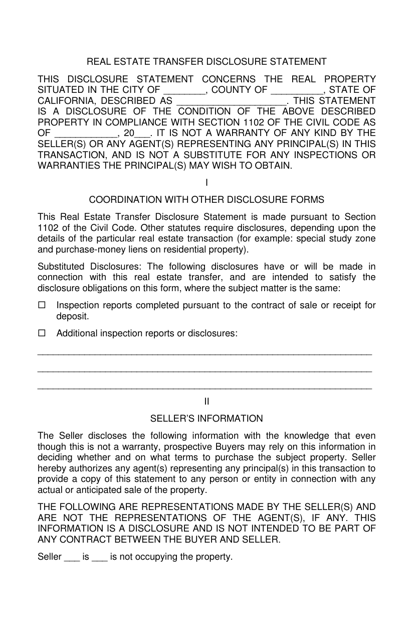

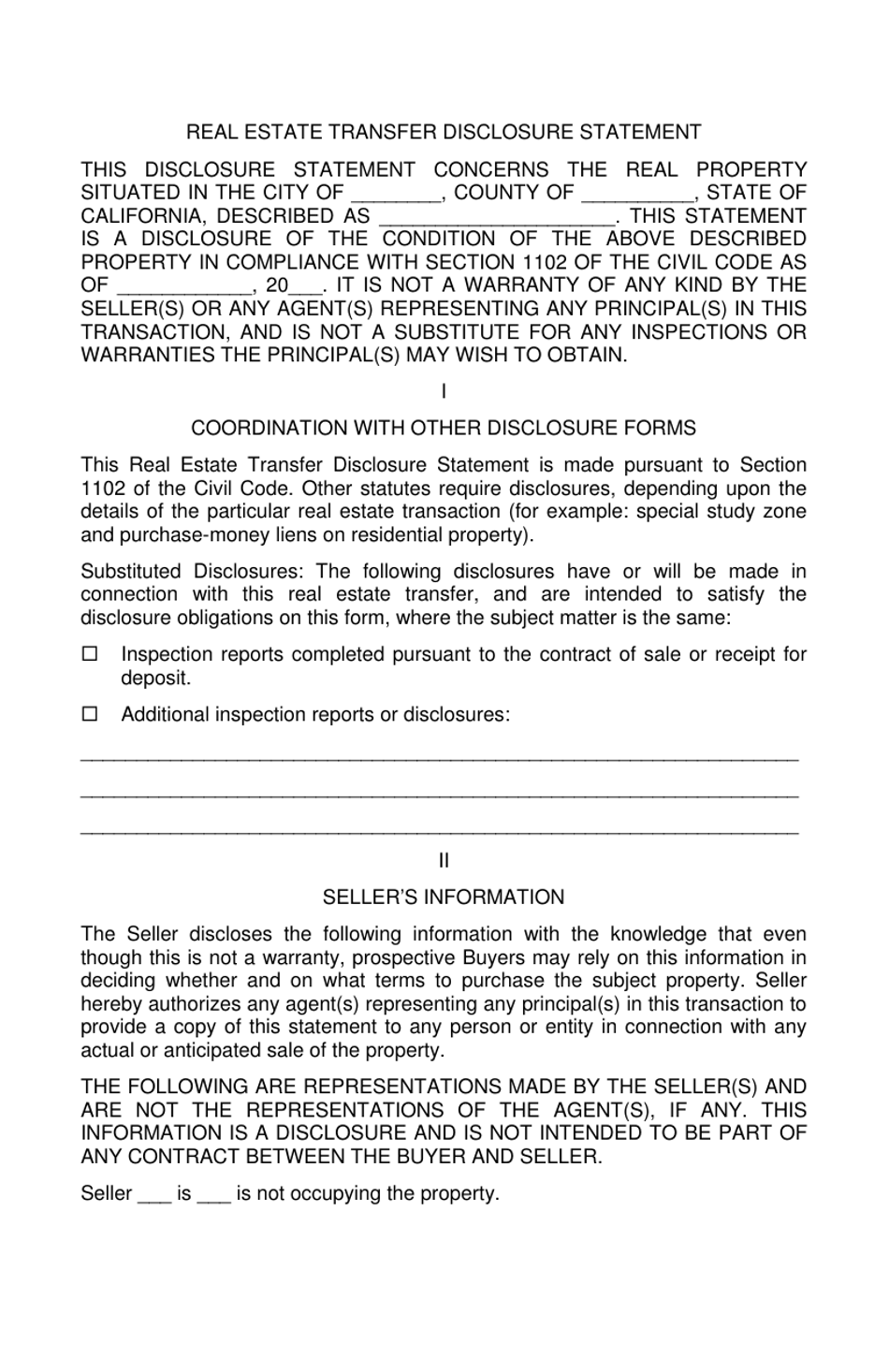

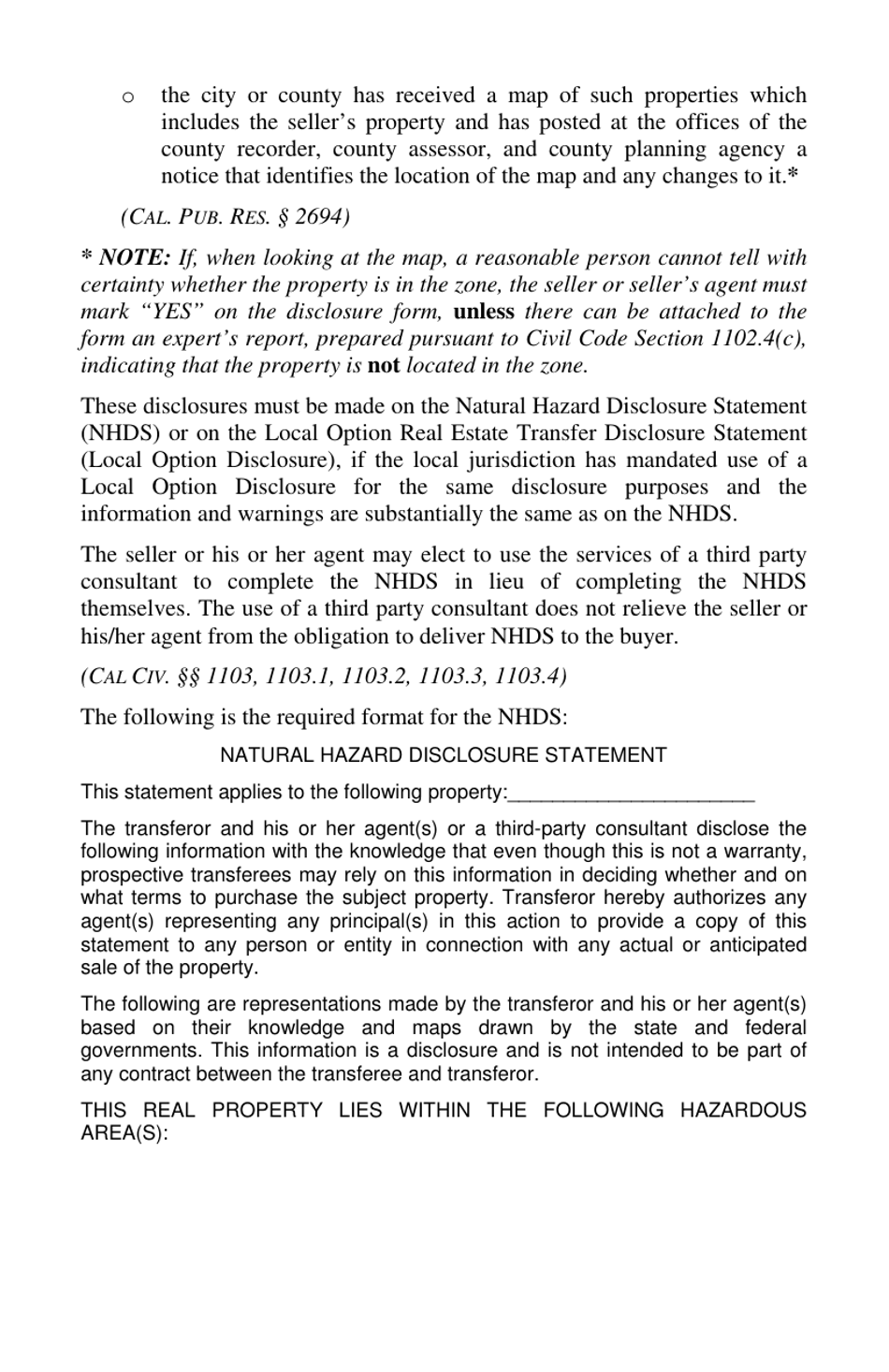

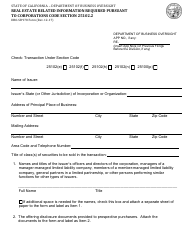

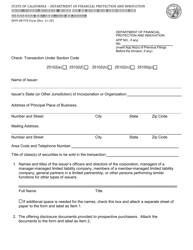

Real Estate Transfer Disclosure Statement - California

Real Estate Transfer Disclosure Statement is a legal document that was released by the California Department of Real Estate - a government authority operating within California.

FAQ

Q: What is a Real Estate Transfer Disclosure Statement?

A: A Real Estate Transfer Disclosure Statement (TDS) is a form required in California when selling a residential property.

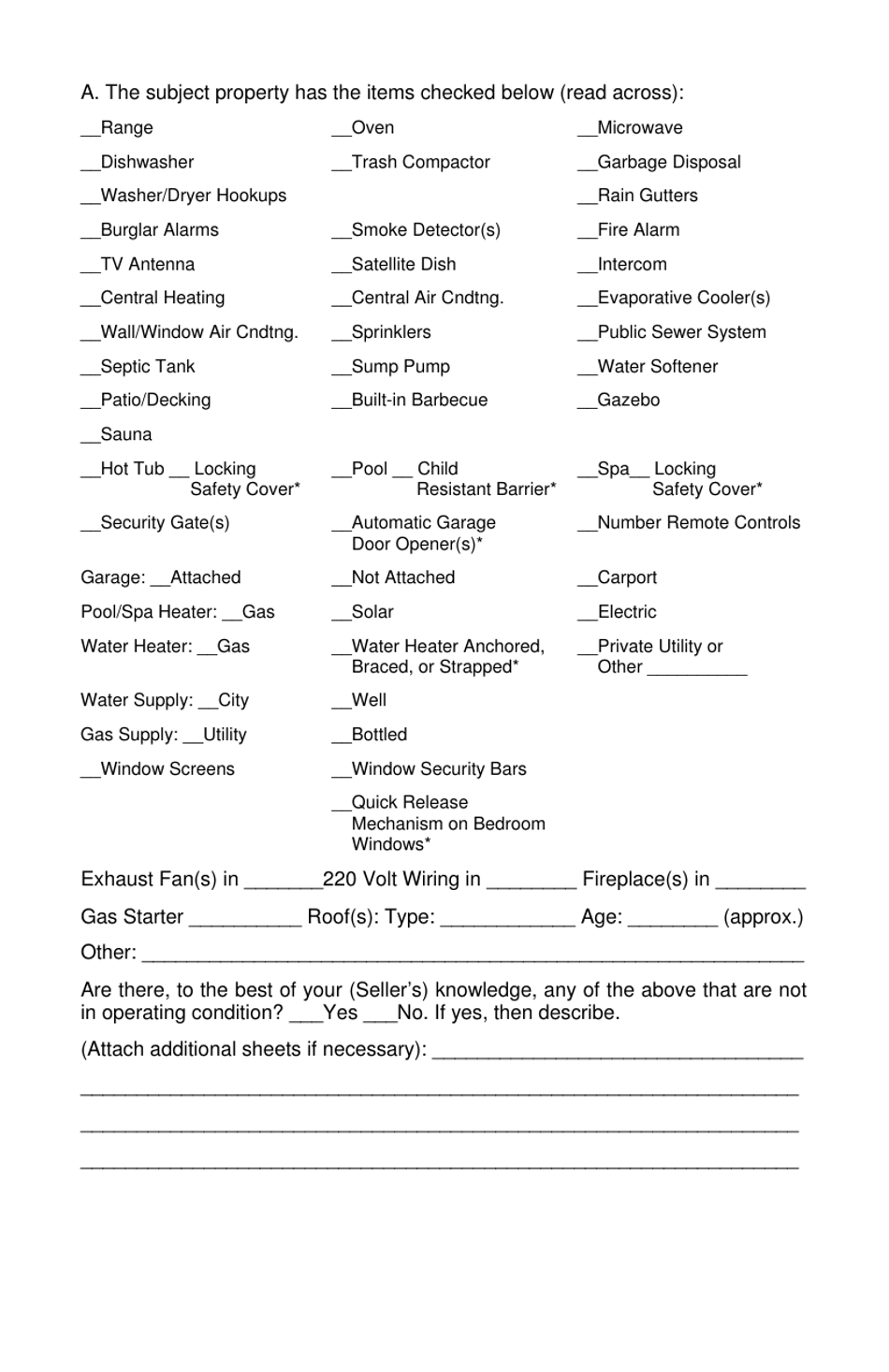

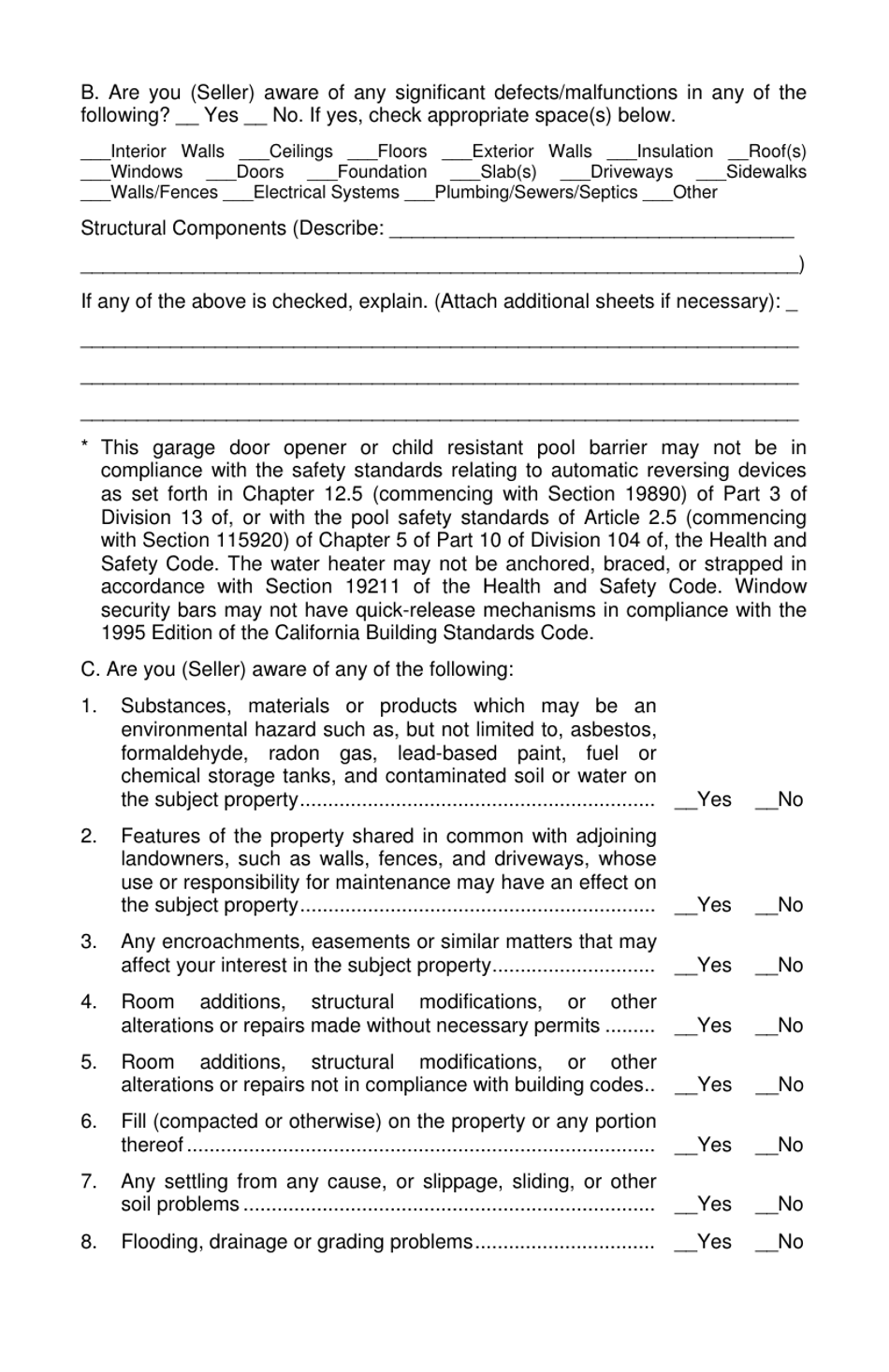

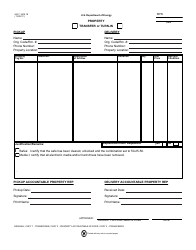

Q: What does the TDS contain?

A: The TDS contains information about the condition of the property and any known defects.

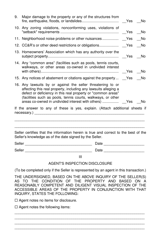

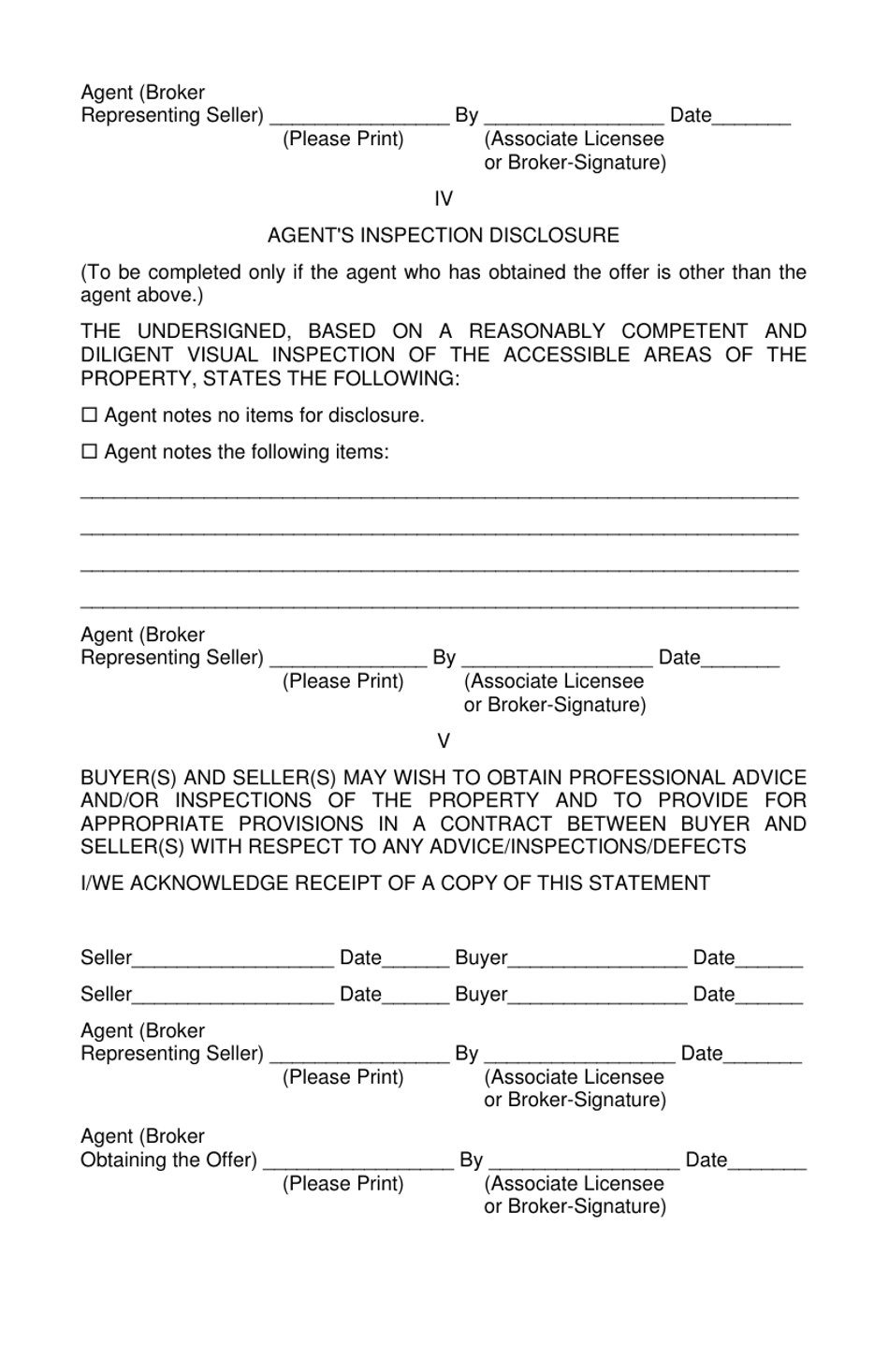

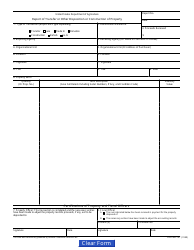

Q: Who completes the TDS?

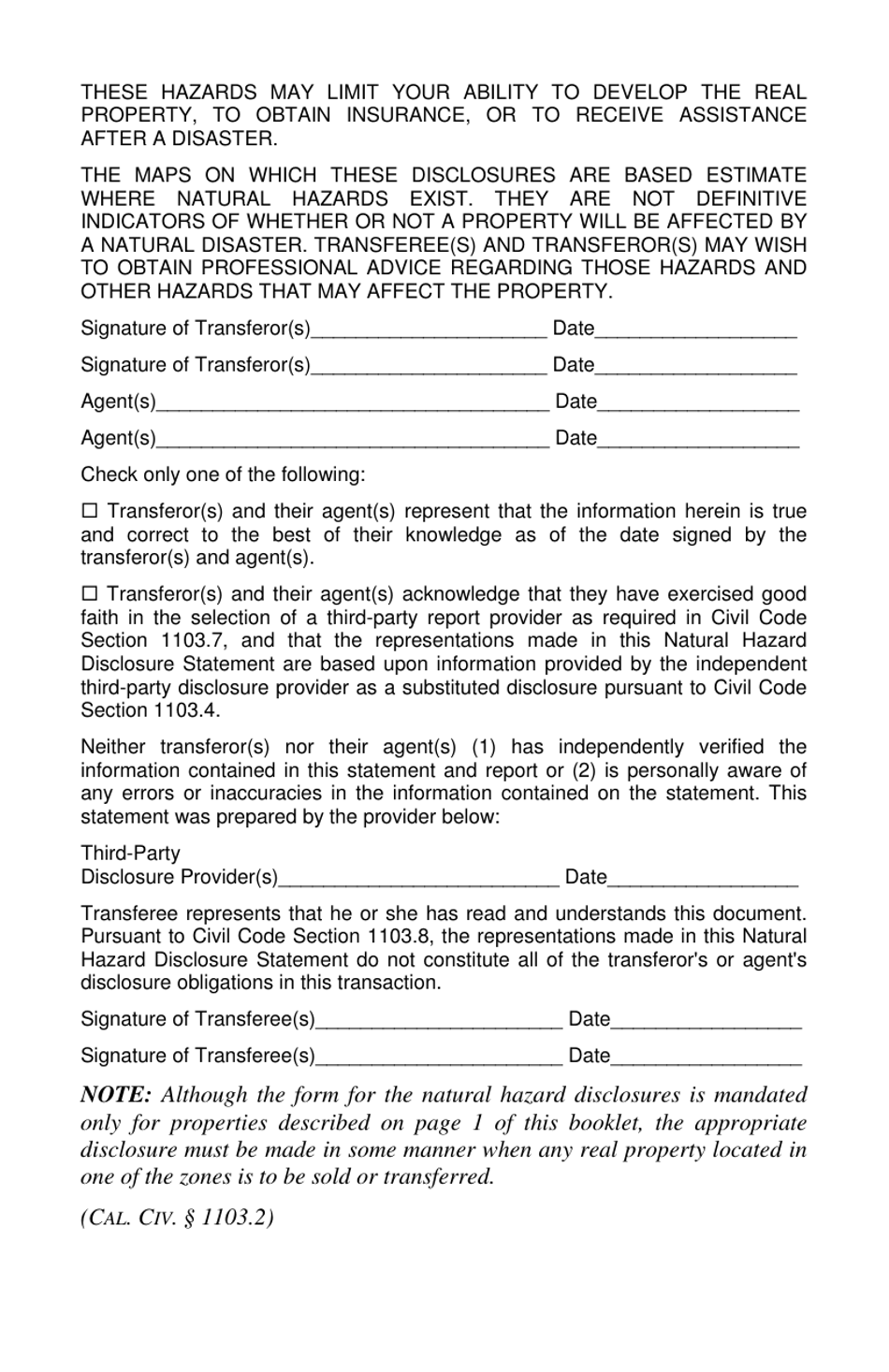

A: The seller of the property is responsible for completing the TDS.

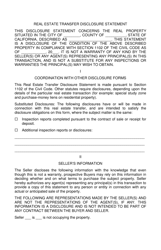

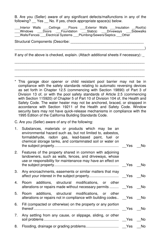

Q: What type of information is disclosed in the TDS?

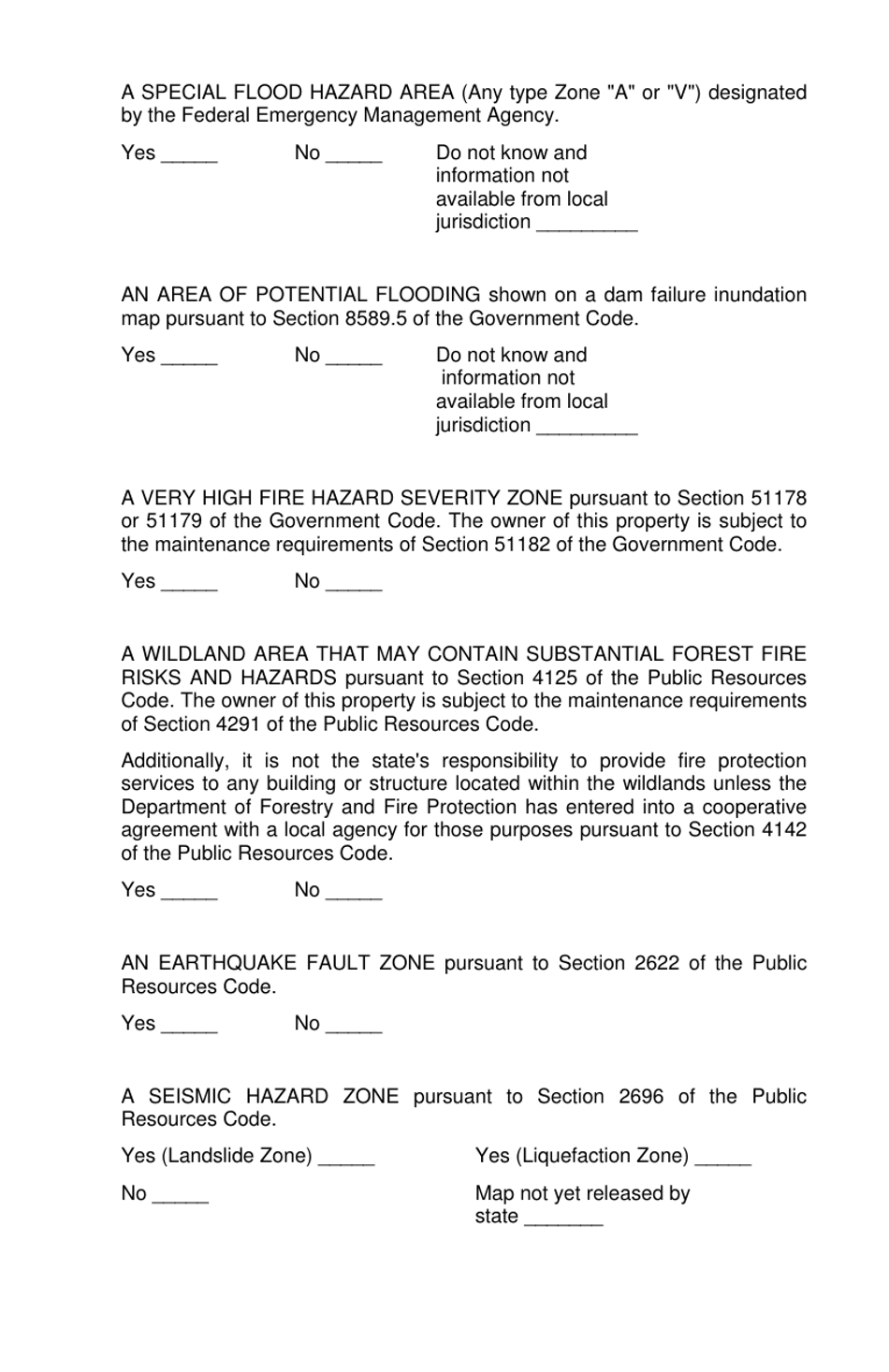

A: Information about the property's structure, systems, and any known hazards or defects must be disclosed in the TDS.

Q: Is the TDS required for all residential property sales in California?

A: Yes, the TDS is required for all residential property sales, with a few exceptions.

Q: What happens if the seller fails to complete the TDS?

A: Failure to complete the TDS can result in legal consequences for the seller.

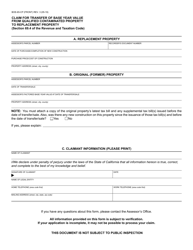

Q: Can buyers rely solely on the TDS for information about the property?

A: No, buyers are encouraged to conduct their own inspections and investigations in addition to reviewing the TDS.

Q: Are there any exemptions to the TDS requirement?

A: Yes, certain types of sales, such as transfers between family members or foreclosures, may be exempt from the TDS requirement.

Q: Can I use a generic disclosure form instead of the TDS?

A: No, the TDS is a specific form required by law and using a generic disclosure form may not fulfill the legal requirement.

Form Details:

- The latest edition currently provided by the California Department of Real Estate;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Real Estate.