This version of the form is not currently in use and is provided for reference only. Download this version of

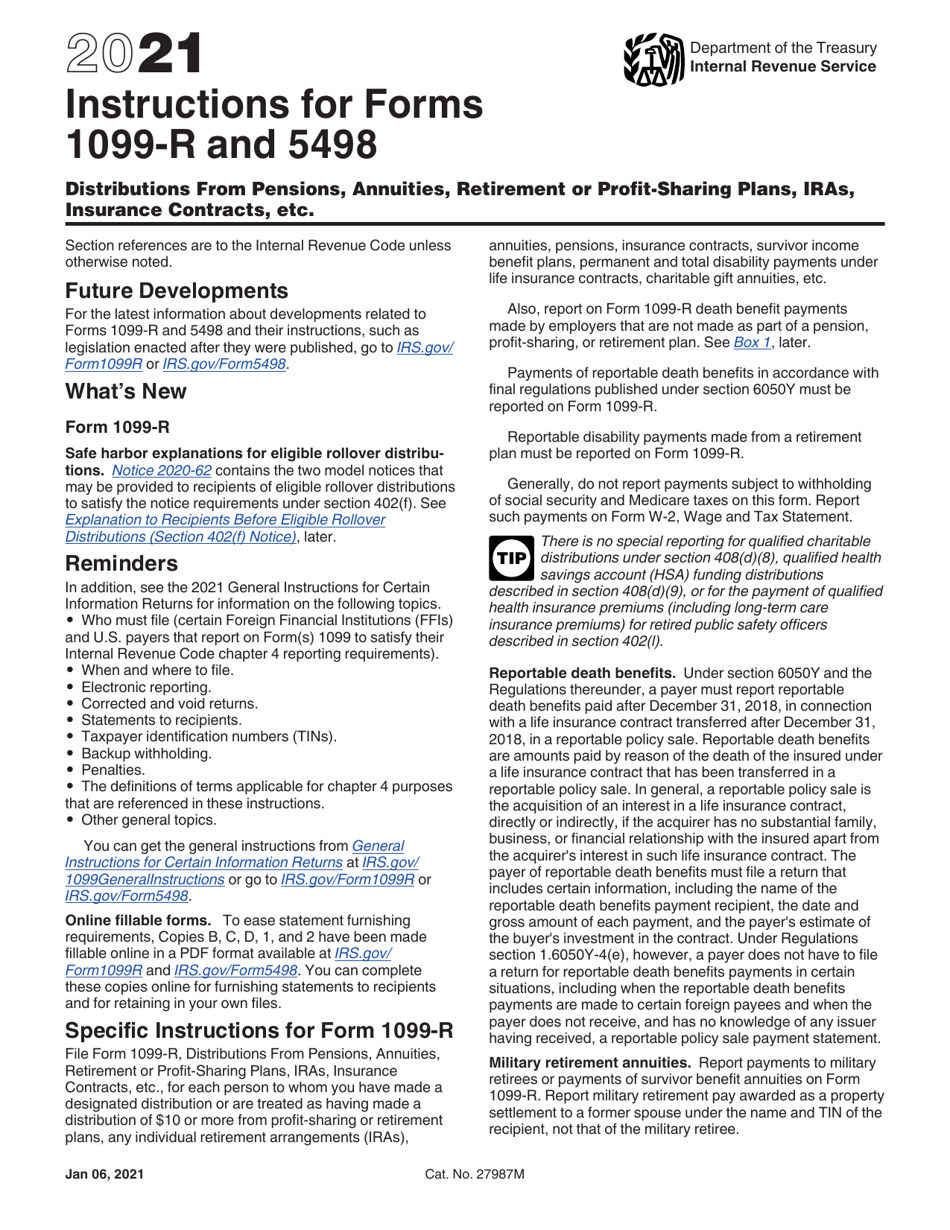

Instructions for IRS Form 1099-R, 5498

for the current year.

Instructions for IRS Form 1099-R, 5498

This document contains official instructions for IRS Form 1099-R , and IRS Form 5498 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-R is available for download through this link. The latest available IRS Form 5498 can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-R?

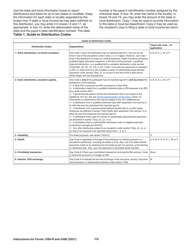

A: IRS Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement plans, or other retirement accounts.

Q: What is IRS Form 5498?

A: IRS Form 5498 is a tax form used to report contributions made to individual retirement arrangements (IRAs) and the fair market value of the account.

Q: Who should file IRS Form 1099-R?

A: Financial institutions or other entities who made distributions of $10 or more from retirement or pension plans must file IRS Form 1099-R for each recipient.

Q: Who should file IRS Form 5498?

A: Custodians or trustees of individual retirement arrangements (IRAs) must file IRS Form 5498 to report contributions made to the IRA.

Q: What information is required on IRS Form 1099-R?

A: IRS Form 1099-R requires information such as the recipient's name, address, social security number, distribution amount, and tax withheld.

Q: What information is required on IRS Form 5498?

A: IRS Form 5498 requires information such as the IRA owner's name, address, social security number, contribution amount, fair market value of the account, and rollover information if applicable.

Q: When is the deadline to file IRS Form 1099-R?

A: The deadline to file IRS Form 1099-R is generally January 31st of the year following the calendar year in which the distribution was made.

Q: When is the deadline to file IRS Form 5498?

A: The deadline to file IRS Form 5498 is generally May 31st of the year following the calendar year in which the contributions were made.

Q: Are there any penalties for not filing IRS Form 1099-R or 5498?

A: Yes, there can be penalties for not filing IRS Form 1099-R or 5498, including monetary penalties for each form not filed correctly or on time.

Instruction Details:

- This 23-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.