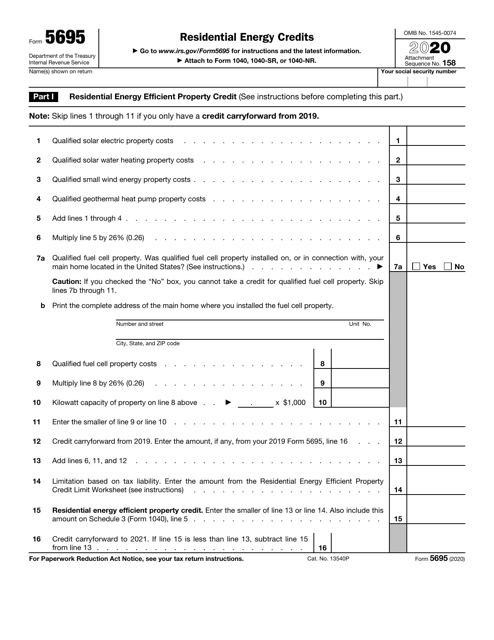

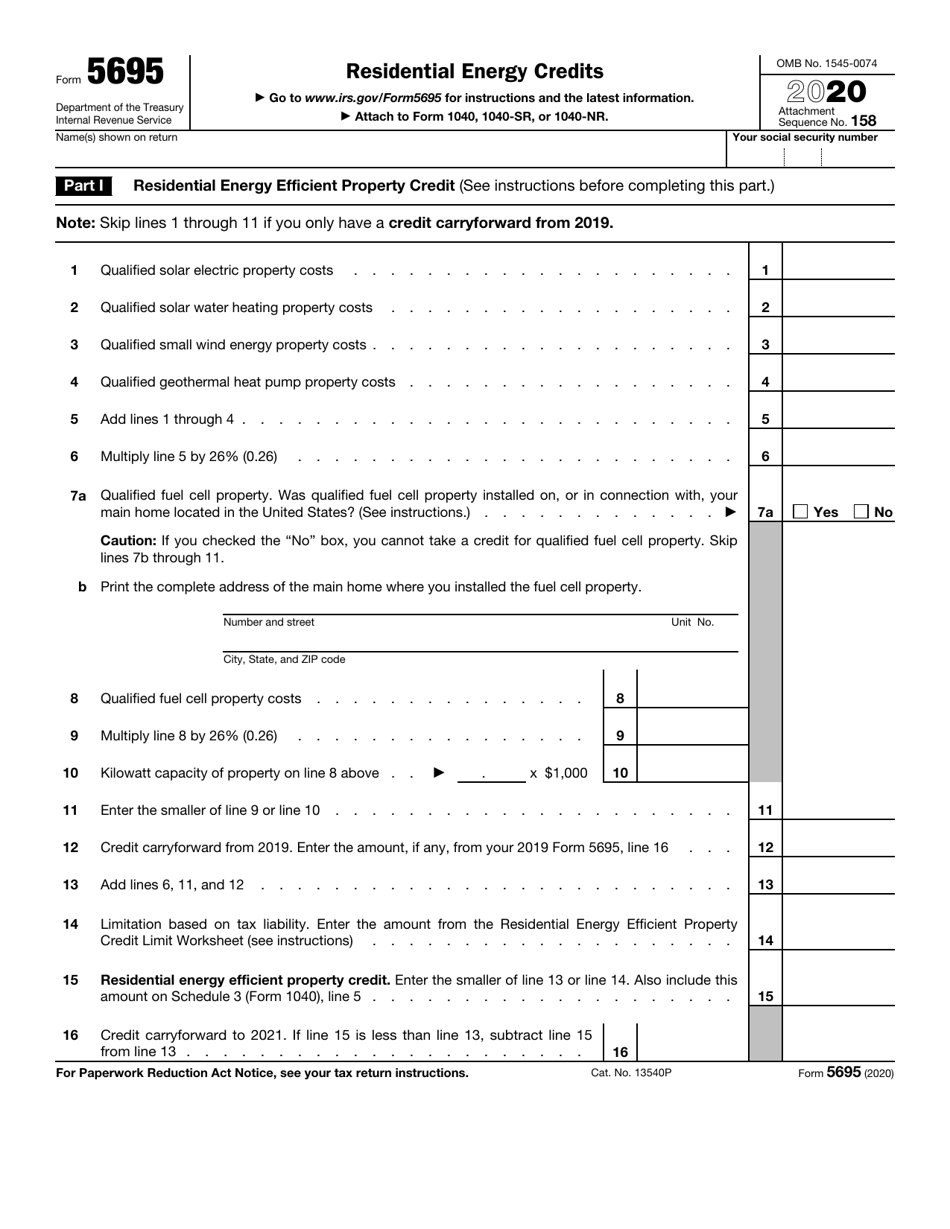

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 5695

for the current year.

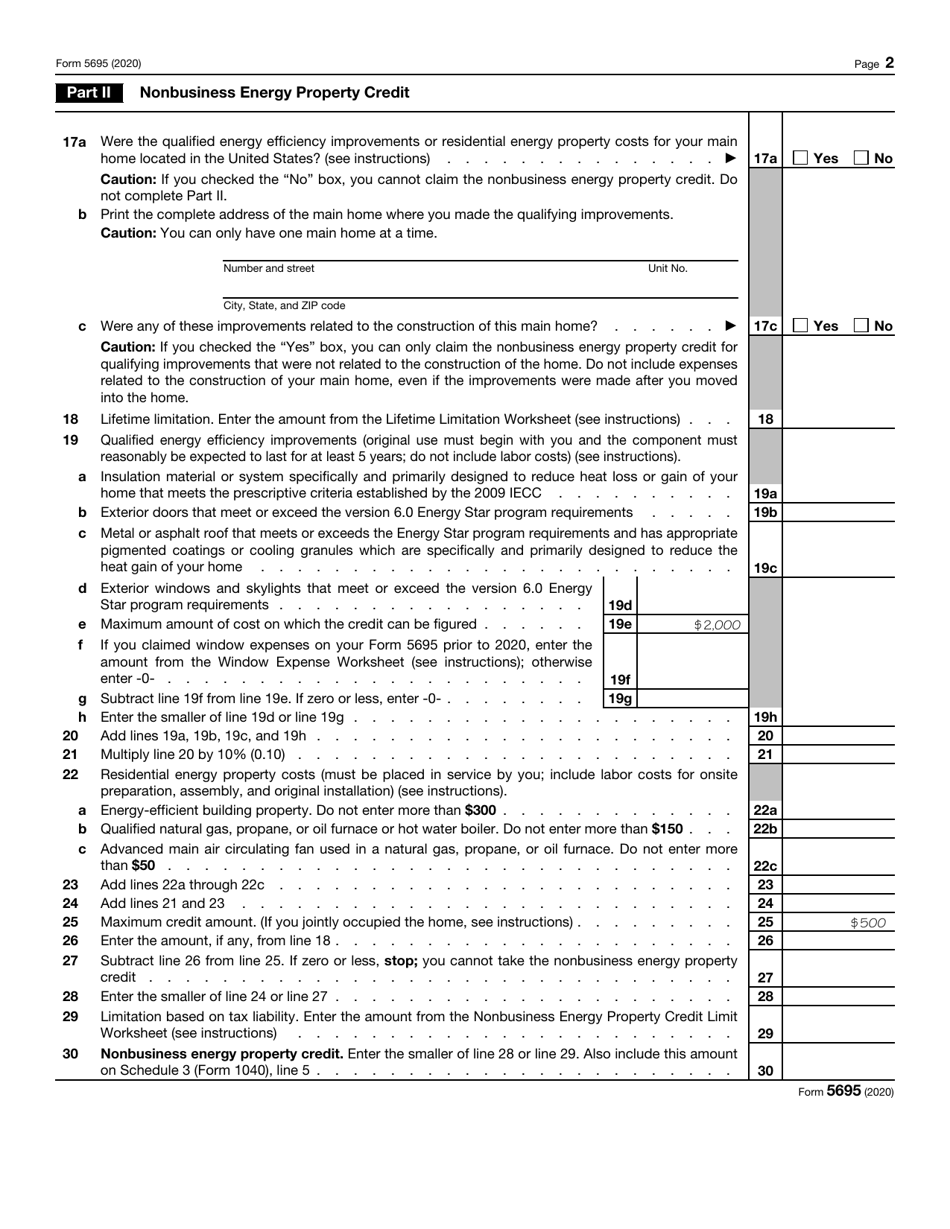

IRS Form 5695 Residential Energy Credits

What Is IRS Form 5695?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 5695?

A: IRS Form 5695 is a form used to claim residential energy credits.

Q: What are residential energy credits?

A: Residential energy credits are tax credits available to homeowners who make qualifying energy efficiency improvements to their homes.

Q: What kind of improvements qualify for residential energy credits?

A: Improvements such as installing solar panels, energy-efficient windows, or insulation may qualify for residential energy credits.

Q: How do I fill out IRS Form 5695?

A: You can fill out IRS Form 5695 by following the instructions provided with the form. It is important to accurately report the qualifying expenses and provide any necessary documentation.

Q: What is the maximum credit amount I can claim with IRS Form 5695?

A: The maximum credit amount you can claim with IRS Form 5695 varies depending on the type of qualifying improvements you made.

Q: Are residential energy credits refundable?

A: No, residential energy credits are non-refundable, meaning they can reduce your tax liability but cannot result in a refund if you have no tax liability.

Q: Can I claim residential energy credits for a rental property?

A: No, residential energy credits can only be claimed for a qualified main home.

Q: Is there an income limit to qualify for residential energy credits?

A: No, there is no specific income limit to qualify for residential energy credits.

Q: Can I claim residential energy credits for expenses incurred in a previous year?

A: Yes, you can amend your tax return for a previous year to claim residential energy credits if you did not previously claim them.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5695 through the link below or browse more documents in our library of IRS Forms.