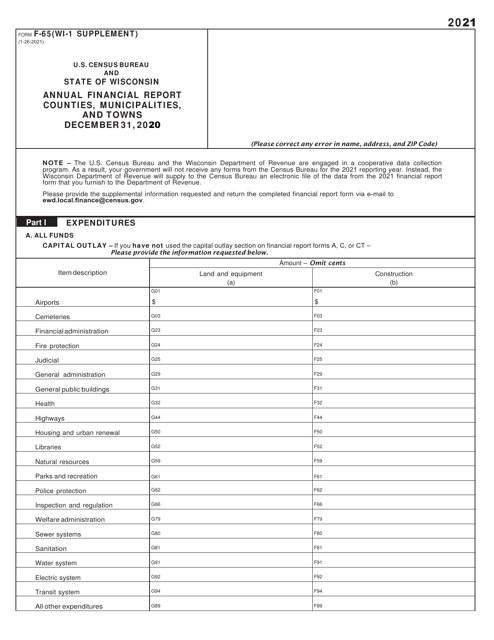

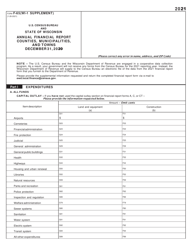

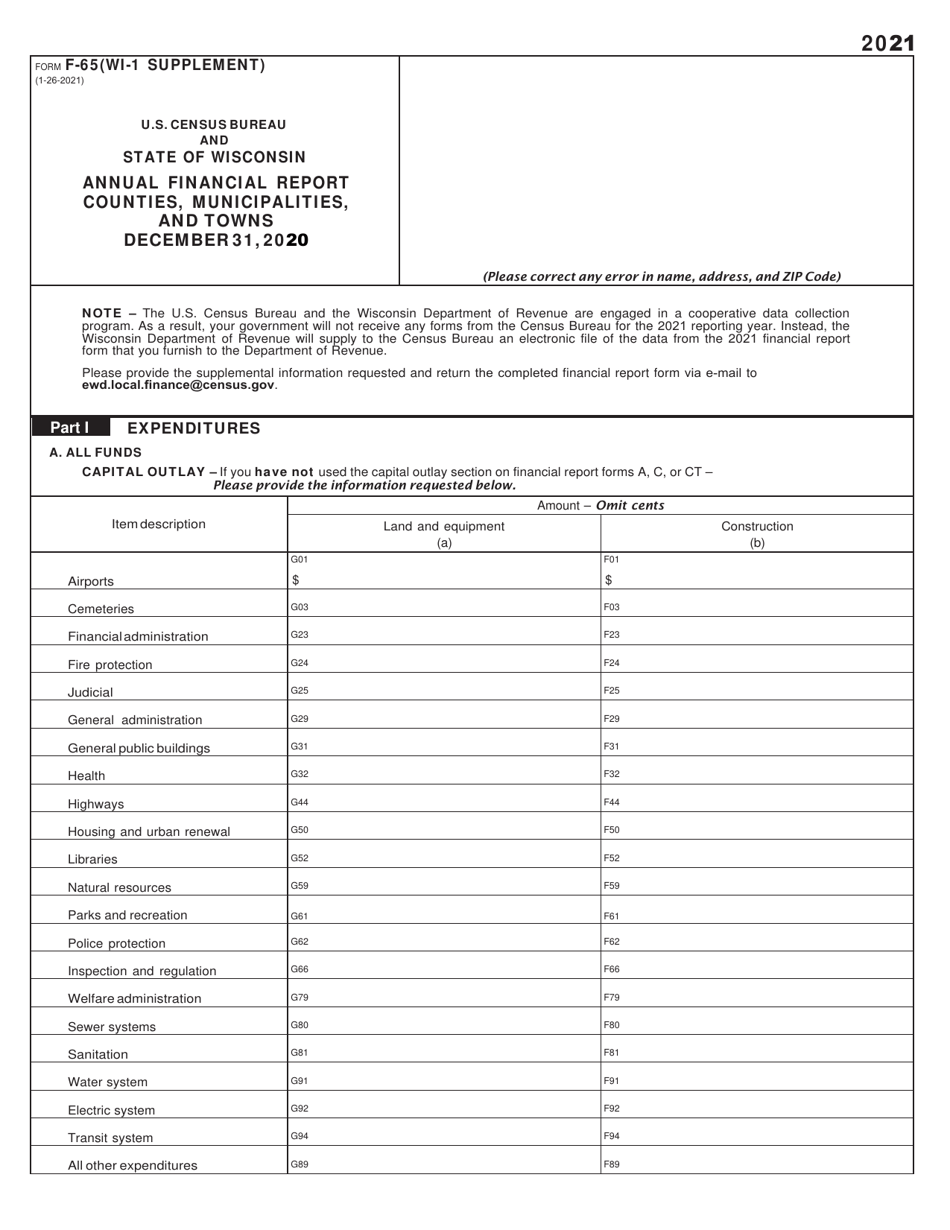

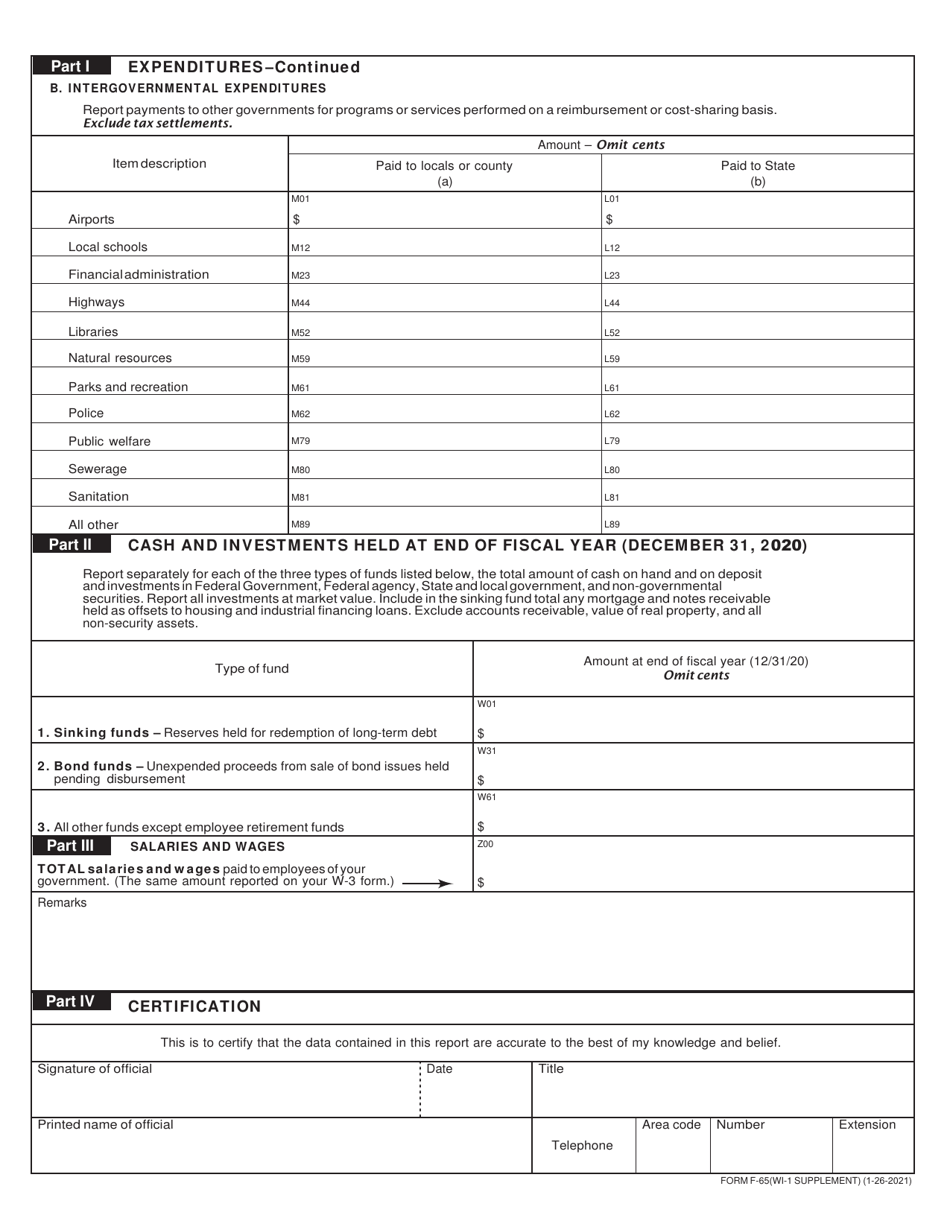

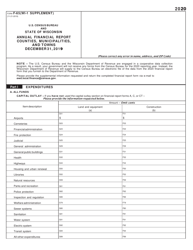

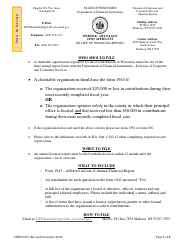

Form F-65 Supplement WI-1 Annual Financial Report - Counties, Municipalities and Towns - Wisconsin

What Is Form F-65 Supplement WI-1?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-65 Supplement WI-1?

A: Form F-65 Supplement WI-1 is an Annual Financial Report for Counties, Municipalities, and Towns in Wisconsin.

Q: Who needs to file Form F-65 Supplement WI-1?

A: Counties, municipalities, and towns in Wisconsin are required to file Form F-65 Supplement WI-1.

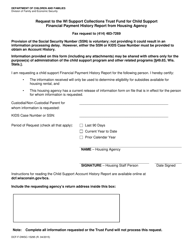

Q: What is the purpose of Form F-65 Supplement WI-1?

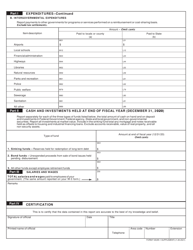

A: The purpose of Form F-65 Supplement WI-1 is to provide a detailed financial report for counties, municipalities, and towns in Wisconsin.

Q: What information is required on Form F-65 Supplement WI-1?

A: Form F-65 Supplement WI-1 requires information such as revenues, expenditures, fund balances, and debt obligations of counties, municipalities, and towns in Wisconsin.

Q: When is Form F-65 Supplement WI-1 due?

A: Form F-65 Supplement WI-1 is due on or before March 31st of each year for the previous calendar year.

Form Details:

- Released on January 26, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-65 Supplement WI-1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.