This version of the form is not currently in use and is provided for reference only. Download this version of

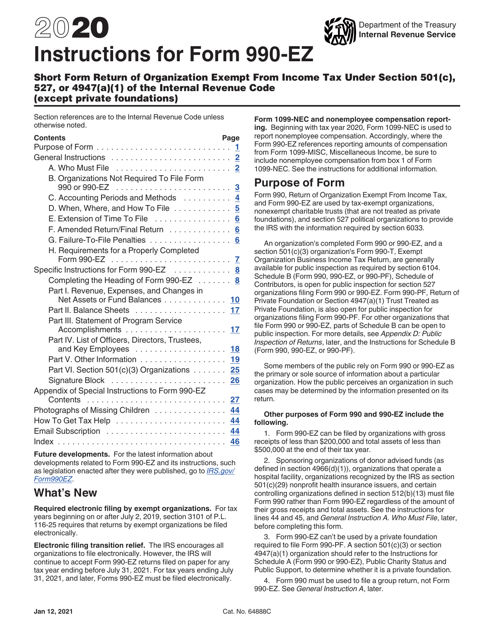

Instructions for IRS Form 990-EZ

for the current year.

Instructions for IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax

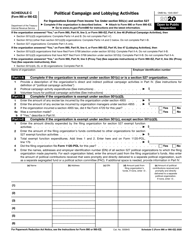

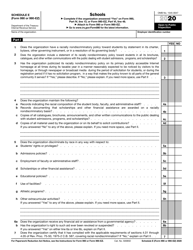

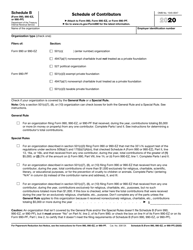

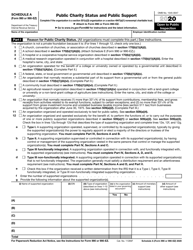

This document contains official instructions for IRS Form 990-EZ , Short Form Return of Organization Exempt From Income Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a shortened version of the full Form 990. It is used by tax-exempt organizations to report their financial information to the IRS.

Q: Who needs to file IRS Form 990-EZ?

A: Certain tax-exempt organizations, such as small charities and nonprofit organizations, are eligible to file Form 990-EZ instead of the full Form 990.

Q: How do I determine if I am eligible to file Form 990-EZ?

A: To determine eligibility, check the IRS instructions for Form 990-EZ. The instructions provide guidelines on which organizations can use the form.

Q: What information is required on Form 990-EZ?

A: Form 990-EZ requires organizations to provide information about their income, expenses, assets, liabilities, and program activities. It also requires details about the organization's governance and compliance with tax laws.

Q: When is the deadline to file Form 990-EZ?

A: Form 990-EZ is due by the 15th day of the 5th month after the end of the organization's fiscal year. For example, if your fiscal year ends on December 31st, the form is due May 15th of the following year.

Q: Are there any penalties for filing Form 990-EZ late or incorrectly?

A: Yes, there are penalties for late filing or incorrect information on Form 990-EZ. It is important to file on time and ensure the accuracy of the information provided.

Q: Do all tax-exempt organizations need to file Form 990-EZ?

A: No, some tax-exempt organizations, such as churches and certain government organizations, are not required to file Form 990-EZ. However, they may still need to file other forms or meet certain reporting requirements.

Q: What should I do if I need help with Form 990-EZ?

A: If you need help with Form 990-EZ, you can consult a tax professional or contact the IRS for assistance. They have resources available to answer questions and provide guidance.

Instruction Details:

- This 48-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.