This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8824

for the current year.

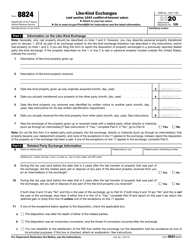

Instructions for IRS Form 8824 Like-Kind Exchanges

This document contains official instructions for IRS Form 8824 , Like-Kind Exchanges - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8824 is available for download through this link.

FAQ

Q: What is IRS Form 8824?

A: IRS Form 8824 is used for reporting Like-Kind Exchanges.

Q: What is a Like-Kind Exchange?

A: A Like-Kind Exchange is a tax-deferred exchange of property held for business or investment purposes.

Q: What are the requirements for a Like-Kind Exchange?

A: The properties being exchanged must be held for business or investment purposes, and they must be of the same nature or character.

Q: How does a Like-Kind Exchange work?

A: In a Like-Kind Exchange, the taxpayer exchanges one property for another property of like-kind, without recognizing any gain or loss on the exchange.

Q: Do I need to report a Like-Kind Exchange on my tax return?

A: Yes, you must report a Like-Kind Exchange on IRS Form 8824.

Q: What information do I need to complete IRS Form 8824?

A: You will need to provide information about the properties being exchanged, the date of the exchange, and the adjusted basis and fair market value of each property.

Q: Are there any time limits for completing a Like-Kind Exchange?

A: Yes, there are specific time limits that must be followed. The taxpayer must identify the replacement property within 45 days of transferring the relinquished property, and the exchange must be completed within 180 days.

Q: Can I use IRS Form 8824 for personal property exchanges?

A: No, IRS Form 8824 is specifically for reporting Like-Kind Exchanges of real property. Personal property exchanges are reported differently.

Q: What are the potential tax benefits of a Like-Kind Exchange?

A: The main benefit of a Like-Kind Exchange is the deferral of capital gains taxes. By exchanging property instead of selling it, the taxpayer can defer paying taxes on any gain until a later date.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.