This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8955-SSA

for the current year.

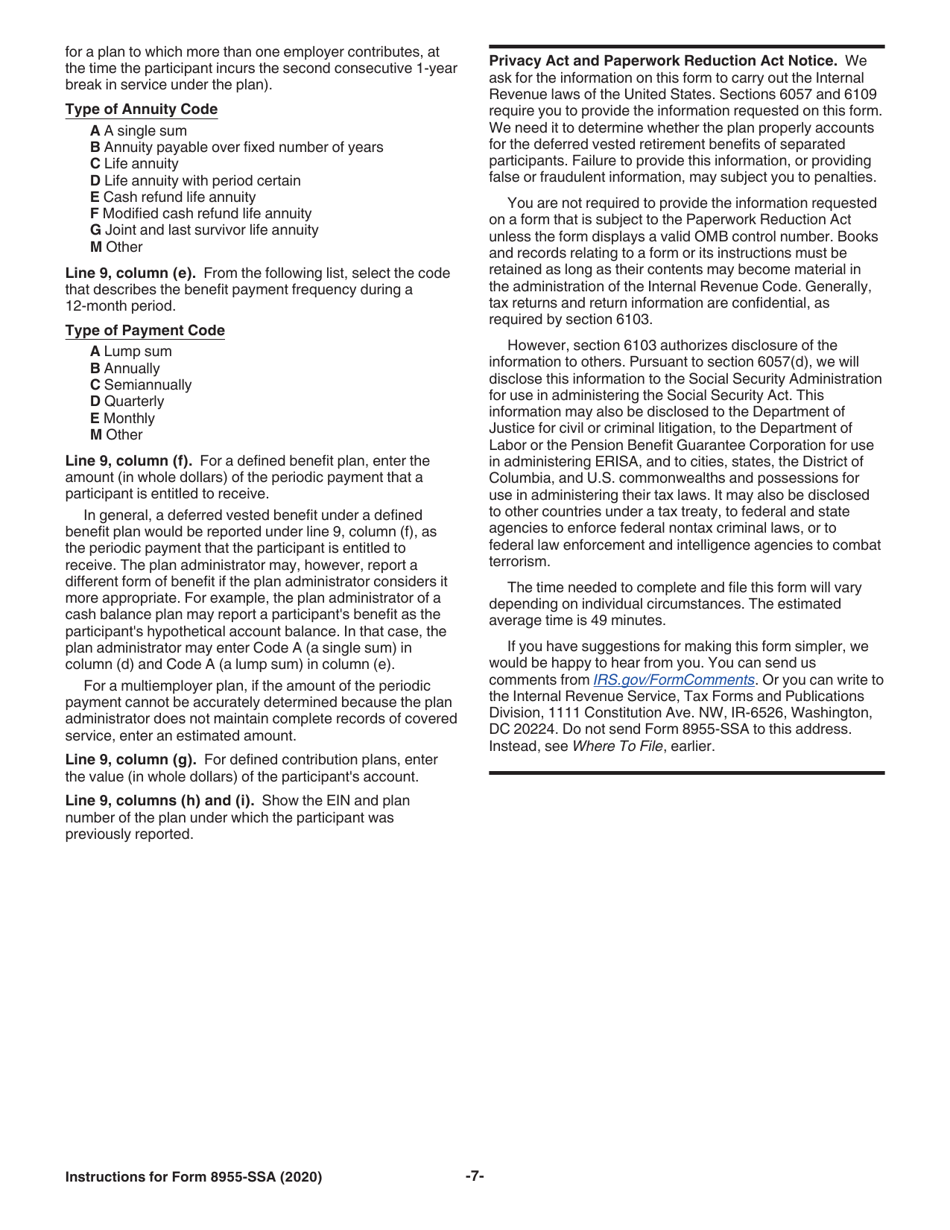

Instructions for IRS Form 8955-SSA Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

This document contains official instructions for IRS Form 8955-SSA , Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8955-SSA is available for download through this link.

FAQ

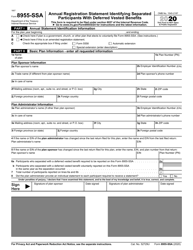

Q: What is IRS Form 8955-SSA?

A: IRS Form 8955-SSA is a form used to report information about separated participants with deferred vested benefits.

Q: Who needs to file IRS Form 8955-SSA?

A: Plan administrators of certain retirement plans, like pension plans, must file this form.

Q: What is the purpose of IRS Form 8955-SSA?

A: The form is used to identify and provide information about participants in retirement plans that have separated from service but still have vested benefits.

Q: When is IRS Form 8955-SSA due?

A: The form is generally due on the last day of the seventh month after the plan year ends.

Q: Are there any penalties for not filing IRS Form 8955-SSA?

A: Yes, there can be penalties for not filing or filing the form late. It's important to meet the filing deadline to avoid any potential penalties.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.