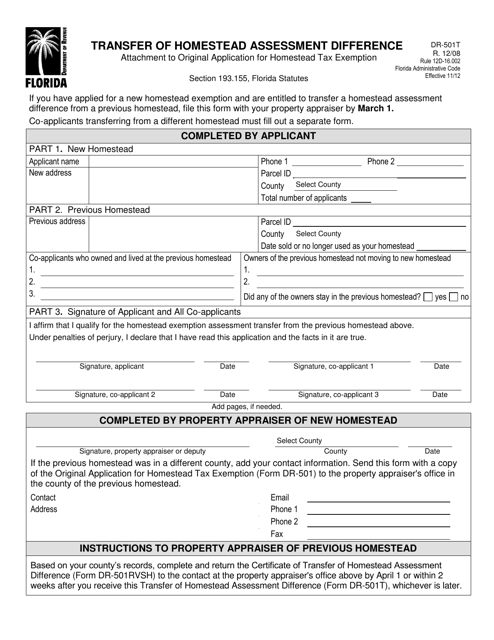

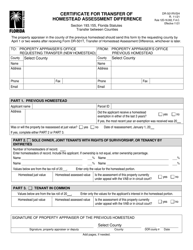

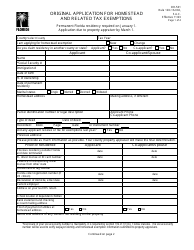

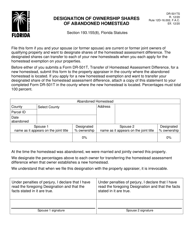

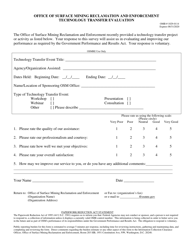

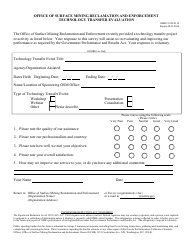

Form DR-501T Transfer of Homestead Assessment Difference - Florida

What Is Form DR-501T?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-501T?

A: Form DR-501T is the Transfer of Homestead Assessment Difference form in Florida.

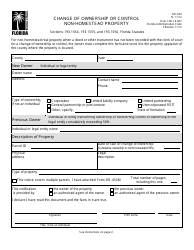

Q: When is Form DR-501T used?

A: Form DR-501T is used when the owner of a homestead property sells their home and purchases a new homestead property.

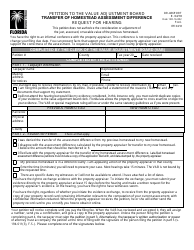

Q: What is the purpose of Form DR-501T?

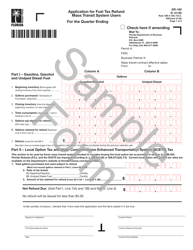

A: The purpose of Form DR-501T is to transfer the homestead assessment difference from the old property to the new property, which can result in a reduction in property taxes for the new property.

Q: How does Form DR-501T work?

A: When the new homestead property is purchased, the owner can apply for a homestead assessment difference transfer on Form DR-501T. This allows the owner to transfer the difference between the market value and assessed value of the old property to the new property, resulting in a lower assessed value and potentially lower property taxes.

Q: Are there any eligibility requirements for using Form DR-501T?

A: Yes, there are eligibility requirements for using Form DR-501T. The owner must have had a homestead exemption on the old property, and the new property must be eligible for a homestead exemption.

Q: Is there a deadline for filing Form DR-501T?

A: Yes, there is a deadline for filing Form DR-501T. The form must be filed within two years of January 1st of the year following the sale of the old property.

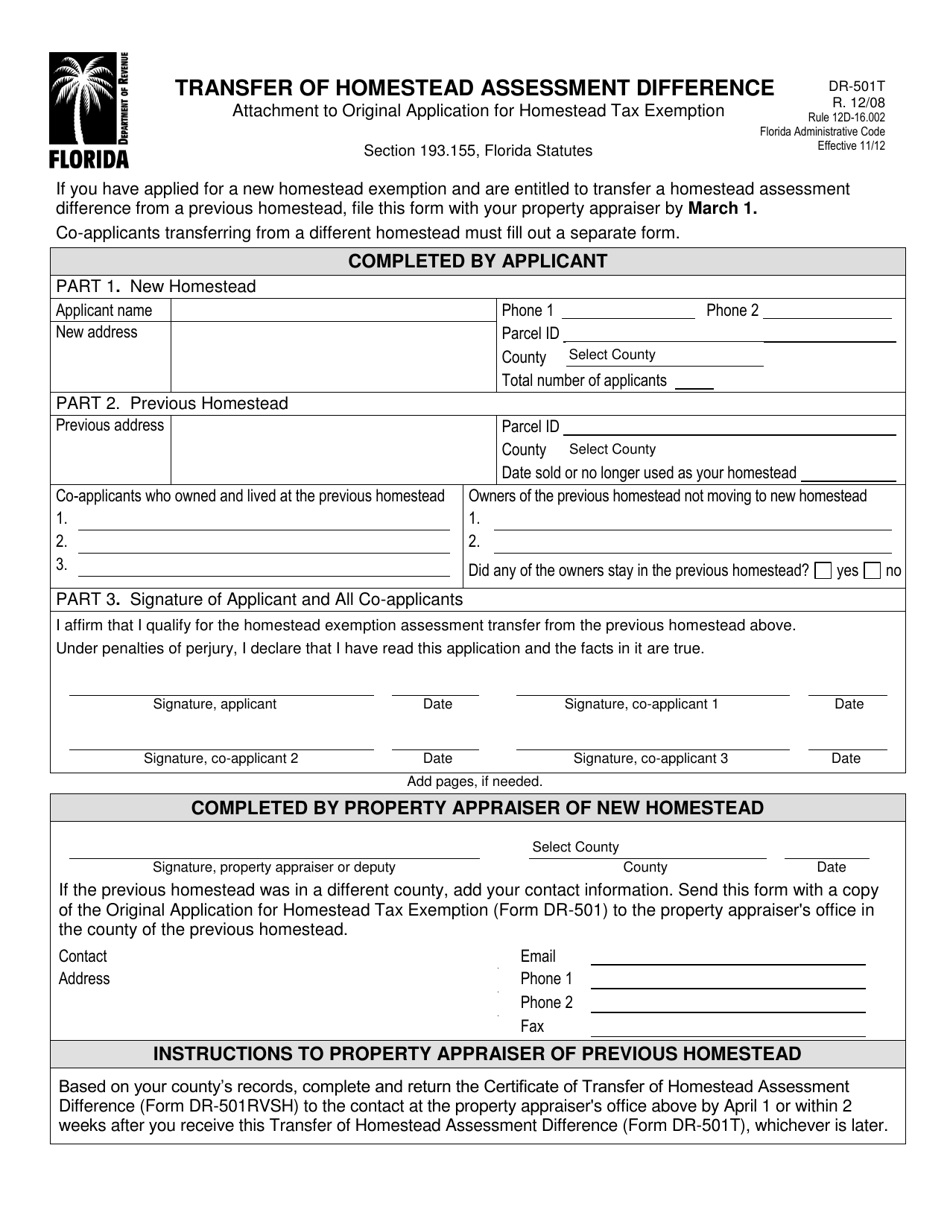

Q: What should I do with Form DR-501T once it is completed?

A: Once completed, Form DR-501T should be submitted to the local county property appraiser's office along with any required documentation.

Q: Can I use Form DR-501T for properties outside of Florida?

A: No, Form DR-501T is specific to the state of Florida and cannot be used for properties located outside of the state.

Form Details:

- Released on December 1, 2008;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-501T by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.