This version of the form is not currently in use and is provided for reference only. Download this version of

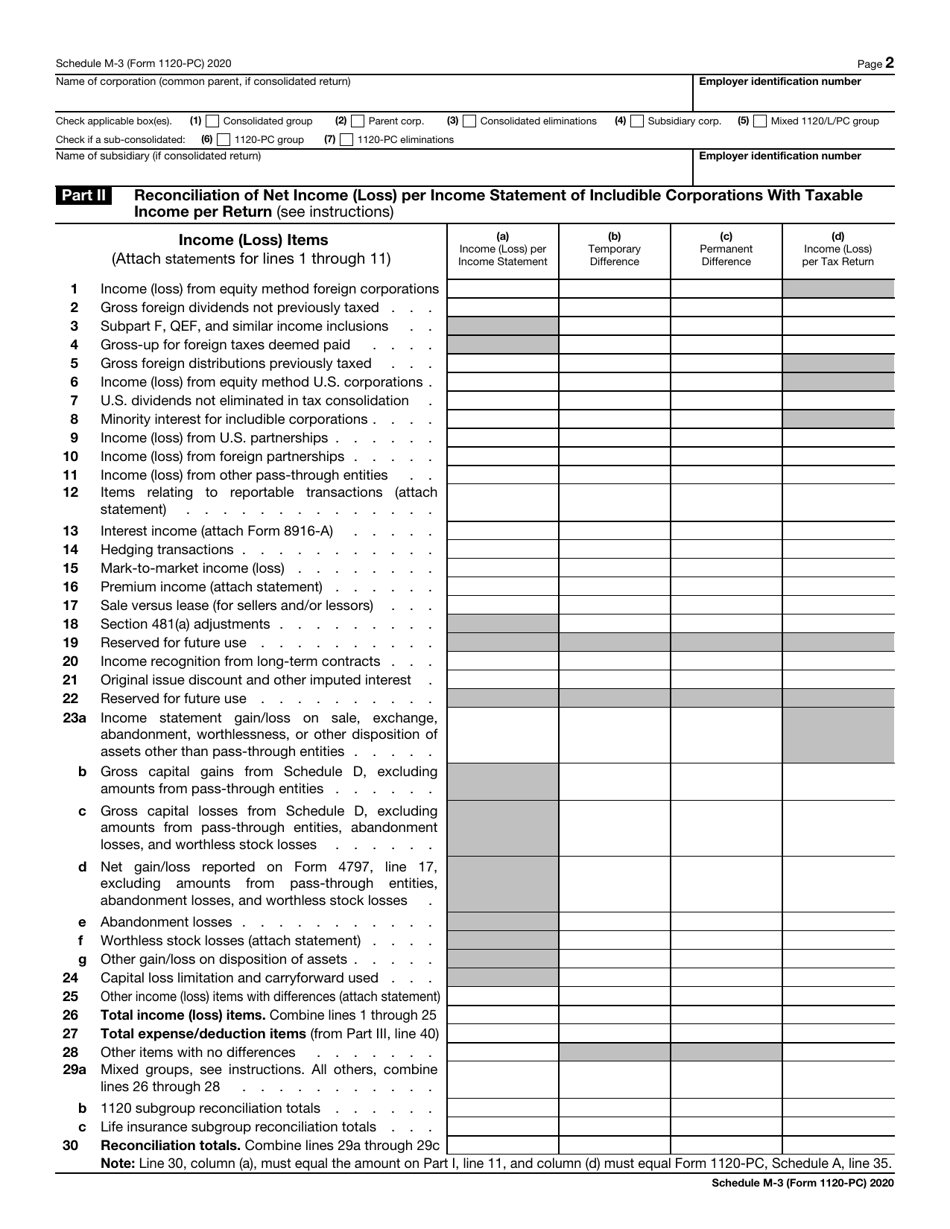

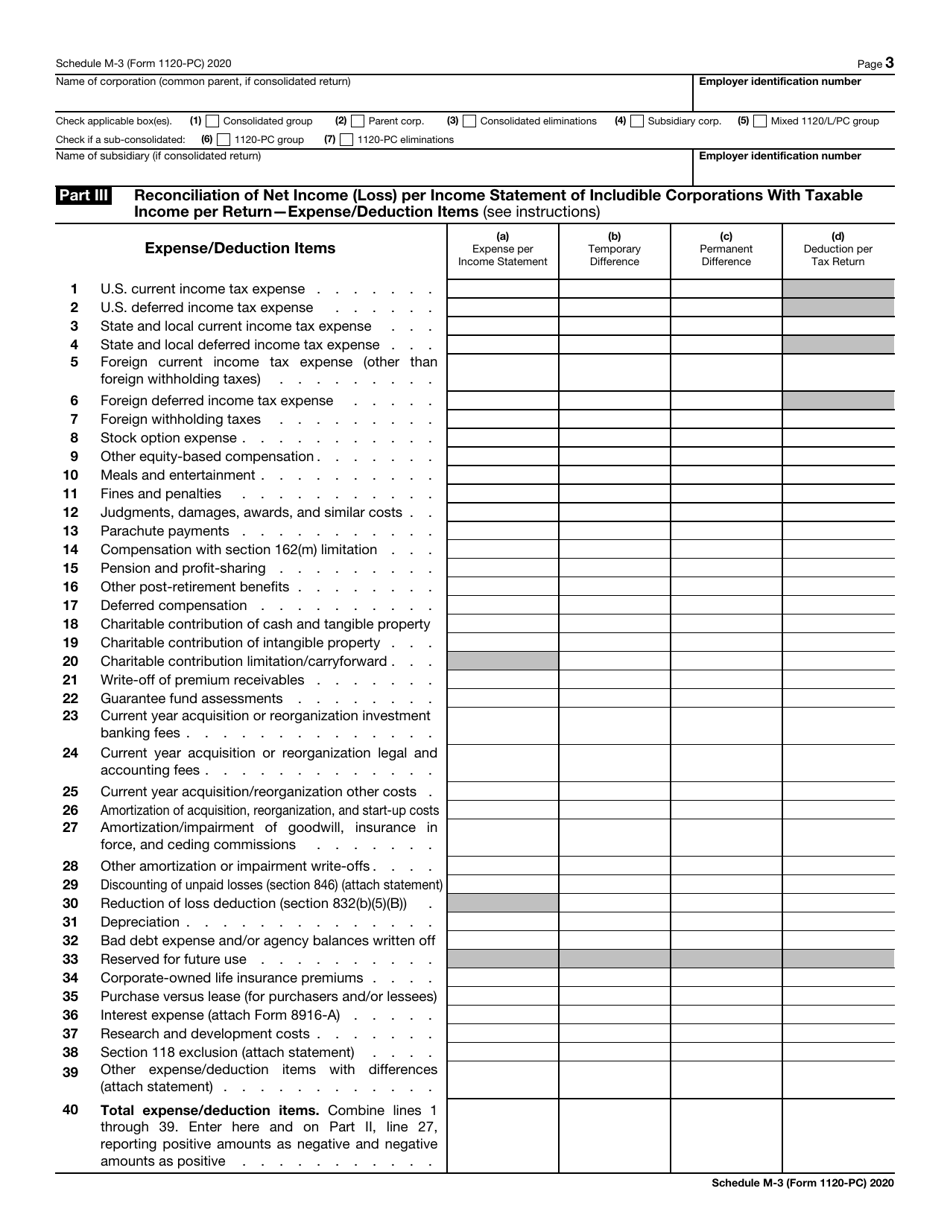

IRS Form 1120-PC Schedule M-3

for the current year.

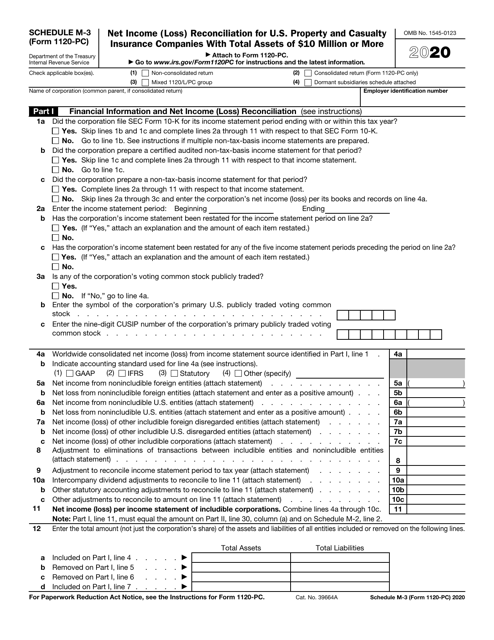

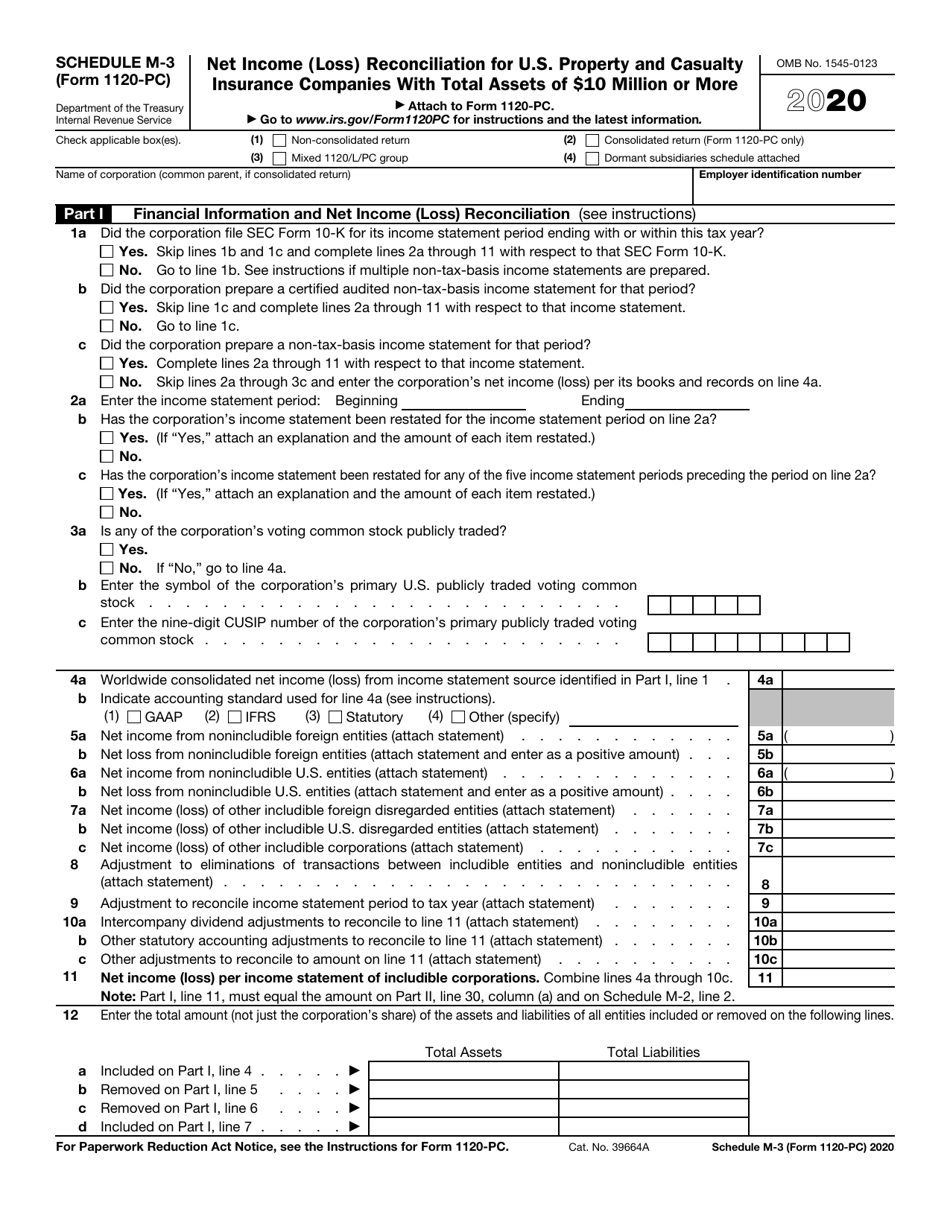

IRS Form 1120-PC Schedule M-3 Net Income (Loss) Reconciliation for U.S. Property and Casualty Insurance Companies With Total Assets of $10 Million or More

What Is IRS Form 1120-PC Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is a form used by U.S. property and casualty insurance companies with total assets of $10 million or more to report net income (loss) reconciliation.

Q: What is Schedule M-3?

A: Schedule M-3 is a part of IRS Form 1120-PC that is used to reconcile the net income (loss) of U.S. property and casualty insurance companies with their financial statements.

Q: Who needs to file IRS Form 1120-PC?

A: U.S. property and casualty insurance companies with total assets of $10 million or more need to file IRS Form 1120-PC.

Q: What is the purpose of Schedule M-3?

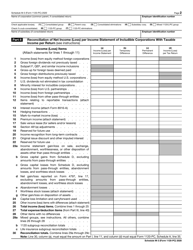

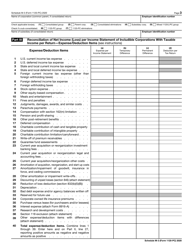

A: The purpose of Schedule M-3 is to provide a detailed reconciliation of the net income (loss) reported on the U.S. property and casualty insurance companies' tax return with the net income (loss) reported on their financial statements.

Q: What information is required on Schedule M-3?

A: Schedule M-3 requires U.S. property and casualty insurance companies to provide detailed information about their income (loss) and deductions, as well as certain balance sheet details.

Q: Are there any exceptions to filing IRS Form 1120-PC?

A: Yes, there are certain exceptions to filing IRS Form 1120-PC, such as when the total assets of the U.S. property and casualty insurance company are below $10 million.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-PC Schedule M-3 through the link below or browse more documents in our library of IRS Forms.