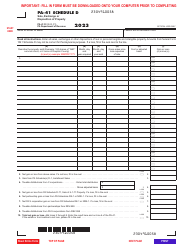

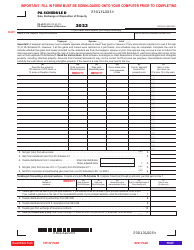

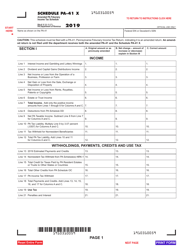

This version of the form is not currently in use and is provided for reference only. Download this version of

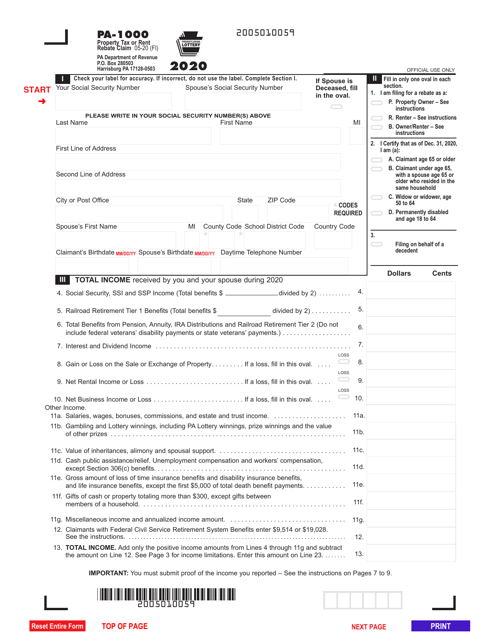

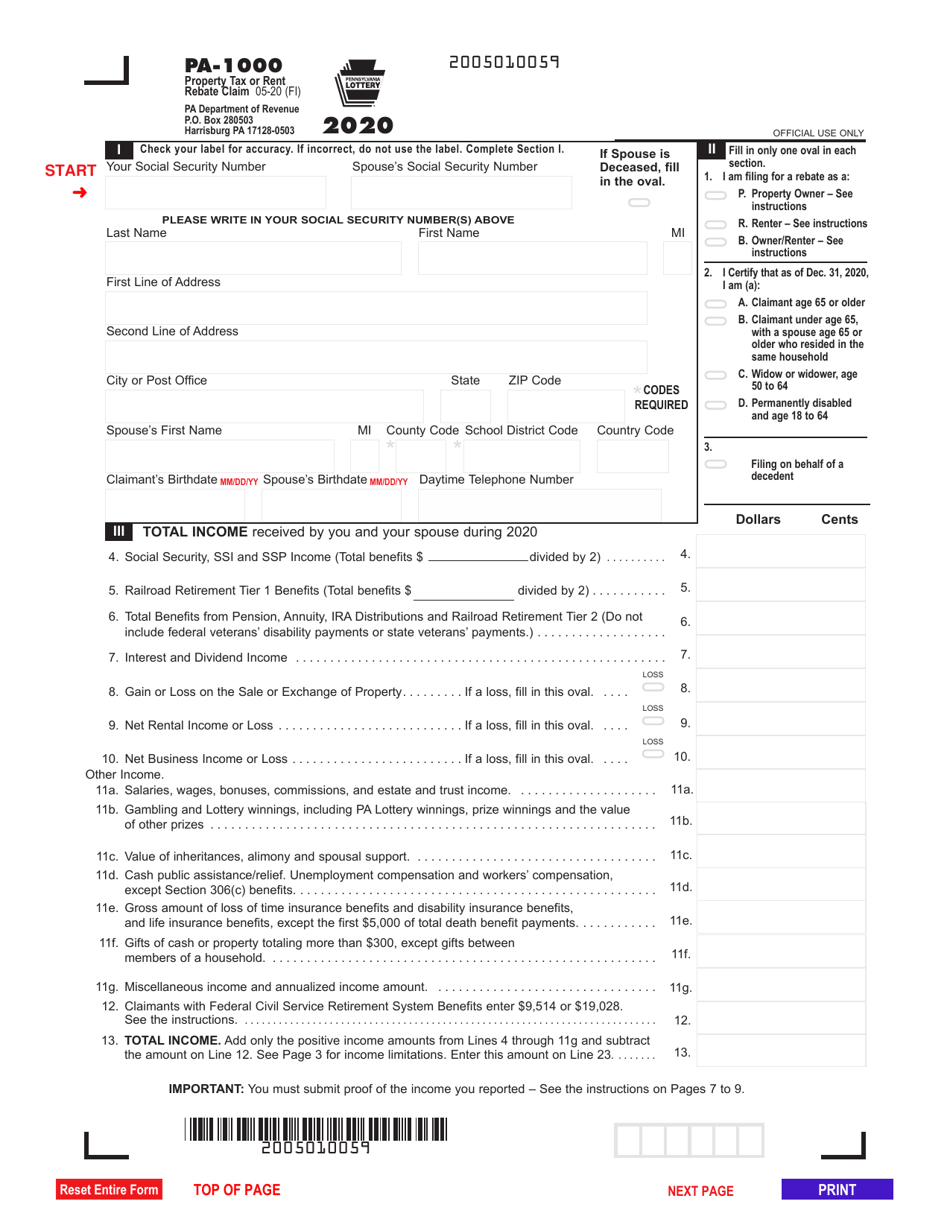

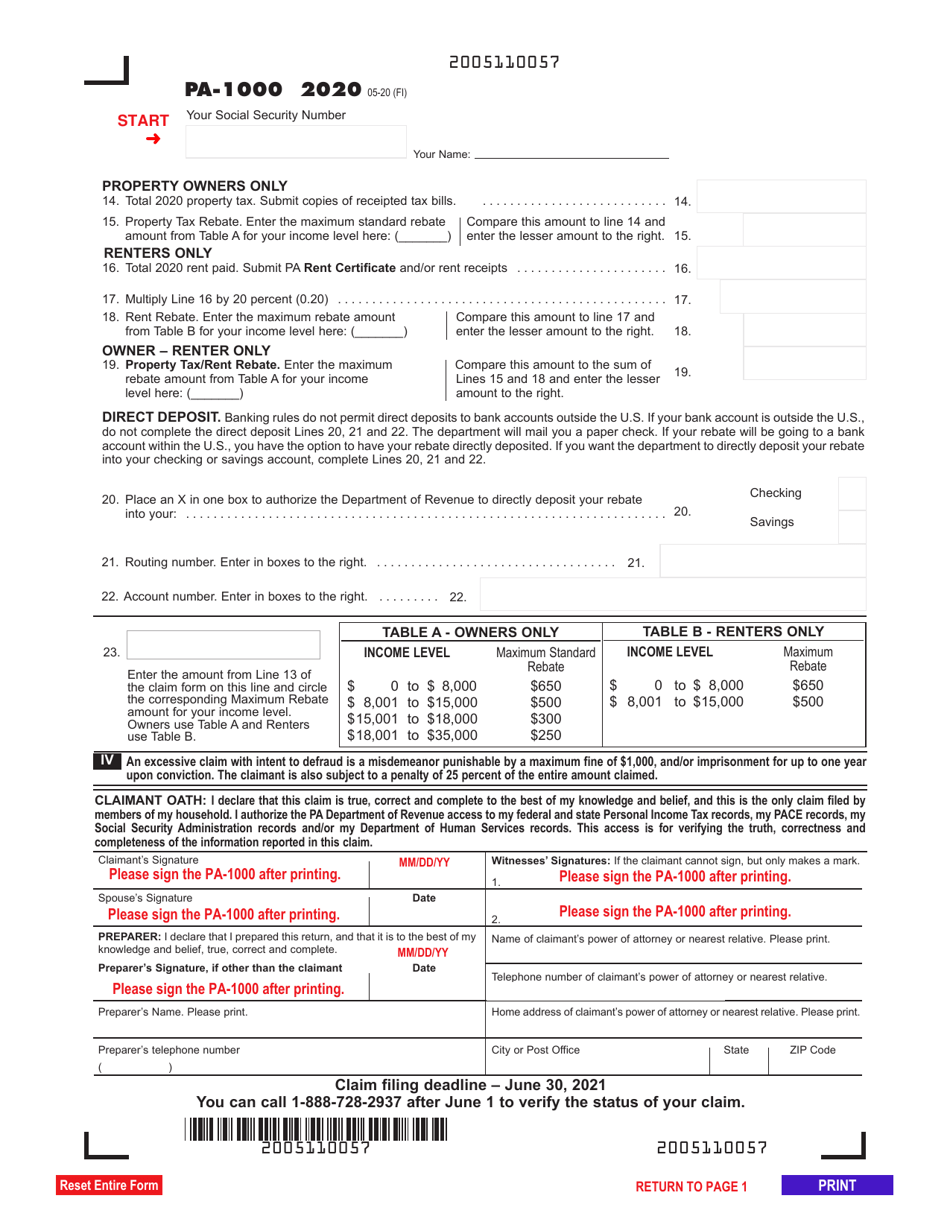

Form PA-1000

for the current year.

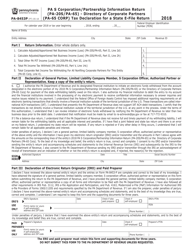

Form PA-1000 Property Tax or Rent Rebate Claim - Pennsylvania

What Is Form PA-1000?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PA-1000 Property Tax or Rent Rebate Claim?

A: The PA-1000 is a form used in Pennsylvania to apply for property tax or rent rebates.

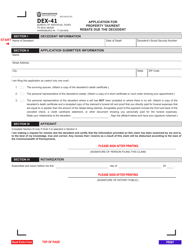

Q: Who is eligible to file a PA-1000 claim?

A: Eligibility requirements vary, but generally, homeowners or renters with low to moderate income and who meet age or disability criteria are eligible.

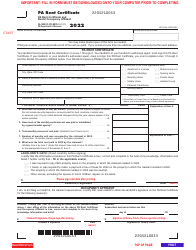

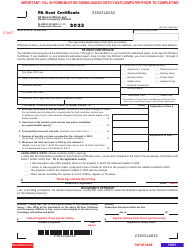

Q: What information do I need to complete the PA-1000 form?

A: You will need to provide your personal information, income details, property or rental information, and documentation supporting your claim.

Q: When is the deadline to file the PA-1000 claim?

A: The deadline to file the PA-1000 claim is typically June 30th of the year following the tax year for which you are claiming the rebate.

Q: How long does it take to receive a rebate?

A: It can take several weeks or months to process and issue rebates, depending on the volume of claims received by the Pennsylvania Department of Revenue.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-1000 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.