This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8862

for the current year.

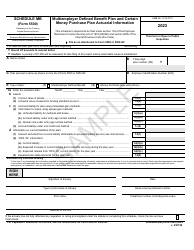

Instructions for IRS Form 8862 Information to Claim Certain Credits After Disallowance

This document contains official instructions for IRS Form 8862 , Information to Claim Certain Credits After Disallowance - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8862 is available for download through this link.

FAQ

Q: What is IRS Form 8862?

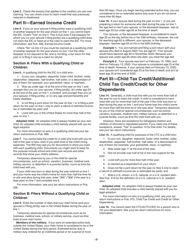

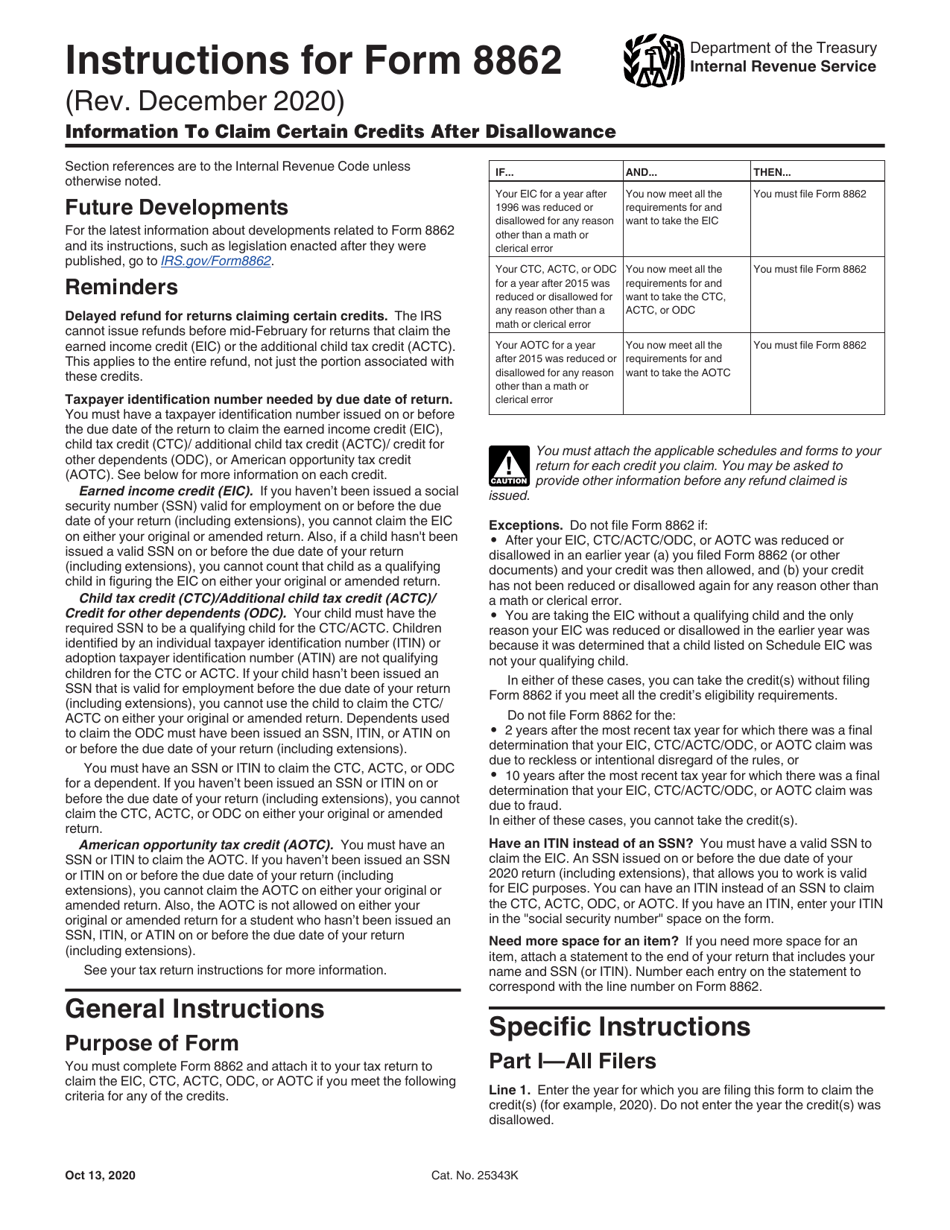

A: IRS Form 8862 is a form used by taxpayers to provide information to claim certain tax credits after their claim was disallowed.

Q: Why would my claim for tax credits be disallowed?

A: The claim for tax credits may be disallowed if the IRS determined that you didn't meet the eligibility requirements or if there were errors in your original claim.

Q: What information is required on IRS Form 8862?

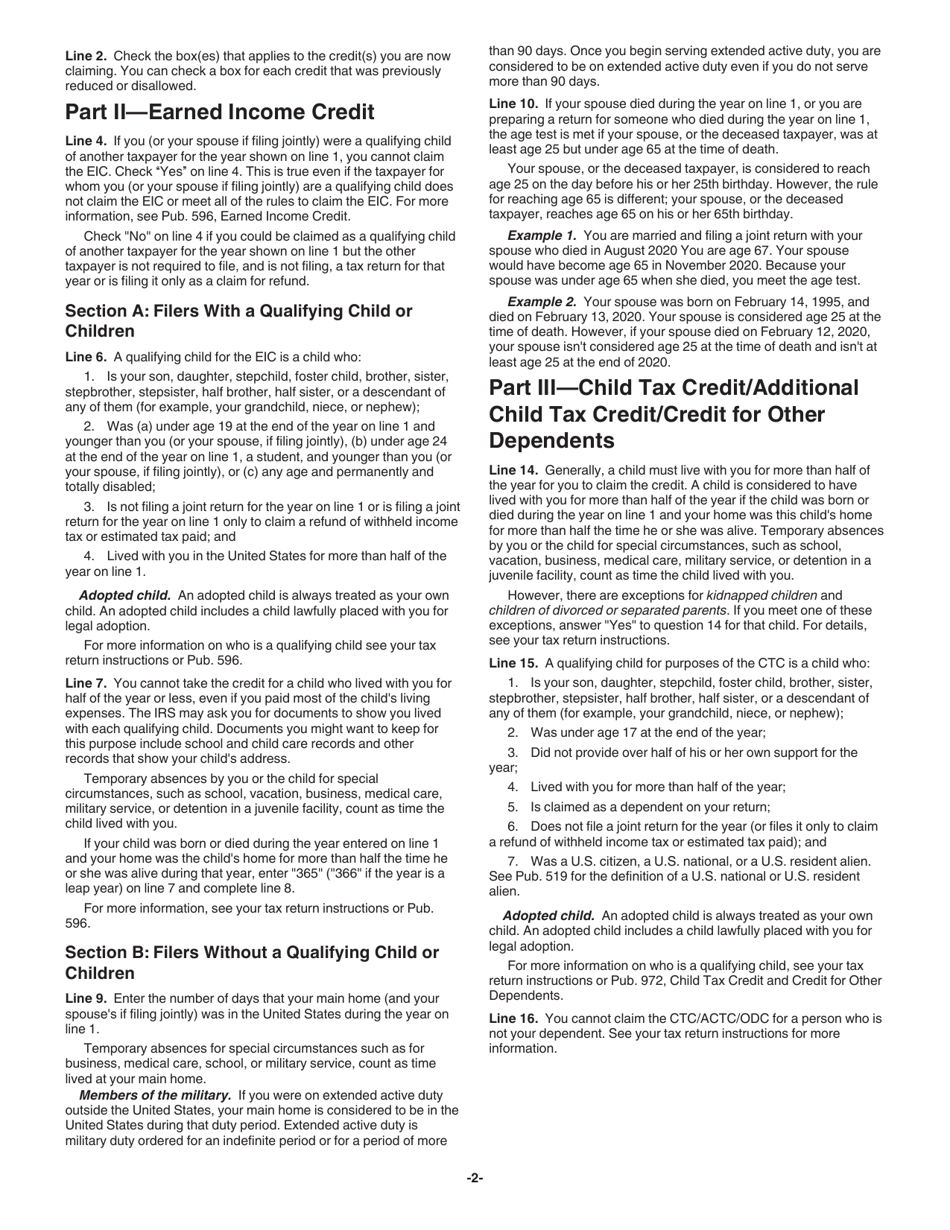

A: IRS Form 8862 requires you to provide certain information, such as your name, Social Security number, and the tax year for which you are claiming the credits.

Q: Which tax credits can be claimed using IRS Form 8862?

A: IRS Form 8862 can be used to claim the Earned Income Credit, the Child Tax Credit, or the American Opportunity Credit.

Q: Can I file IRS Form 8862 electronically?

A: Yes, IRS Form 8862 can be filed electronically using tax preparation software or through a tax professional.

Q: Is there a deadline for filing IRS Form 8862?

A: Yes, IRS Form 8862 must be filed within the time limits specified by the IRS, usually within 60 days from the date of the disallowance notice.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.