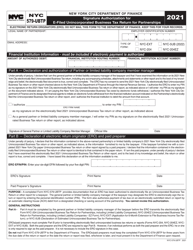

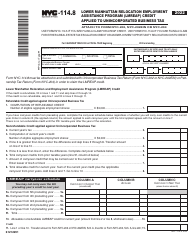

This version of the form is not currently in use and is provided for reference only. Download this version of

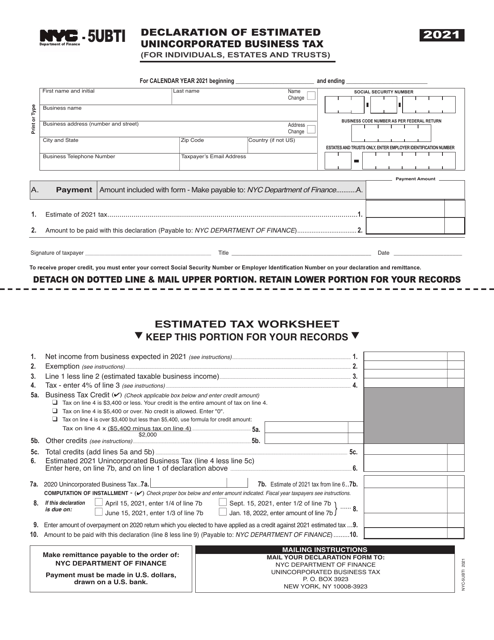

Form NYC-5UBTI

for the current year.

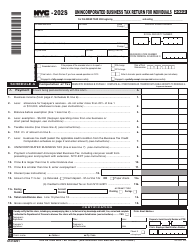

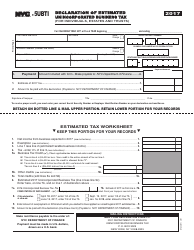

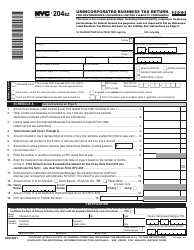

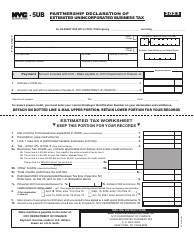

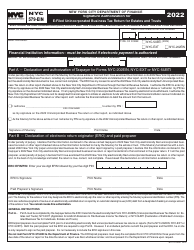

Form NYC-5UBTI Declaration of Estimated Unincorporated Business Tax (For Individuals, Estates and Trusts) - New York City

What Is Form NYC-5UBTI?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file the NYC-5UBTI declaration?

A: Individuals, estates, and trusts engaged in unincorporated business activities in New York City.

Q: What is the purpose of the NYC-5UBTI declaration?

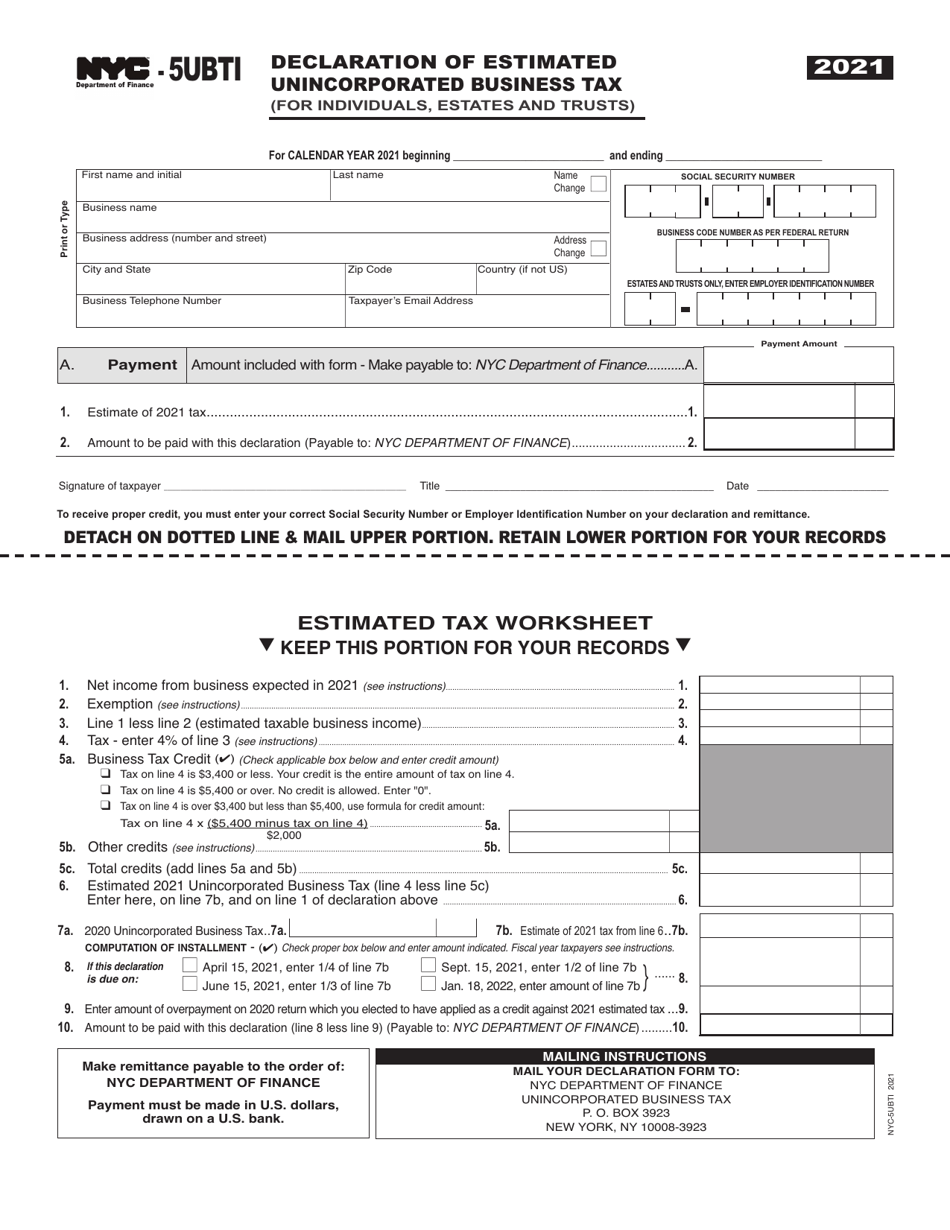

A: To report and pay the estimated unincorporated business tax (UBT) for the tax year.

Q: When is the deadline to file the NYC-5UBTI declaration?

A: The declaration must be filed by April 15th of the tax year.

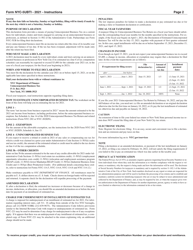

Q: What information is required to complete the NYC-5UBTI declaration?

A: You will need to provide your personal information, business income and expenses, and any other relevant financial information.

Q: Are there any penalties for late or incorrect filing of the NYC-5UBTI declaration?

A: Yes, there are penalties for late filing, underpayment of estimated tax, and negligence or intentional disregard of tax laws.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-5UBTI by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.