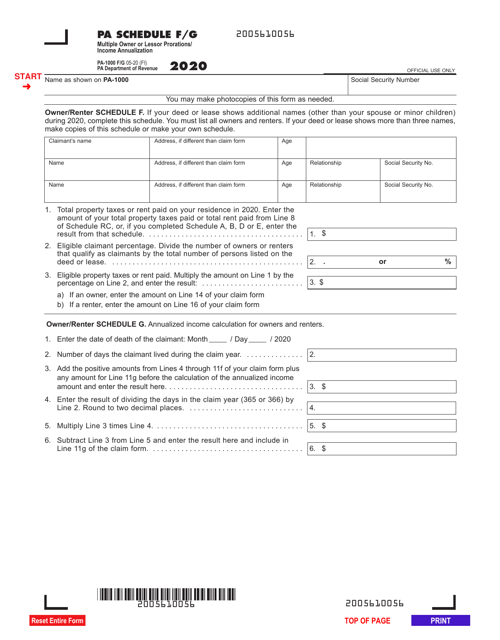

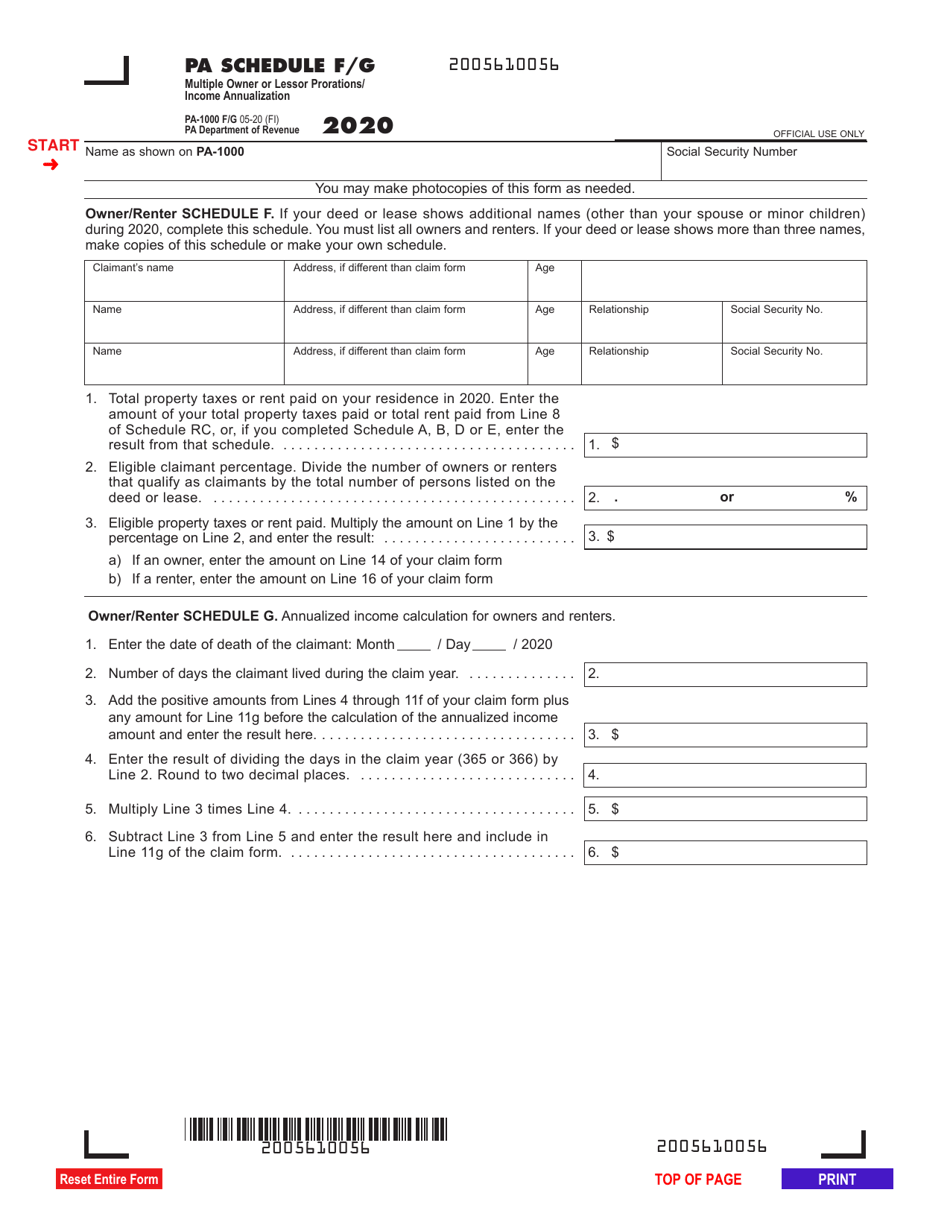

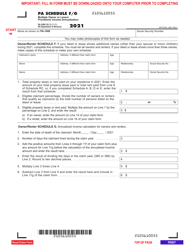

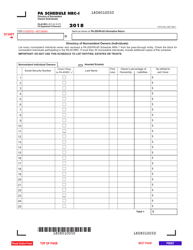

Form PA-1000 F / G Schedule F / G Multiple Owner or Lessor Prorations / Income Annualization - Pennsylvania

What Is Form PA-1000 F/G Schedule F/G?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-1000 F/G Schedule F/G?

A: Form PA-1000 F/G Schedule F/G is a document used for multiple owner or lesser prorations and income annualization in Pennsylvania.

Q: What does Form PA-1000 F/G Schedule F/G include?

A: Form PA-1000 F/G Schedule F/G includes information about prorating income and expenses between multiple owners or lessors.

Q: Who needs to fill out Form PA-1000 F/G Schedule F/G?

A: Anyone who has multiple owners or lessors and needs to prorate income and expenses in Pennsylvania.

Q: What is the purpose of prorating income and expenses in Pennsylvania?

A: The purpose of prorating income and expenses is to allocate them fairly among multiple owners or lessors based on their ownership shares.

Q: When should Form PA-1000 F/G Schedule F/G be filed?

A: Form PA-1000 F/G Schedule F/G should be filed annually along with other required tax forms.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-1000 F/G Schedule F/G by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.