This version of the form is not currently in use and is provided for reference only. Download this version of

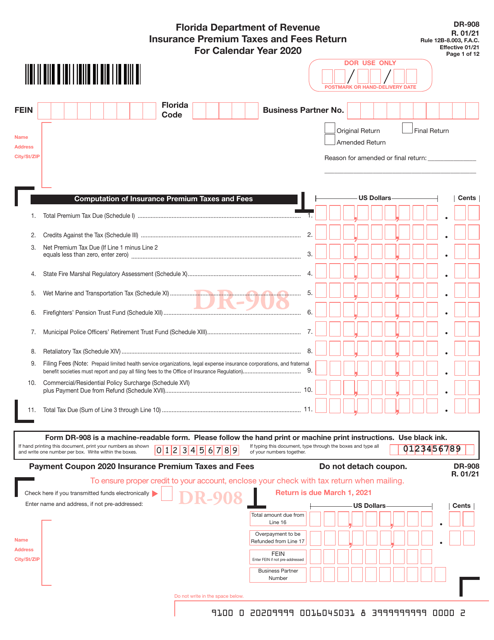

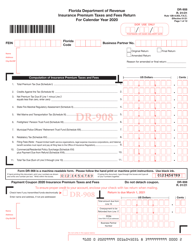

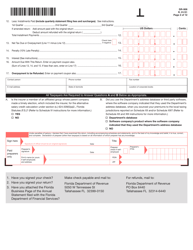

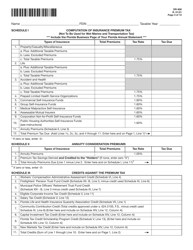

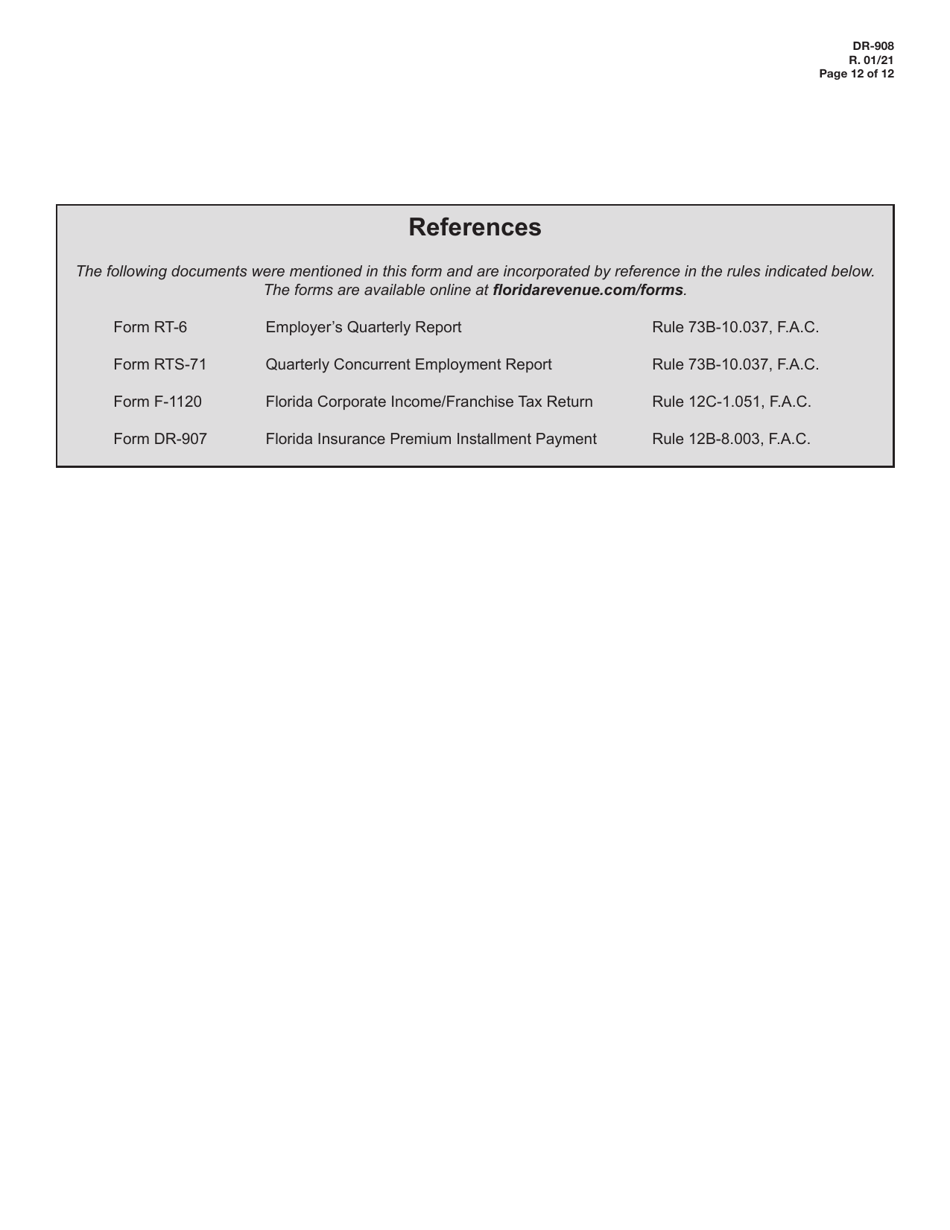

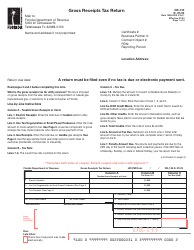

Form DR-908

for the current year.

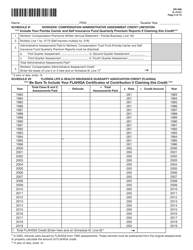

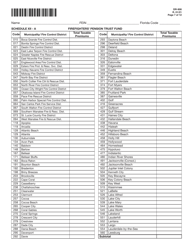

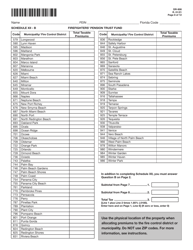

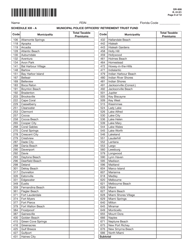

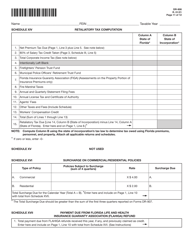

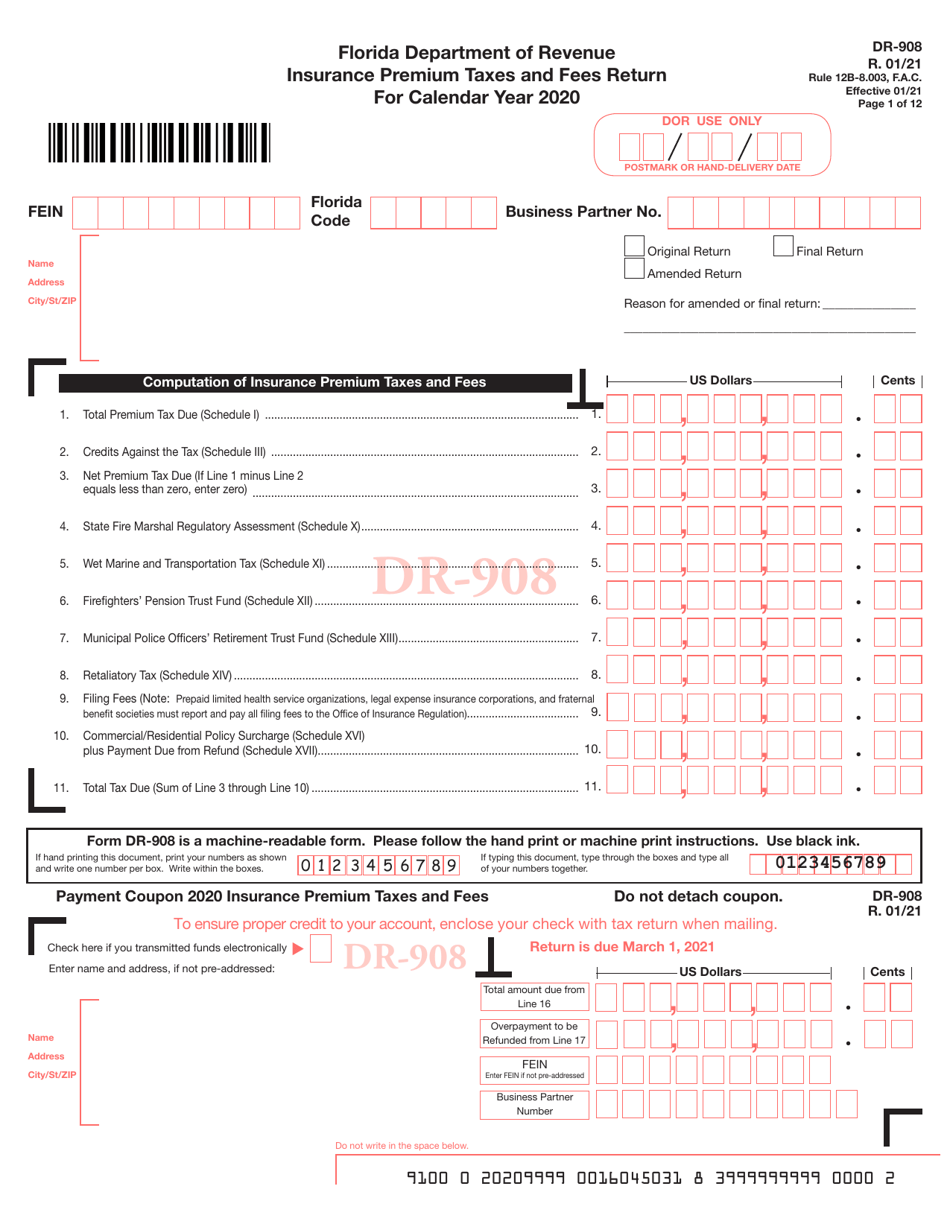

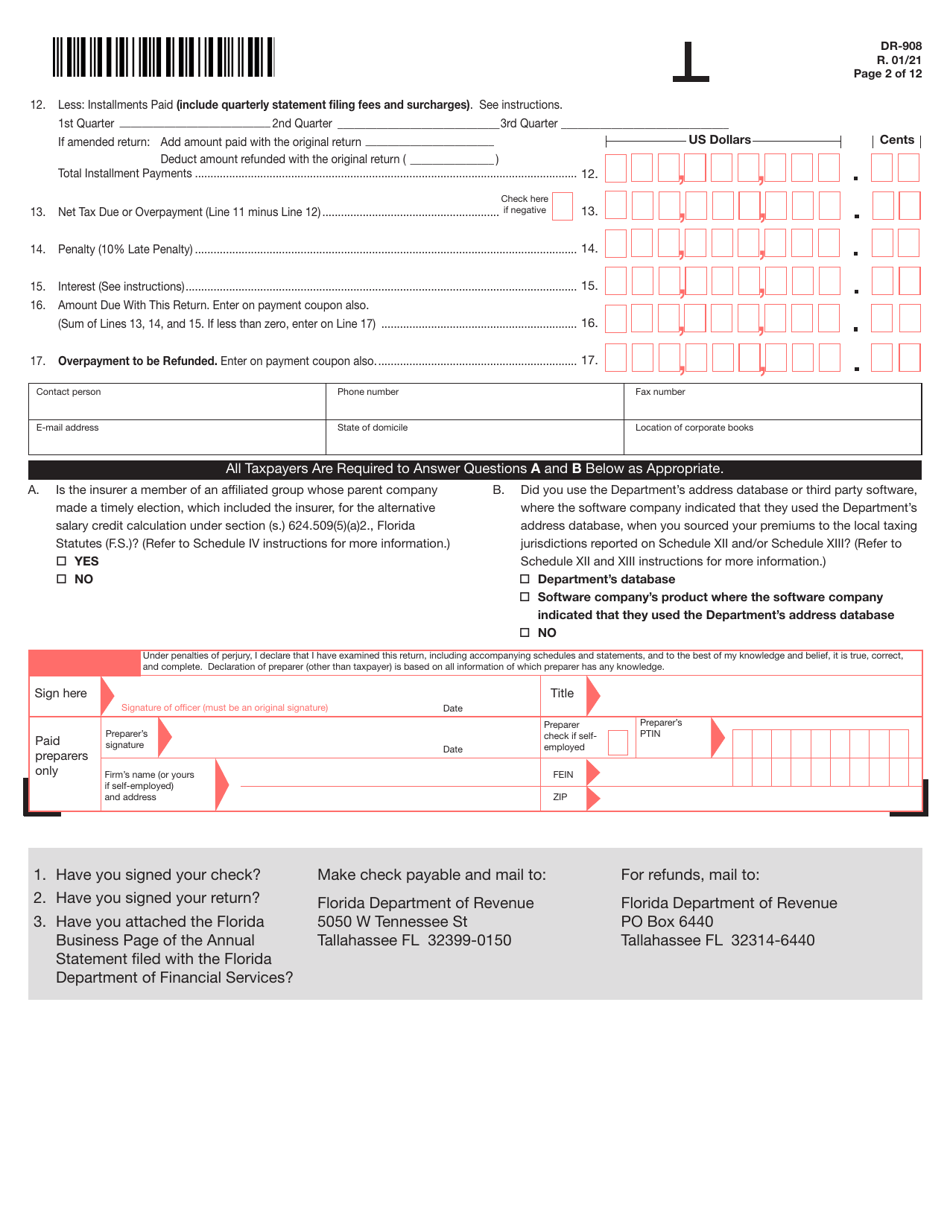

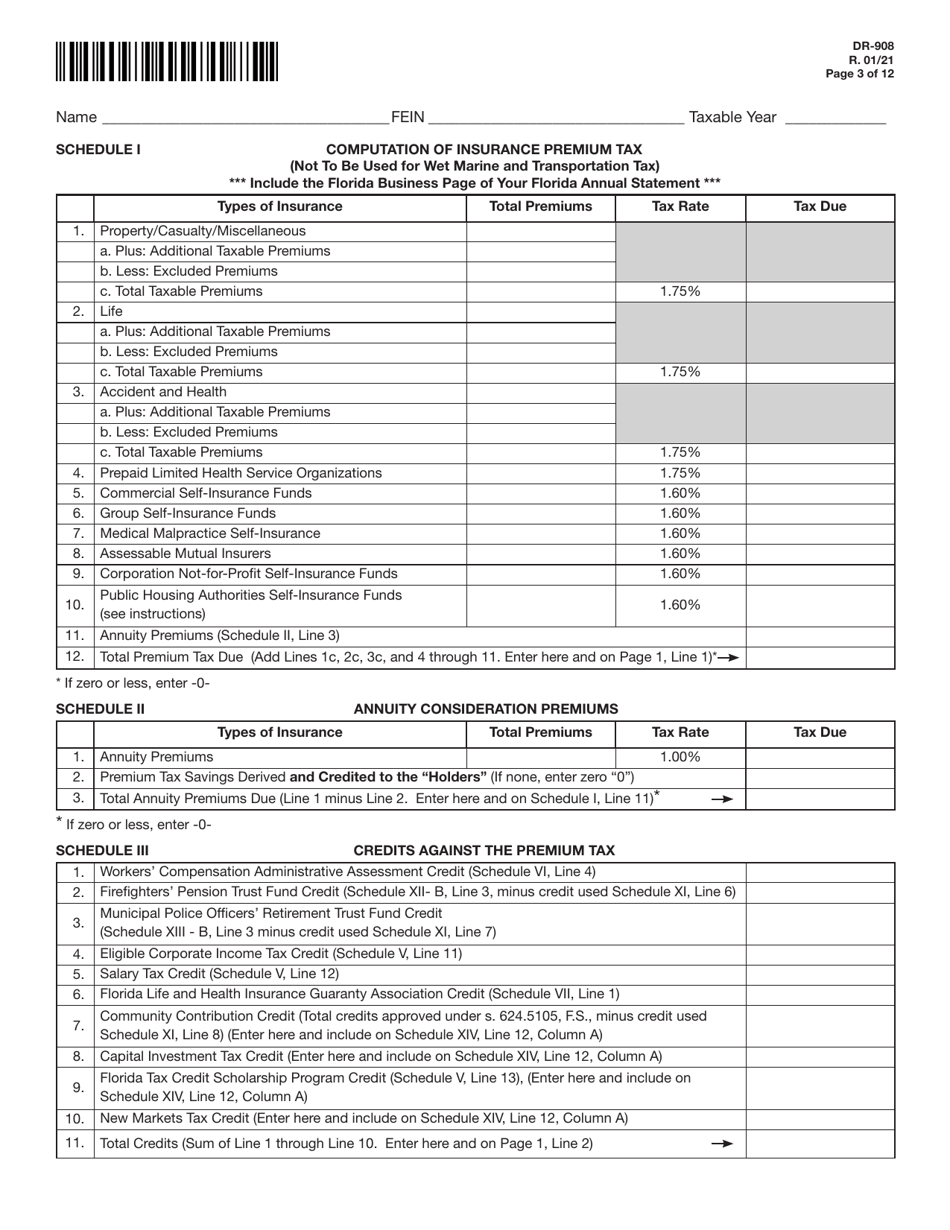

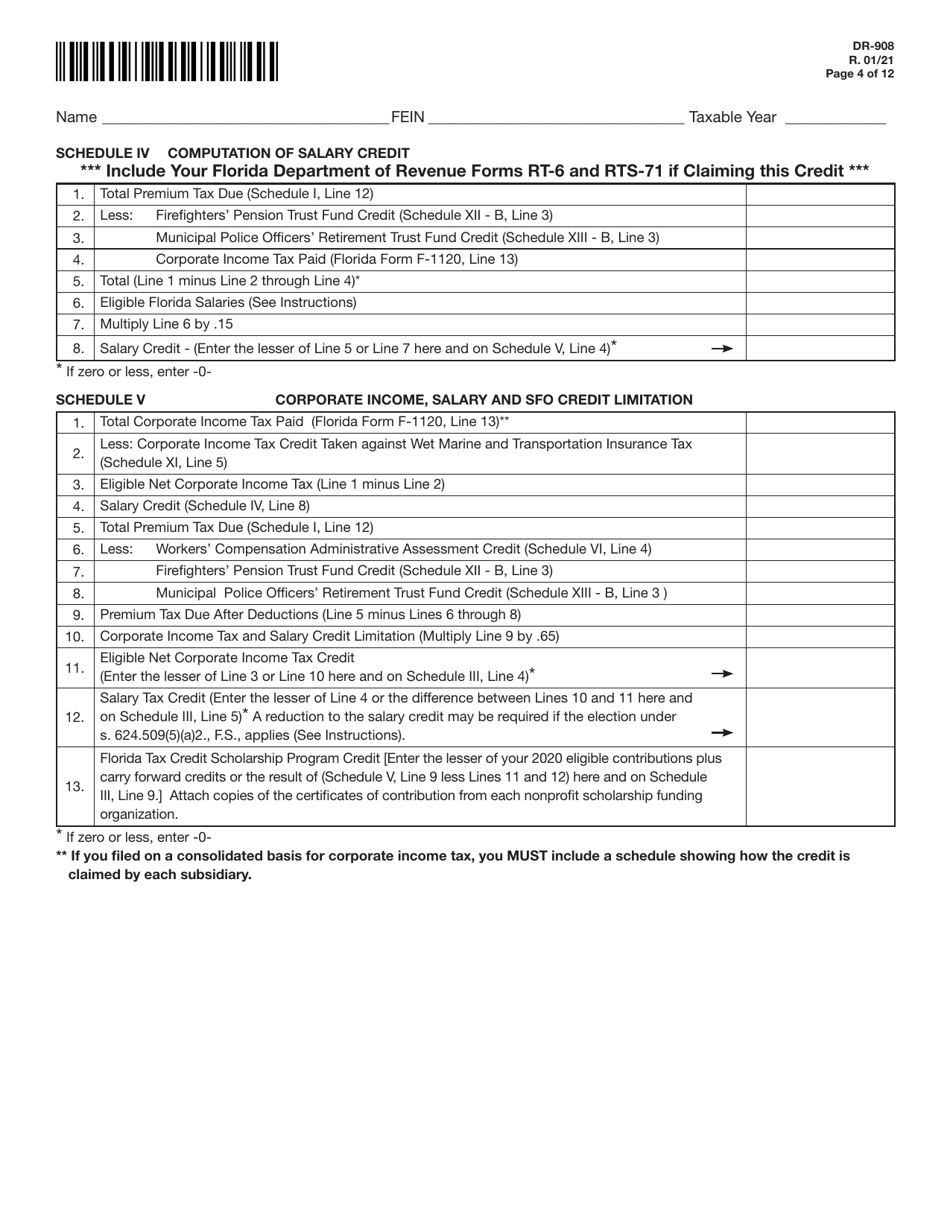

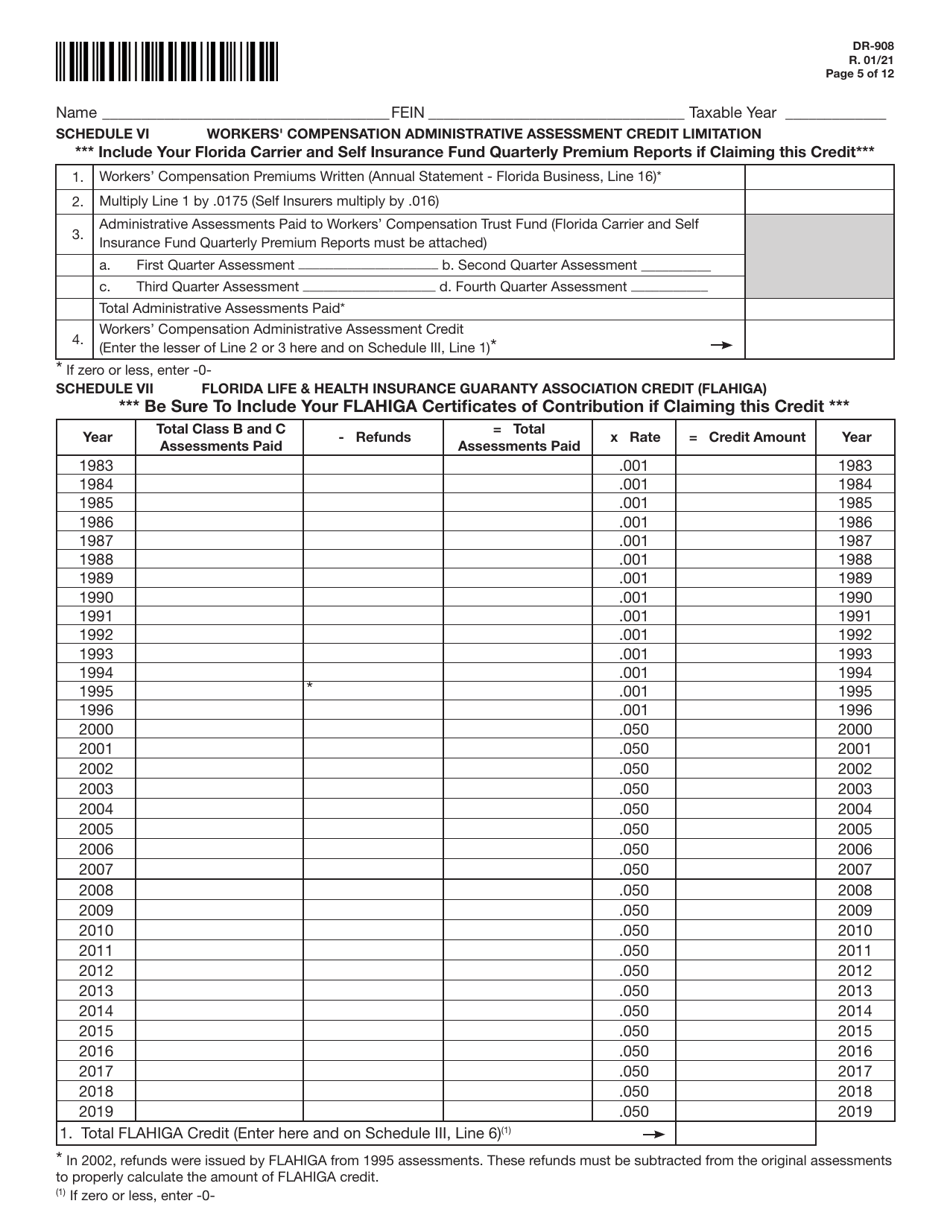

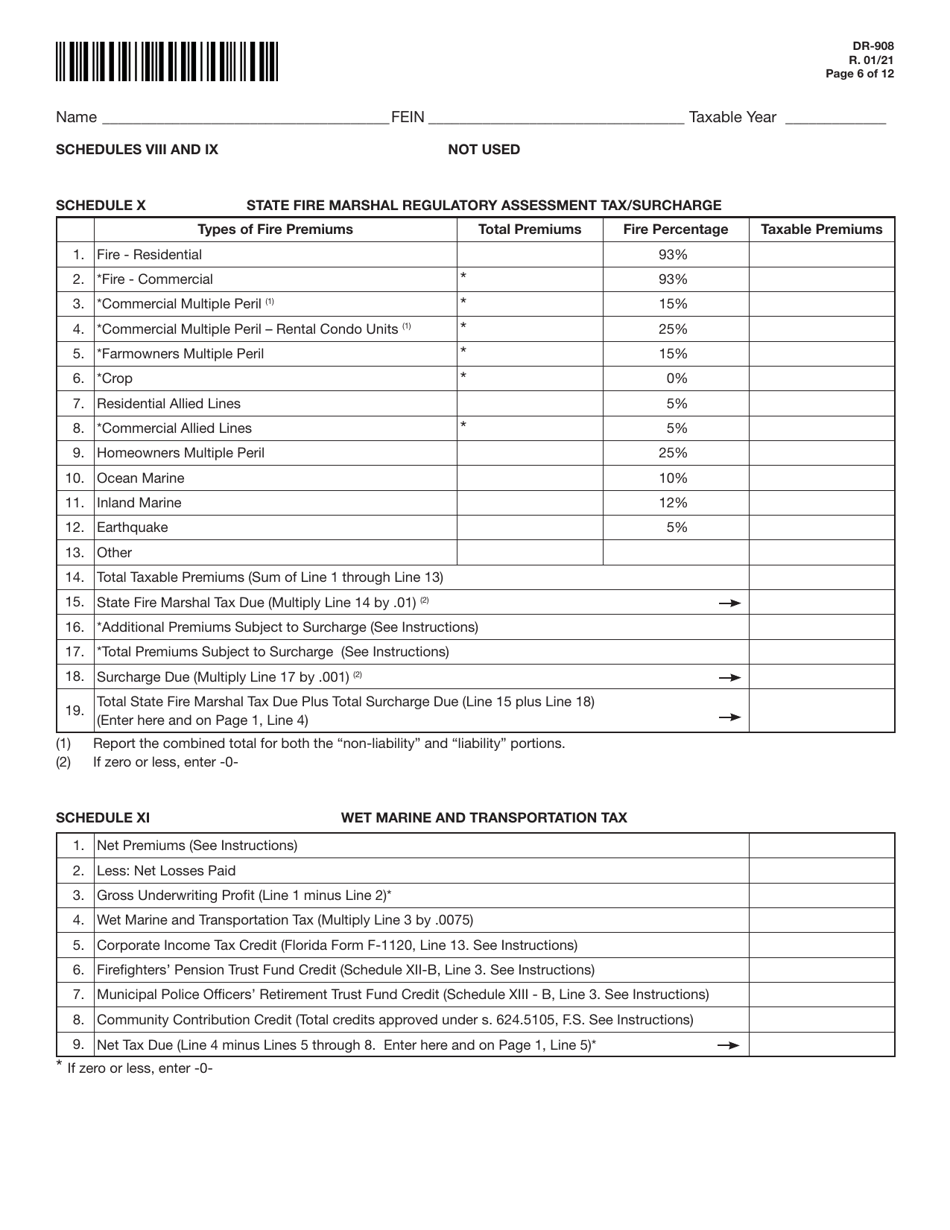

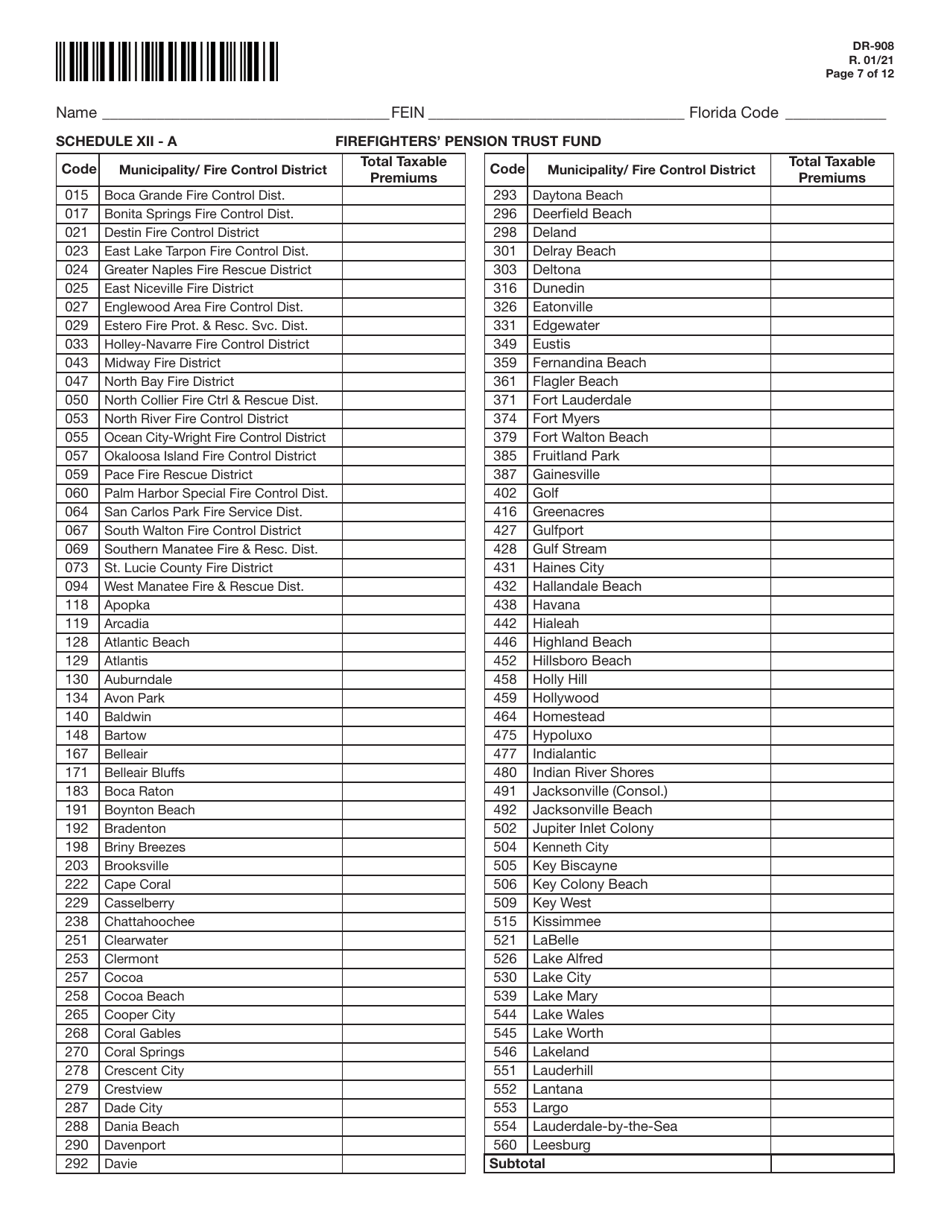

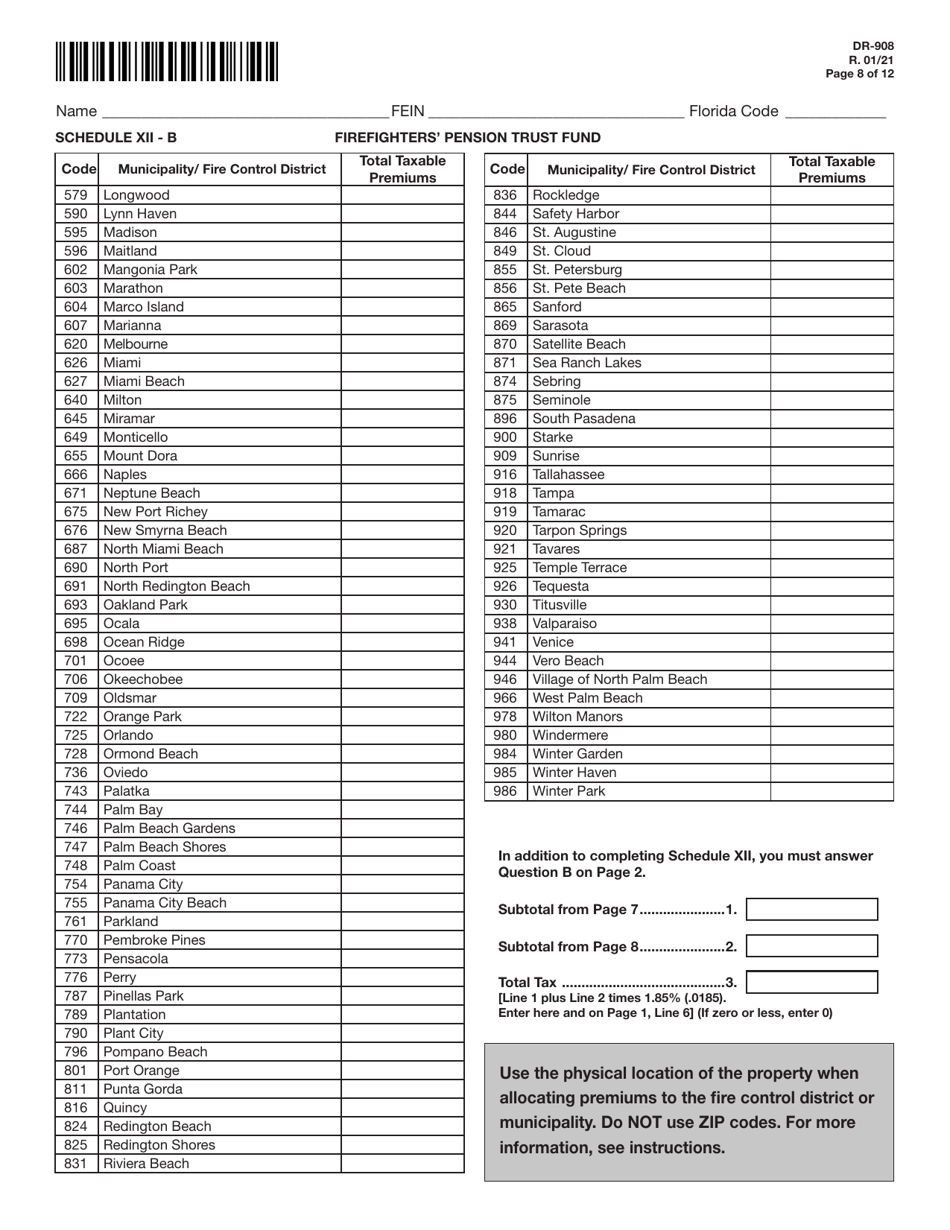

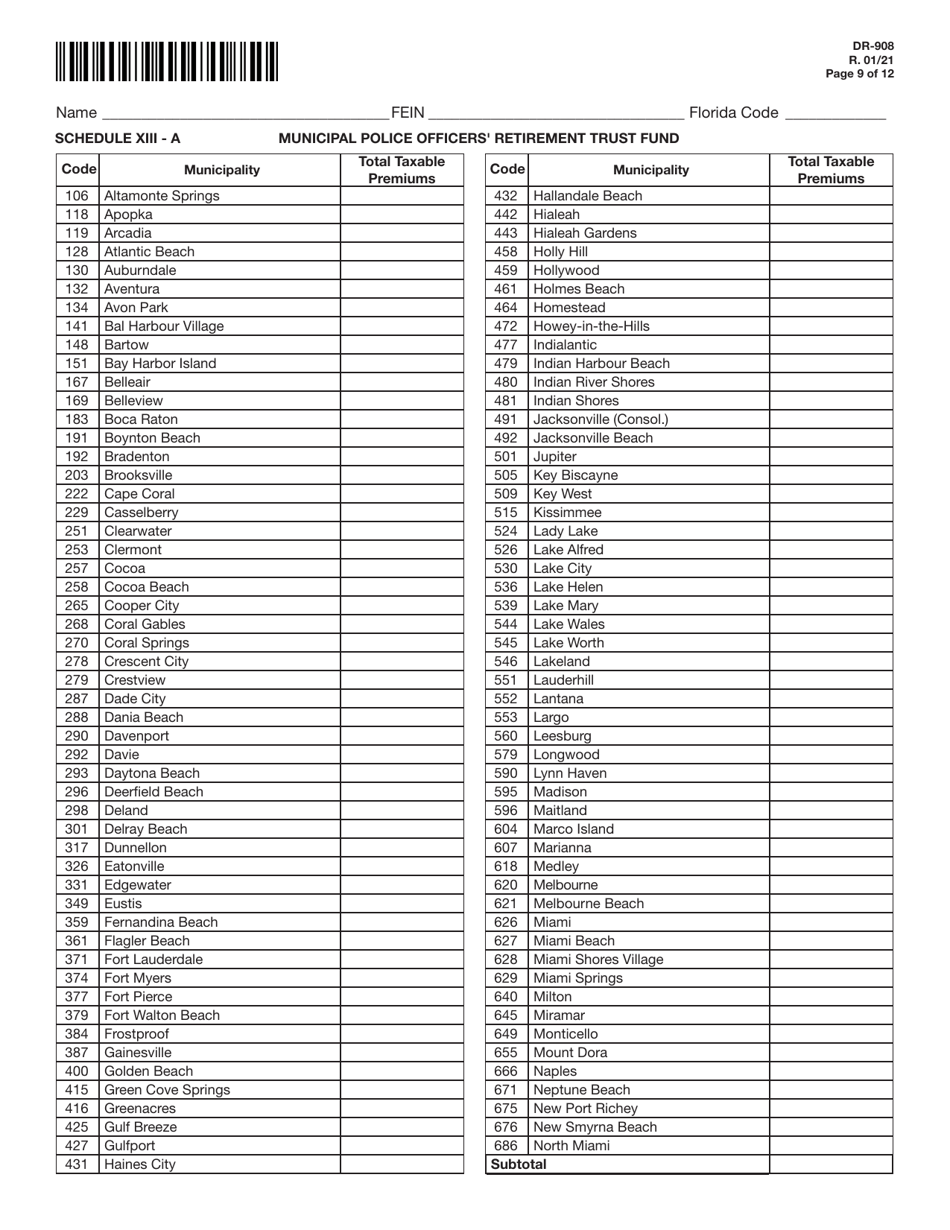

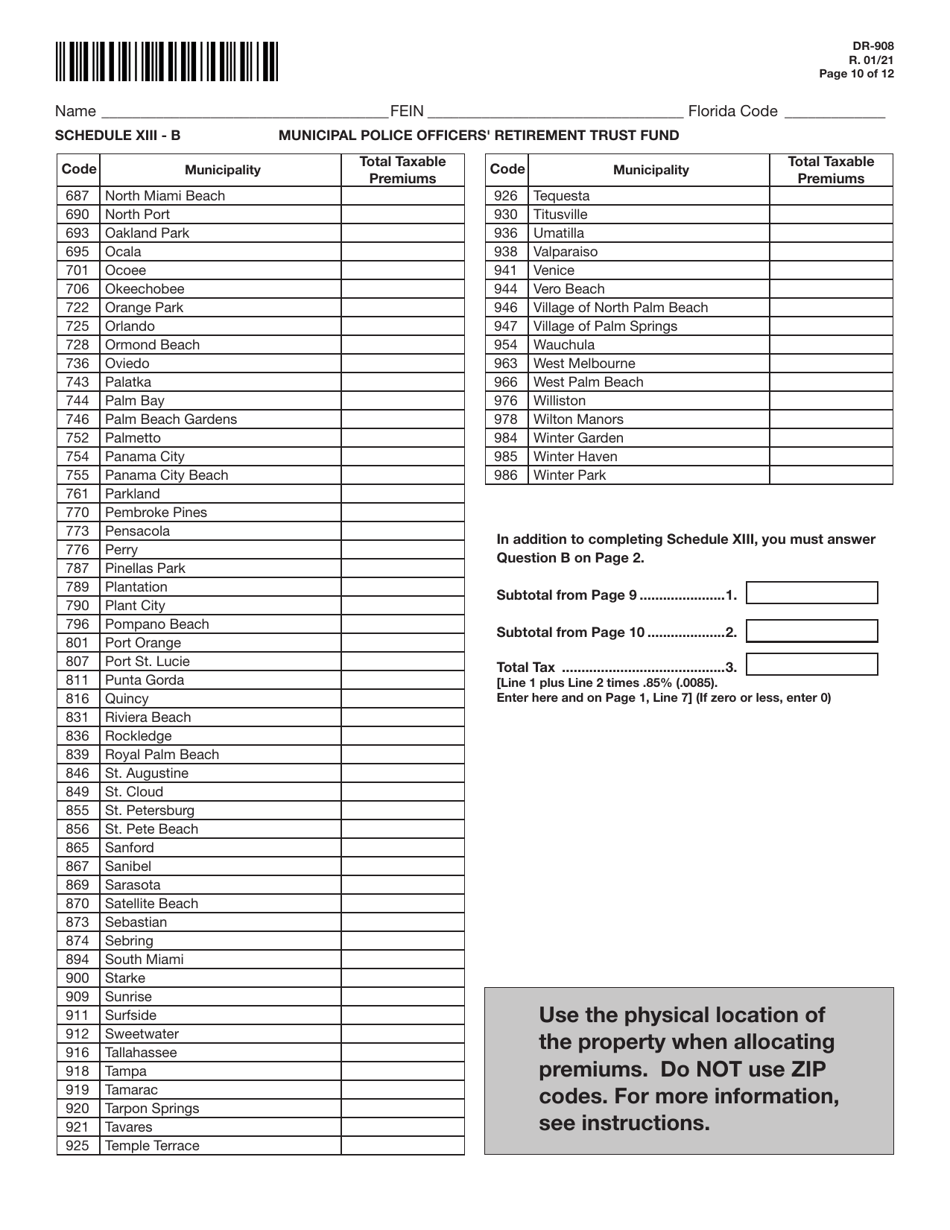

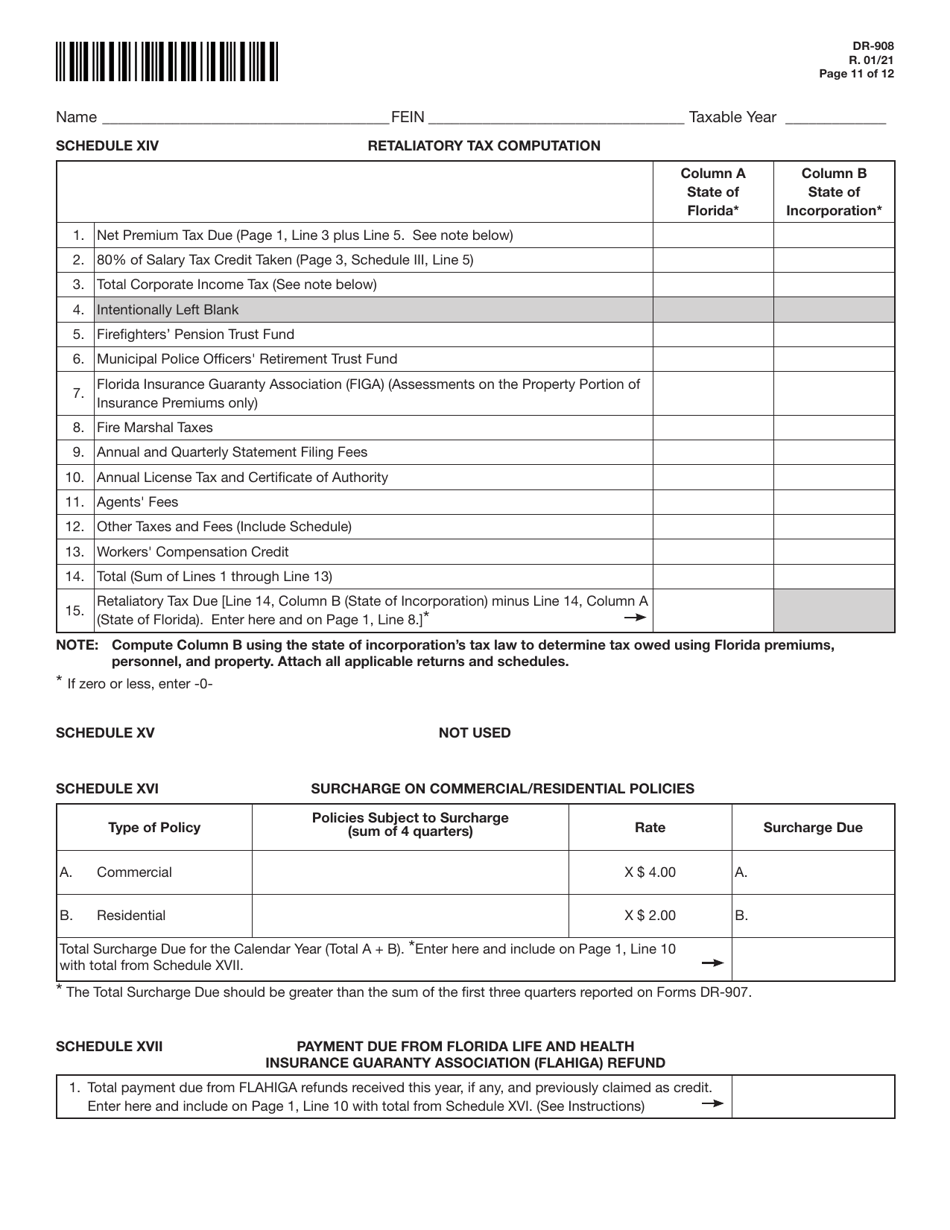

Form DR-908 Insurance Premium Taxes and Fees Return - Florida

What Is Form DR-908?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-908?

A: Form DR-908 is the Insurance Premium Taxes and Fees Return for the state of Florida.

Q: Who needs to file Form DR-908?

A: Insurance companies licensed to do business in Florida are required to file Form DR-908.

Q: What is the purpose of Form DR-908?

A: Form DR-908 is used to report and remit insurance premium taxes and fees to the state of Florida.

Q: When is Form DR-908 due?

A: Form DR-908 is due by March 1st following the end of the calendar year.

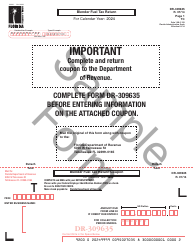

Q: Are there any penalties for late filing of Form DR-908?

A: Yes, there are penalties for late filing of Form DR-908. It is important to file and pay on time to avoid penalties and interest charges.

Q: Are there any exemptions or deductions available on Form DR-908?

A: Yes, there are certain exemptions and deductions available on Form DR-908. These should be carefully reviewed and applied if applicable.

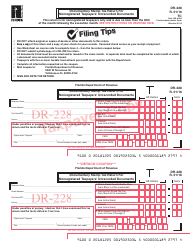

Q: Can I file Form DR-908 electronically?

A: Yes, electronic filing is available for Form DR-908. It is recommended to file electronically for faster processing.

Q: What supporting documents do I need to include with Form DR-908?

A: The specific supporting documents required may vary based on individual circumstances. It is important to review the instructions provided with the form to determine the required documentation.

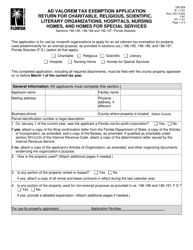

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-908 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.