This version of the form is not currently in use and is provided for reference only. Download this version of

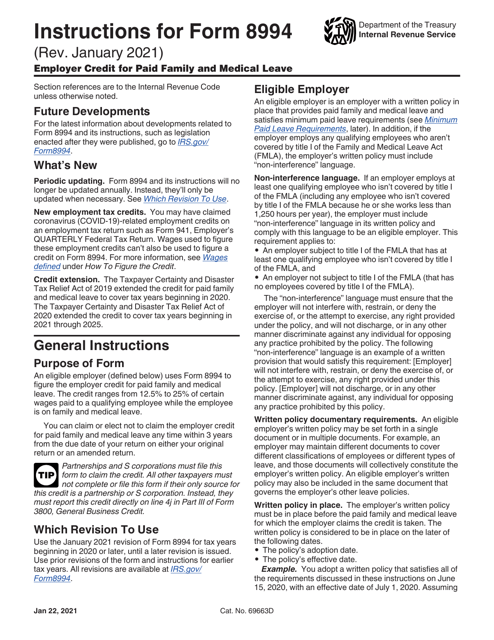

Instructions for IRS Form 8994

for the current year.

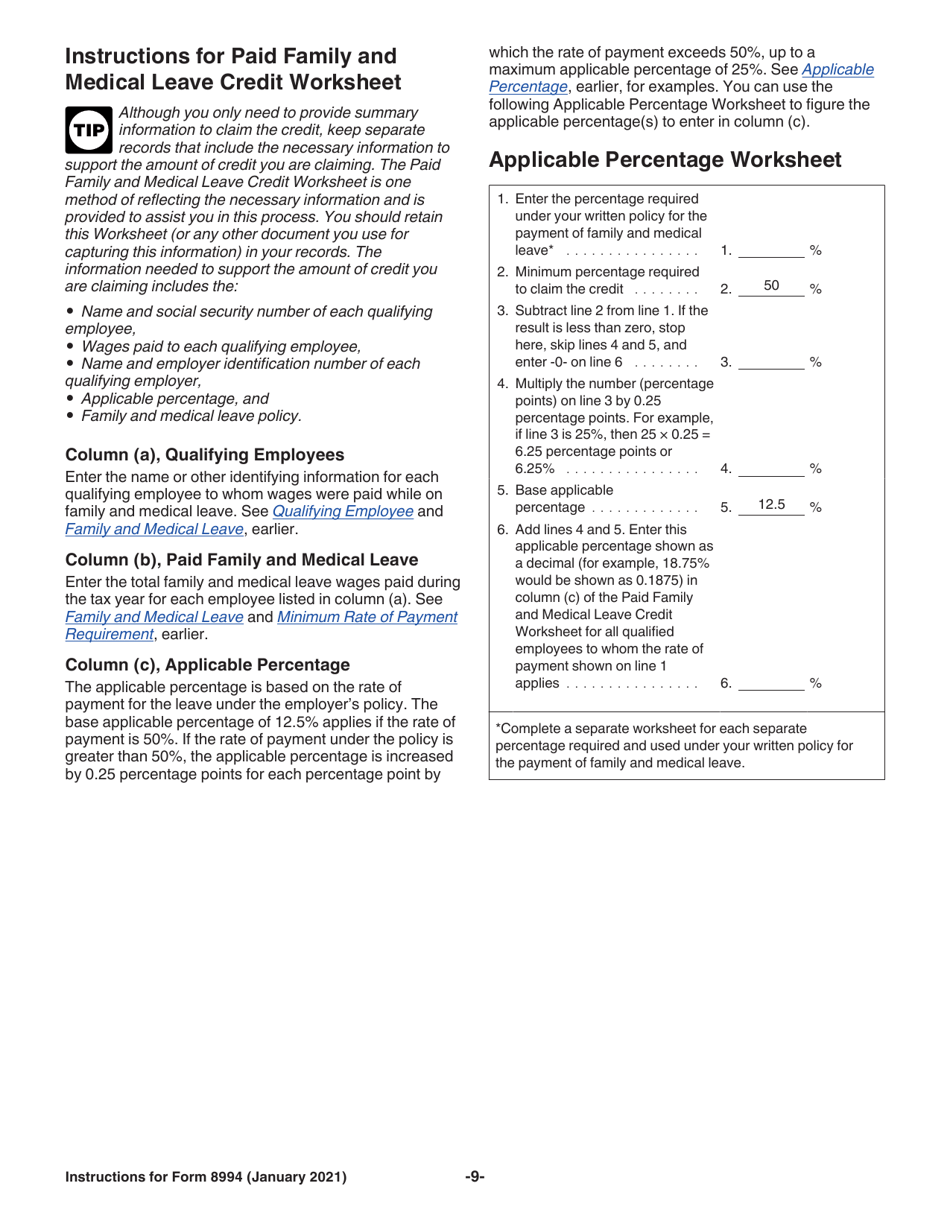

Instructions for IRS Form 8994 Employer Credit for Paid Family and Medical Leave

This document contains official instructions for IRS Form 8994 , Employer Credit for Paid Family and Medical Leave - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8994 is available for download through this link.

FAQ

Q: What is IRS Form 8994?

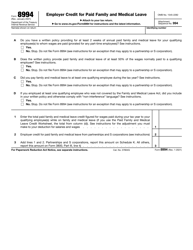

A: IRS Form 8994 is used to claim the Employer Credit for Paid Family and Medical Leave.

Q: What is the Employer Credit for Paid Family and Medical Leave?

A: The Employer Credit for Paid Family and Medical Leave is a credit provided by the IRS to employers who offer paid family and medical leave to their employees.

Q: Who is eligible for this credit?

A: Employers who have a qualifying paid family and medical leave policy in place and meet certain requirements are eligible for this credit.

Q: What is a qualifying paid family and medical leave policy?

A: A qualifying paid family and medical leave policy is a policy that provides paid leave to employees for family and medical reasons as specified by the IRS.

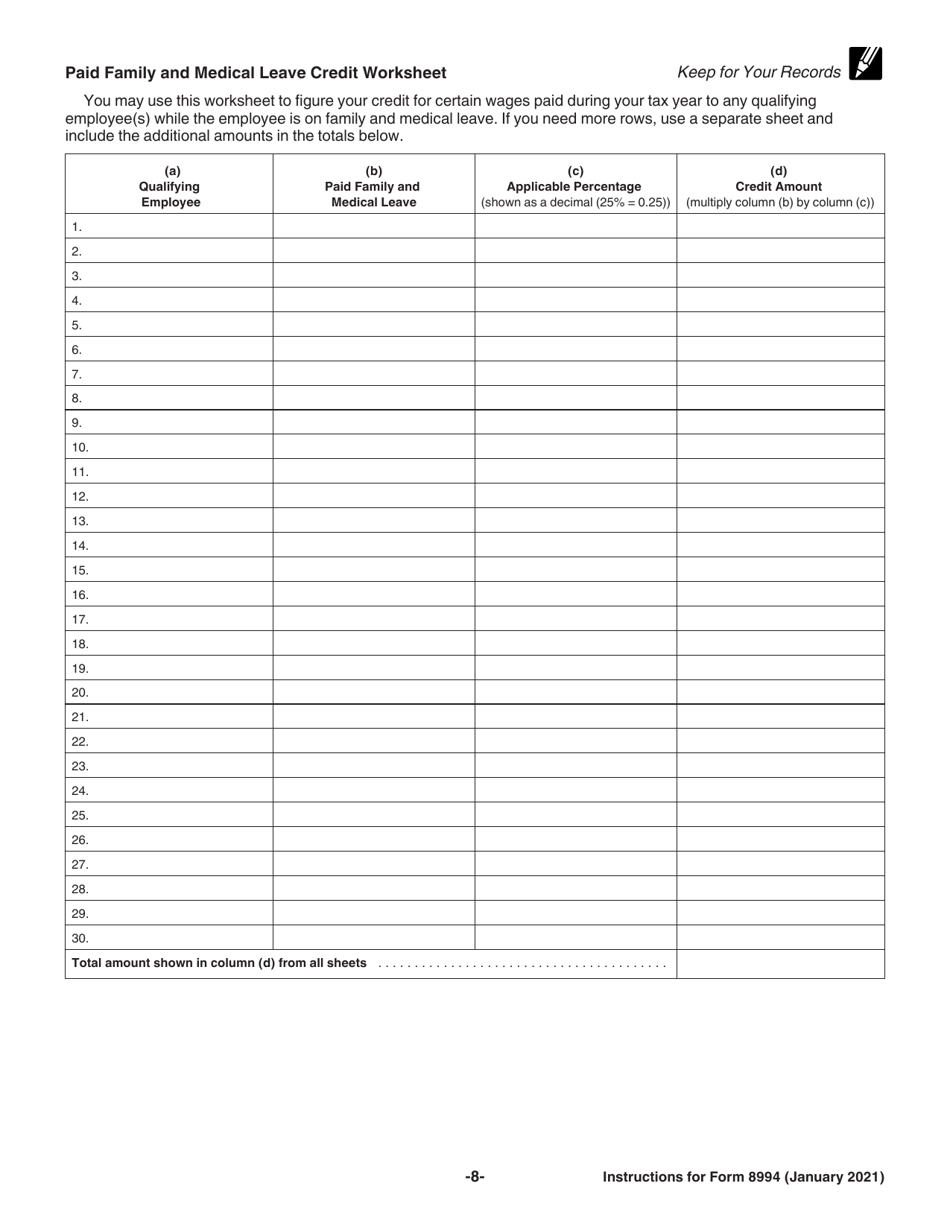

Q: How much is the credit?

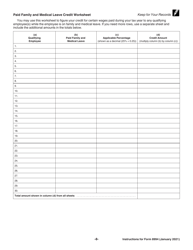

A: The credit is generally a percentage of the wages paid to employees during any period of family and medical leave.

Q: How do I claim the credit?

A: To claim the credit, you must complete and file IRS Form 8994 along with your business tax return.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain limitations and restrictions on the credit, such as the maximum amount of wages eligible for the credit and the duration of the leave.

Q: Can I claim the credit for unpaid leave?

A: No, the credit is only available for paid family and medical leave.

Q: Can I claim the credit for self-employed individuals?

A: No, the credit is only available to employers.

Q: Are there any deadlines for claiming the credit?

A: Yes, the credit must be claimed on the employer's tax return for the year in which the paid leave was provided.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.