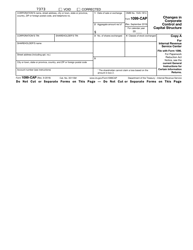

This version of the form is not currently in use and is provided for reference only. Download this version of

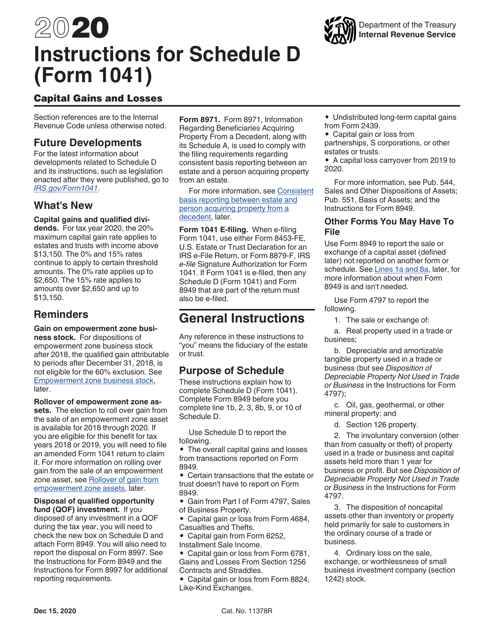

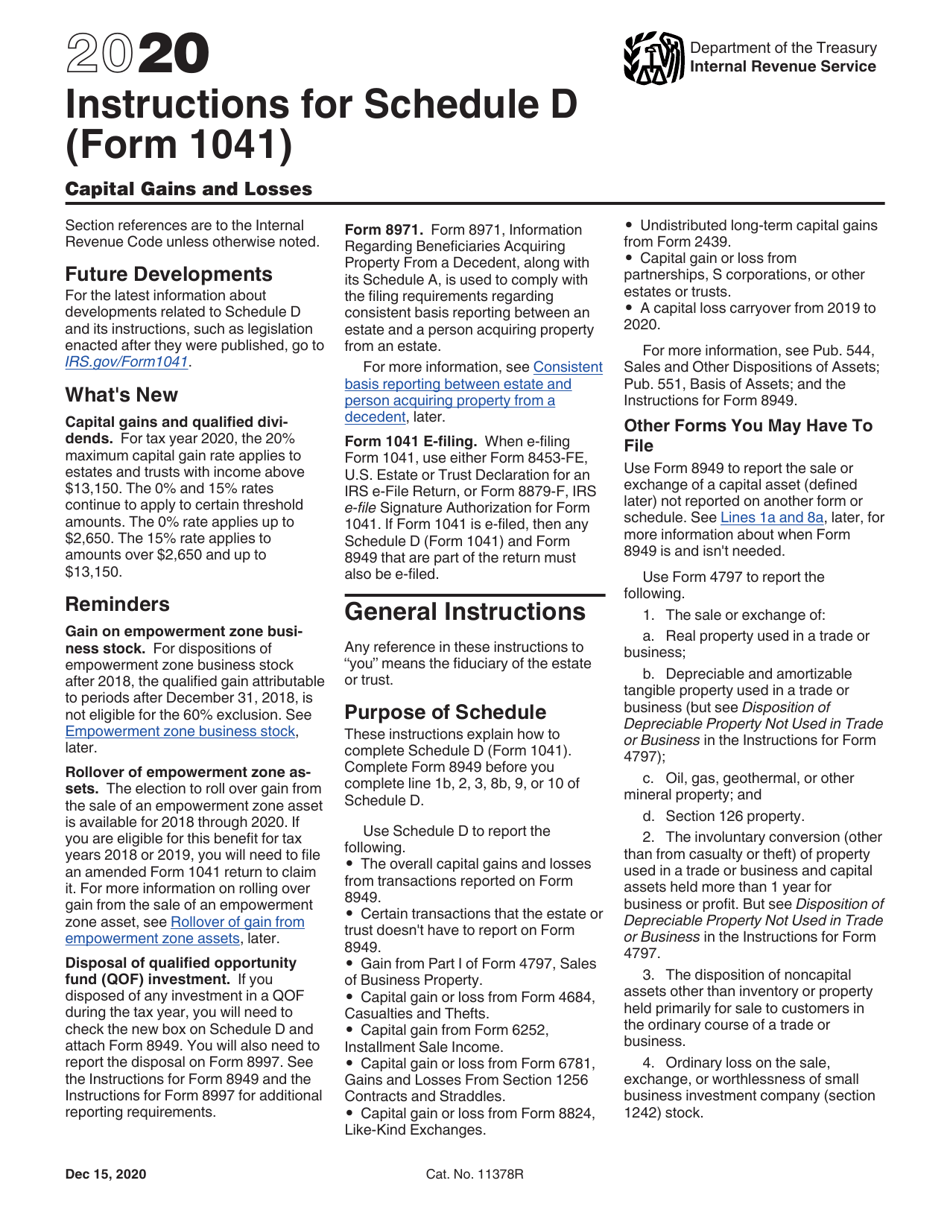

Instructions for IRS Form 1041 Schedule D

for the current year.

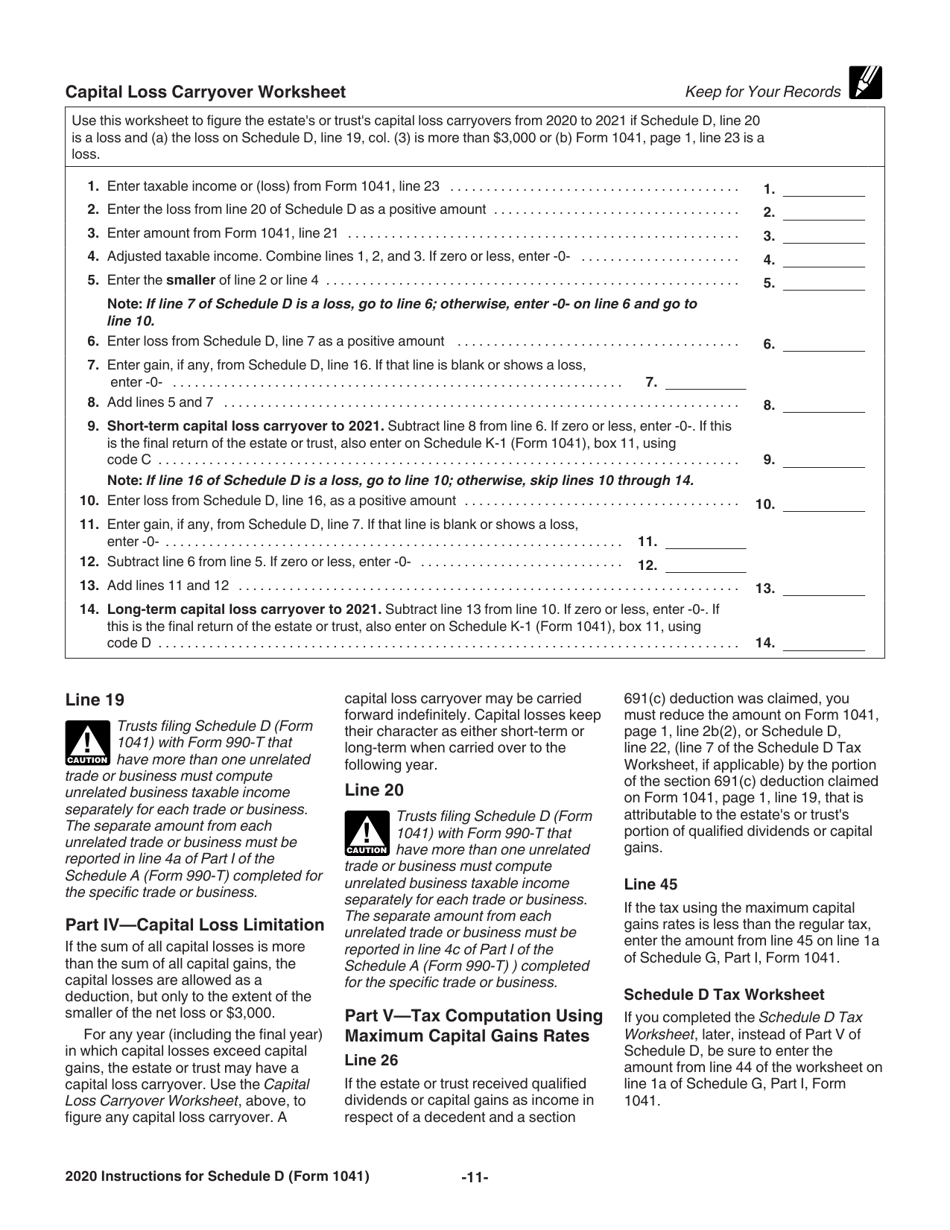

Instructions for IRS Form 1041 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1041 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1041 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1041 Schedule D?

A: IRS Form 1041 Schedule D is a supplemental form that is used to report capital gains and losses on a trust or estate's tax return.

Q: Who needs to file IRS Form 1041 Schedule D?

A: Trusts and estates that have capital gains and losses during the tax year need to file IRS Form 1041 Schedule D.

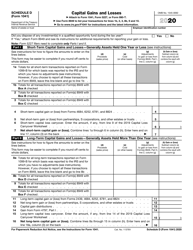

Q: What information is required on IRS Form 1041 Schedule D?

A: On IRS Form 1041 Schedule D, you will need to report the details of each capital asset sold, the purchase and sale dates, the sale price, and the cost basis of the asset.

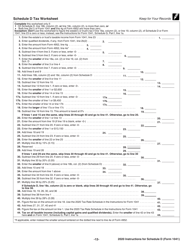

Q: How do I calculate capital gains or losses on IRS Form 1041 Schedule D?

A: To calculate capital gains or losses on IRS Form 1041 Schedule D, subtract the cost basis (purchase price) of the asset from the sale price. If the result is positive, it is a capital gain; if negative, it is a capital loss.

Q: Are there any special rules or exceptions for reporting capital gains and losses on IRS Form 1041 Schedule D?

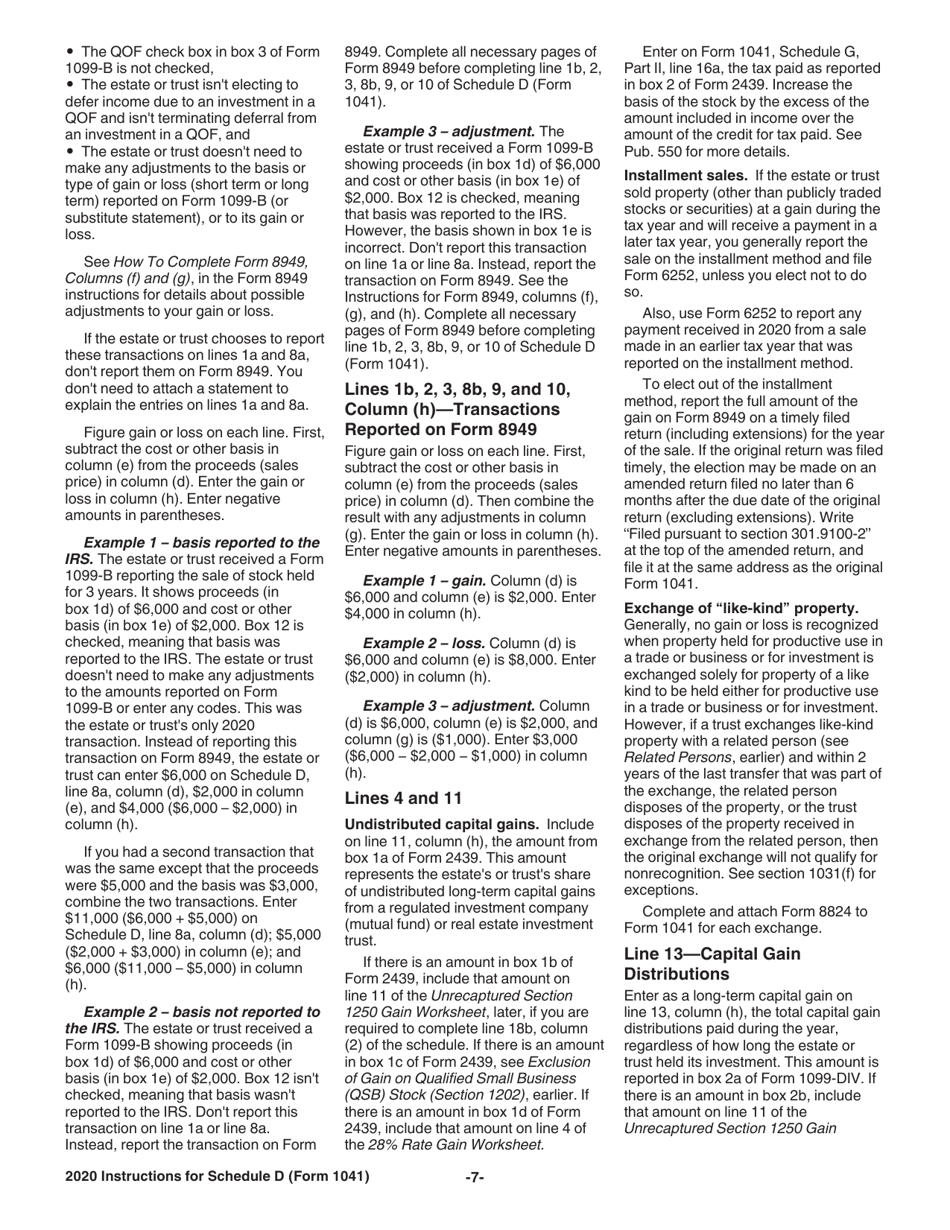

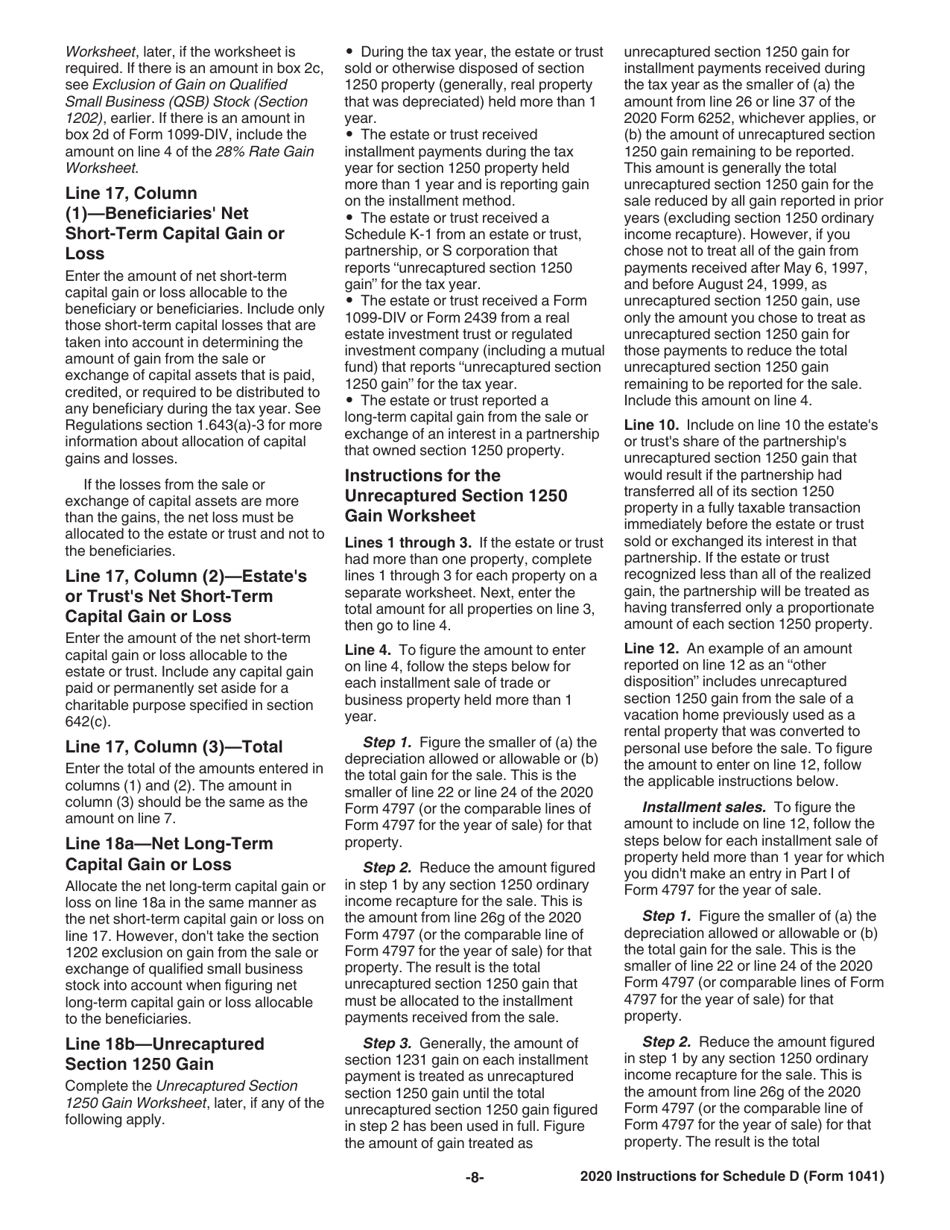

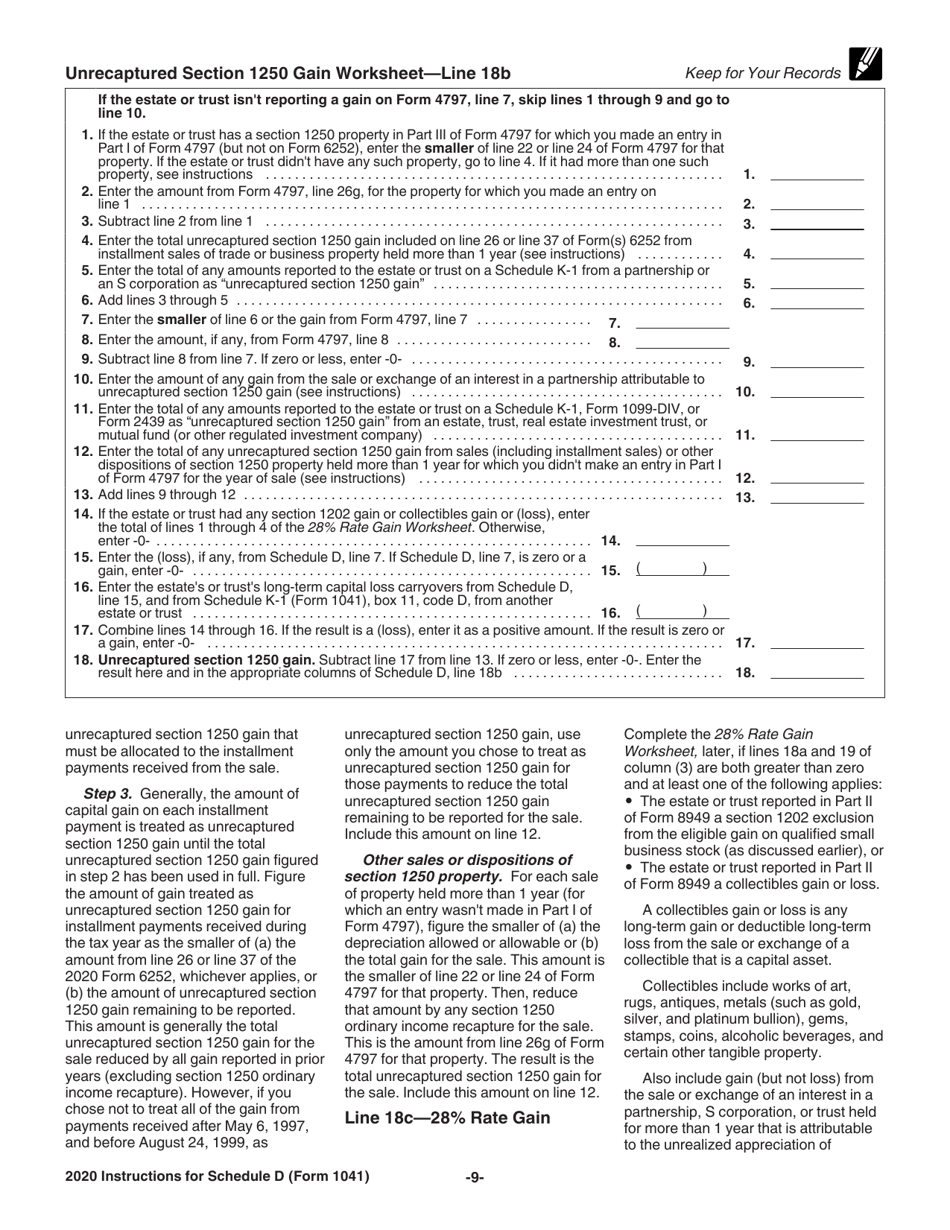

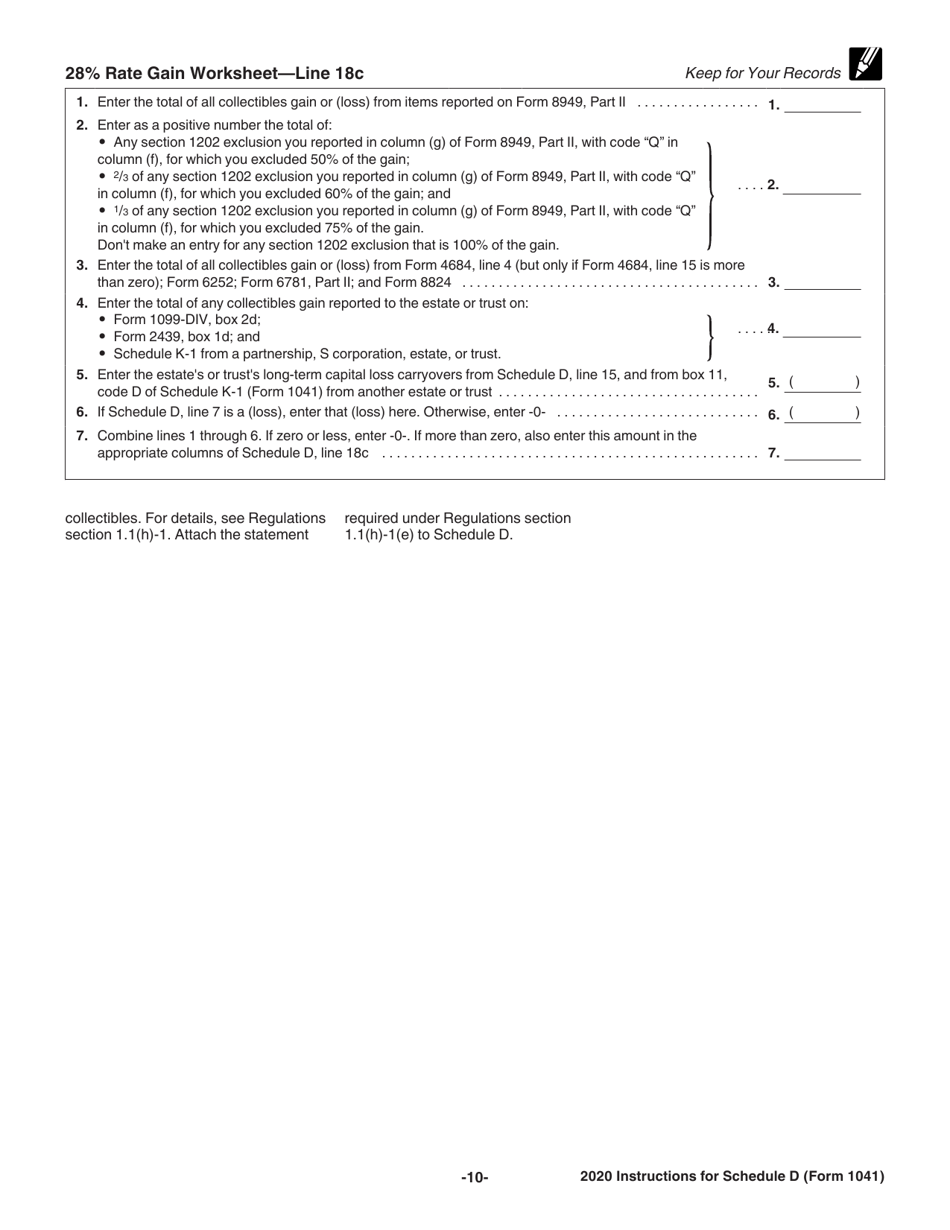

A: Yes, there are certain rules and exceptions for reporting capital gains and losses on IRS Form 1041 Schedule D, such as the wash sale rule and the 28% rate gain worksheet for collectibles.

Q: When is the deadline for filing IRS Form 1041 Schedule D?

A: The deadline for filing IRS Form 1041 Schedule D is the same as the deadline for filing the trust or estate's tax return, which is usually April 15th.

Q: Can I e-file IRS Form 1041 Schedule D?

A: Yes, you can e-file IRS Form 1041 Schedule D using tax software or through a tax professional.

Q: Do I need to include supporting documents with IRS Form 1041 Schedule D?

A: It is not necessary to include supporting documents with IRS Form 1041 Schedule D when filing, but you should keep them for your records in case of an audit.

Q: What happens if I make a mistake on IRS Form 1041 Schedule D?

A: If you make a mistake on IRS Form 1041 Schedule D, you may need to file an amended tax return (Form 1040-X) to correct the error.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.