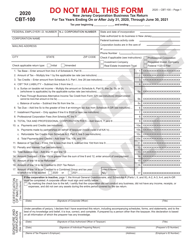

This version of the form is not currently in use and is provided for reference only. Download this version of

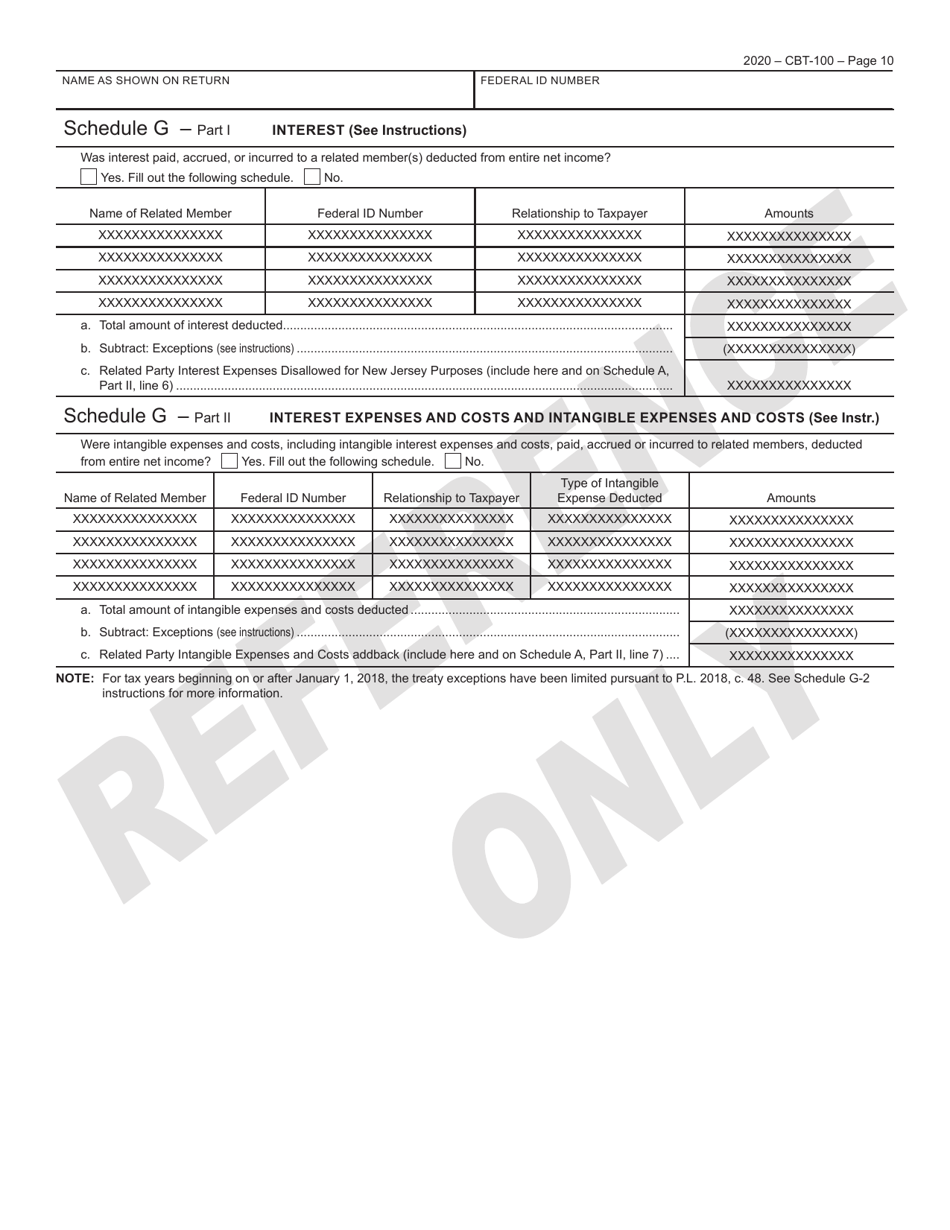

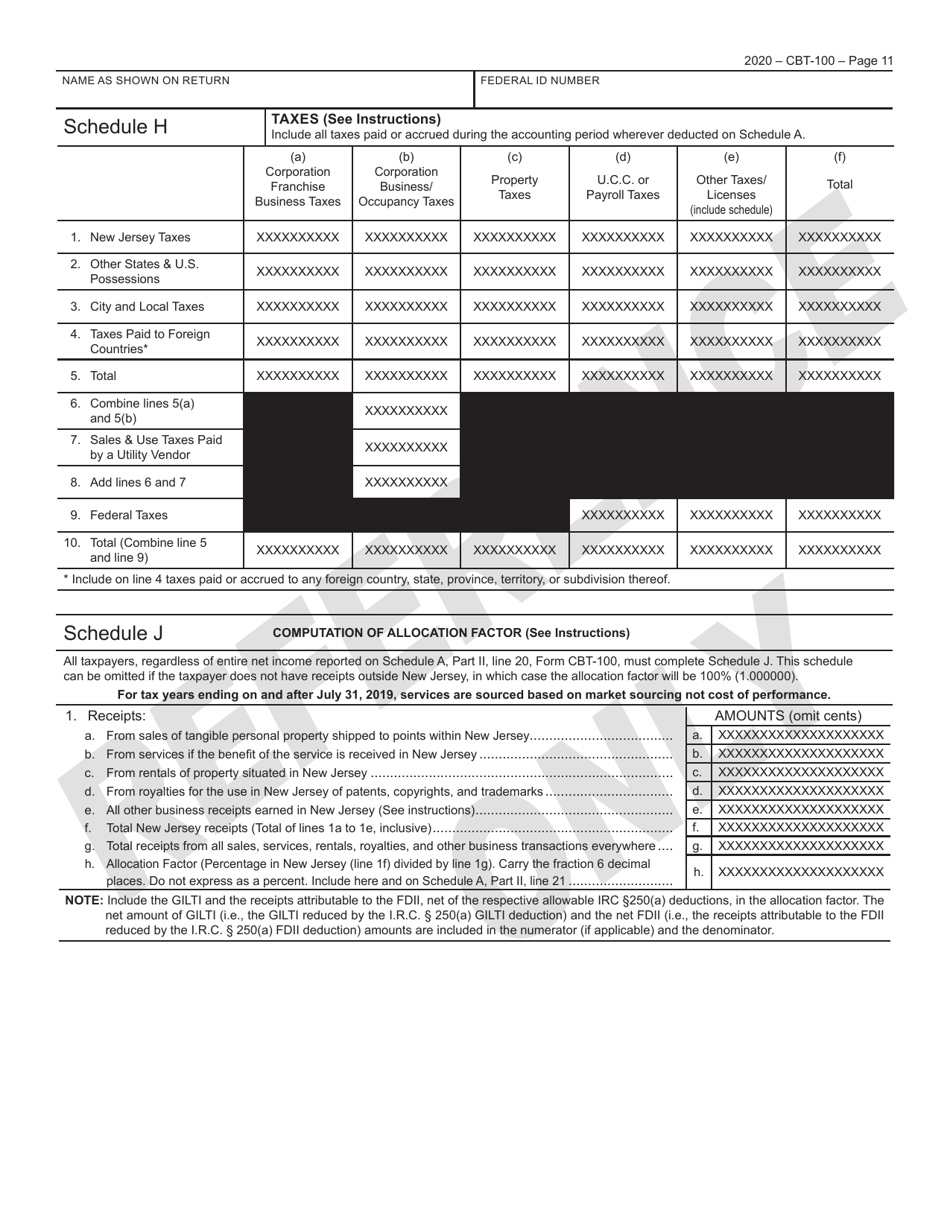

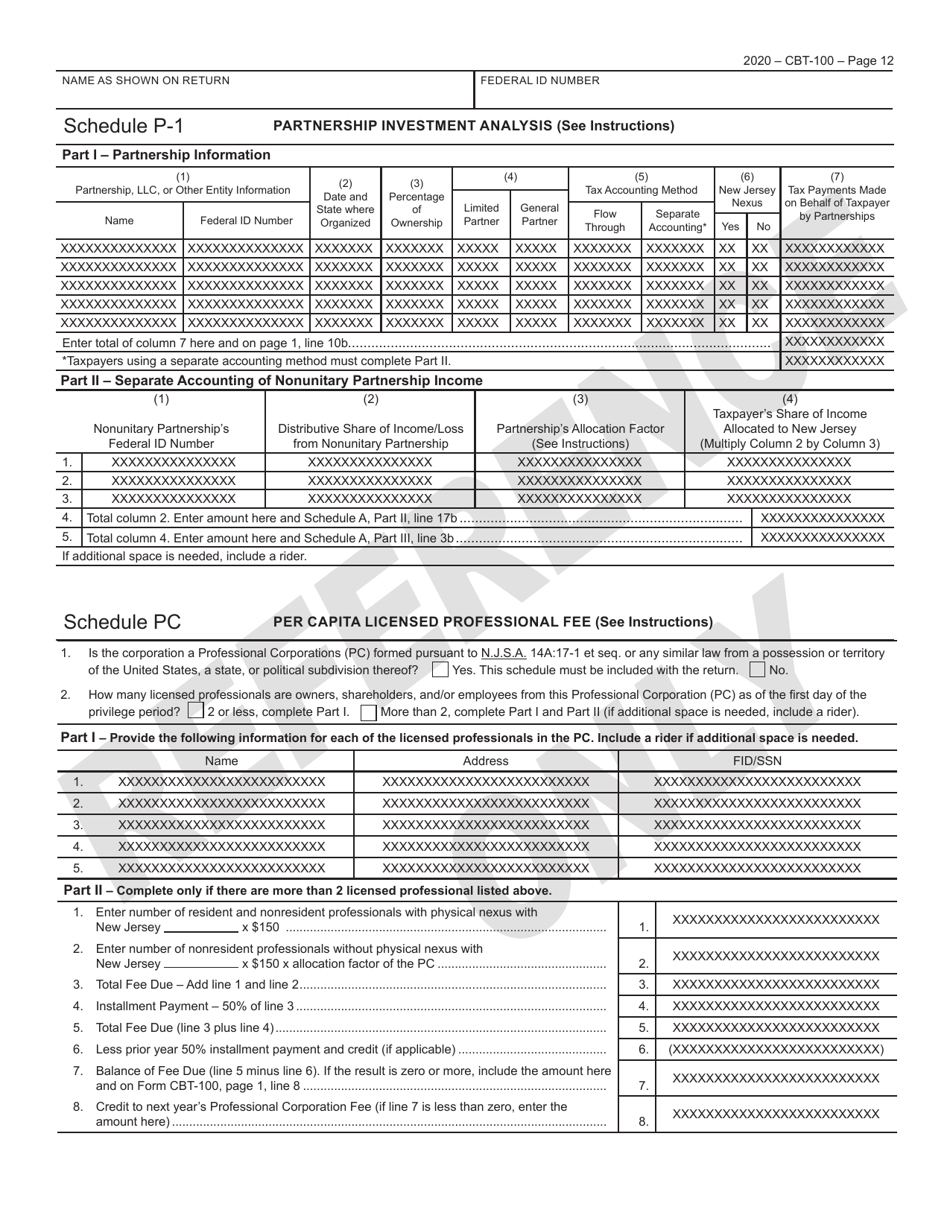

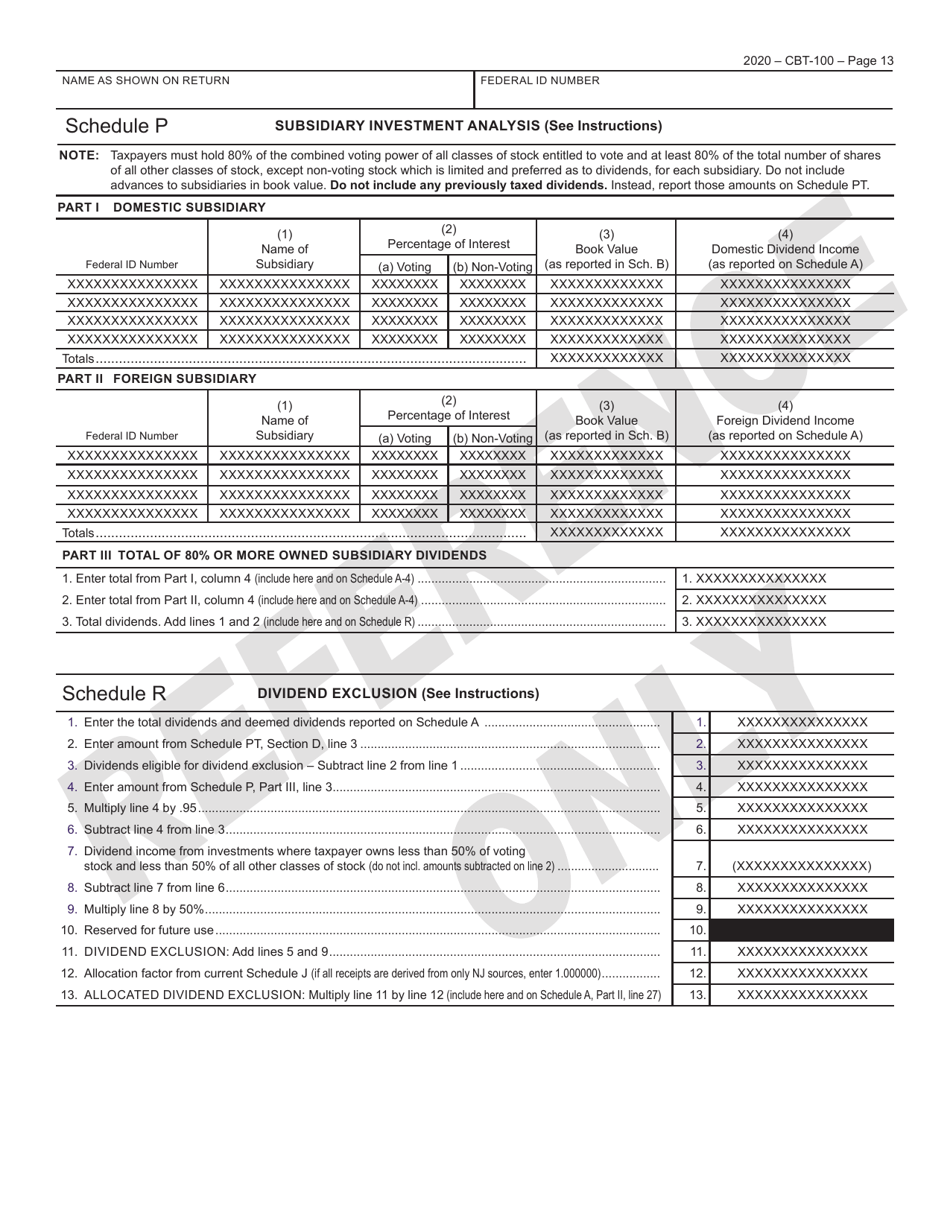

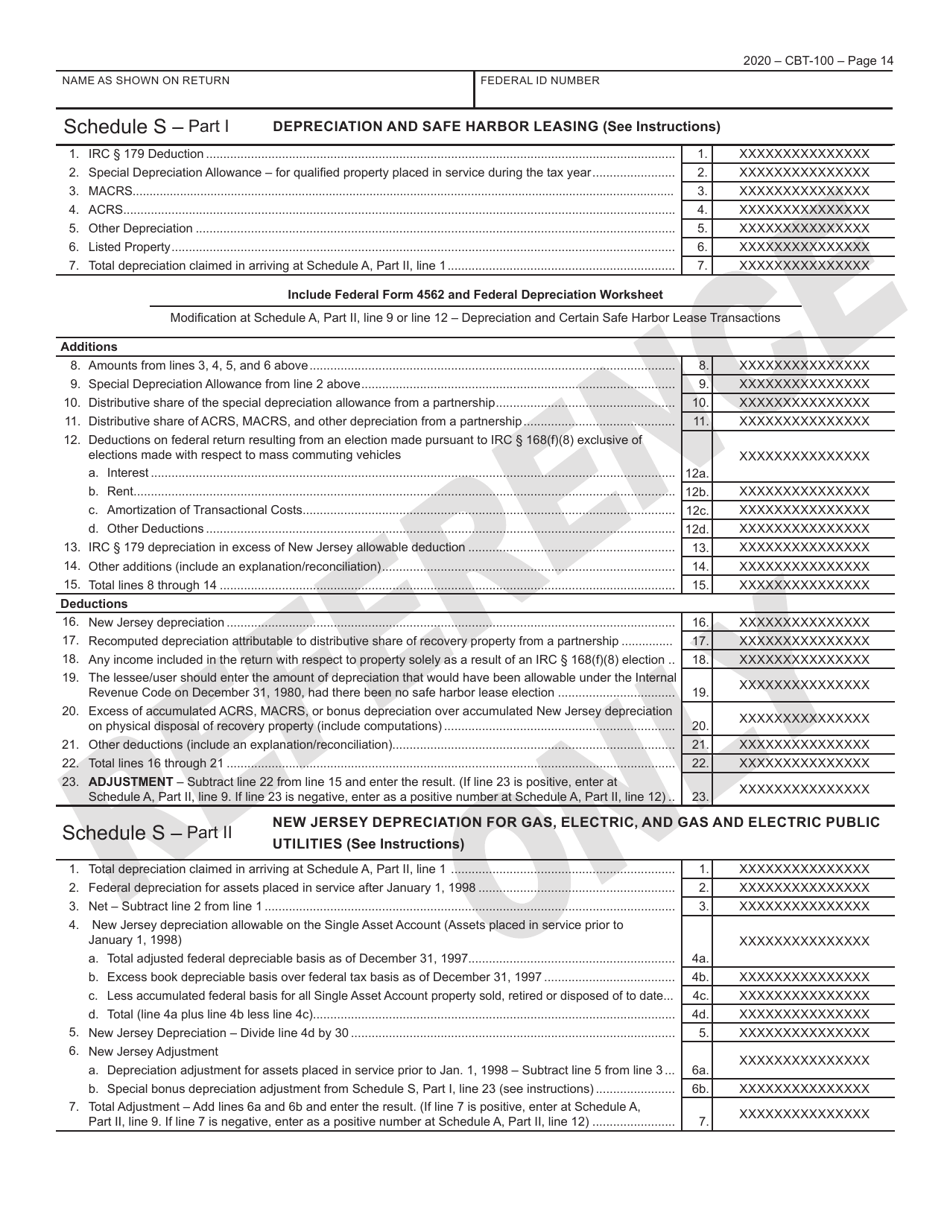

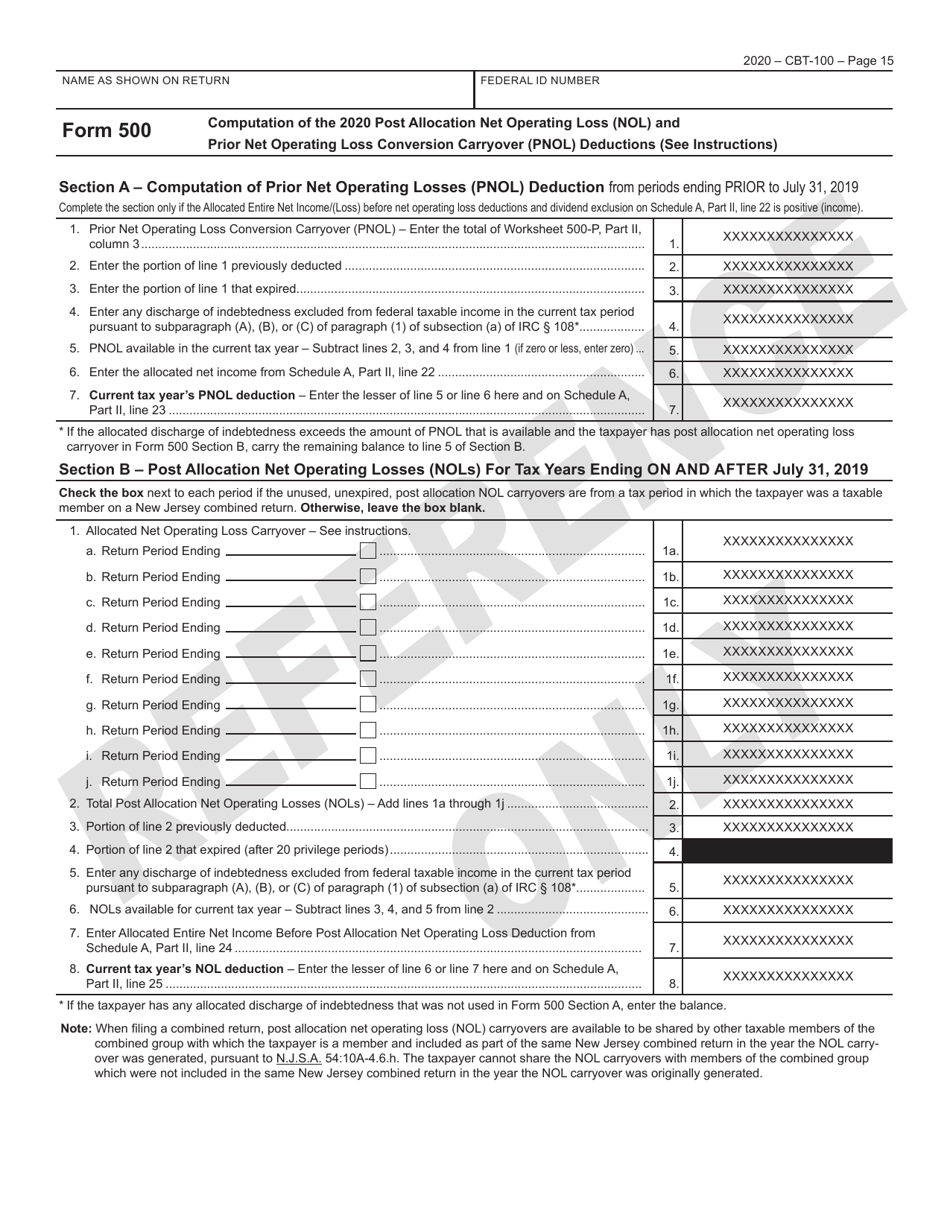

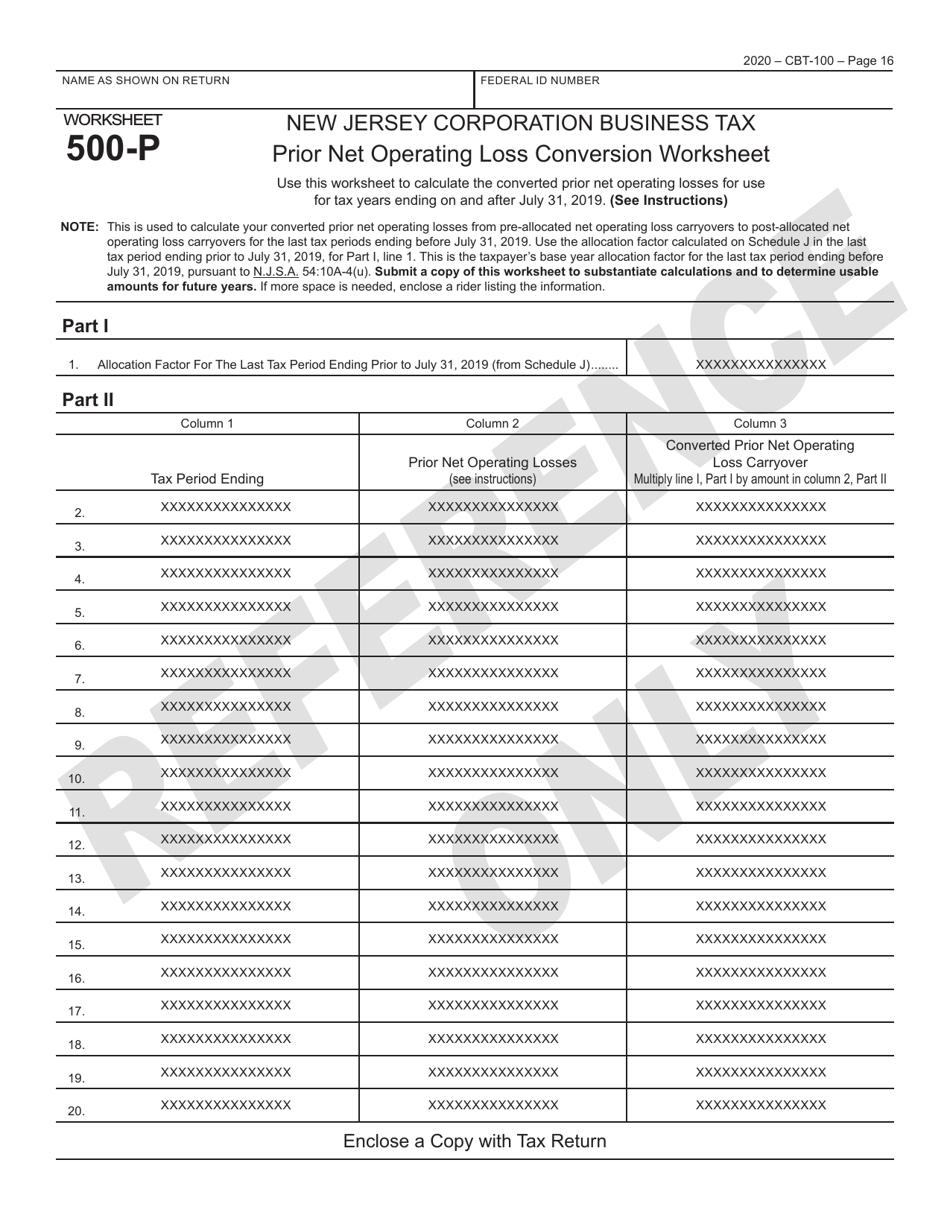

Form CBT-100

for the current year.

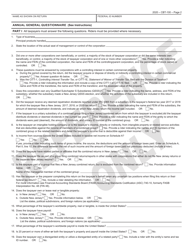

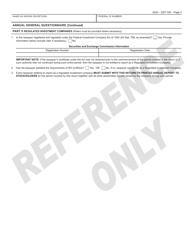

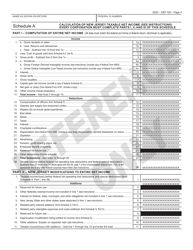

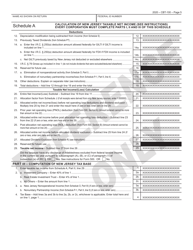

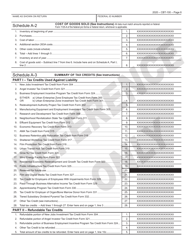

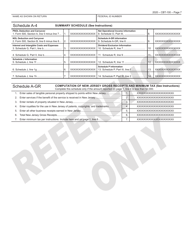

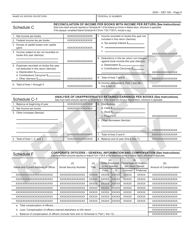

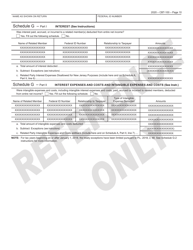

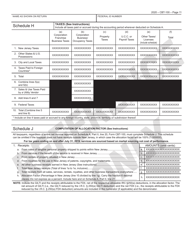

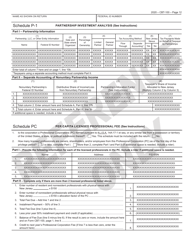

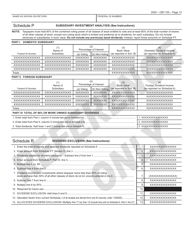

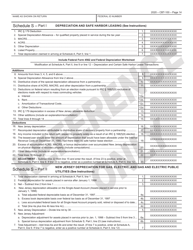

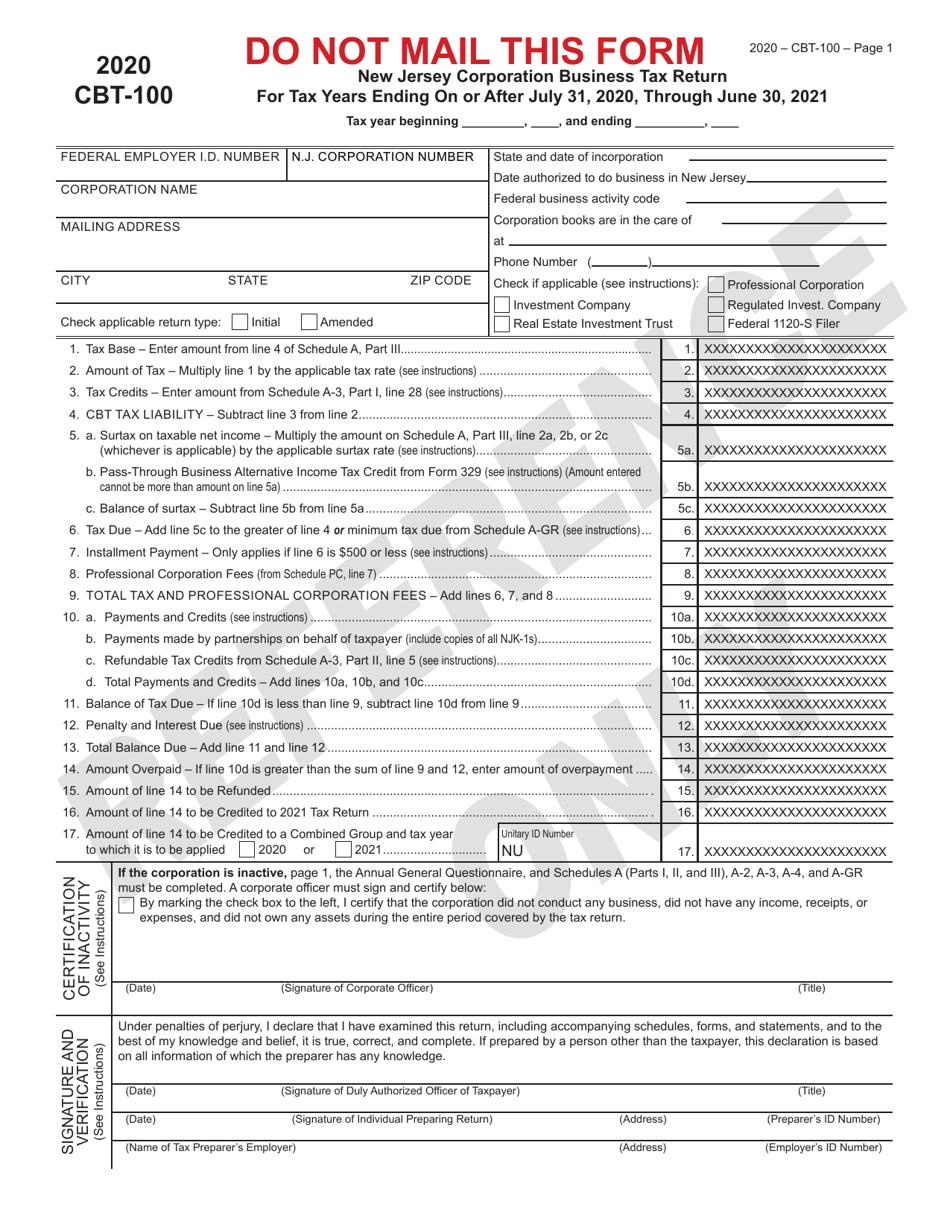

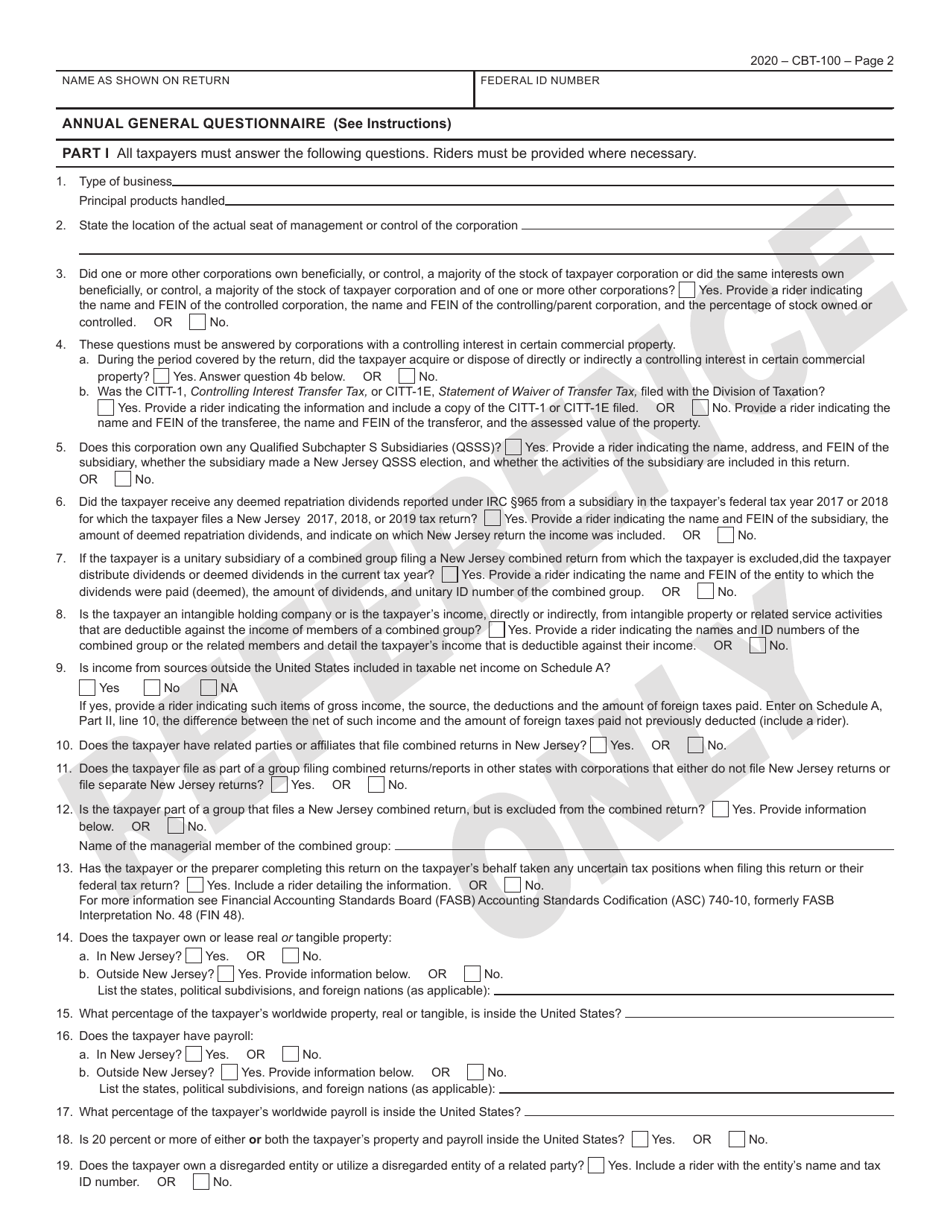

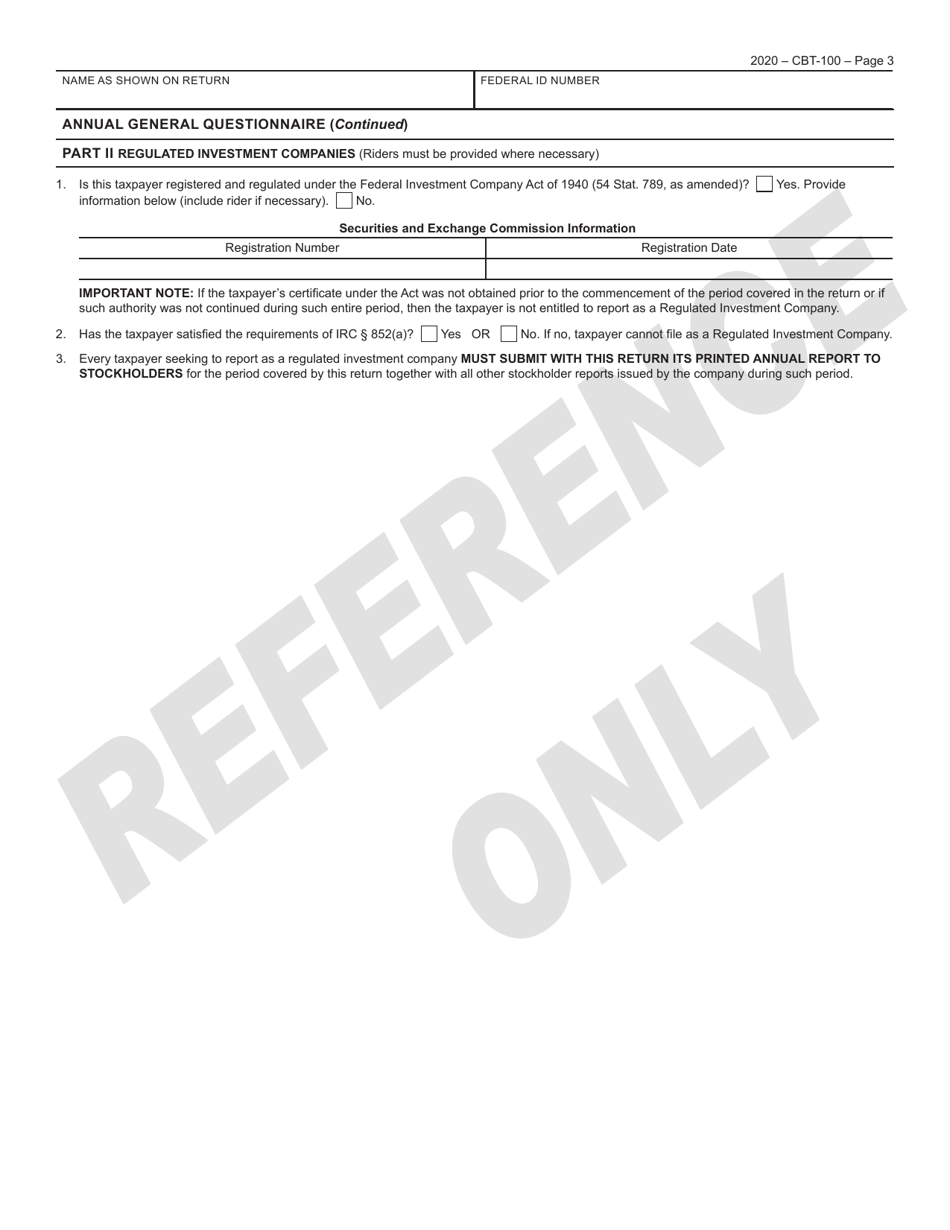

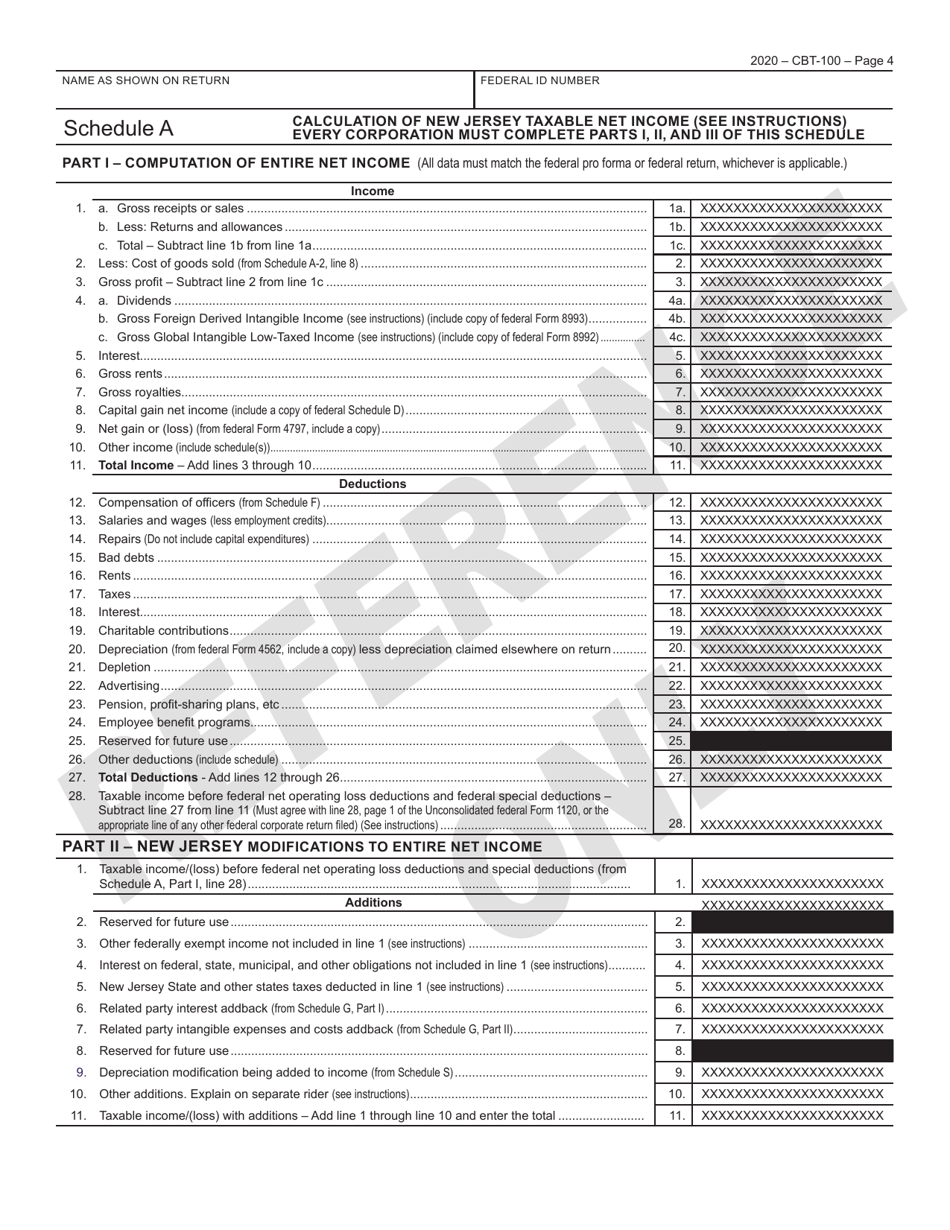

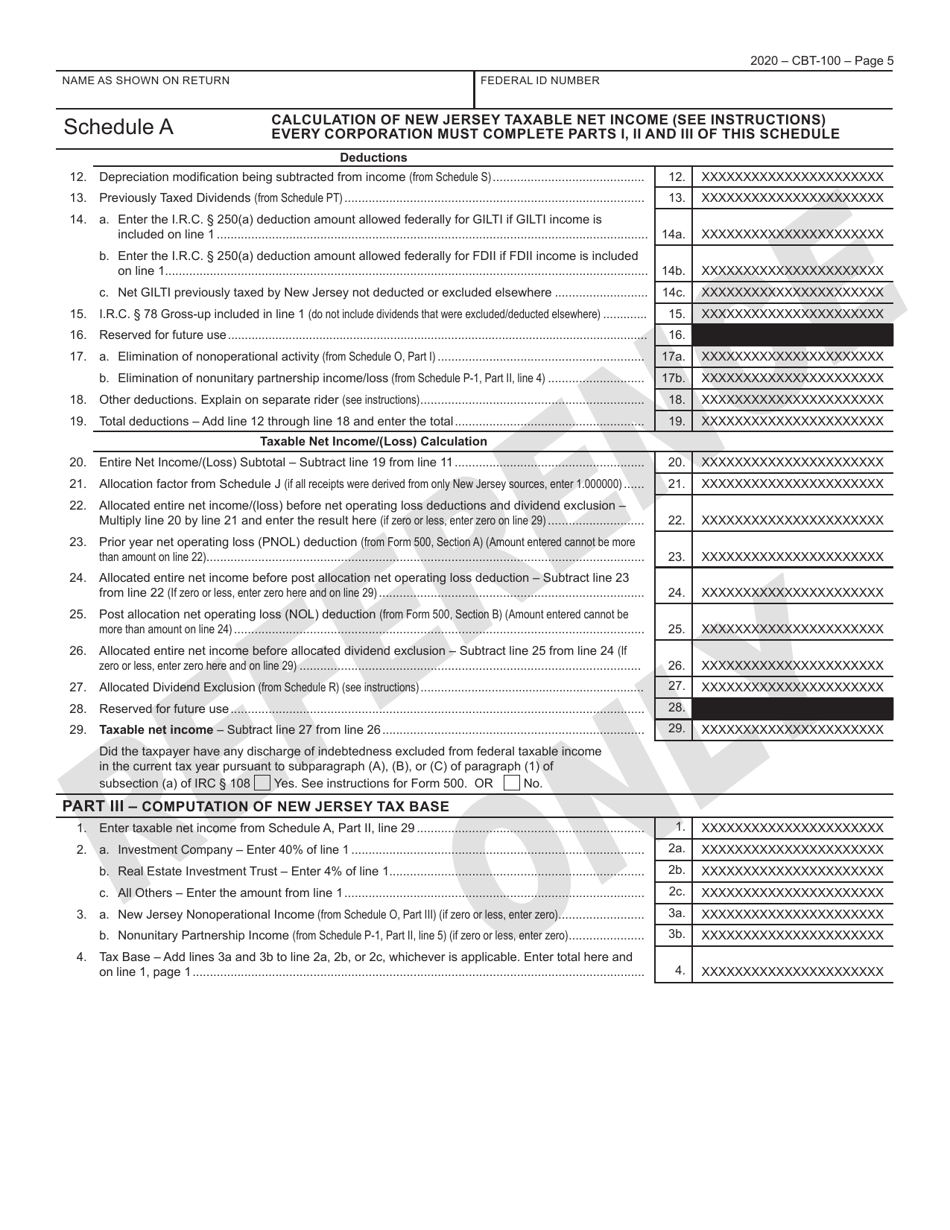

Form CBT-100 New Jersey Corporation Business Tax Return - New Jersey

What Is Form CBT-100?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CBT-100?

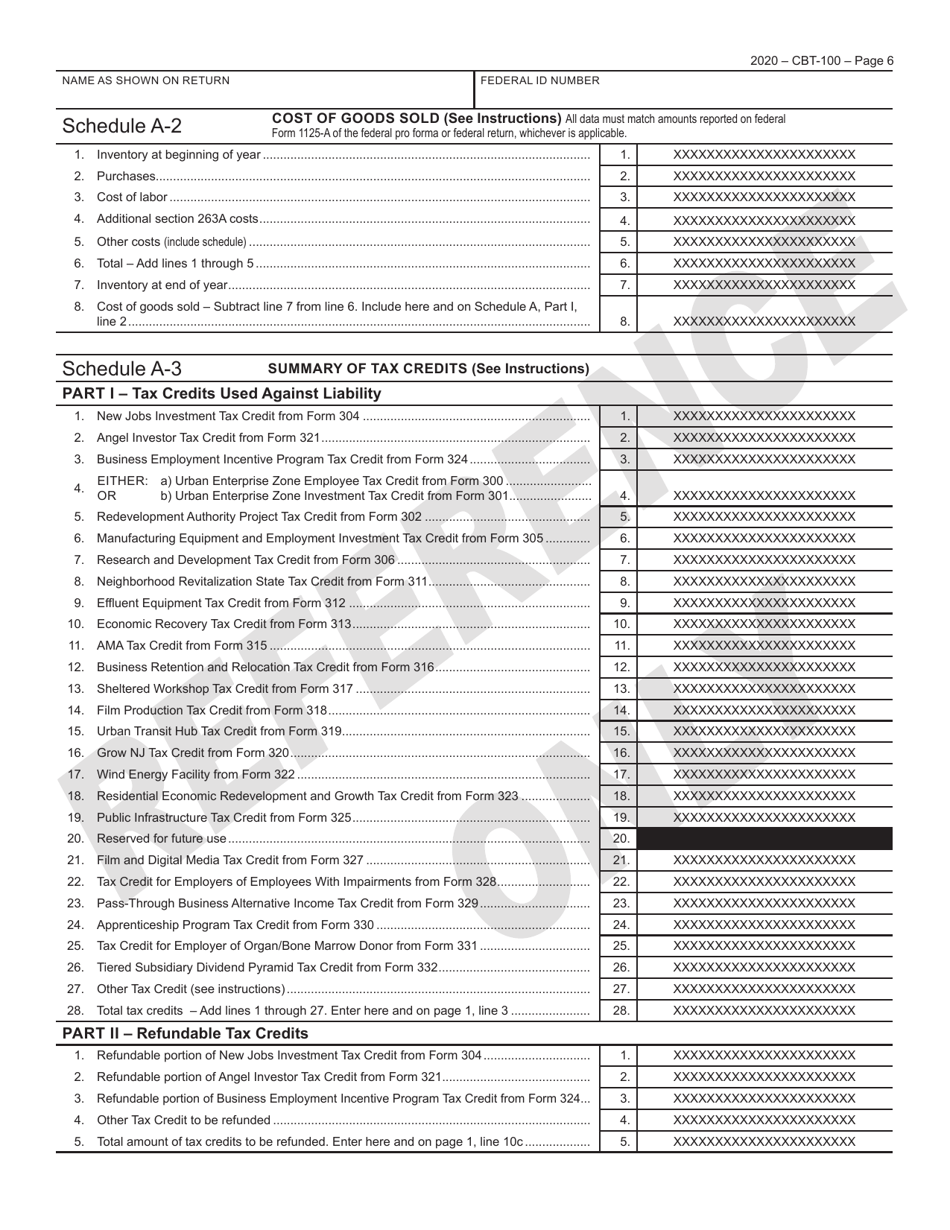

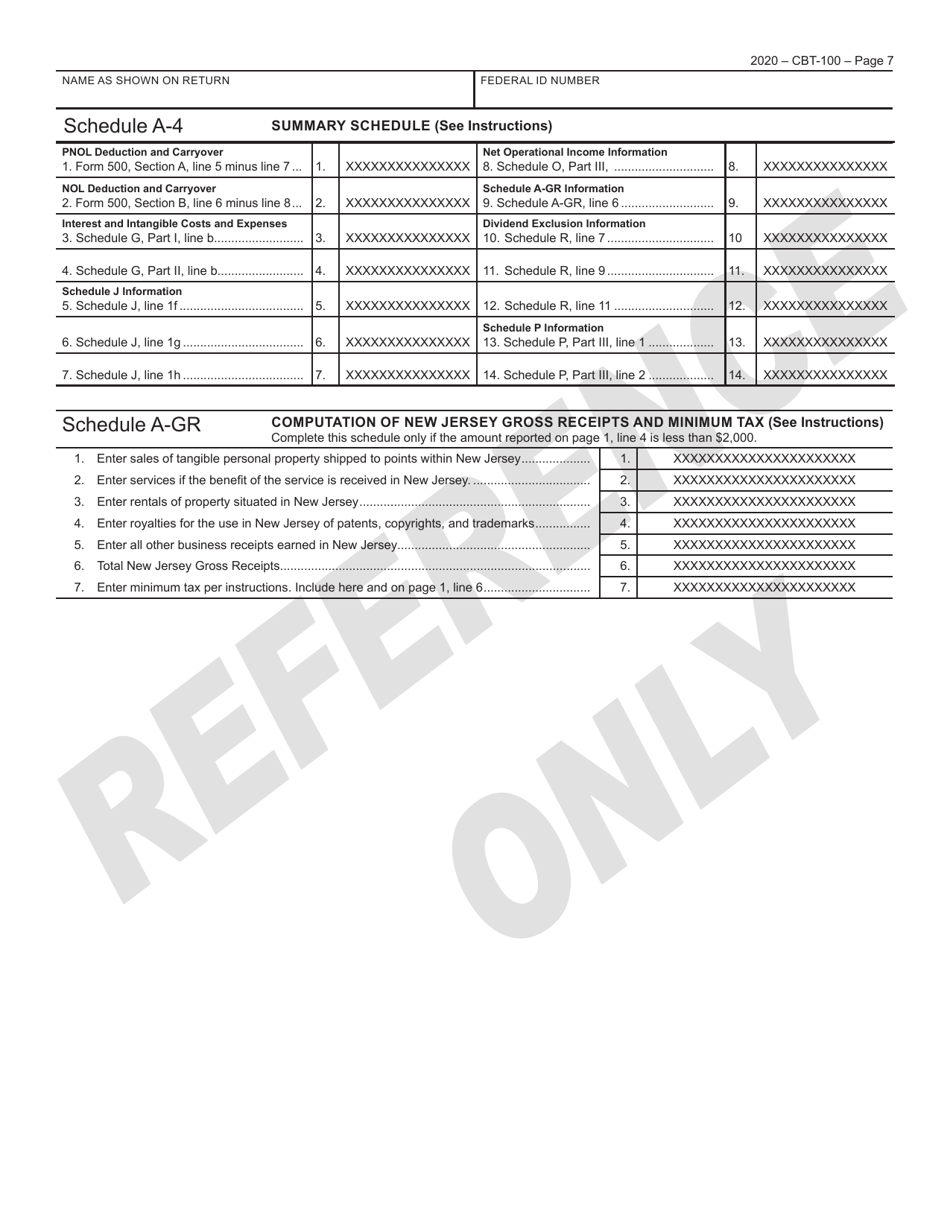

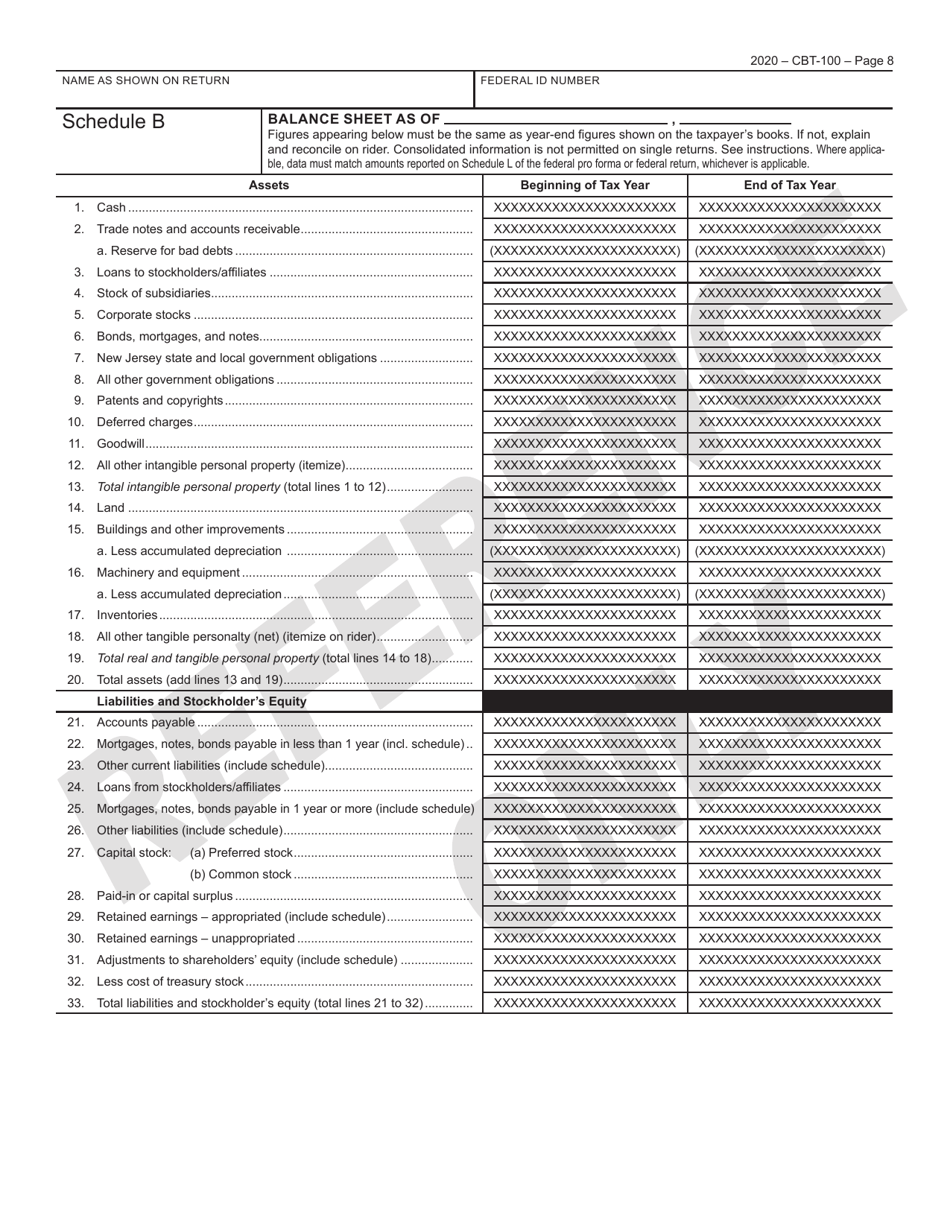

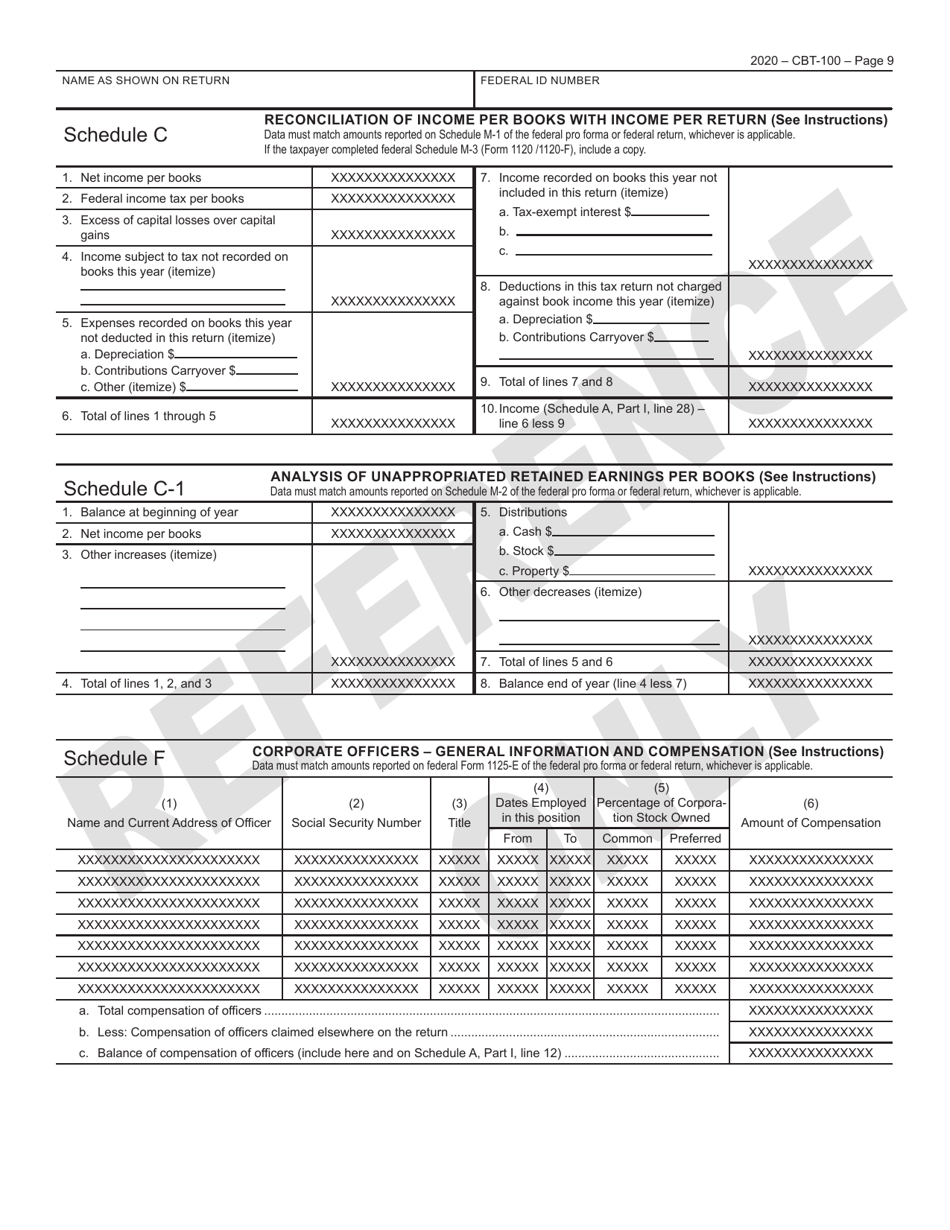

A: Form CBT-100 is the New Jersey Corporation Business Tax Return.

Q: Who needs to file Form CBT-100?

A: Any corporation doing business in New Jersey is required to file Form CBT-100.

Q: What is the purpose of Form CBT-100?

A: Form CBT-100 is used to report a corporation's income, deductions, and tax liability in New Jersey.

Q: When is the deadline for filing Form CBT-100?

A: The deadline for filing Form CBT-100 is generally the 15th day of the fourth month following the close of the corporation's taxable year.

Q: Are there any penalties for late filing of Form CBT-100?

A: Yes, there are penalties for late filing of Form CBT-100. The penalties can vary depending on the length of the delay.

Q: Is there an extension available for filing Form CBT-100?

A: Yes, corporations can request an extension to file Form CBT-100. The extension request must be filed before the original due date of the return.

Q: Is there a minimum tax requirement for corporations filing Form CBT-100?

A: Yes, there is a minimum tax requirement for corporations filing Form CBT-100. The minimum tax amount is based on the corporation's total receipts in New Jersey.

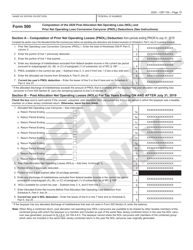

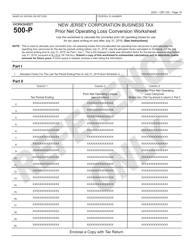

Q: What supporting documentation should be included with Form CBT-100?

A: Corporations should include any necessary schedules, statements, and attachments with Form CBT-100, as specified by the New Jersey Division of Taxation.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-100 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.