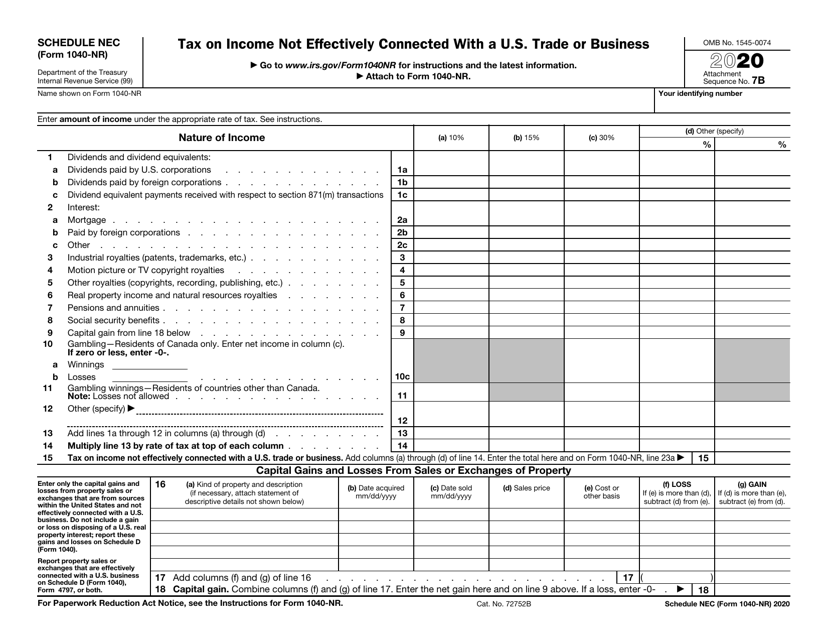

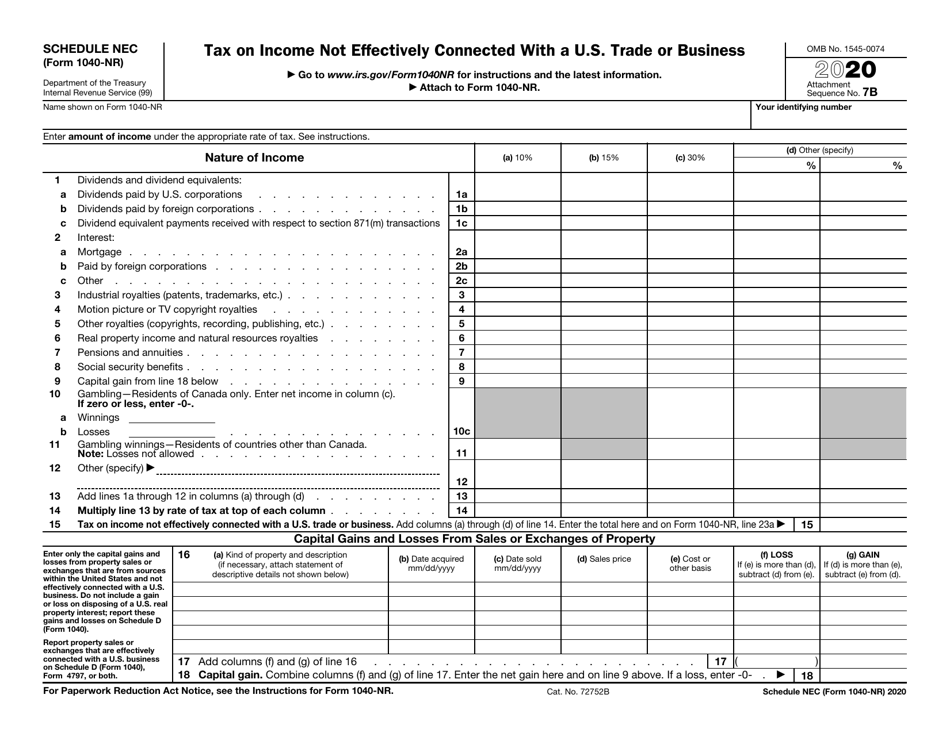

This version of the form is not currently in use and is provided for reference only. Download this version of

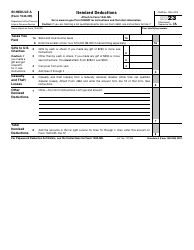

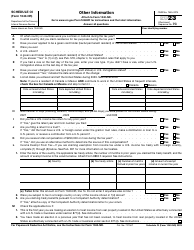

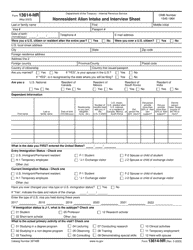

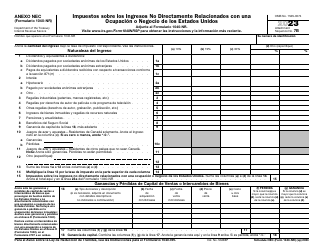

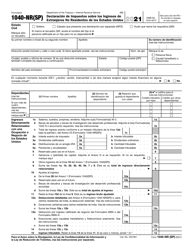

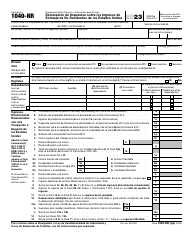

IRS Form 1040-NR Schedule NEC

for the current year.

IRS Form 1040-NR Schedule NEC Tax on Income Not Effectively Connected With a U.S. Trade or Business

What Is IRS Form 1040-NR Schedule NEC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-NR Schedule NEC?

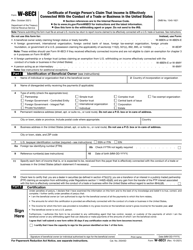

A: IRS Form 1040-NR Schedule NEC is a tax form used by nonresident aliens to report income that is not effectively connected with a U.S. trade or business.

Q: Who should use IRS Form 1040-NR Schedule NEC?

A: Nonresident aliens who have income that is not effectively connected with a U.S. trade or business should use IRS Form 1040-NR Schedule NEC.

Q: What is meant by income not effectively connected with a U.S. trade or business?

A: Income not effectively connected with a U.S. trade or business refers to income that is generated from sources outside the U.S. and is not related to a trade or business conducted in the U.S.

Q: When should IRS Form 1040-NR Schedule NEC be filed?

A: IRS Form 1040-NR Schedule NEC should be filed along with Form 1040-NR when a nonresident alien is required to file a U.S. tax return.

Q: What type of income should be reported on IRS Form 1040-NR Schedule NEC?

A: Income not effectively connected with a U.S. trade or business, such as rental income, interest income, and dividends, should be reported on IRS Form 1040-NR Schedule NEC.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-NR Schedule NEC through the link below or browse more documents in our library of IRS Forms.