This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8082

for the current year.

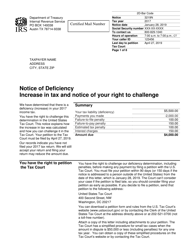

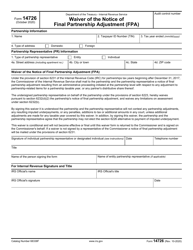

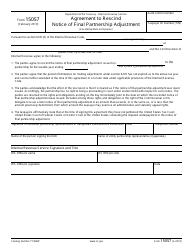

Instructions for IRS Form 8082 Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

This document contains official instructions for IRS Form 8082 , Notice of Inconsistent Treatment or Administrative Adjustment Request (Aar) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8082 is available for download through this link.

FAQ

Q: What is IRS Form 8082?

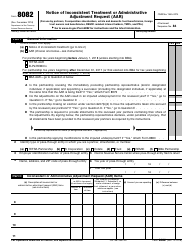

A: IRS Form 8082 is a form used to notify the IRS of inconsistent treatment or to request an administrative adjustment.

Q: When should I use IRS Form 8082?

A: You should use IRS Form 8082 when you have inconsistent treatment of an item on your tax return.

Q: What is inconsistent treatment?

A: Inconsistent treatment refers to different reporting or treatment of the same item on your tax return compared to other taxpayers or previous tax returns.

Q: What is an administrative adjustment request (AAR)?

A: An administrative adjustment request (AAR) is a request to adjust the amount of tax due or overpayment claimed on your tax return.

Q: How do I fill out IRS Form 8082?

A: To fill out IRS Form 8082, you need to provide your identifying information, describe the inconsistent treatment, and explain your reasoning for the inconsistent treatment.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.