Top 10 Ways to Prepare for Retirement

Top 10 Ways to Prepare for Retirement is a 6-page legal document that was released by the U.S. Department of Labor - Employee Benefits Security Administration on September 1, 2015 and used nation-wide.

FAQ

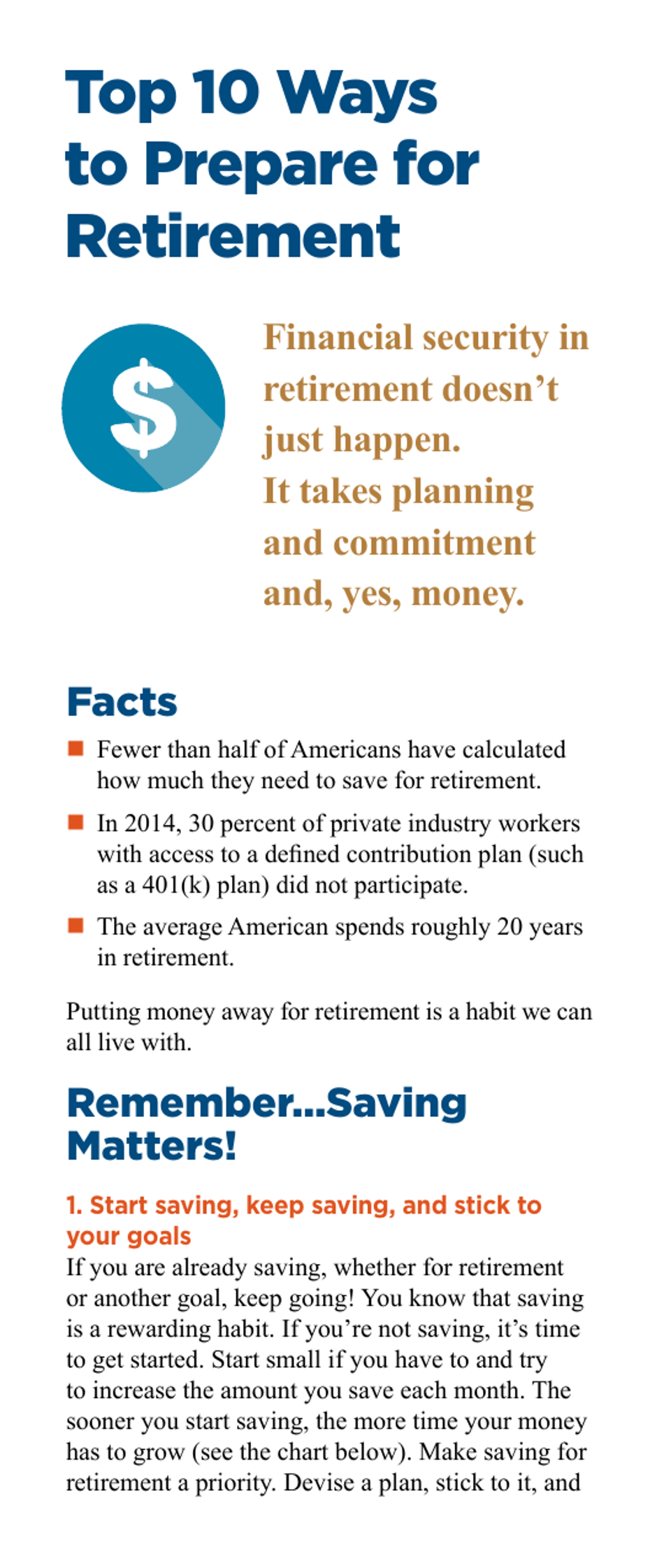

Q: Why is it important to prepare for retirement?

A: Preparing for retirement is important to ensure financial security and a comfortable lifestyle in your later years.

Q: When should I start preparing for retirement?

A: It is recommended to start preparing for retirement as early as possible to maximize savings and investments.

Q: What are some ways to save for retirement?

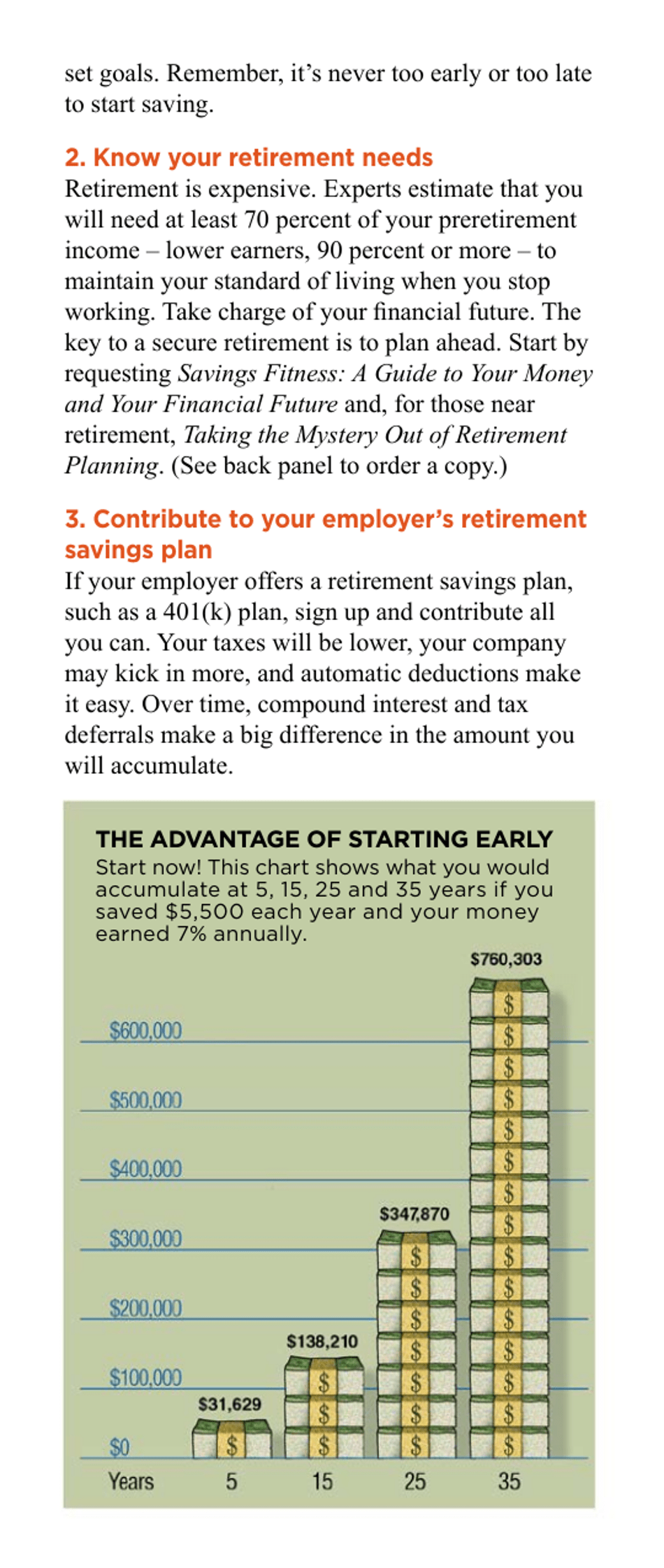

A: Some ways to save for retirement include contributing to a 401(k) or IRA, investing in stocks or real estate, and saving money in a dedicated retirement account.

Q: How much money do I need for retirement?

A: The amount of money needed for retirement varies depending on individual factors such as lifestyle, healthcare costs, and desired retirement age.

Q: What is a 401(k) and how does it work?

A: A 401(k) is a retirement savings plan offered by employers. It allows employees to contribute a portion of their salary to a tax-advantaged account, with some employers offering matching contributions.

Q: What is an IRA and how does it work?

A: An IRA (Individual Retirement Account) is a personal retirement savings account that allows individuals to contribute money each year. There are different types of IRAs, such as traditional IRAs and Roth IRAs, each with their own tax advantages.

Q: Is Social Security enough for retirement?

A: Social Security alone is generally not enough to cover all retirement expenses. It is important to have additional savings and investments for a comfortable retirement.

Q: Should I seek professional financial advice for retirement planning?

A: Seeking professional financial advice can be beneficial for retirement planning, as experts can provide guidance on saving, investing, and creating a retirement plan.

Q: How can I estimate my retirement expenses?

A: Estimating retirement expenses involves considering factors such as housing, healthcare, daily living costs, and any desired activities or travel during retirement.

Q: What are some common mistakes to avoid when preparing for retirement?

A: Common mistakes to avoid include not saving enough, not diversifying investments, and underestimating future expenses.

Form Details:

- The latest edition currently provided by the U.S. Department of Labor - Employee Benefits Security Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.