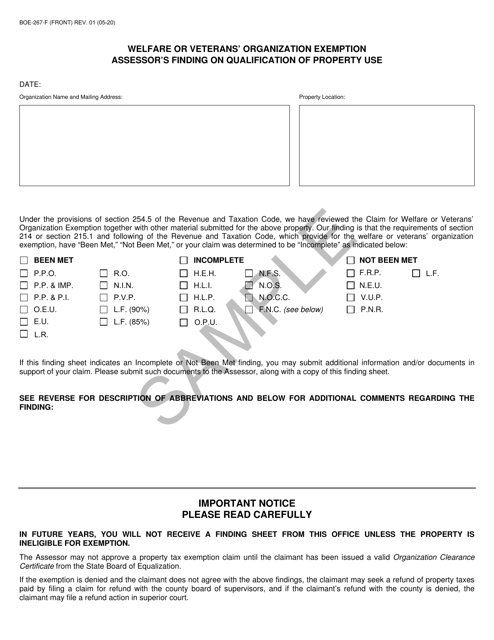

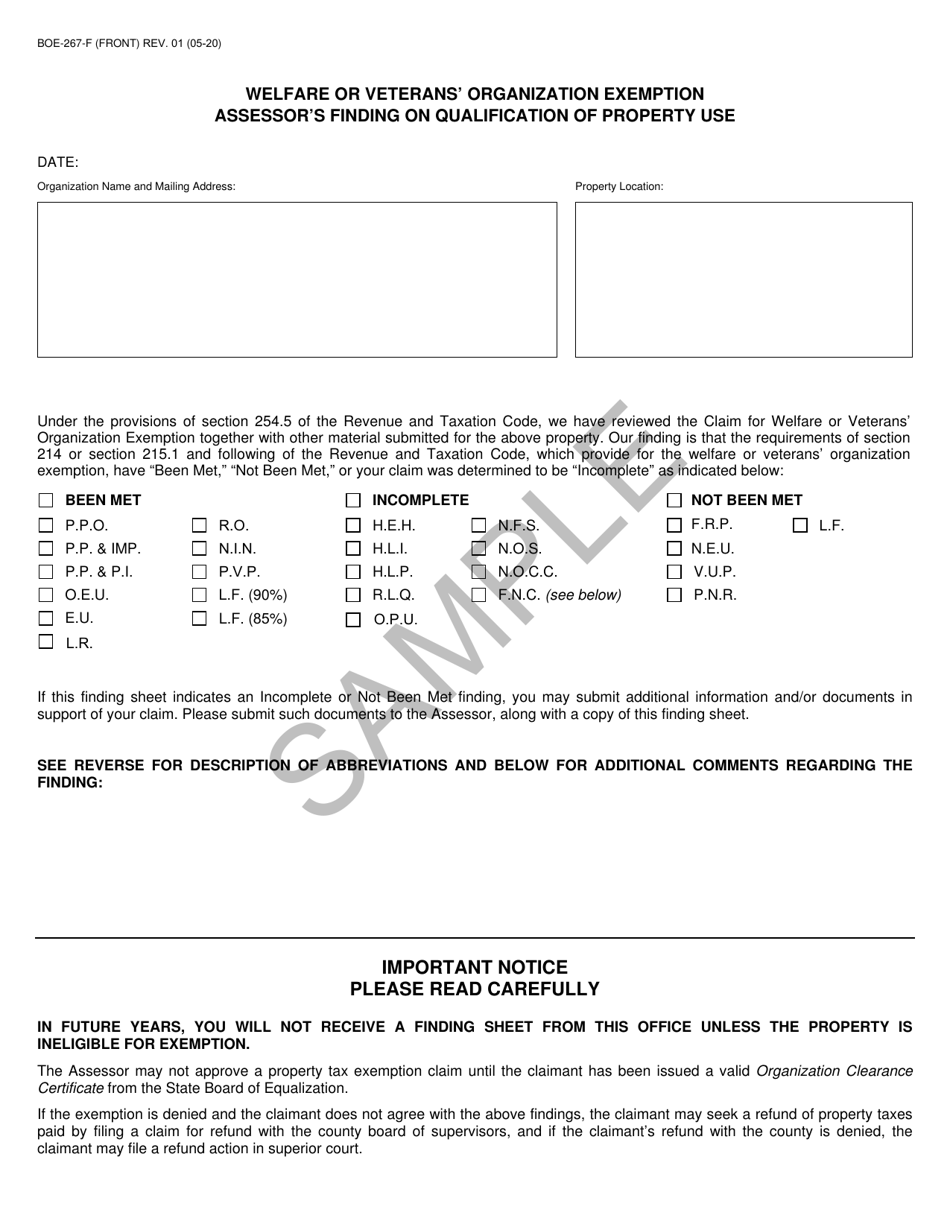

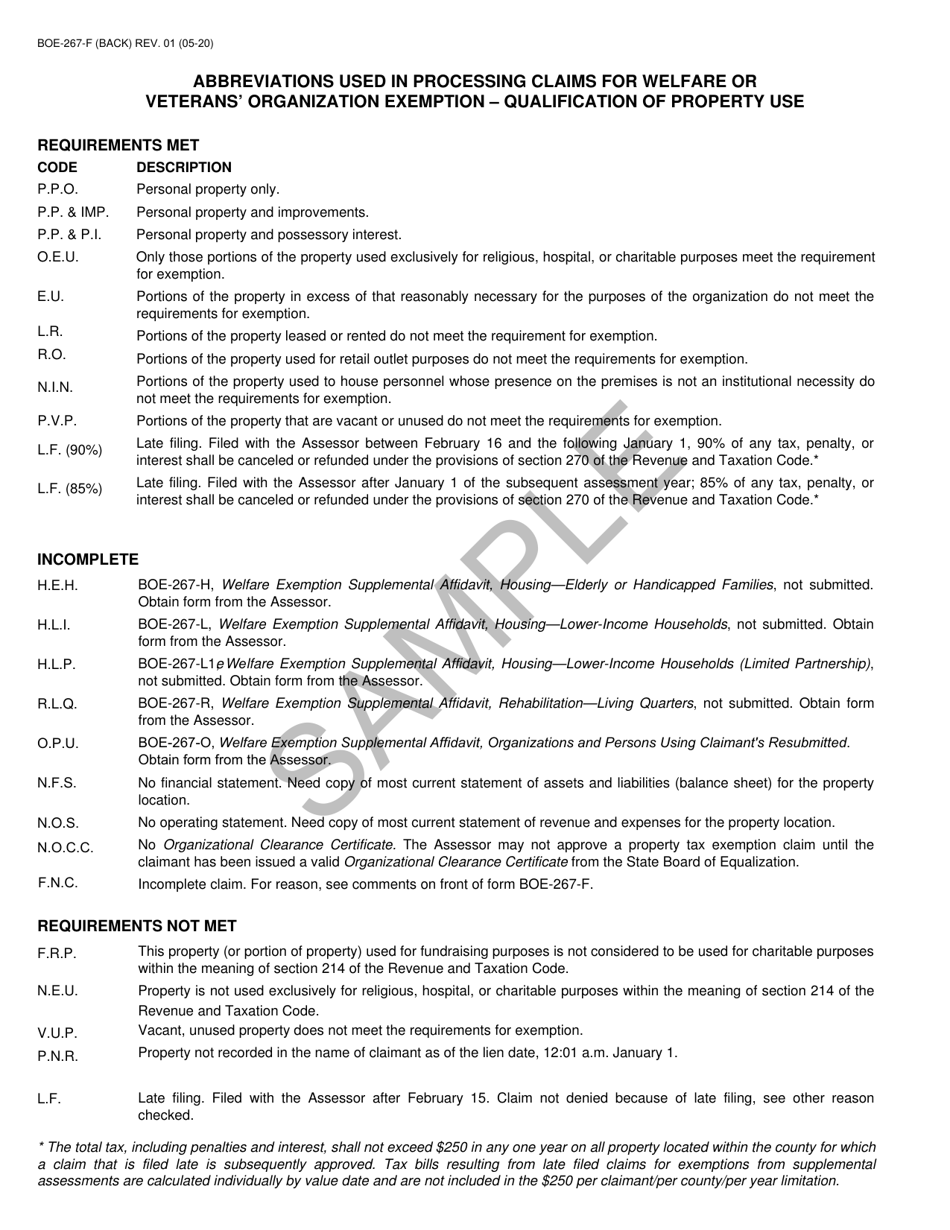

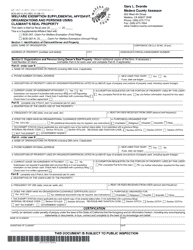

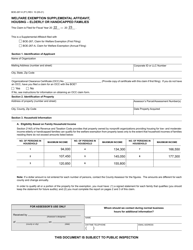

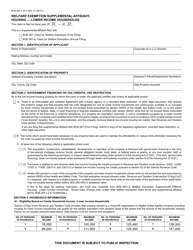

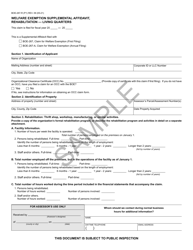

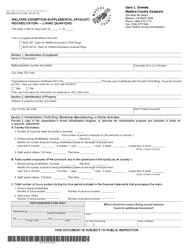

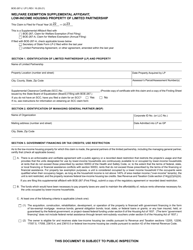

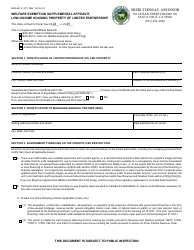

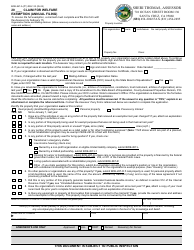

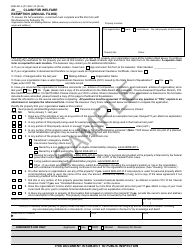

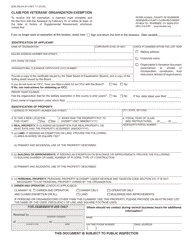

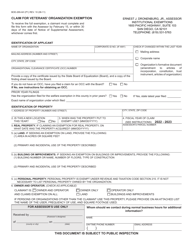

Form BOE-267-F Welfare or Veterans' Organization Exemption Assessor's Finding on Qualification of Property Use - California

What Is Form BOE-267-F?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-267-F?

A: BOE-267-F is a form used in California to determine the qualification of property use for welfare or veterans' organizations.

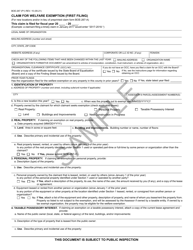

Q: Who uses BOE-267-F?

A: Welfare or veterans' organizations in California use BOE-267-F to apply for property tax exemption.

Q: What does BOE-267-F assess?

A: BOE-267-F assesses the qualification of property use for exemptions for welfare or veterans' organizations.

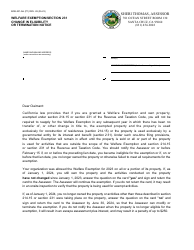

Q: What is the purpose of BOE-267-F?

A: The purpose of BOE-267-F is to determine if a welfare or veterans' organization qualifies for a property tax exemption in California.

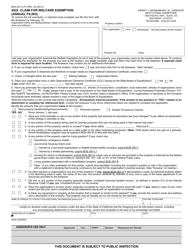

Q: What does the Assessor's Finding refer to?

A: The Assessor's Finding refers to the conclusion reached by the assessor regarding the qualification of property use for exemption.

Q: What is the Assessor's Finding based on?

A: The Assessor's Finding is based on the information provided by the welfare or veterans' organization on the BOE-267-F form.

Q: What happens if a welfare or veterans' organization qualifies for exemption?

A: If a welfare or veterans' organization qualifies for exemption, they may be eligible for a property tax exemption in California.

Q: What happens if a welfare or veterans' organization does not qualify for exemption?

A: If a welfare or veterans' organization does not qualify for exemption, they may be subject to property taxes in California.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-267-F by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.