This version of the form is not currently in use and is provided for reference only. Download this version of

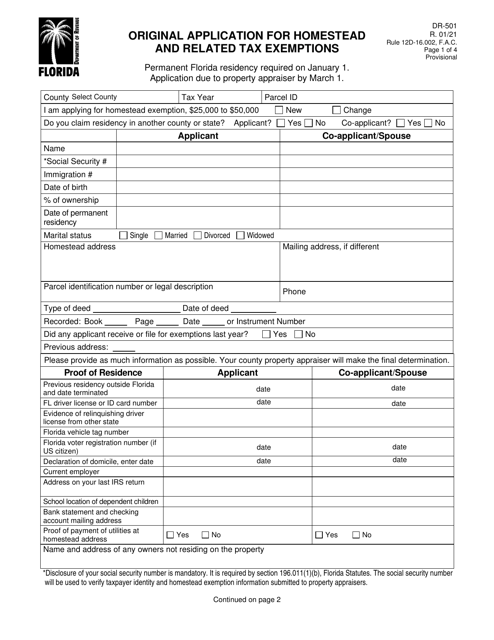

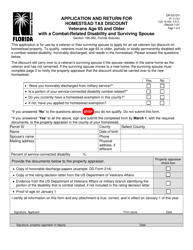

Form DR-501

for the current year.

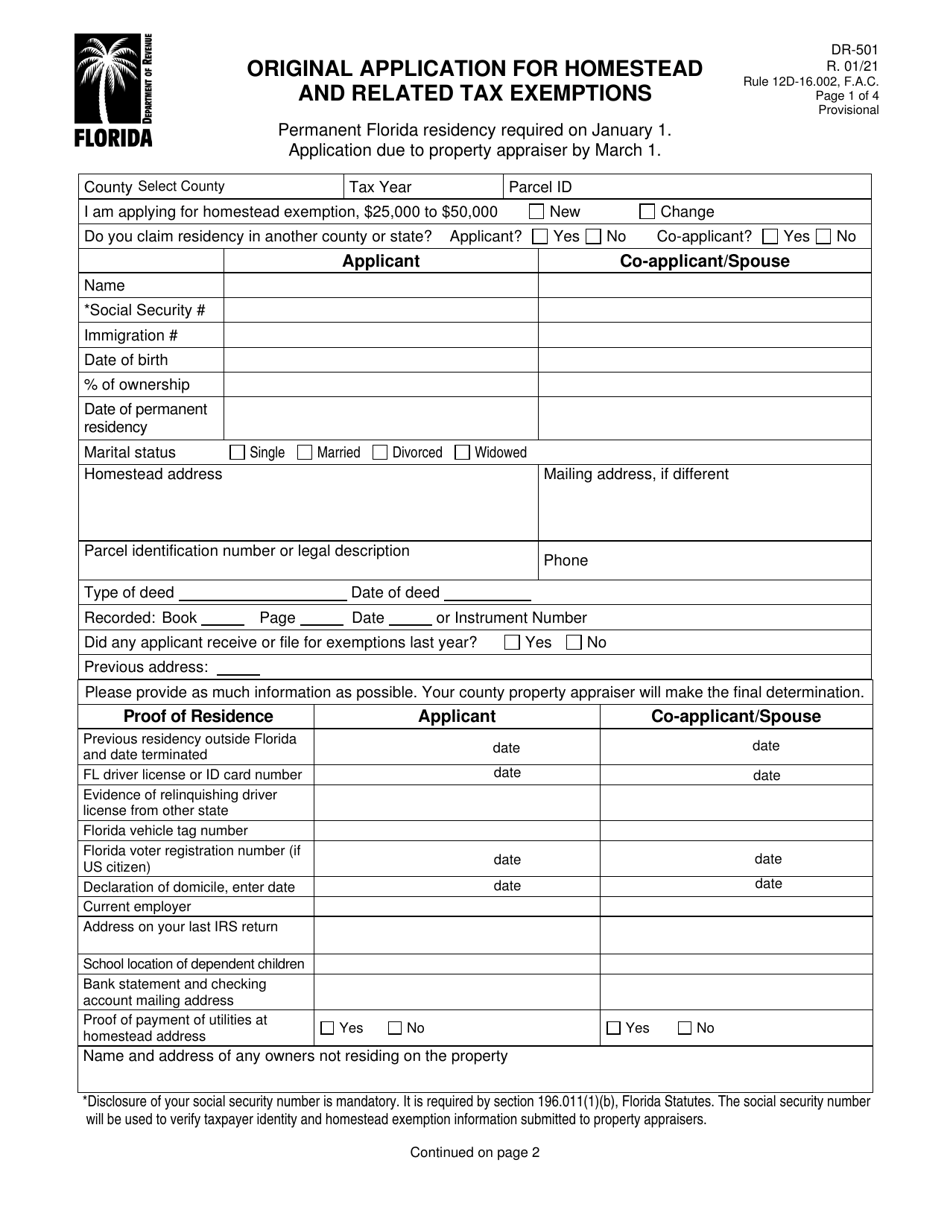

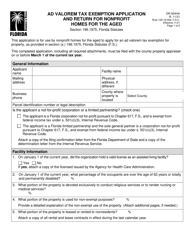

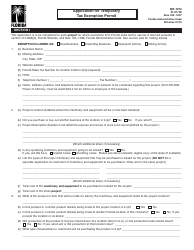

Form DR-501 Original Application for Homestead and Related Tax Exemptions - Florida

What Is Form DR-501?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-501?

A: Form DR-501 is the Original Application for Homestead and Related Tax Exemptions in Florida.

Q: What is the purpose of Form DR-501?

A: The purpose of Form DR-501 is to apply for homestead and related tax exemptions in Florida.

Q: Who can use Form DR-501?

A: Form DR-501 can be used by individuals who own and occupy a property as their permanent residence.

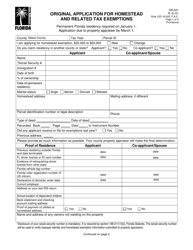

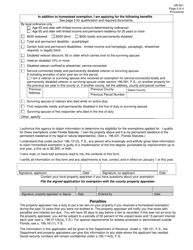

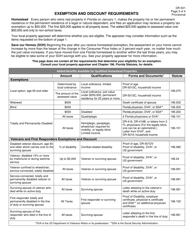

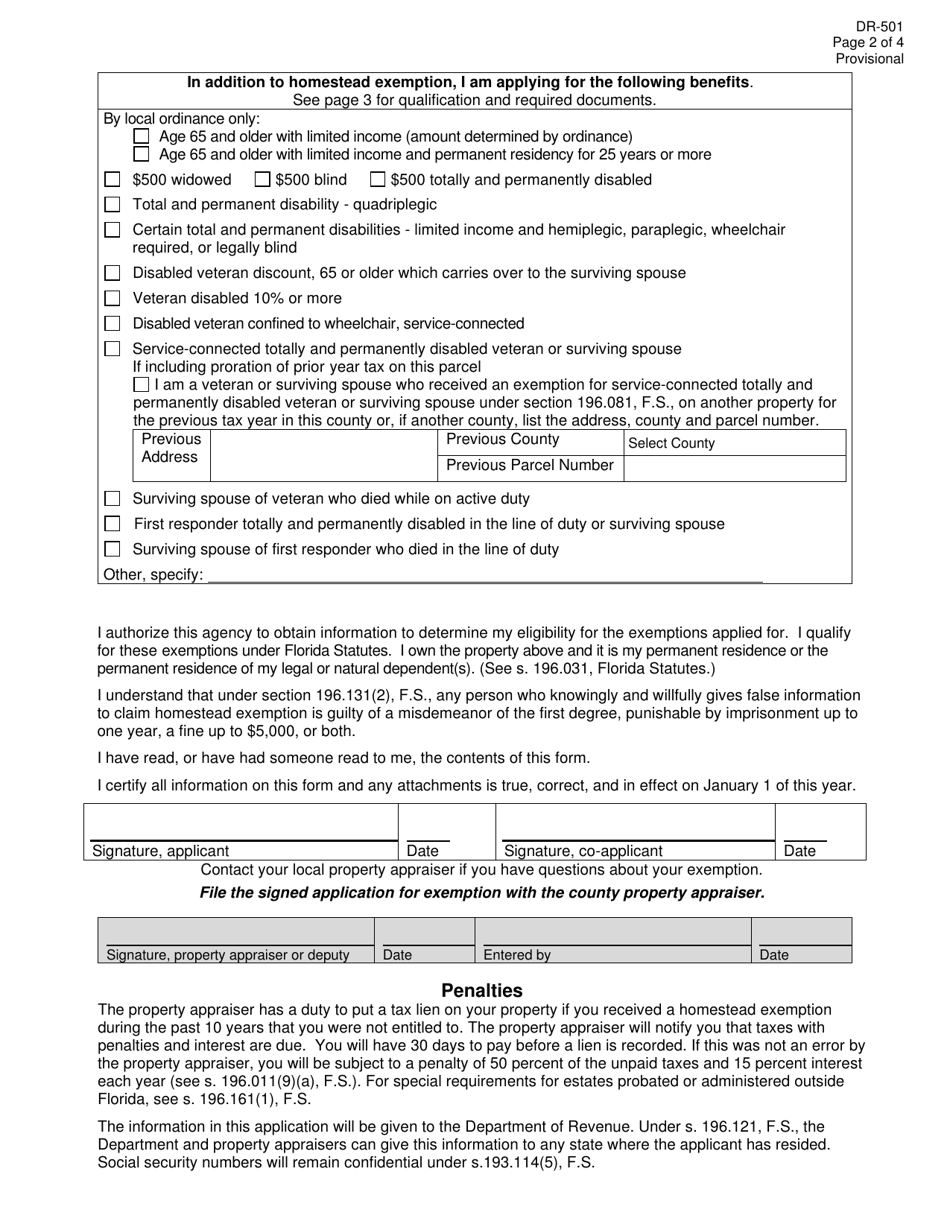

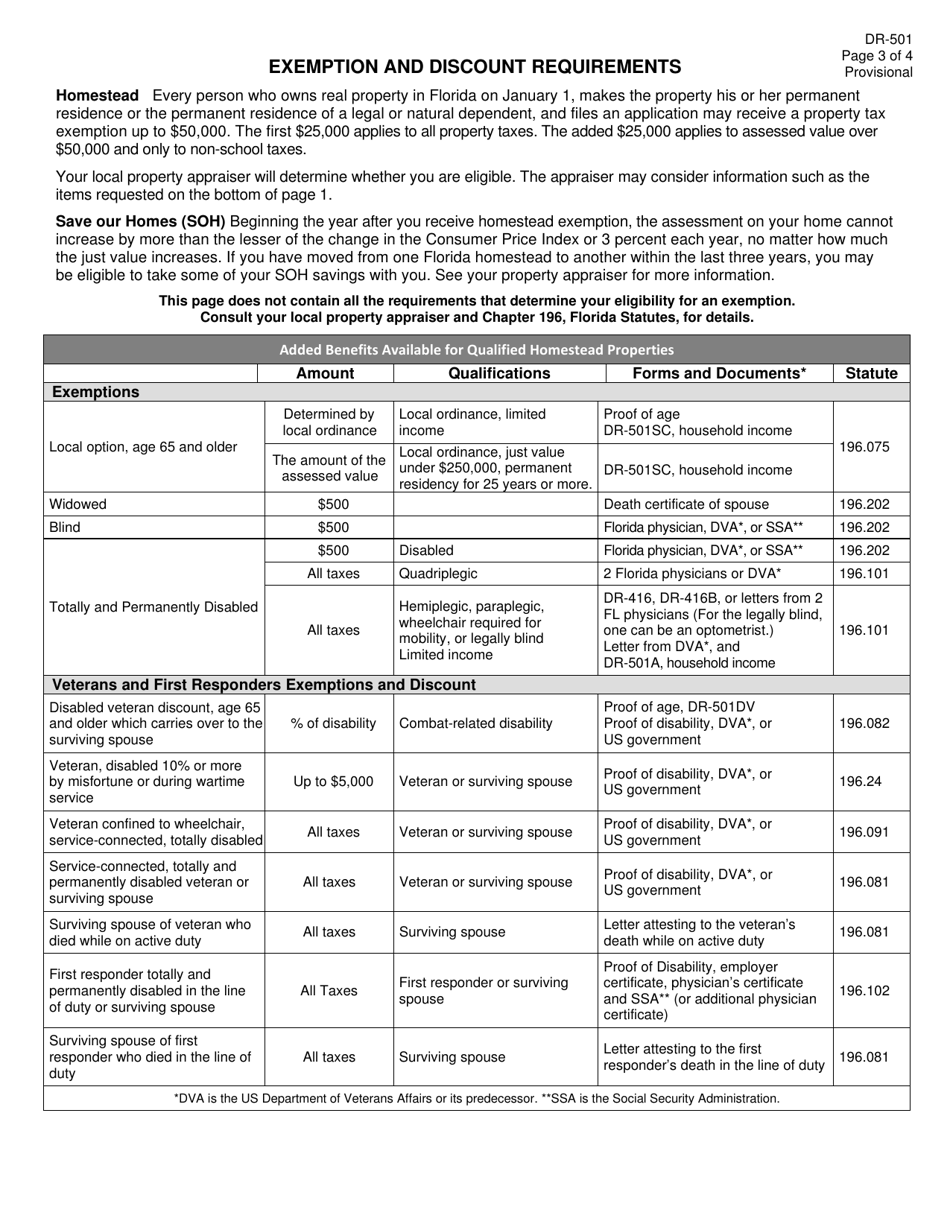

Q: What tax exemptions can be applied for using Form DR-501?

A: Form DR-501 allows applicants to apply for homestead exemption, additional senior exemption, disability exemption, widow/widower exemption, and veteran's disability exemption.

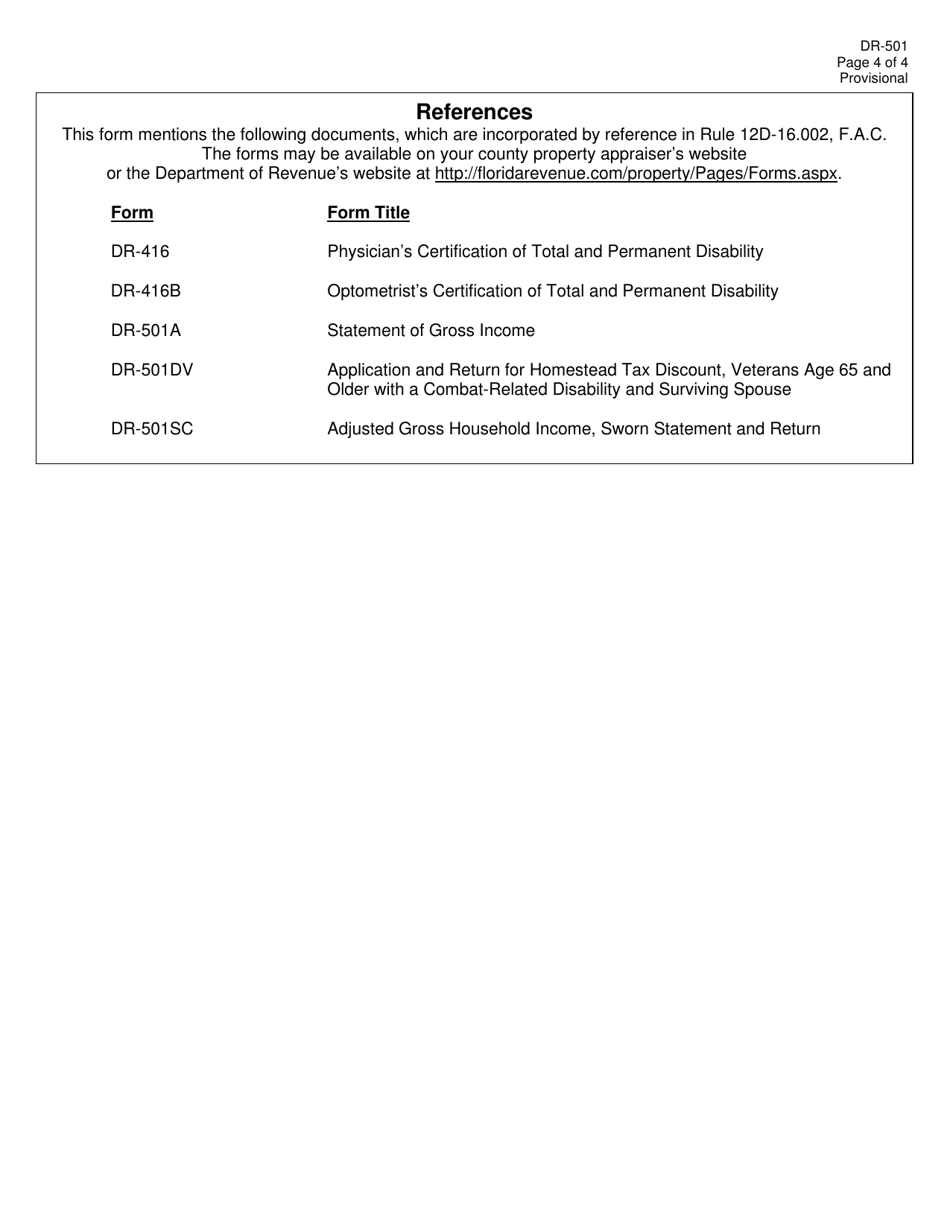

Q: What documents are required to be submitted with Form DR-501?

A: Applicants need to submit proof of ownership, proof of residency, and any necessary supporting documentation for the specific exemption being applied for.

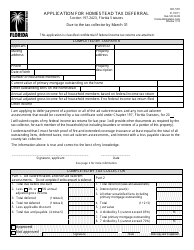

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-501 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.