This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8829

for the current year.

Instructions for IRS Form 8829 Expenses for Business Use of Your Home

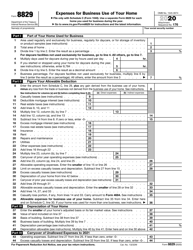

This document contains official instructions for IRS Form 8829 , Expenses for Business Use of Your Home - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8829 is available for download through this link.

FAQ

Q: What is IRS Form 8829?

A: IRS Form 8829 is a form used to claim expenses for the business use of your home.

Q: Who can use IRS Form 8829?

A: Self-employed individuals and employees who work from home may use IRS Form 8829.

Q: What expenses can be claimed on IRS Form 8829?

A: Expenses such as mortgage interest, rent, utilities, and maintenance expenses can be claimed on IRS Form 8829.

Q: How do I calculate the business use of my home?

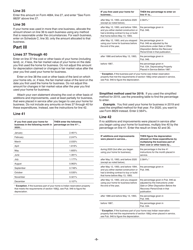

A: To calculate the business use of your home, you divide the square footage used for business by the total square footage of your home.

Q: What is the simplified method for calculating expenses on IRS Form 8829?

A: The simplified method allows you to calculate the business use of your home by multiplying the square footage used for business by a standard rate per square foot.

Q: How do I report expenses on IRS Form 8829?

A: You report expenses on IRS Form 8829 by entering the amounts in the appropriate sections of the form.

Q: Can I claim a home office deduction if I am an employee?

A: Yes, employees who work from home may be eligible to claim a home office deduction on IRS Form 8829.

Q: What is the purpose of IRS Form 8829?

A: IRS Form 8829 is used to calculate and claim the expenses for the business use of your home.

Q: Can I claim the home office deduction if I have a separate office space outside my home?

A: No, the home office deduction is only available for the business use of your primary residence.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.