This version of the form is not currently in use and is provided for reference only. Download this version of

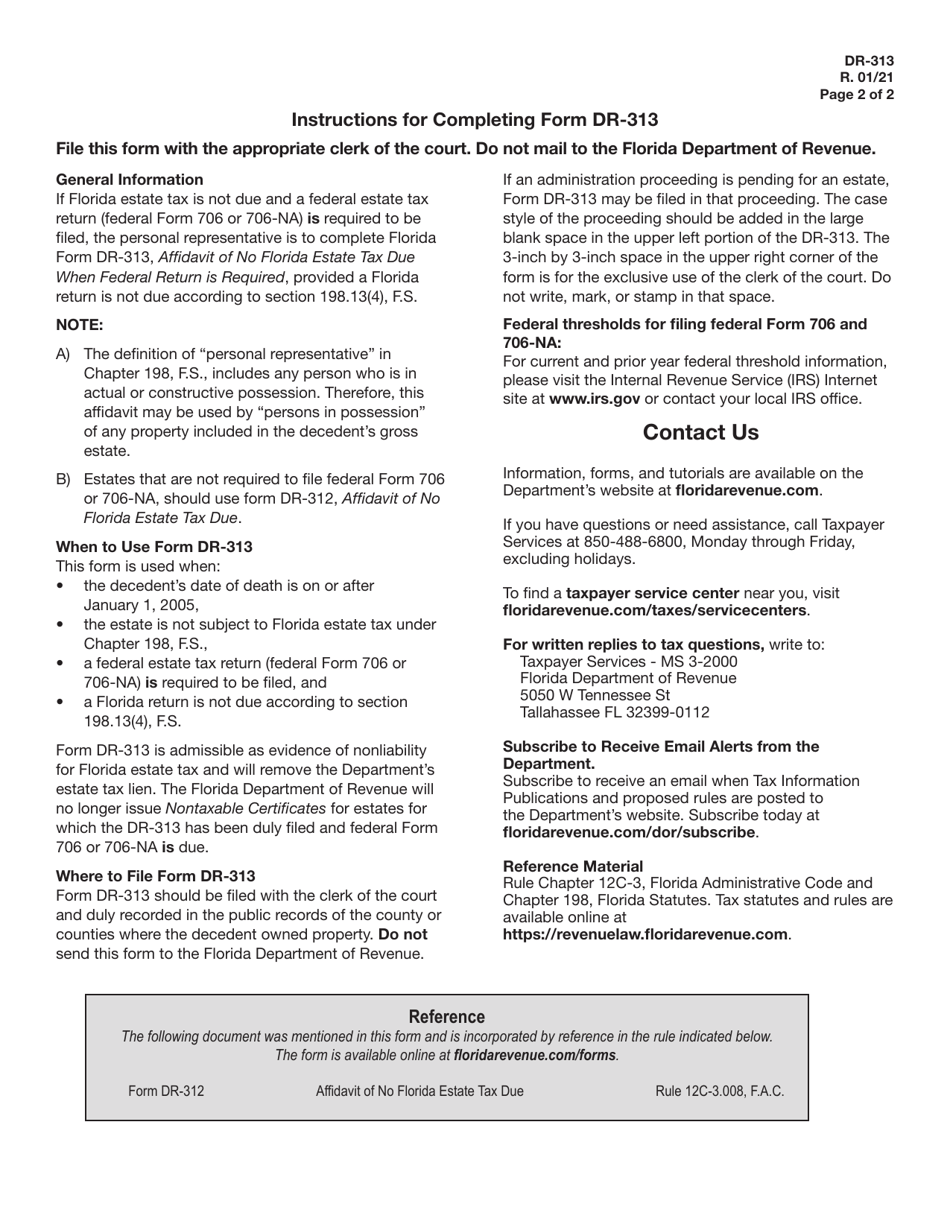

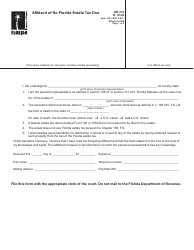

Form DR-313

for the current year.

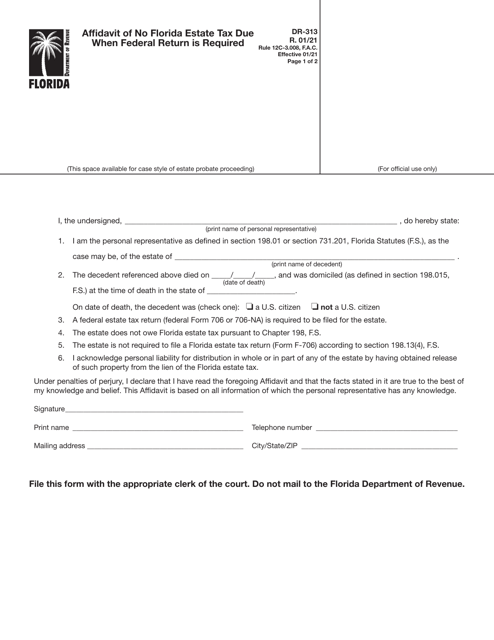

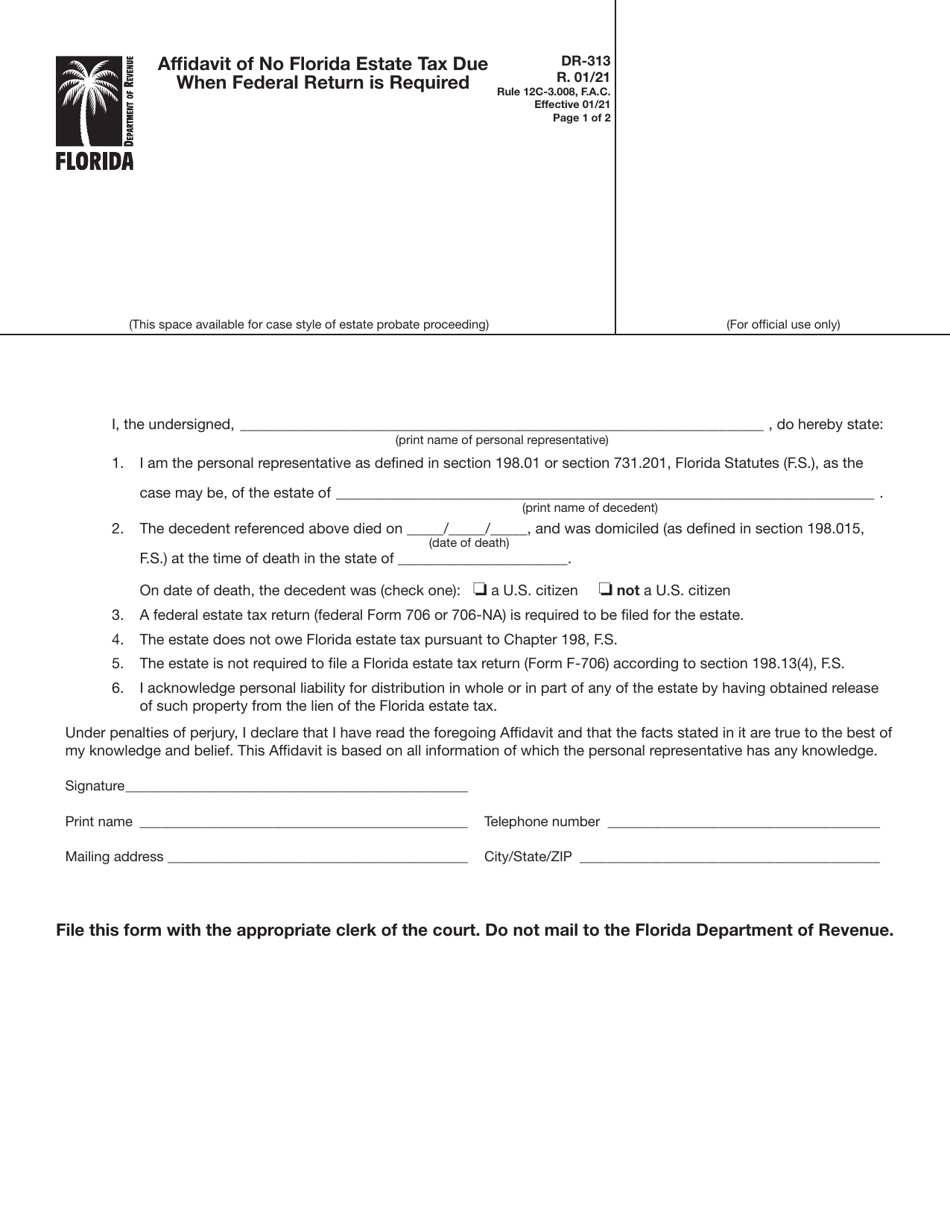

Form DR-313 Affidavit of No Florida Estate Tax Due When Federal Return Is Required - Florida

What Is Form DR-313?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

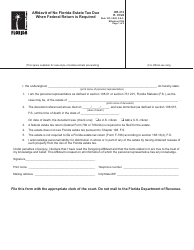

Q: What is Form DR-313?

A: Form DR-313 is the Affidavit of No Florida Estate Tax Due When Federal Return Is Required in Florida.

Q: Why is Form DR-313 used?

A: Form DR-313 is used to certify that no Florida estate tax is due when a federal return is required.

Q: When is Form DR-313 required to be filed?

A: Form DR-313 should be filed within 9 months after the decedent's death or within 1 year after the end of the alternate valuation period, whichever is later.

Q: Who needs to file Form DR-313?

A: The Personal Representative or executor of the estate needs to file Form DR-313.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-313 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.