This version of the form is not currently in use and is provided for reference only. Download this version of

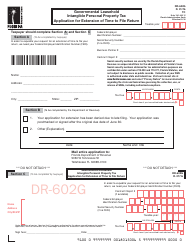

Form DR-501DV

for the current year.

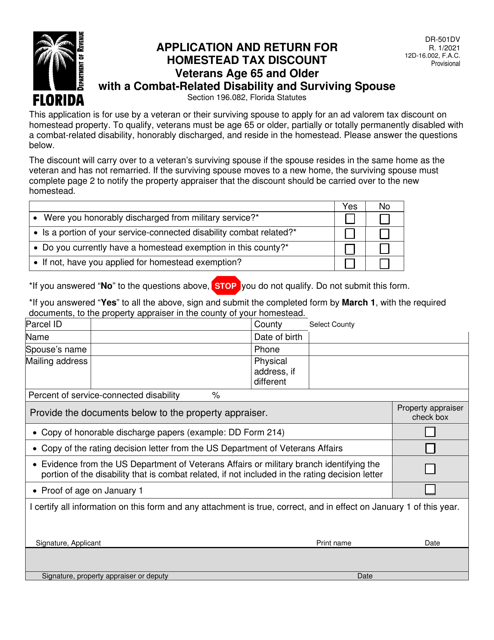

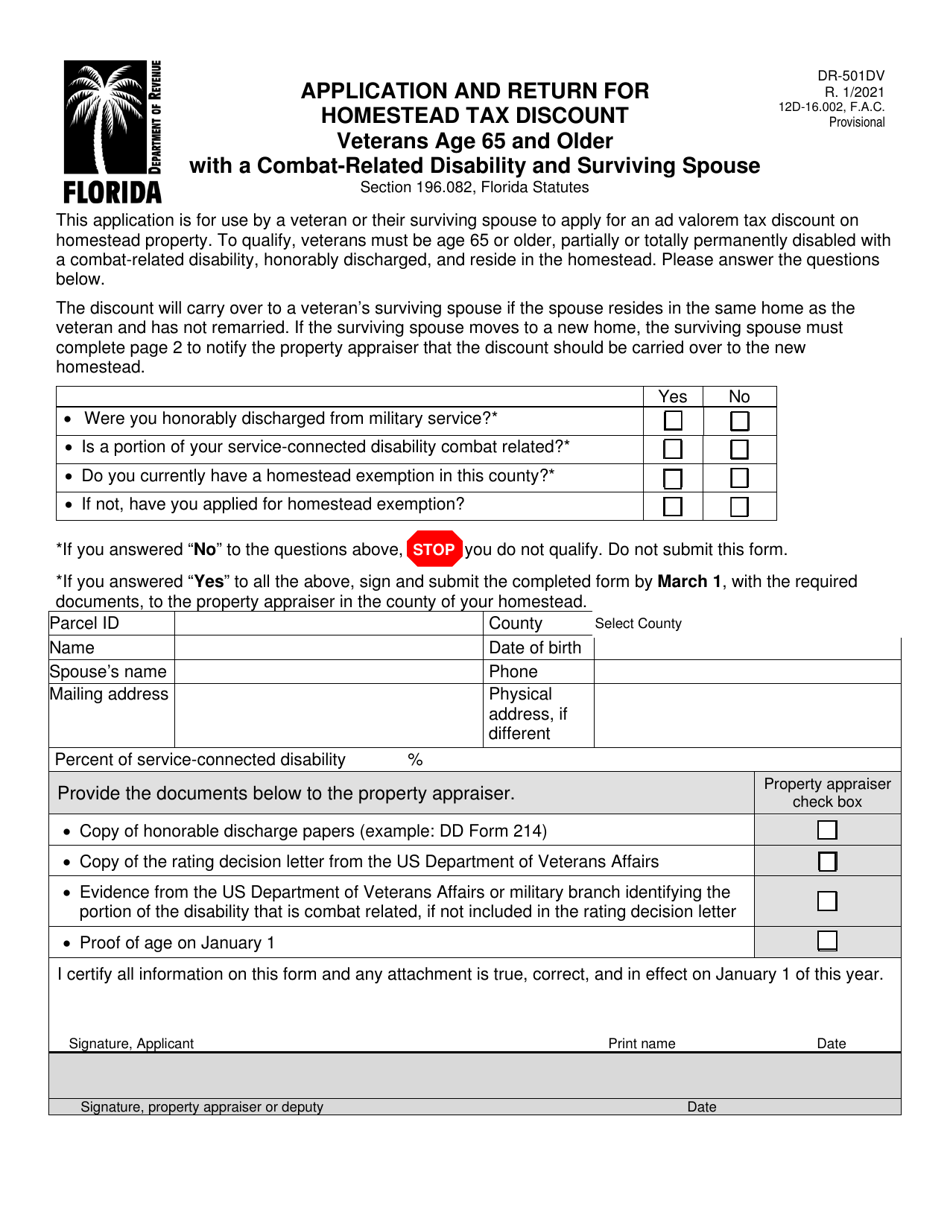

Form DR-501DV Application and Return for Homestead Tax Discount - Veterans Age 65 and Older With a Combat-Related Disability and Surviving Spouse - Florida

What Is Form DR-501DV?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-501DV?

A: Form DR-501DV is the application and return for Homestead Tax Discount for veterans age 65 and older with a combat-related disability and surviving spouses in Florida.

Q: Who is eligible for the Homestead Tax Discount?

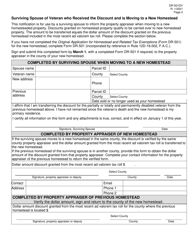

A: Veterans age 65 and older with a combat-related disability and surviving spouses are eligible for the Homestead Tax Discount in Florida.

Q: What is the purpose of Form DR-501DV?

A: The purpose of Form DR-501DV is to apply for and claim the Homestead Tax Discount for veterans age 65 and older with a combat-related disability and surviving spouses in Florida.

Q: What documents are required to be submitted with Form DR-501DV?

A: Along with Form DR-501DV, you will need to submit proof of eligibility, such as your military discharge papers (DD-214), letters from the Department of Veterans Affairs, and any other supporting documentation.

Q: Is there a deadline to submit Form DR-501DV?

A: Yes, the deadline to submit Form DR-501DV for the Homestead Tax Discount in Florida is March 1st of each year.

Q: What is the benefit of the Homestead Tax Discount?

A: The Homestead Tax Discount provides a reduction in property taxes for eligible veterans age 65 and older with a combat-related disability and surviving spouses in Florida.

Q: Can I apply for the Homestead Tax Discount if I am a non-veteran?

A: No, the Homestead Tax Discount is specifically for veterans age 65 and older with a combat-related disability and surviving spouses in Florida.

Q: Are there any fees associated with applying for the Homestead Tax Discount?

A: No, there are no fees associated with applying for the Homestead Tax Discount in Florida.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-501DV by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.