This version of the form is not currently in use and is provided for reference only. Download this version of

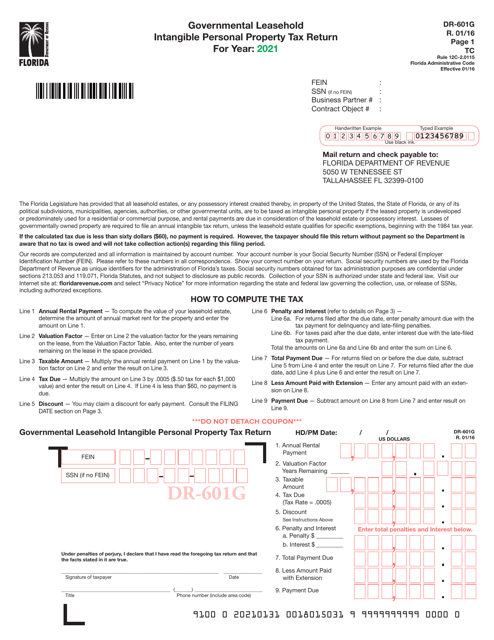

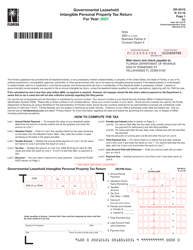

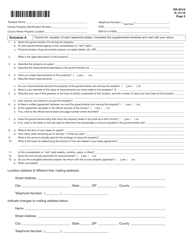

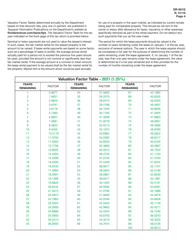

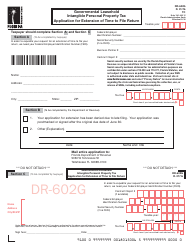

Form DR-601G

for the current year.

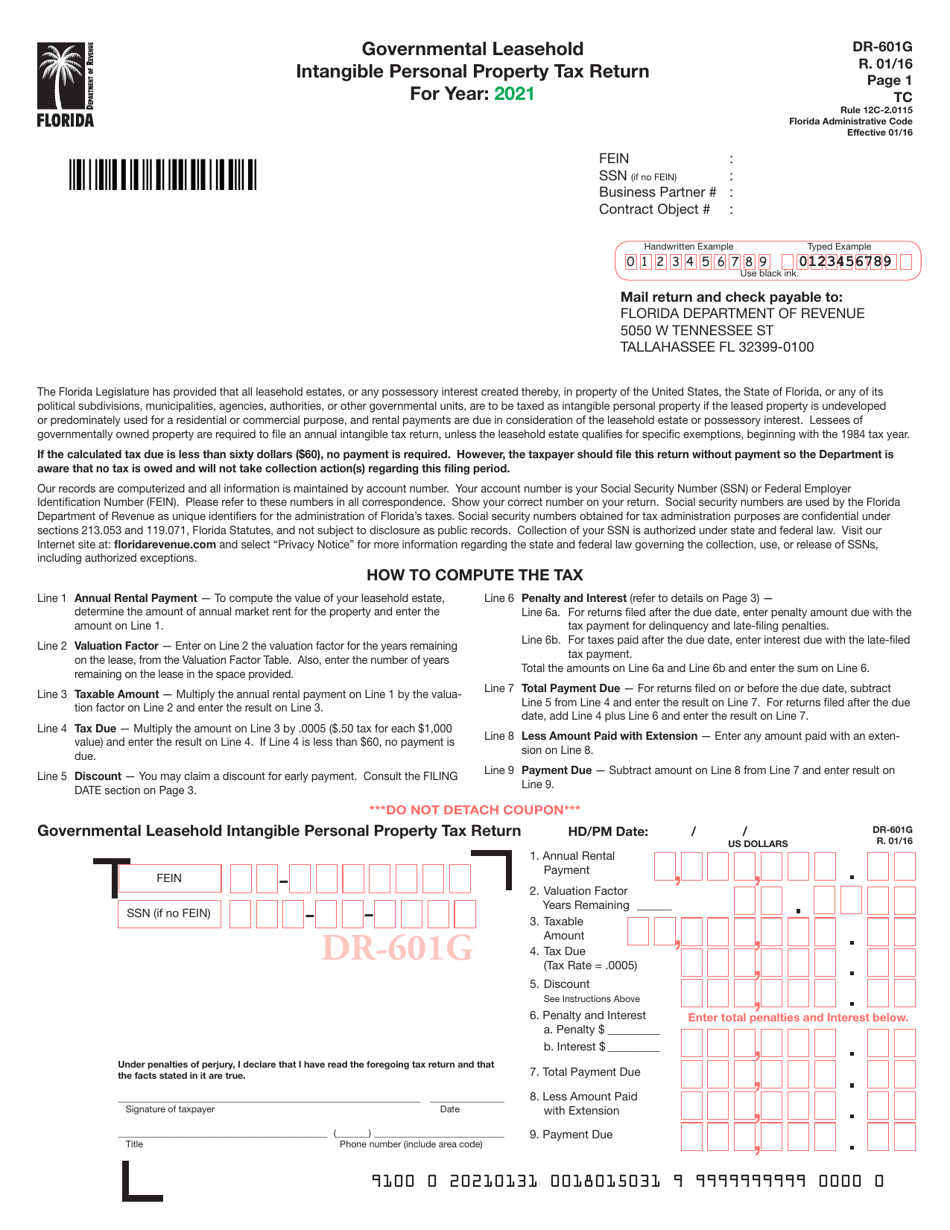

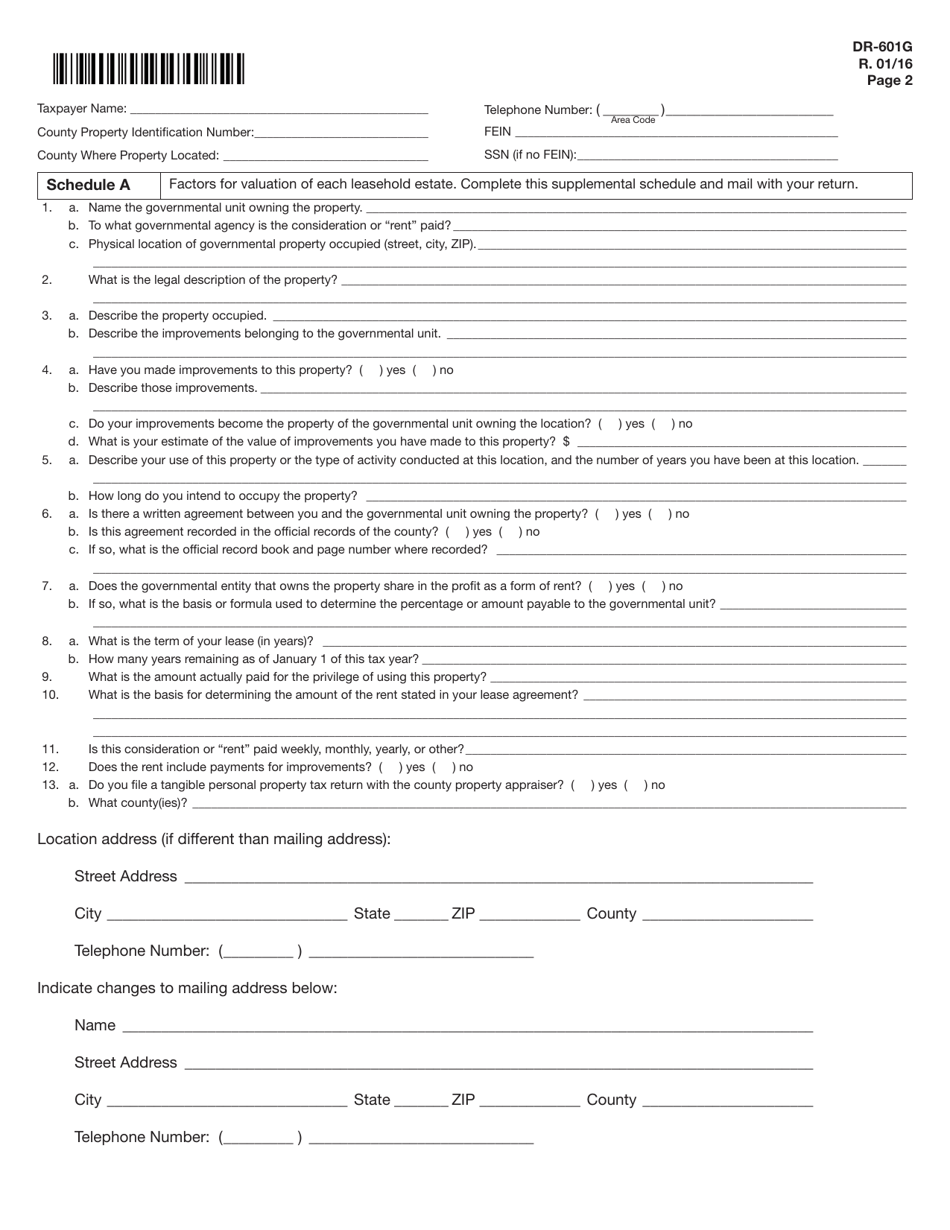

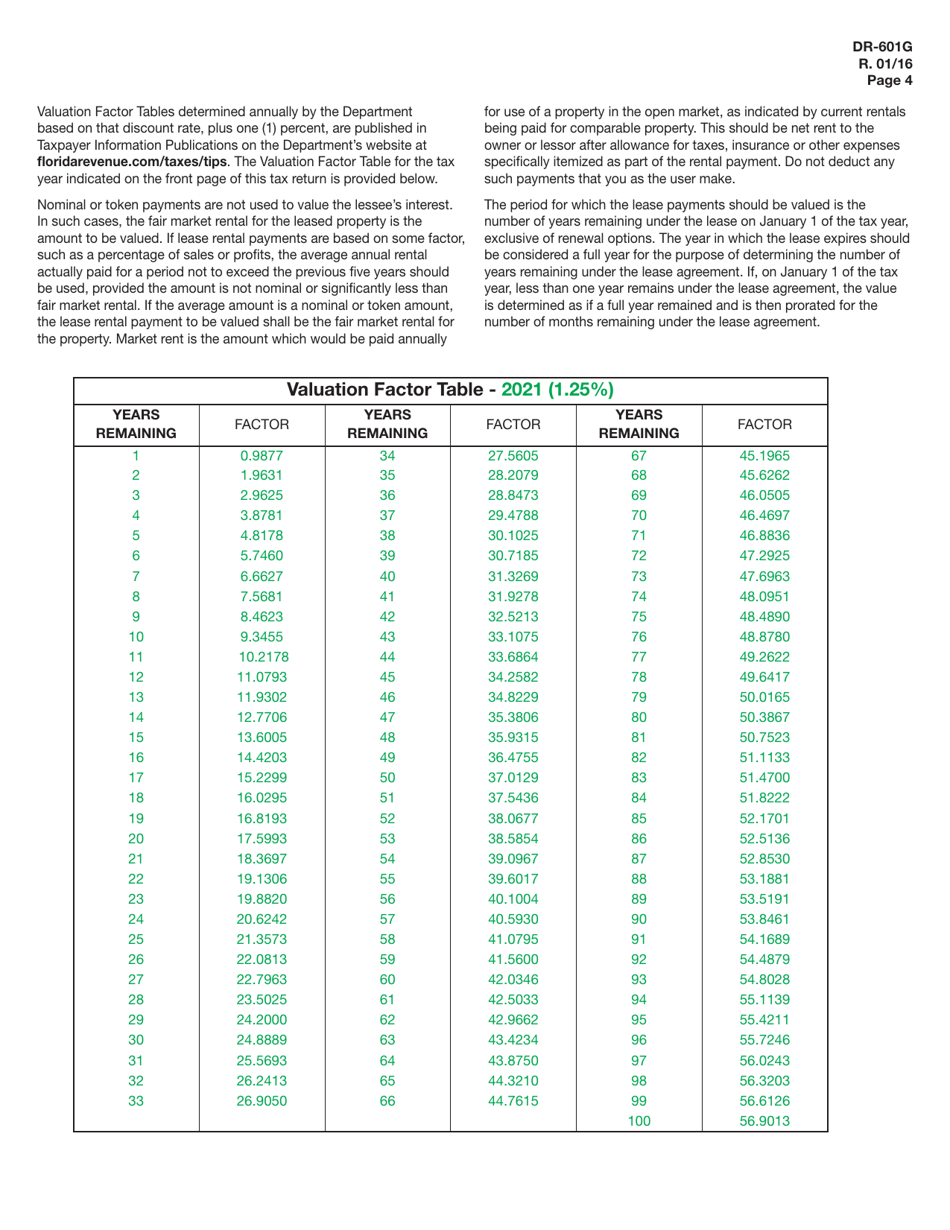

Form DR-601G Governmental Leasehold Intangible Personal Property Tax Return - Florida

What Is Form DR-601G?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-601G?

A: Form DR-601G is the Governmental Leasehold Intangible Personal Property Tax Return in Florida.

Q: Who needs to file Form DR-601G?

A: Individuals or businesses that are leasing governmental property in Florida and have intangible personal property are required to file Form DR-601G.

Q: What is considered government leasehold intangible personal property?

A: Government leasehold intangible personal property refers to leasehold interests in intangible personal property that is being used on governmental property.

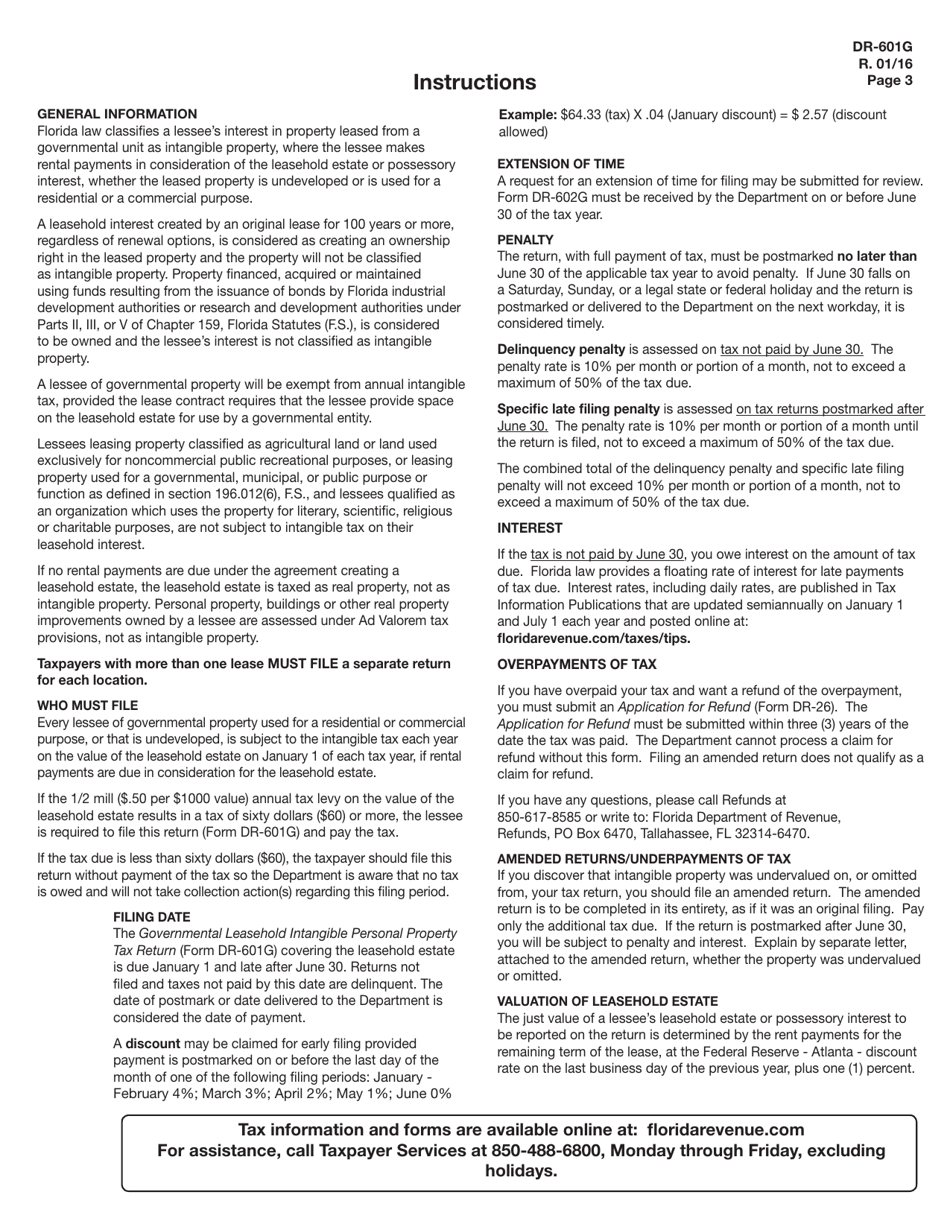

Q: When is Form DR-601G due?

A: Form DR-601G is due by April 1st of each year.

Q: Are there any penalties for not filing Form DR-601G?

A: Yes, if Form DR-601G is not filed or is filed late, penalties and interest may be assessed.

Q: What should I do if the value of the intangible personal property changes during the year?

A: If the value of the intangible personal property changes during the year, you should file an amended return using Form DR-601X.

Q: Can I e-file Form DR-601G?

A: No, electronic filing is not available for Form DR-601G. It must be filed by mail or in person.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-601G by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.