This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 6251

for the current year.

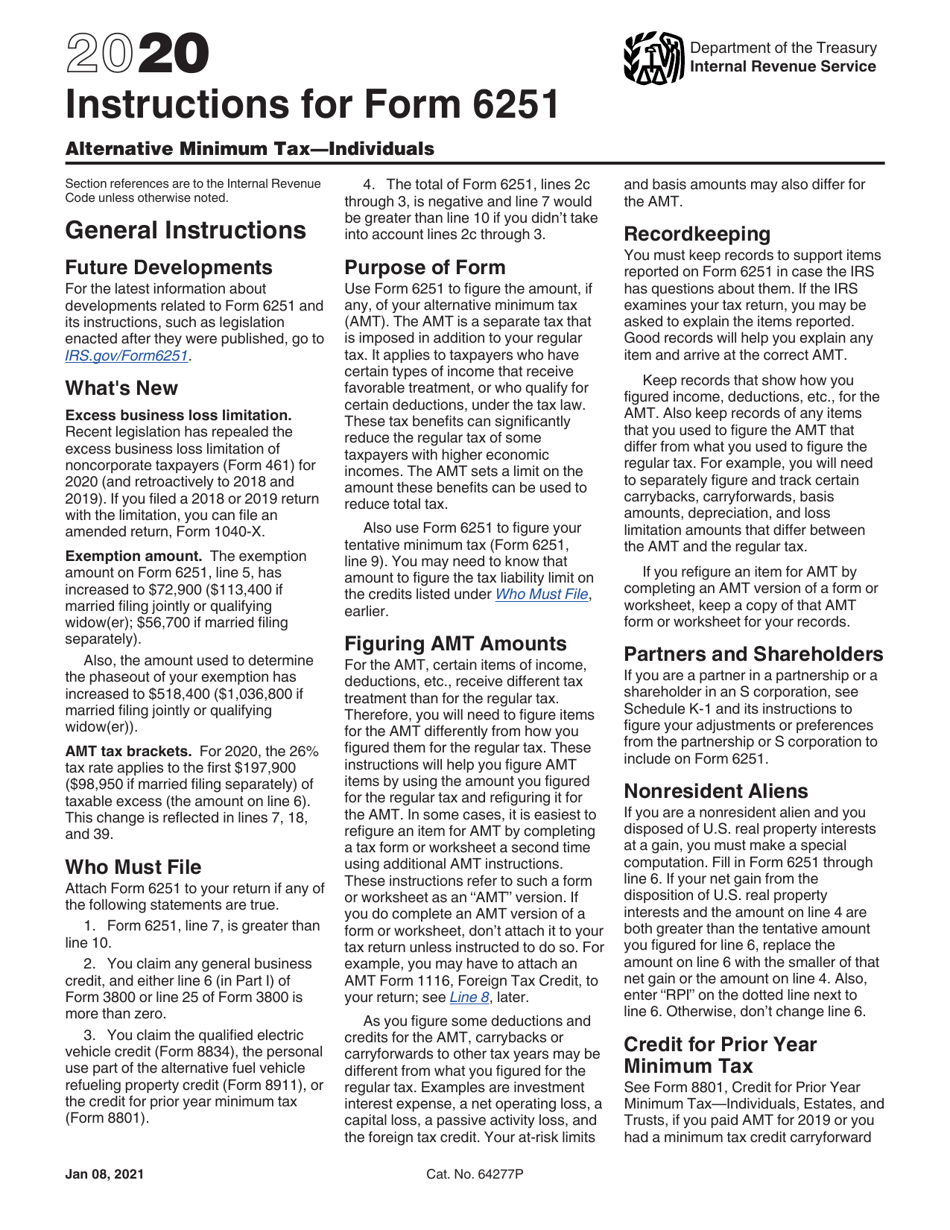

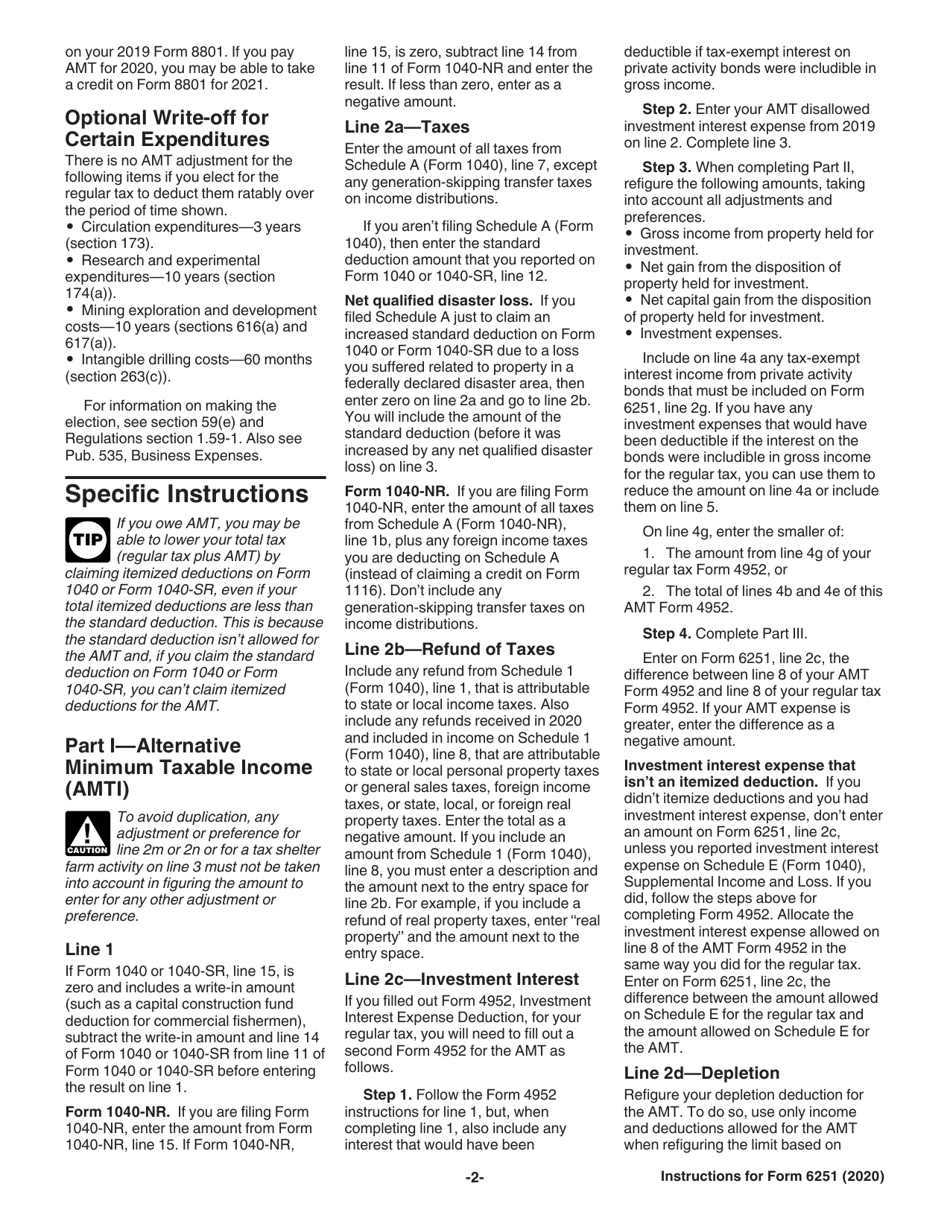

Instructions for IRS Form 6251 Alternative Minimum Tax - Individuals

This document contains official instructions for IRS Form 6251 , Alternative Minimum Tax - Individuals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 6251 is available for download through this link.

FAQ

Q: What is IRS Form 6251?

A: IRS Form 6251 is the form used to determine if you owe alternative minimum tax (AMT) for individuals.

Q: Who needs to file IRS Form 6251?

A: You need to file IRS Form 6251 if you meet certain criteria and need to calculate your alternative minimum tax.

Q: What is alternative minimum tax (AMT)?

A: Alternative minimum tax (AMT) is a separate tax calculation that ensures individuals with certain income levels pay a minimum amount of tax.

Q: What are the criteria for owing alternative minimum tax?

A: The criteria for owing alternative minimum tax include having certain types of income, deductions, and exemptions, as determined by the IRS.

Q: Are there any exemptions or credits available for alternative minimum tax?

A: Yes, there are exemptions and credits available that can reduce or eliminate the alternative minimum tax owed.

Q: What are the steps for filling out IRS Form 6251?

A: The steps for filling out IRS Form 6251 include providing personal information, calculating alternative minimum taxable income, determining AMT, and completing relevant schedules.

Q: When is the deadline for filing IRS Form 6251?

A: The deadline for filing IRS Form 6251 is typically the same as the deadline for filing your federal income tax return, which is April 15th of each year.

Q: Can I file IRS Form 6251 electronically?

A: Yes, you can file IRS Form 6251 electronically using tax software or through an authorized e-file provider.

Q: What should I do if I need help with IRS Form 6251?

A: If you need help with IRS Form 6251, you can consult the instructions provided by the IRS, seek assistance from a tax professional, or contact the IRS directly for guidance.

Instruction Details:

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.