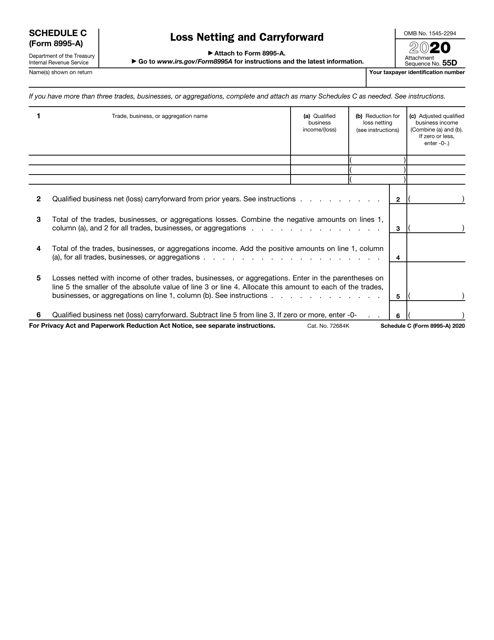

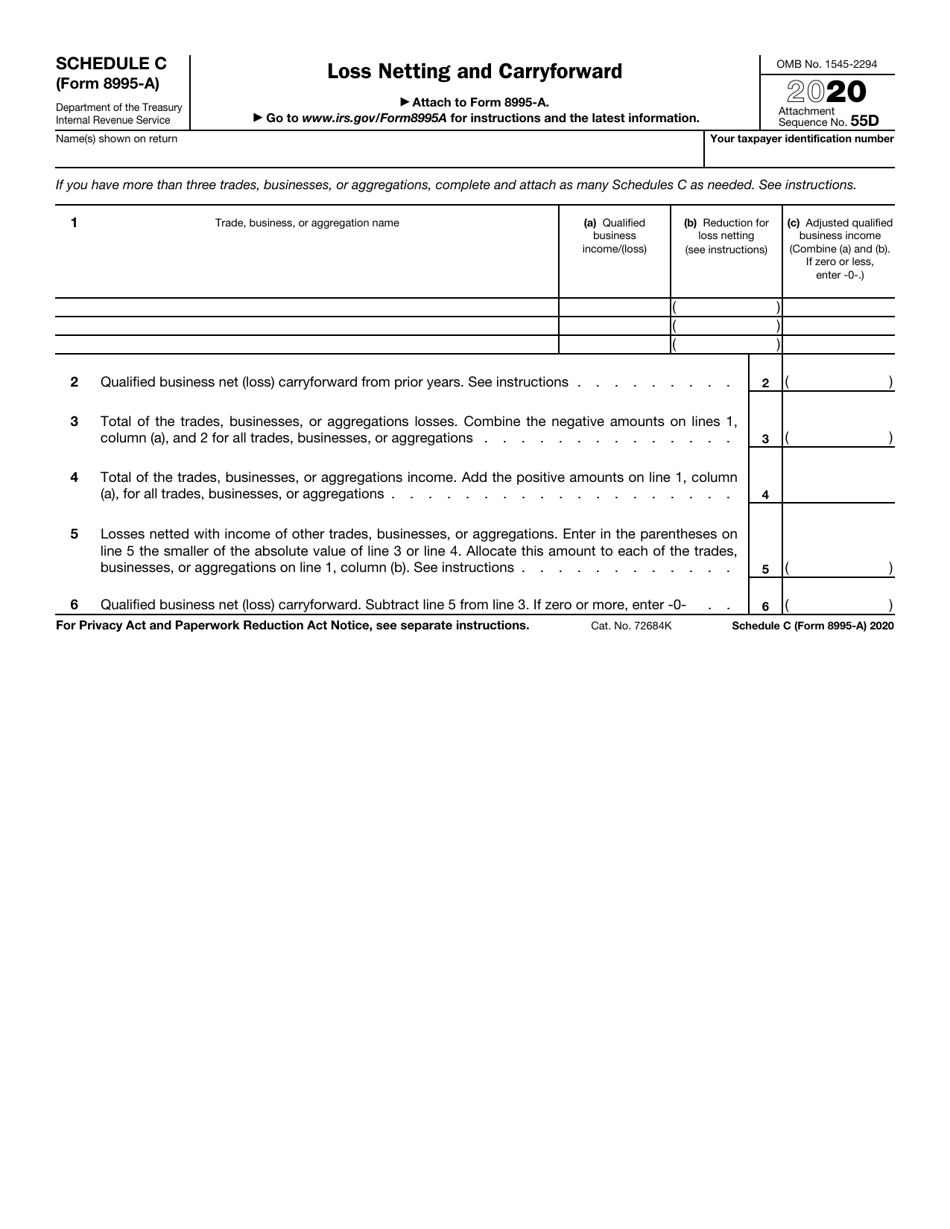

This version of the form is not currently in use and is provided for reference only. Download this version of

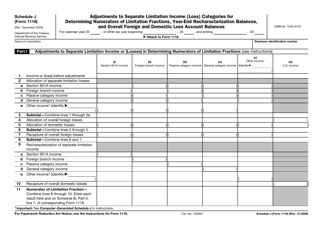

IRS Form 8995-A Schedule C

for the current year.

IRS Form 8995-A Schedule C Loss Netting and Carryforward

What Is IRS Form 8995-A Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8995-A, Qualified Business Income Deduction. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a tax form used to calculate the netting and carryforward of Schedule C losses.

Q: What is Schedule C loss netting?

A: Schedule C loss netting refers to the process of combining and offsetting business losses on Schedule C of your tax return.

Q: What is Schedule C loss carryforward?

A: Schedule C loss carryforward allows you to carry forward any excess business losses from a prior tax year to offset future income.

Q: How do I use IRS Form 8995-A?

A: You use IRS Form 8995-A to calculate your Qualified Business Income (QBI) deduction and determine if you have any Schedule C losses to net or carryforward.

Q: Who needs to file IRS Form 8995-A?

A: Taxpayers who have business losses reported on Schedule C of their tax return may need to file IRS Form 8995-A.

Q: Can I carry forward my Schedule C losses indefinitely?

A: No, there are limitations on how long you can carry forward Schedule C losses. Generally, losses can be carried forward for up to 20 years.

Q: Are there any special rules or limitations for Schedule C loss netting and carryforward?

A: Yes, there are specific rules and limitations that apply to Schedule C loss netting and carryforward. It is recommended to consult with a tax professional for guidance.

Q: What other forms or schedules do I need to complete along with IRS Form 8995-A?

A: You may need to complete additional forms or schedules depending on your individual tax situation. Consult with a tax professional or refer to the IRS instructions for IRS Form 8995-A for more information.

Q: What if I made a mistake on IRS Form 8995-A?

A: If you made a mistake on IRS Form 8995-A, you may need to file an amended tax return using Form 1040-X to correct the error.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A Schedule C through the link below or browse more documents in our library of IRS Forms.