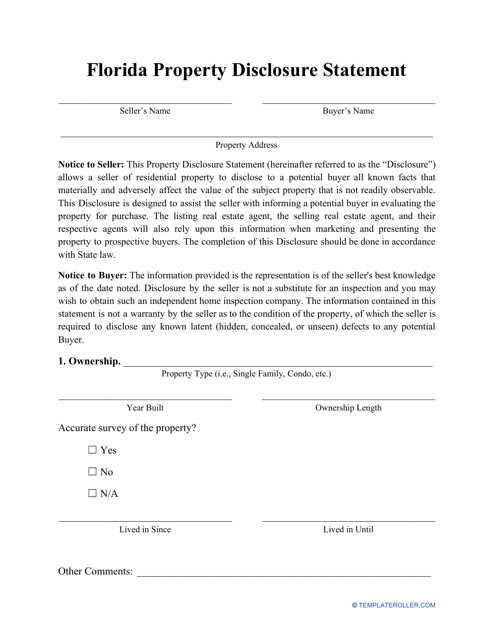

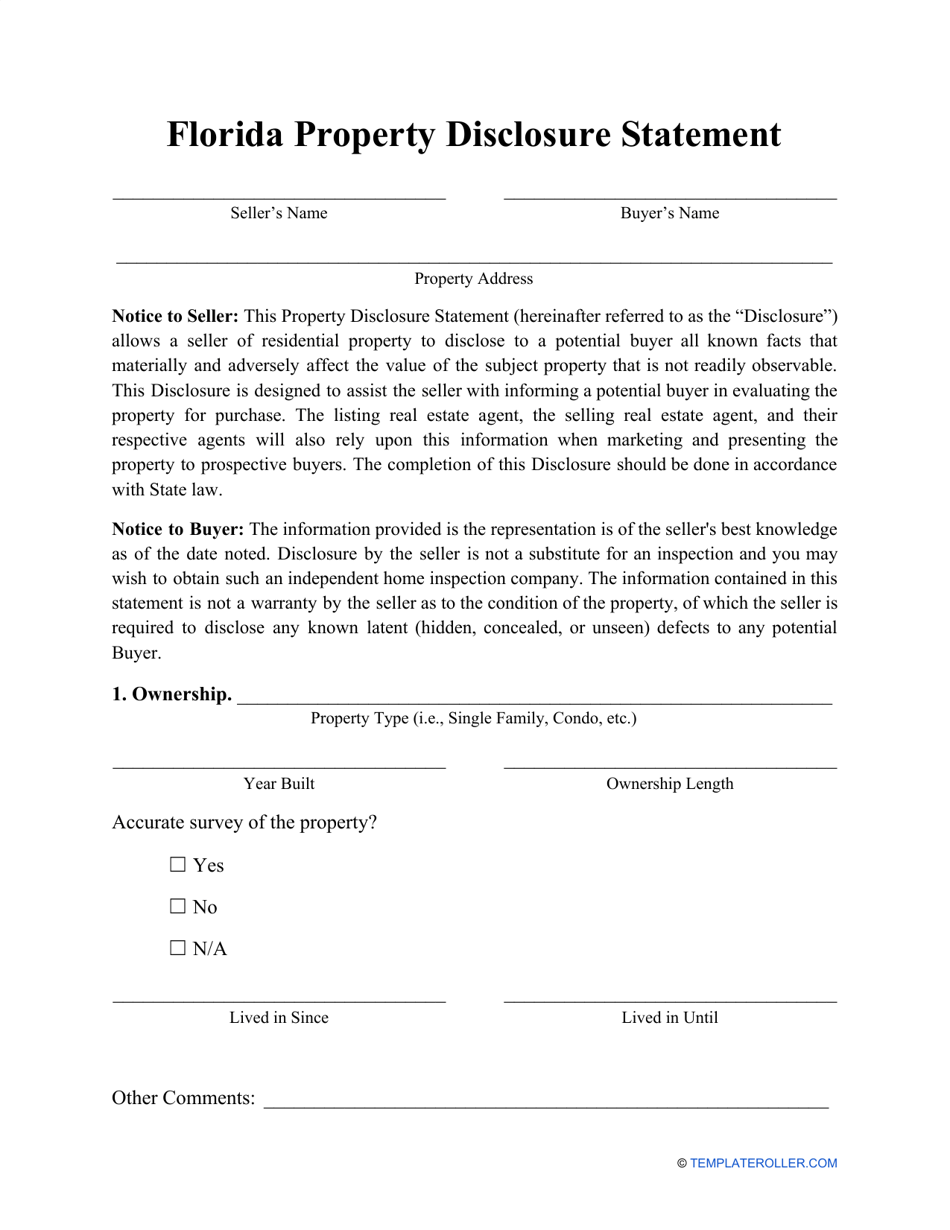

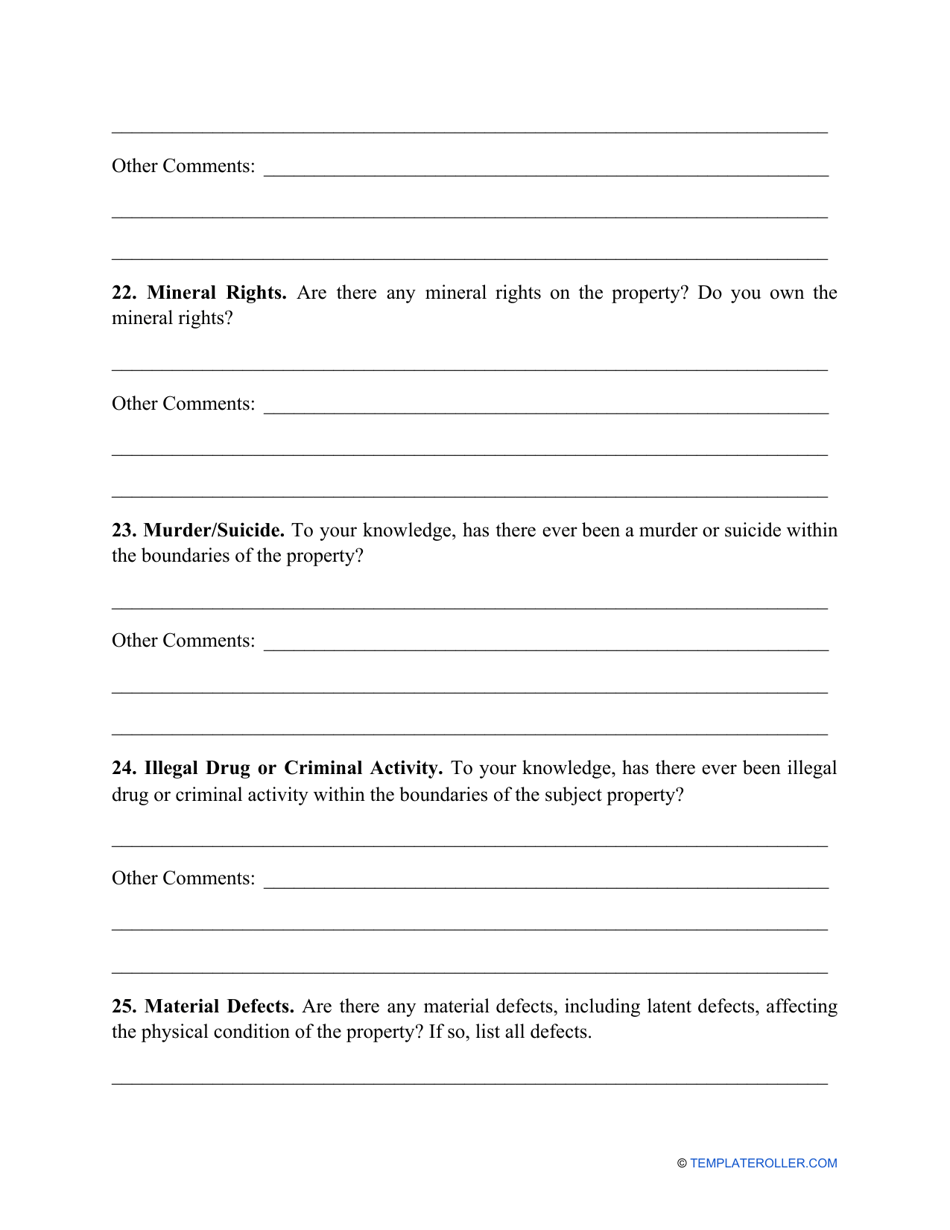

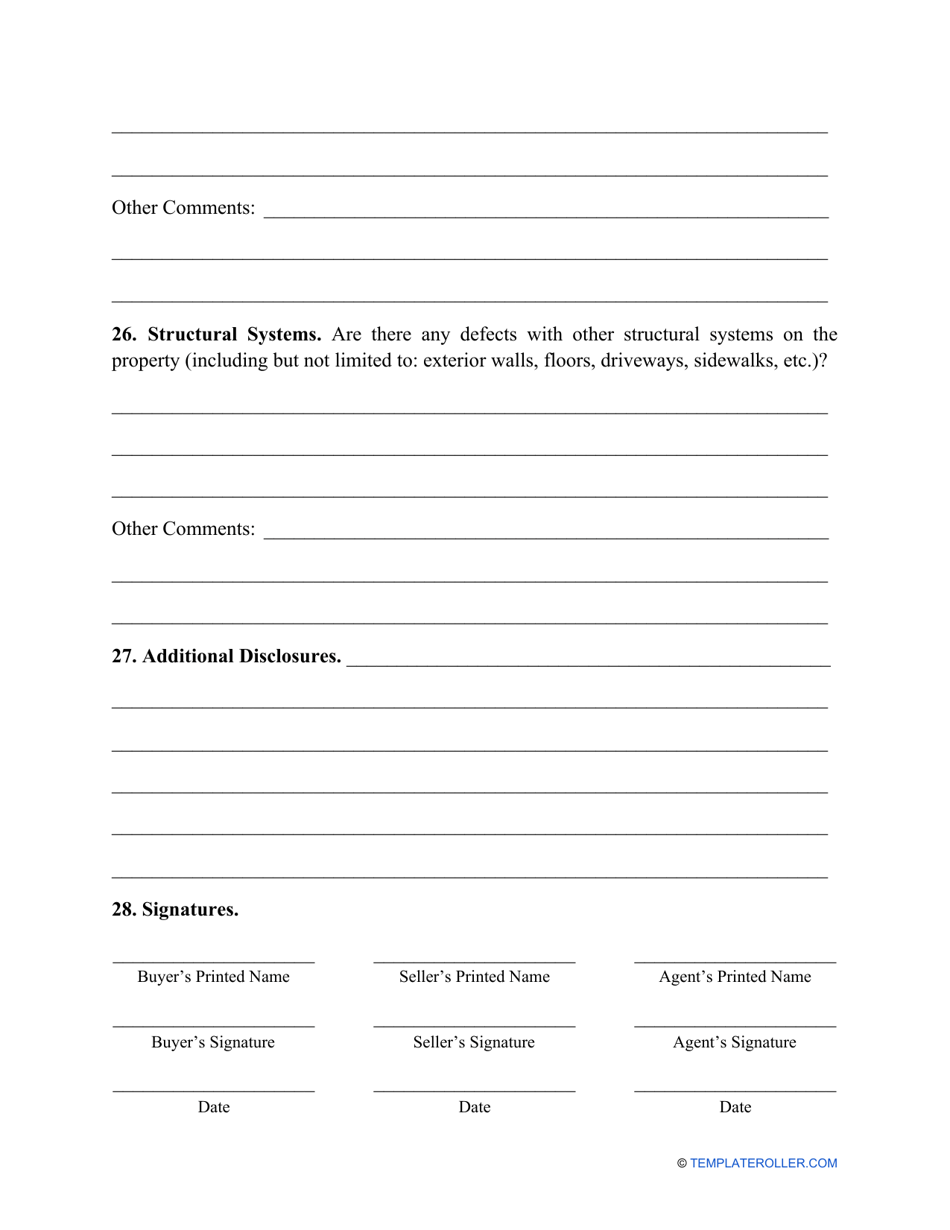

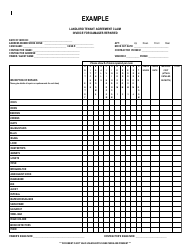

Property Disclosure Statement Form - Florida

The Property Disclosure Statement Form in Florida is used to disclose information about the condition and history of a property being sold. It helps buyers understand any known issues or defects with the property before making a purchase.

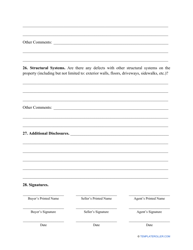

In Florida, it is typically the seller who files the Property Disclosure Statement form.

FAQ

Q: What is a Property Disclosure Statement?

A: A Property Disclosure Statement is a form used in Florida to disclose any known defects or issues with a property being sold.

Q: Why is a Property Disclosure Statement important?

A: A Property Disclosure Statement is important because it helps buyers make informed decisions about the condition of the property before purchasing.

Q: Who fills out the Property Disclosure Statement?

A: The seller of the property is responsible for filling out the Property Disclosure Statement.

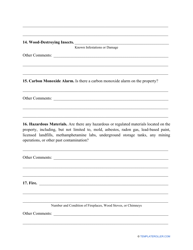

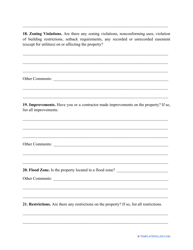

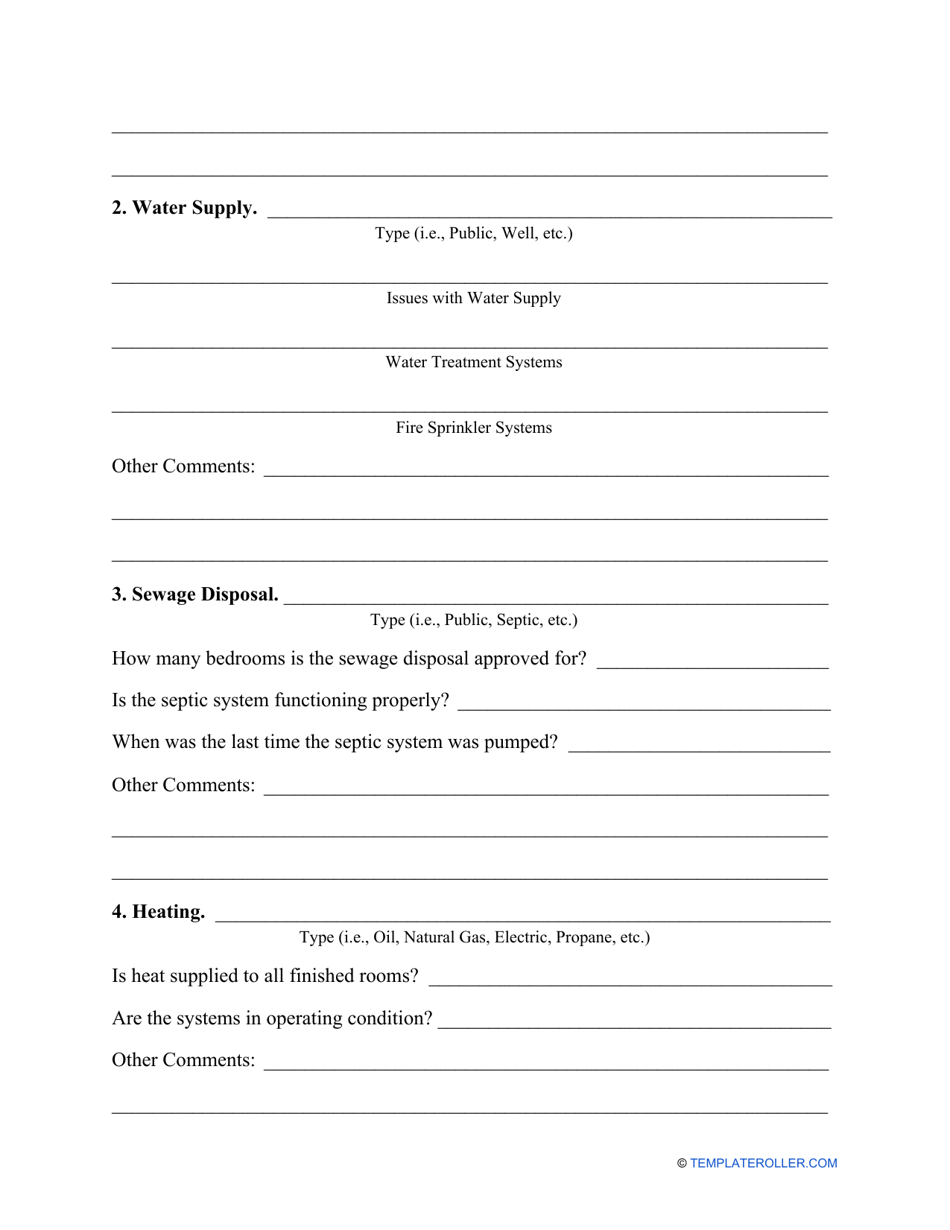

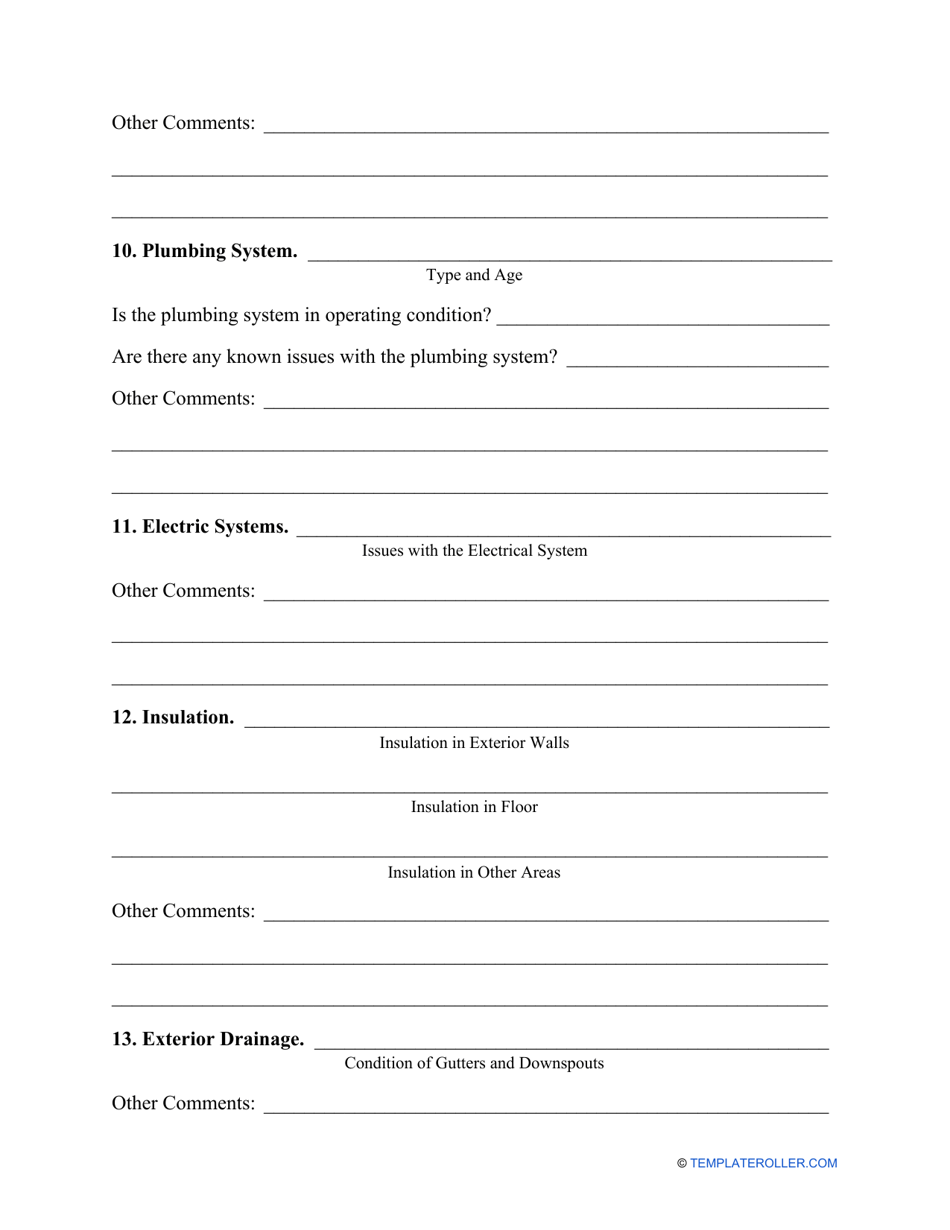

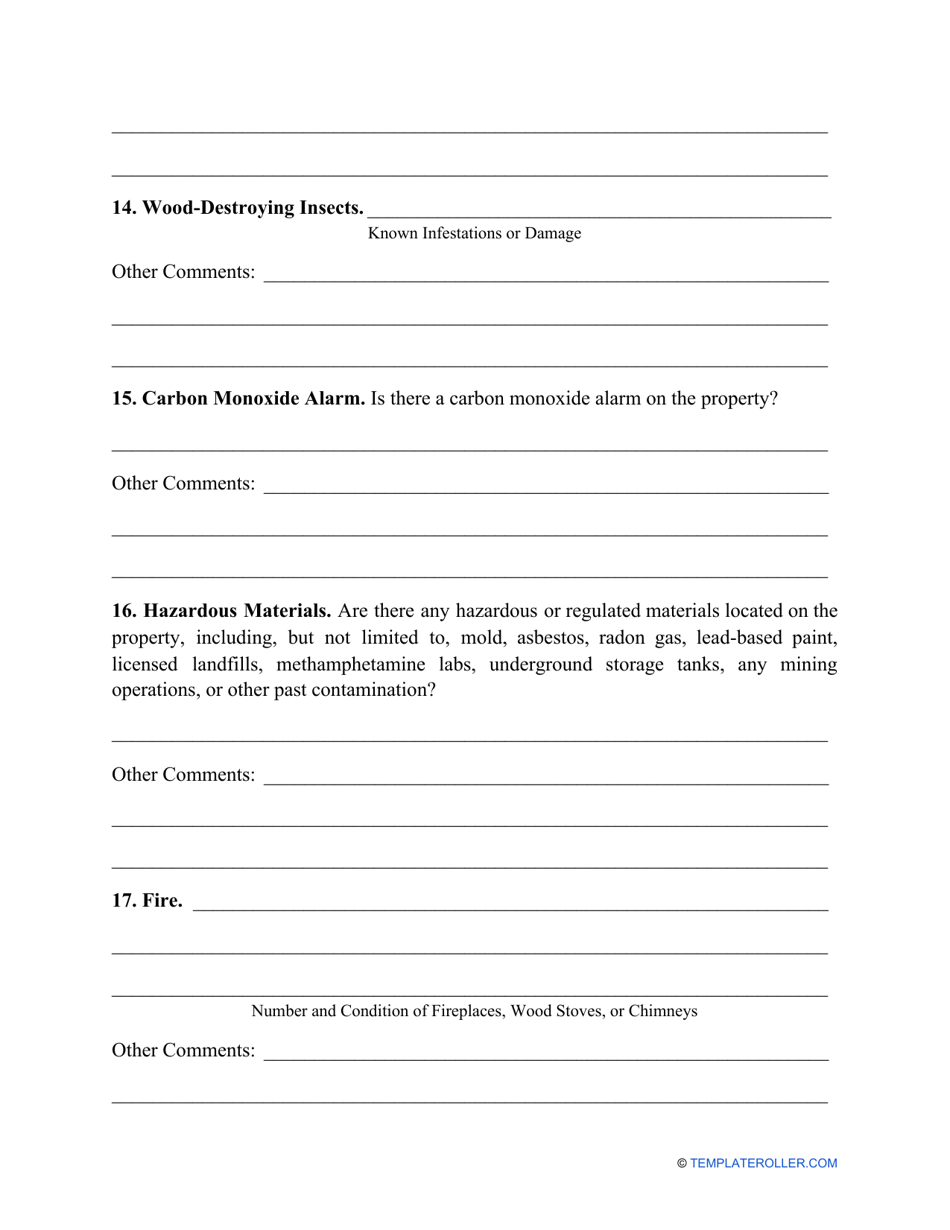

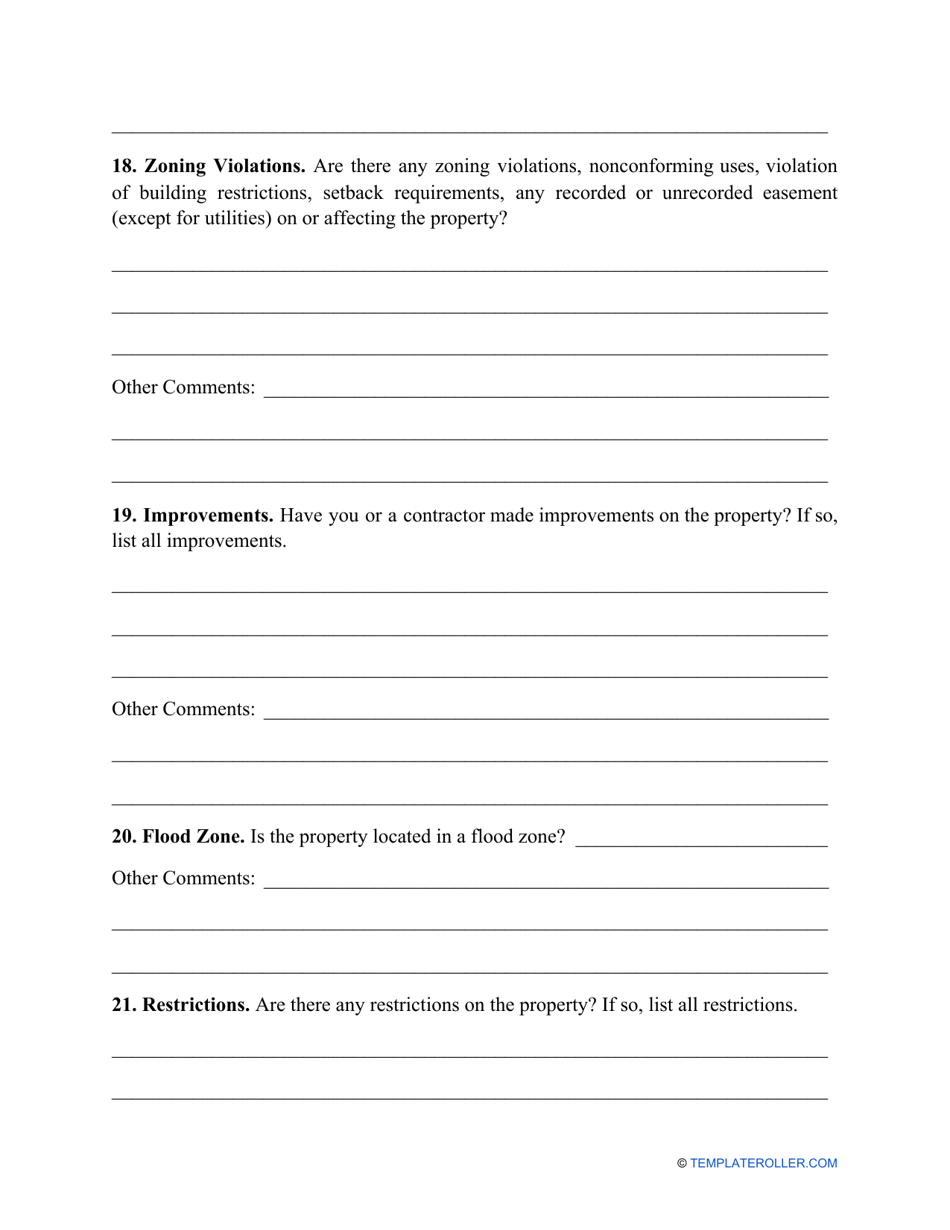

Q: What information is typically included in a Property Disclosure Statement?

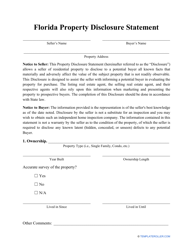

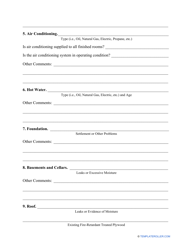

A: A Property Disclosure Statement typically includes information about the condition of the property, any past or current issues, and any renovations or improvements that have been made.

Q: Is a Property Disclosure Statement legally required in Florida?

A: Yes, a Property Disclosure Statement is legally required in Florida for residential properties being sold.

Q: Can a buyer sue the seller for not disclosing a defect?

A: Yes, a buyer may have legal recourse if the seller fails to disclose a known defect or issue with the property.

Q: Are there any exceptions to disclosing defects in Florida?

A: In Florida, sellers are not required to disclose defects that the buyer could have discovered through a reasonably diligent inspection or if the defect was previously disclosed.