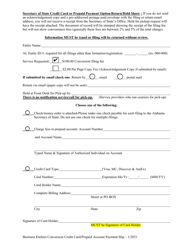

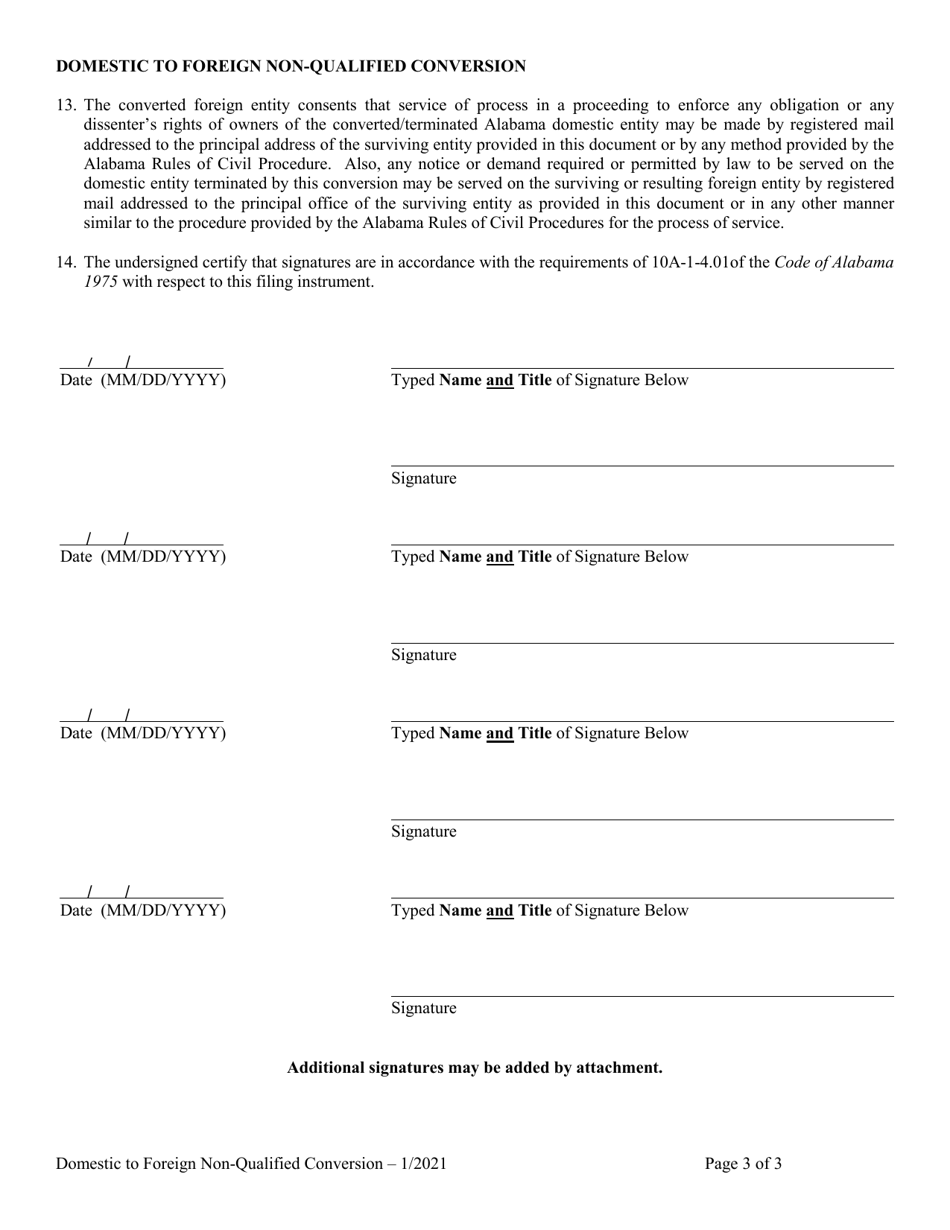

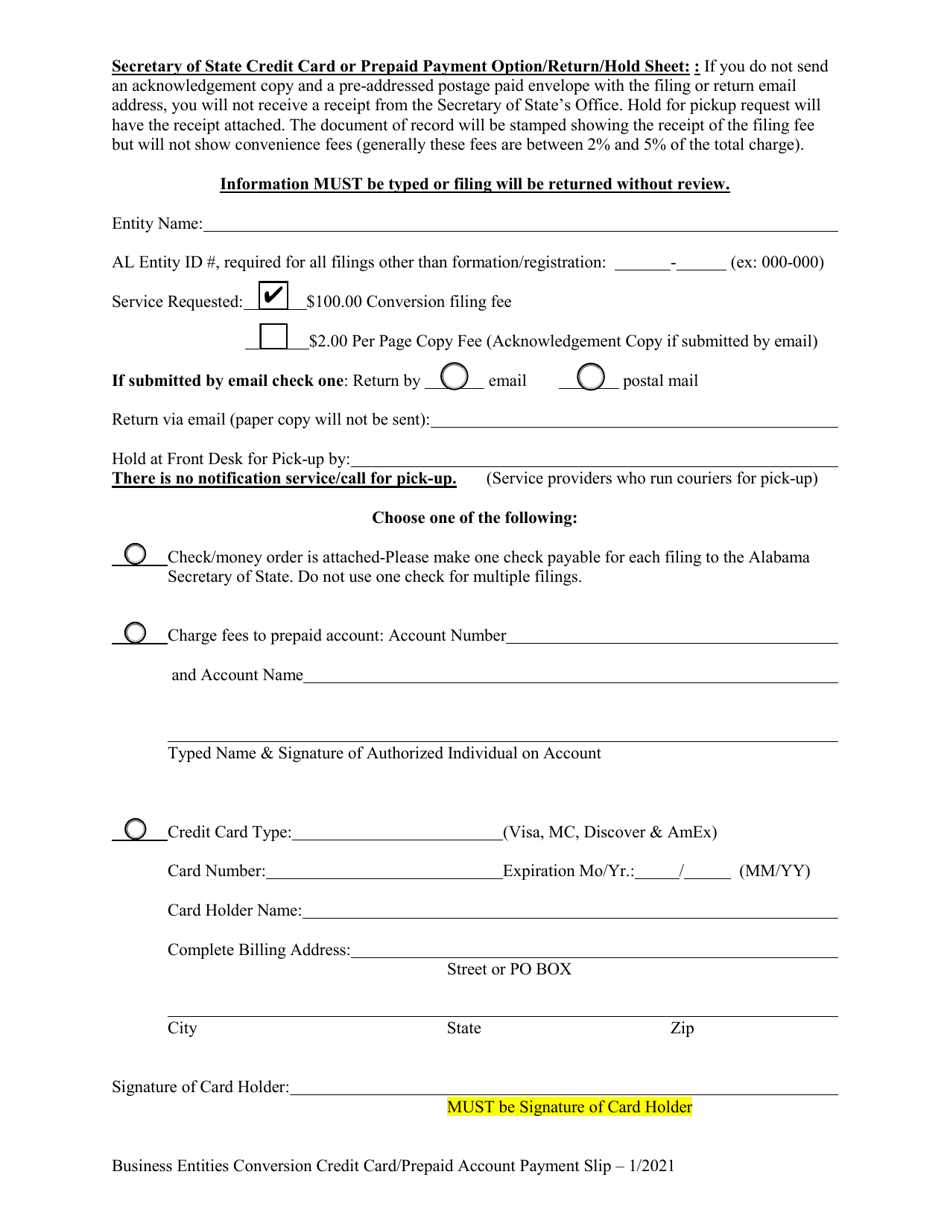

A: The specific process may vary, but generally, it involves filing a conversion document with the Alabama Secretary of State and complying with any additional requirements or fees.

Q: What are the implications of converting to a non-registered foreign entity?

A: The domestic entity will no longer be registered in Alabama and may be subject to the laws and regulations of the foreign jurisdiction it is converting to.

Q: Can a non-registered foreign entity still conduct business in Alabama?

A: No, a non-registered foreign entity cannot conduct business in Alabama unless it registers as a foreign entity and complies with the state's requirements for foreign entities.

Q: Are there any tax implications or considerations when converting to a non-registered foreign entity?

A: Yes, converting to a non-registered foreign entity may have tax implications, and it is advisable to consult with a tax professional or an attorney to understand the specific implications for your situation.

Form Details:

- Released on January 1, 2021;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.