This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1065 Schedule M-3

for the current year.

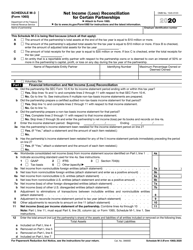

Instructions for IRS Form 1065 Schedule M-3 Net Income (Loss) Reconciliation for Certain Partnerships

This document contains official instructions for IRS Form 1065 Schedule M-3, Net Income (Loss) Reconciliation for Certain Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065 Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1065 Schedule M-3?

A: IRS Form 1065 Schedule M-3 is a form used by certain partnerships to reconcile their net income (loss).

Q: What is the purpose of Schedule M-3?

A: The purpose of Schedule M-3 is to provide more detailed information on the partnership's net income (loss) by reconciling it to the partnership's financial statements.

Q: Who needs to file Schedule M-3?

A: Certain partnerships with $10 million or more in total assets at the end of the tax year are required to file Schedule M-3.

Q: What information is included in Schedule M-3?

A: Schedule M-3 includes information such as the partnership's accounting method, deferred tax liabilities and assets, and adjustments to net income (loss).

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.