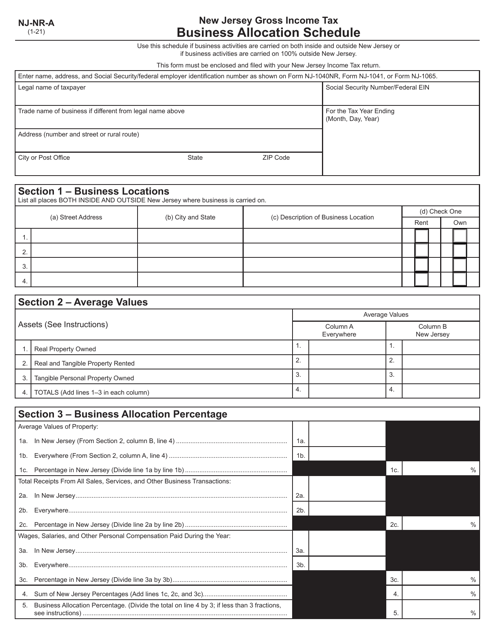

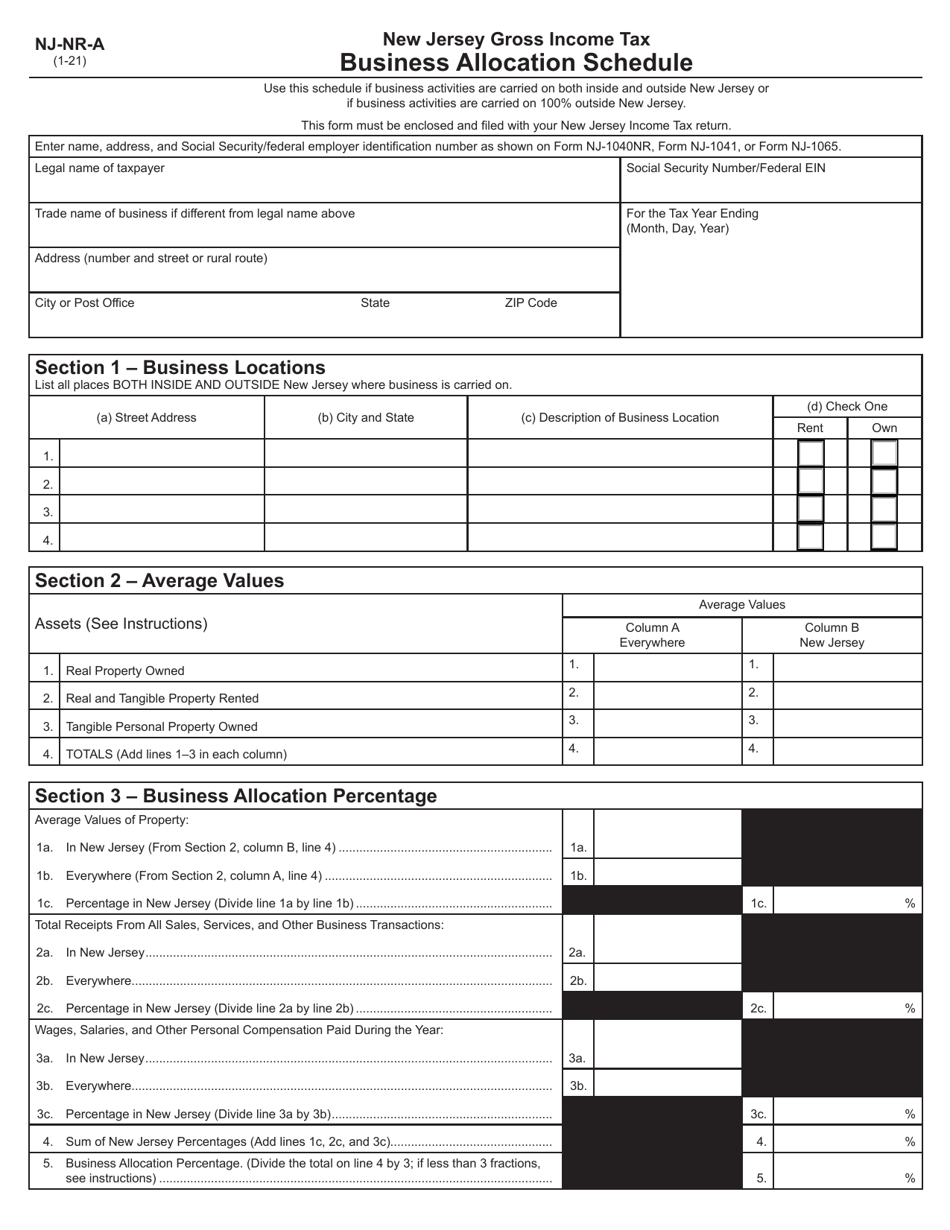

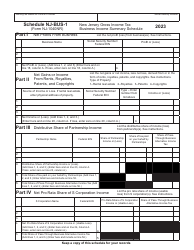

Form NH-NR-A Business Allocation Schedule - New Jersey

What Is Form NH-NR-A?

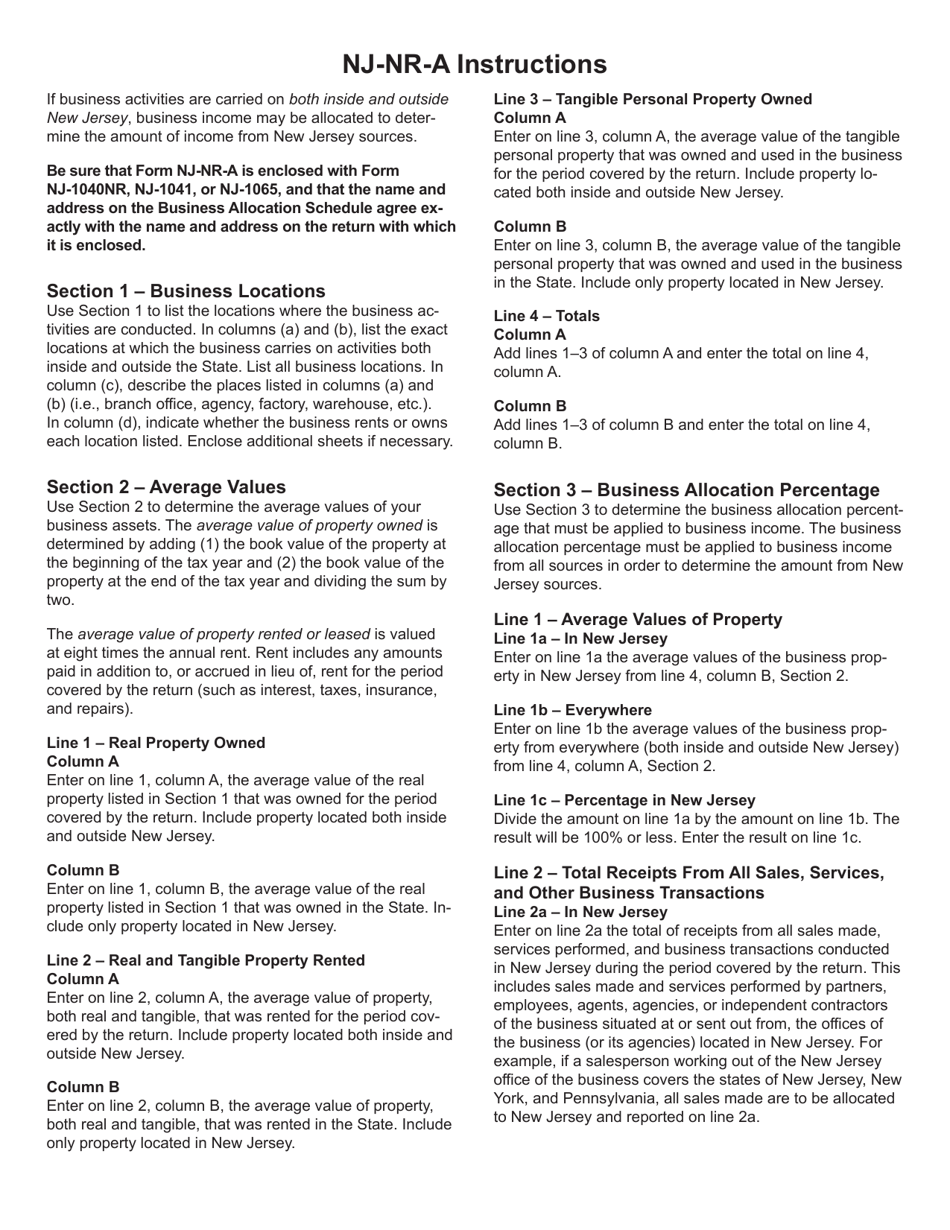

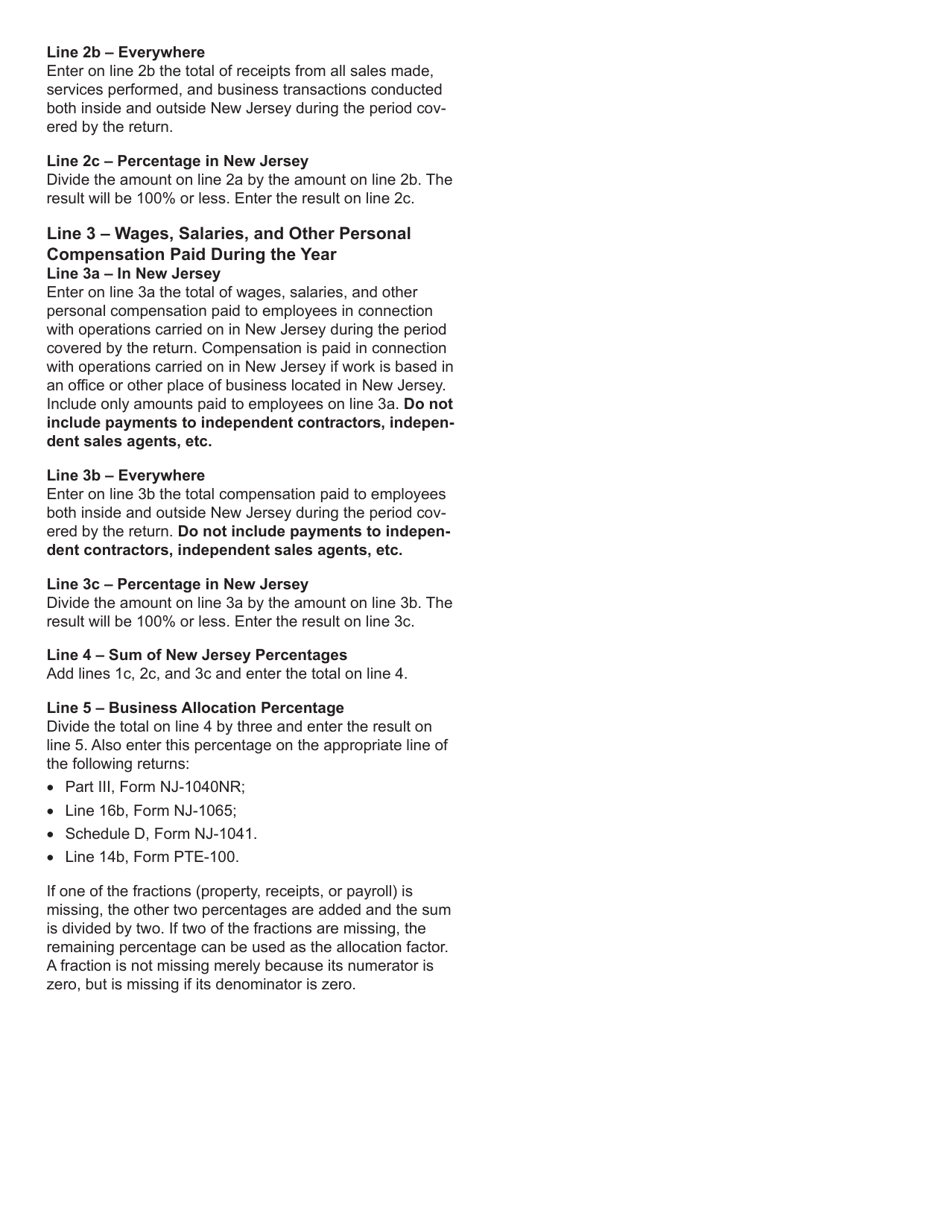

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NH-NR-A?

A: Form NH-NR-A is a Business Allocation Schedule for New Jersey.

Q: Who needs to file Form NH-NR-A?

A: Any business entity that derives income from New Jersey sources and is not subject to New Jersey Gross Income Tax needs to file Form NH-NR-A.

Q: What is the purpose of Form NH-NR-A?

A: The purpose of Form NH-NR-A is to allocate the income, deductions, and credits of a non-resident business entity derived from New Jersey sources.

Q: When is Form NH-NR-A due?

A: Form NH-NR-A is due on or before the 15th day of the fourth month following the close of the tax year for the business entity.

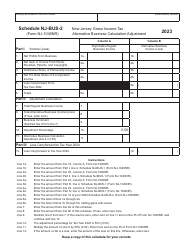

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-NR-A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.