This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041 Schedule I

for the current year.

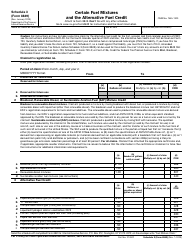

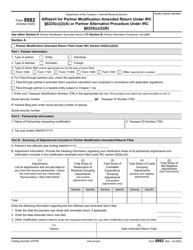

Instructions for IRS Form 1041 Schedule I Alternative Minimum Tax - Estates and Trusts

This document contains official instructions for IRS Form 1041 Schedule I, Alternative Minimum Tax - Estates and Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1041 Schedule I is available for download through this link.

FAQ

Q: What is IRS Form 1041 Schedule I?

A: IRS Form 1041 Schedule I is a form used by estates and trusts to calculate their alternative minimum tax (AMT).

Q: Who needs to file IRS Form 1041 Schedule I?

A: Estates and trusts that meet certain criteria need to file IRS Form 1041 Schedule I to report and calculate their alternative minimum tax.

Q: What is alternative minimum tax?

A: Alternative minimum tax is an additional tax imposed on estates and trusts to ensure they pay a minimum amount of tax, even if they have significant tax deductions or credits.

Q: What information is required on IRS Form 1041 Schedule I?

A: IRS Form 1041 Schedule I requires information about the estate or trust's income, deductions, and adjustments to calculate the alternative minimum tax.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.