This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule F

for the current year.

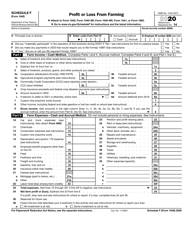

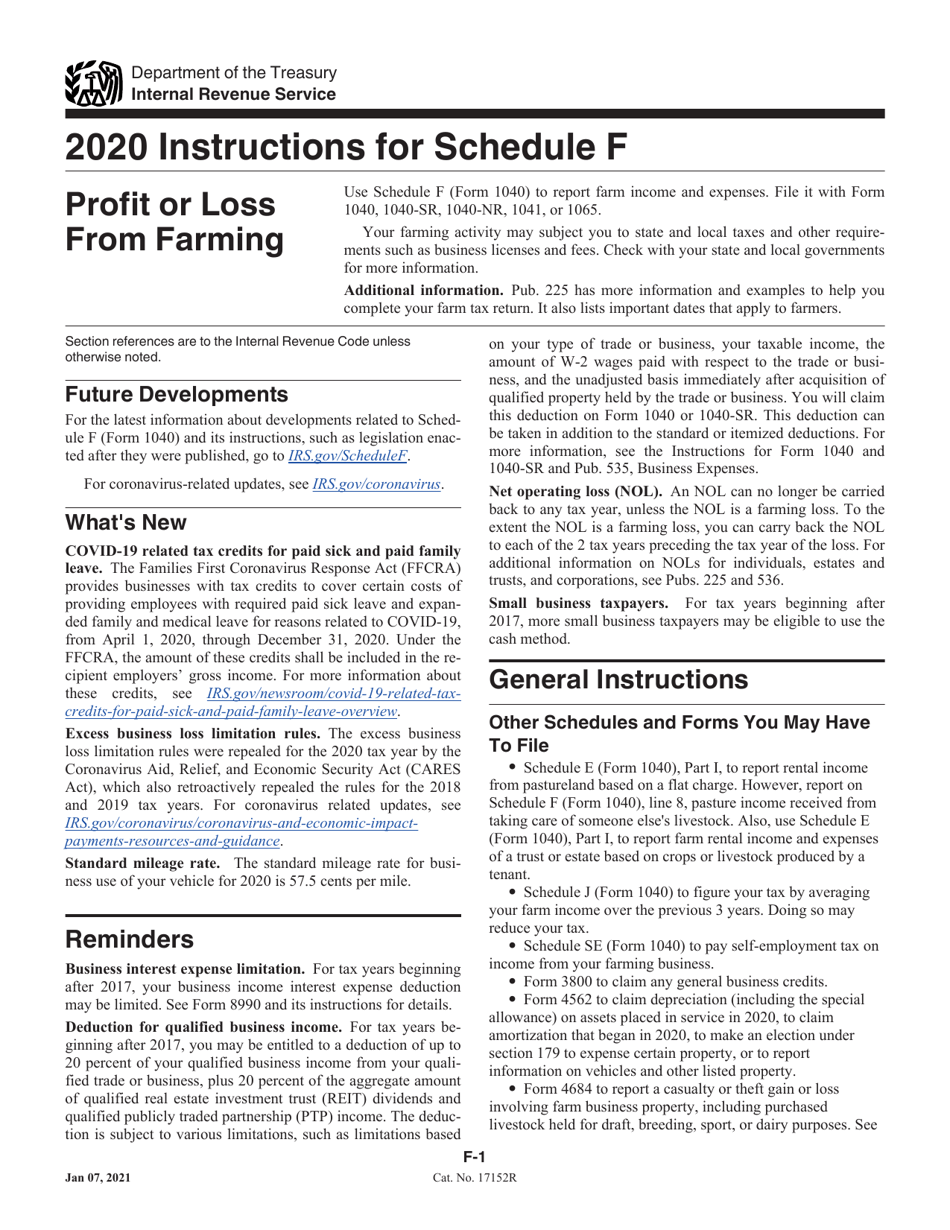

Instructions for IRS Form 1040 Schedule F Profit or Loss From Farming

This document contains official instructions for IRS Form 1040 Schedule F, Profit or Loss From Farming - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule F is available for download through this link.

FAQ

Q: What is Form 1040 Schedule F?

A: Form 1040 Schedule F is a tax form used to report profits or losses from farming activities.

Q: Who needs to file Form 1040 Schedule F?

A: Individuals who have farming activities and want to report their profits or losses from farming need to file Form 1040 Schedule F.

Q: What information is required to complete Form 1040 Schedule F?

A: To complete Form 1040 Schedule F, you will need information about your farming income, expenses, and any other related activities.

Q: What kind of farming activities are included in Form 1040 Schedule F?

A: Form 1040 Schedule F includes a wide range of farming activities, such as cultivating land, raising livestock, and producing crops.

Q: Are there any specific deductions or credits available for farmers on Form 1040 Schedule F?

A: Yes, there are specific deductions and credits available for farmers on Form 1040 Schedule F, such as depreciation of farm assets and fuel tax credits.

Q: When is the deadline to file Form 1040 Schedule F?

A: The deadline to file Form 1040 Schedule F is usually the same as the deadline to file your annual tax return, which is April 15th.

Q: Can Form 1040 Schedule F be filed electronically?

A: Yes, you can file Form 1040 Schedule F electronically if you are using tax software or hiring a tax professional.

Q: Do I need to keep any records or receipts related to Form 1040 Schedule F?

A: Yes, it is important to keep records and receipts related to your farming activities as supporting documentation for your Form 1040 Schedule F.

Q: What should I do if I have questions or need assistance with Form 1040 Schedule F?

A: If you have questions or need assistance with Form 1040 Schedule F, you can consult with a tax professional or contact the IRS for further guidance.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.