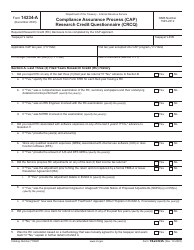

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 6765

for the current year.

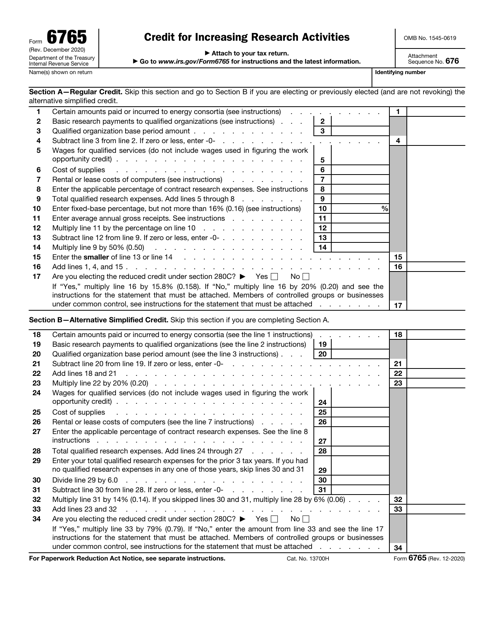

IRS Form 6765 Credit for Increasing Research Activities

What Is IRS Form 6765?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 6765?

A: IRS Form 6765 is a tax form used to claim the Credit for Increasing Research Activities.

Q: What is the purpose of IRS Form 6765?

A: The purpose of IRS Form 6765 is to calculate and claim the tax credit for qualifying research activities.

Q: Who can use IRS Form 6765?

A: Businesses and some individuals who incur qualified research expenses can use IRS Form 6765 to claim the tax credit.

Q: What is the Credit for Increasing Research Activities?

A: The Credit for Increasing Research Activities is a tax credit that provides an incentive for businesses to invest in research and development activities.

Q: What types of expenses qualify for the credit?

A: Expenses related to qualified research activities, such as wages, supplies, and contract research, may qualify for the credit.

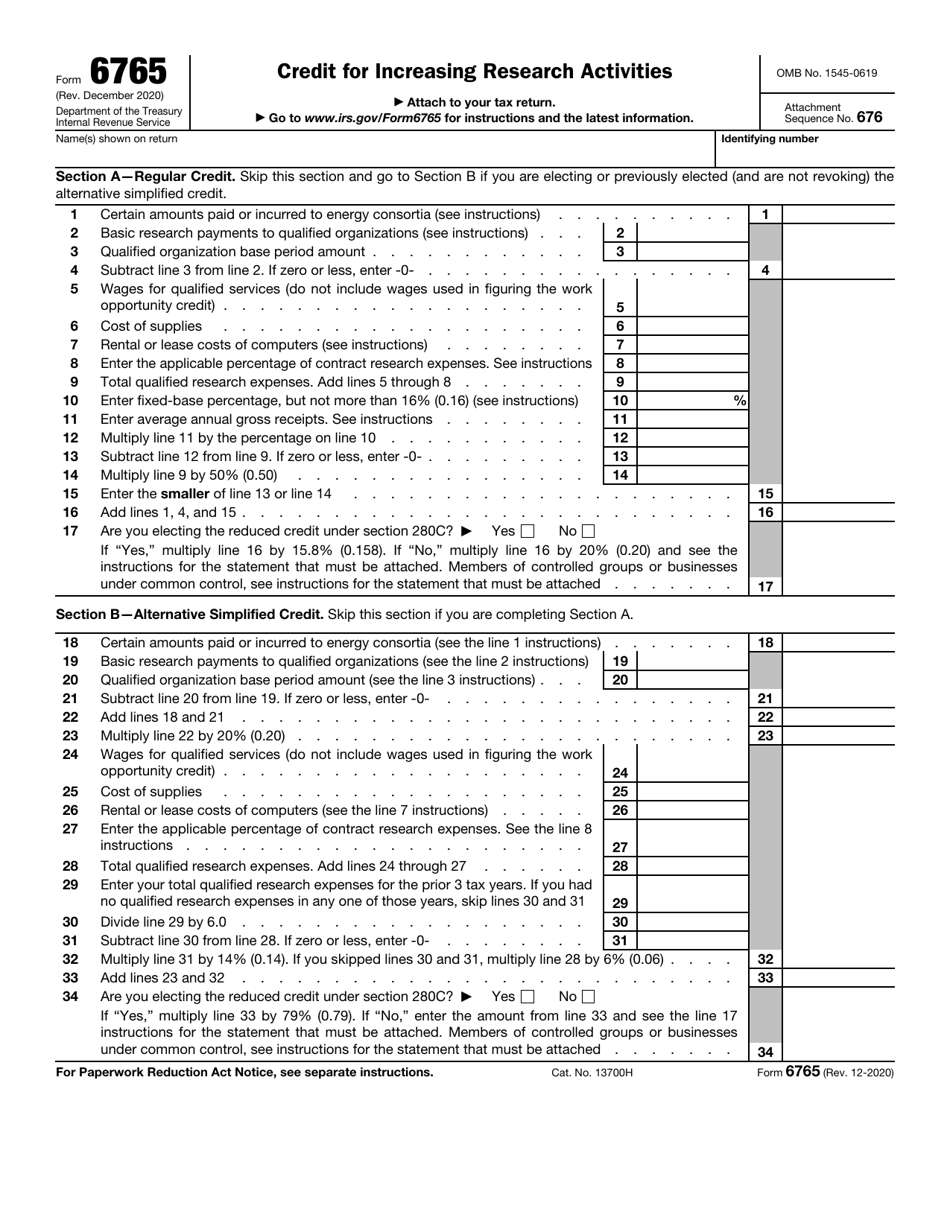

Q: How is the credit calculated?

A: The credit is generally calculated as a percentage of qualified research expenses that exceed a base amount determined by the taxpayer's historical research expenses.

Q: Can individuals claim the credit?

A: Yes, individuals can claim the credit if they are engaged in qualified research activities and meet certain criteria.

Q: Are there any limitations to claiming the credit?

A: Yes, there are certain limitations on the amount of credit that can be claimed, including the taxpayer's taxable income and the taxpayer's tax liability.

Q: When is IRS Form 6765 due?

A: IRS Form 6765 is generally due on the same date as the taxpayer's federal income tax return, which is April 15th for most individuals and businesses.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6765 through the link below or browse more documents in our library of IRS Forms.