This version of the form is not currently in use and is provided for reference only. Download this version of

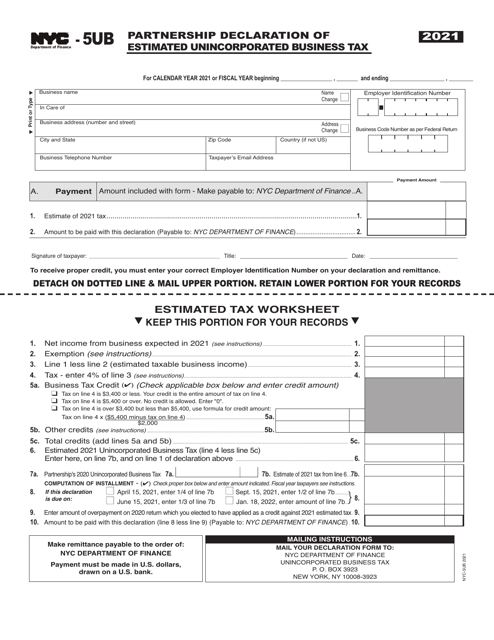

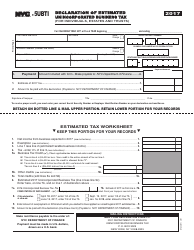

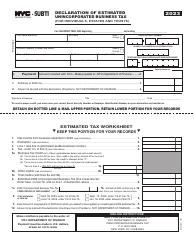

Form NYC-5UB

for the current year.

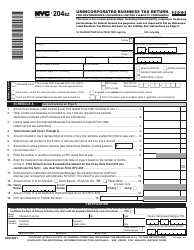

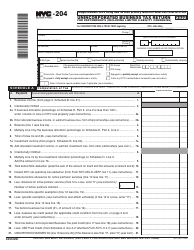

Form NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax - New York City

What Is Form NYC-5UB?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

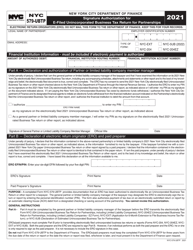

Q: What is the NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax?

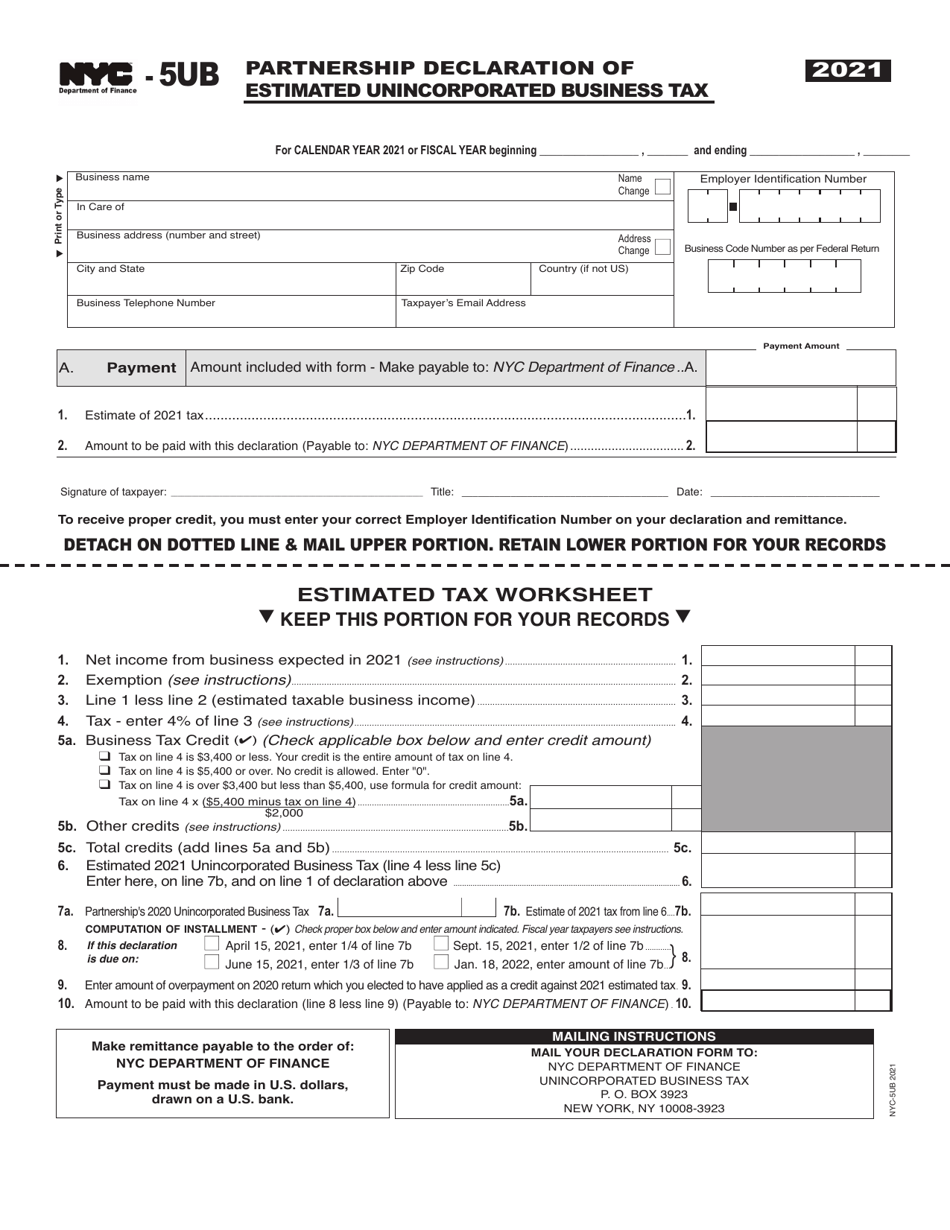

A: The NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax is a form used by partnerships in New York City to report and pay estimated taxes on their unincorporated business income.

Q: Who needs to file the NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax?

A: Partnerships in New York City with unincorporated business income are required to file the NYC-5UB form.

Q: What is the purpose of filing the NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax?

A: The purpose of filing the NYC-5UB form is to report and pay estimated taxes on the partnership's unincorporated business income to the New York City Department of Finance.

Q: When is the deadline for filing the NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax?

A: The deadline for filing the NYC-5UB form is generally April 15th of each year, or the next business day if April 15th falls on a weekend or holiday.

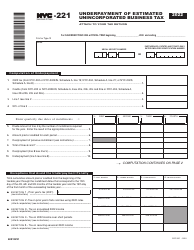

Q: Are there any penalties for not filing the NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax?

A: Yes, there are penalties for not filing the NYC-5UB form, including late filing penalties and interest on any unpaid taxes.

Q: Is the NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax only for partnerships?

A: Yes, the NYC-5UB form is specifically designed for partnerships and is not applicable to other types of business entities.

Q: What information do I need to complete the NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax?

A: You will generally need information about the partnership's income, deductions, and estimated tax payments to complete the NYC-5UB form.

Q: Can I amend my NYC-5UB Partnership Declaration of Estimated Unincorporated Business Tax?

A: Yes, you can amend your NYC-5UB form by filing an amended return and providing the correct information.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-5UB by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.