Employer's Guide to the Work Opportunity Pportunity Tax Credit

Employer's Guide to the Work Opportunity Pportunity Tax Credit is a 9-page legal document that was released by the U.S. Department of Labor - Employment & Training Administration on August 1, 2014 and used nation-wide.

FAQ

Q: What is the Work Opportunity Tax Credit?

A: The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire individuals from specific targeted groups.

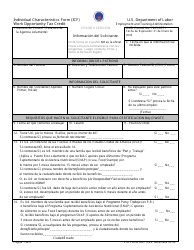

Q: Who qualifies for the Work Opportunity Tax Credit?

A: Individuals from specific targeted groups, such as veterans, long-term unemployed individuals, ex-felons, and recipients of certain government assistance programs.

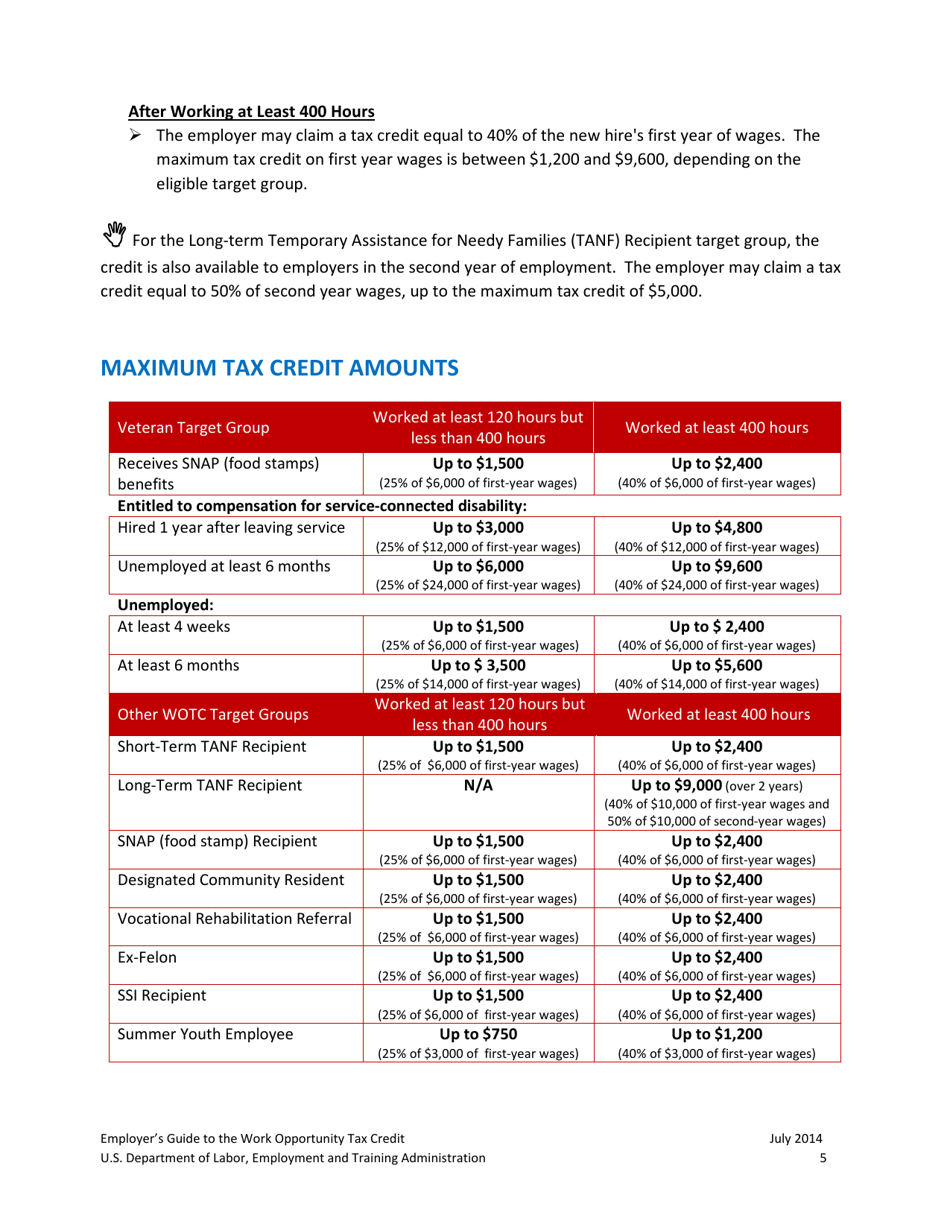

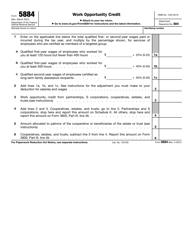

Q: How much is the Work Opportunity Tax Credit?

A: The amount of the tax credit depends on the target group of the individual hired and the number of hours worked by the employee.

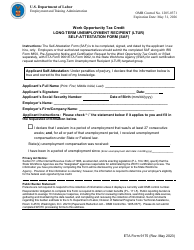

Q: How can employers claim the Work Opportunity Tax Credit?

A: Employers can claim the credit by filing IRS Form 5884 and submitting it with their annual tax return.

Q: Is there a deadline to claim the Work Opportunity Tax Credit?

A: Yes, employers must submit their Form 5884 within 28 days after the eligible employee begins working.

Q: Are there any limitations or restrictions on the Work Opportunity Tax Credit?

A: Yes, the credit is subject to various limitations, such as the number of qualified employees an employer can claim credit for and the amount of wages eligible for the credit.

Q: Can the Work Opportunity Tax Credit be carried forward or back?

A: No, the credit cannot be carried forward or back, but it can be used to offset the employer's income tax liability for the current year.

Q: Are there any other tax incentives available for employers who hire individuals with disabilities?

A: Yes, in addition to the Work Opportunity Tax Credit, there are other tax incentives such as the Disabled Access Credit and the Barrier Removal Tax Deduction.

Form Details:

- The latest edition currently provided by the U.S. Department of Labor - Employment & Training Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.