This version of the form is not currently in use and is provided for reference only. Download this version of

Form BOE-571-F

for the current year.

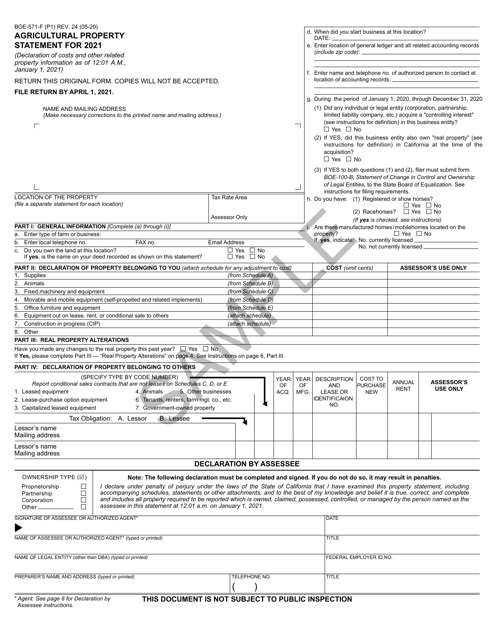

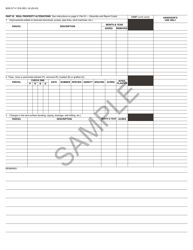

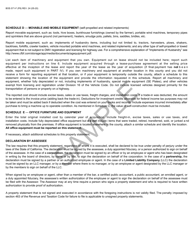

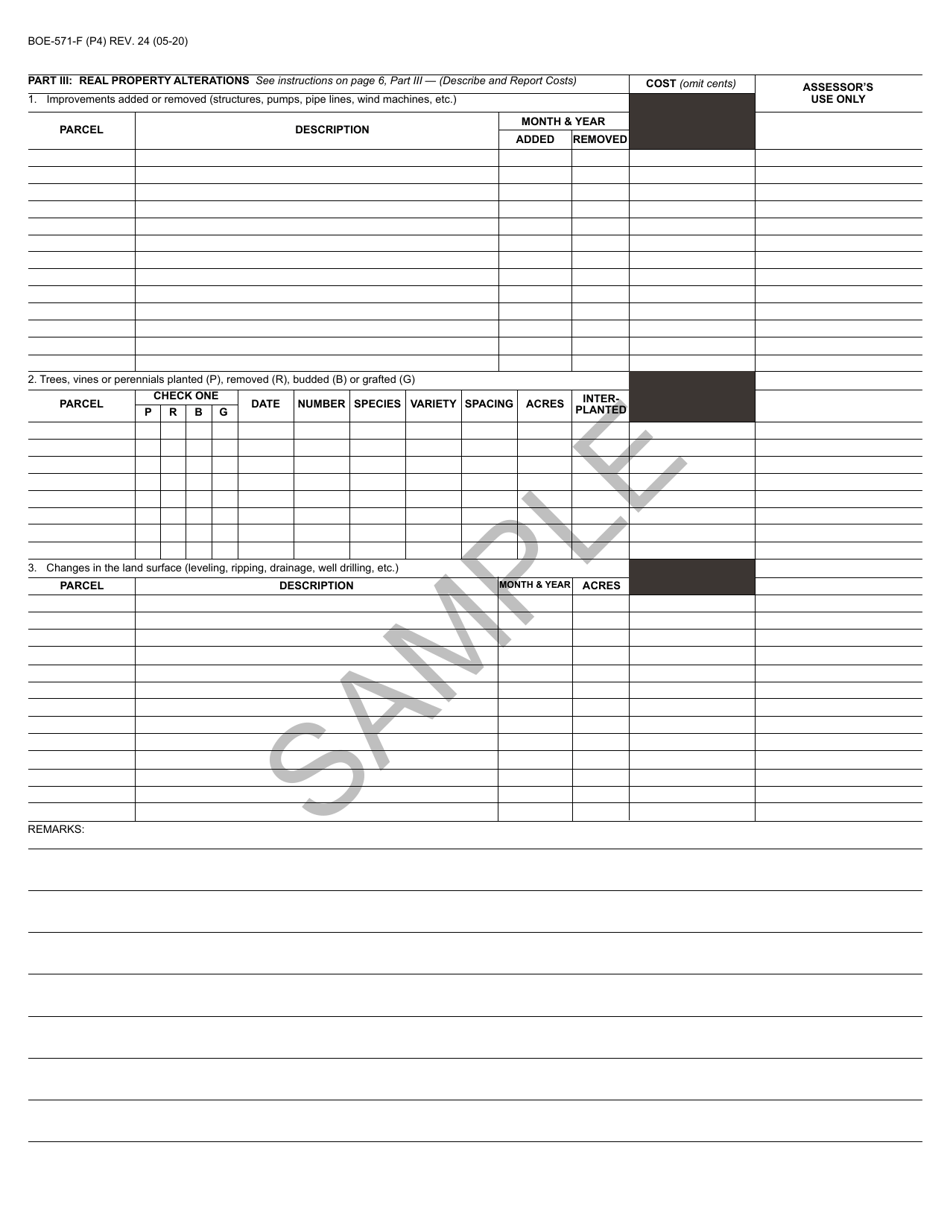

Form BOE-571-F Agricultural Property Statement - California

What Is Form BOE-571-F?

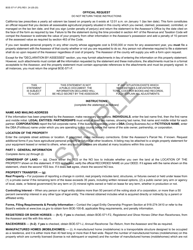

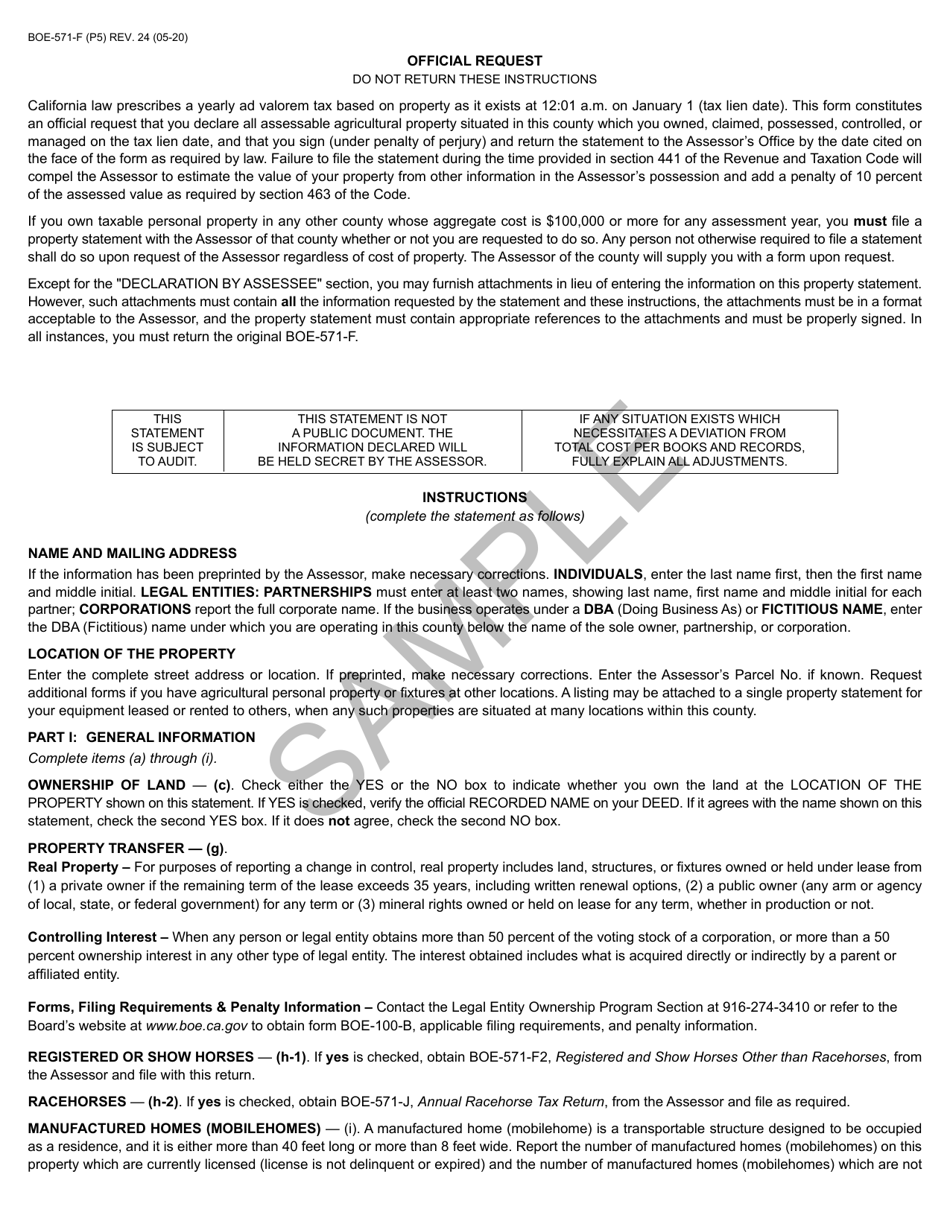

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the BOE-571-F Agricultural Property Statement?

A: The BOE-571-F Agricultural Property Statement is a form used in California to report information about agricultural properties.

Q: Who needs to fill out the BOE-571-F form?

A: Owners of agricultural properties in California are required to fill out the BOE-571-F form.

Q: When is the deadline to file the BOE-571-F form?

A: The deadline to file the BOE-571-F form is April 1st each year.

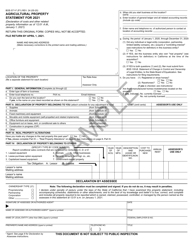

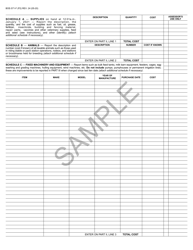

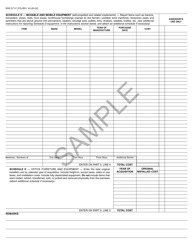

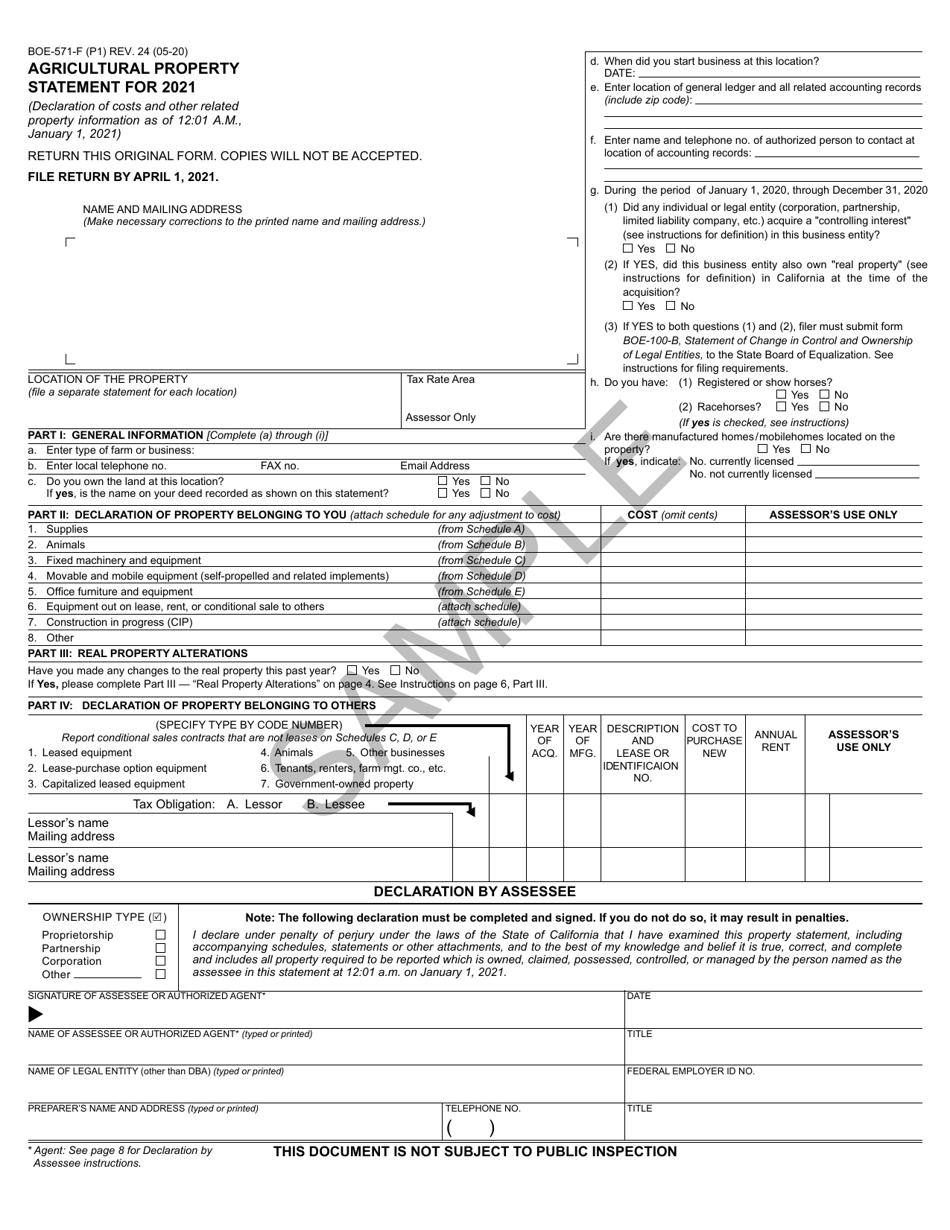

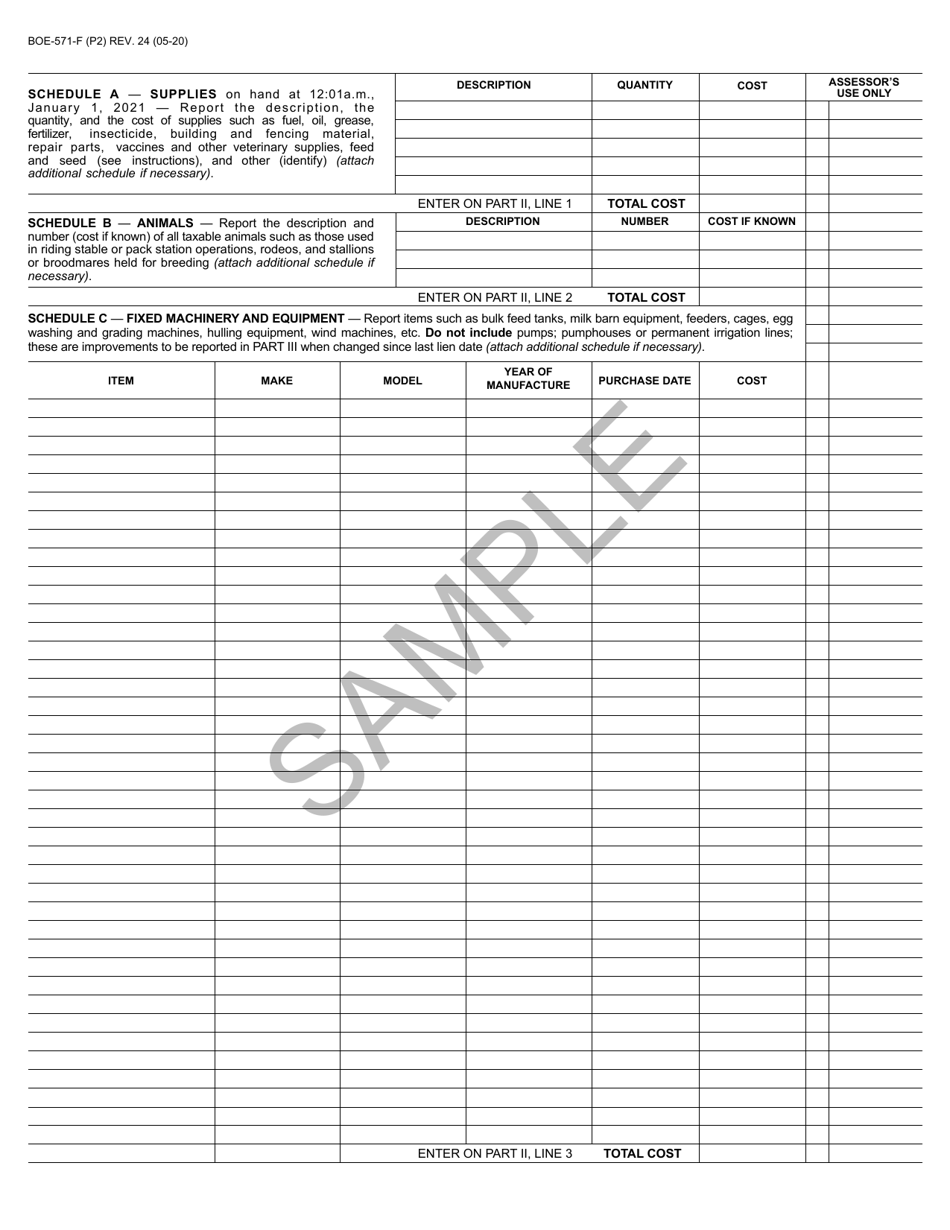

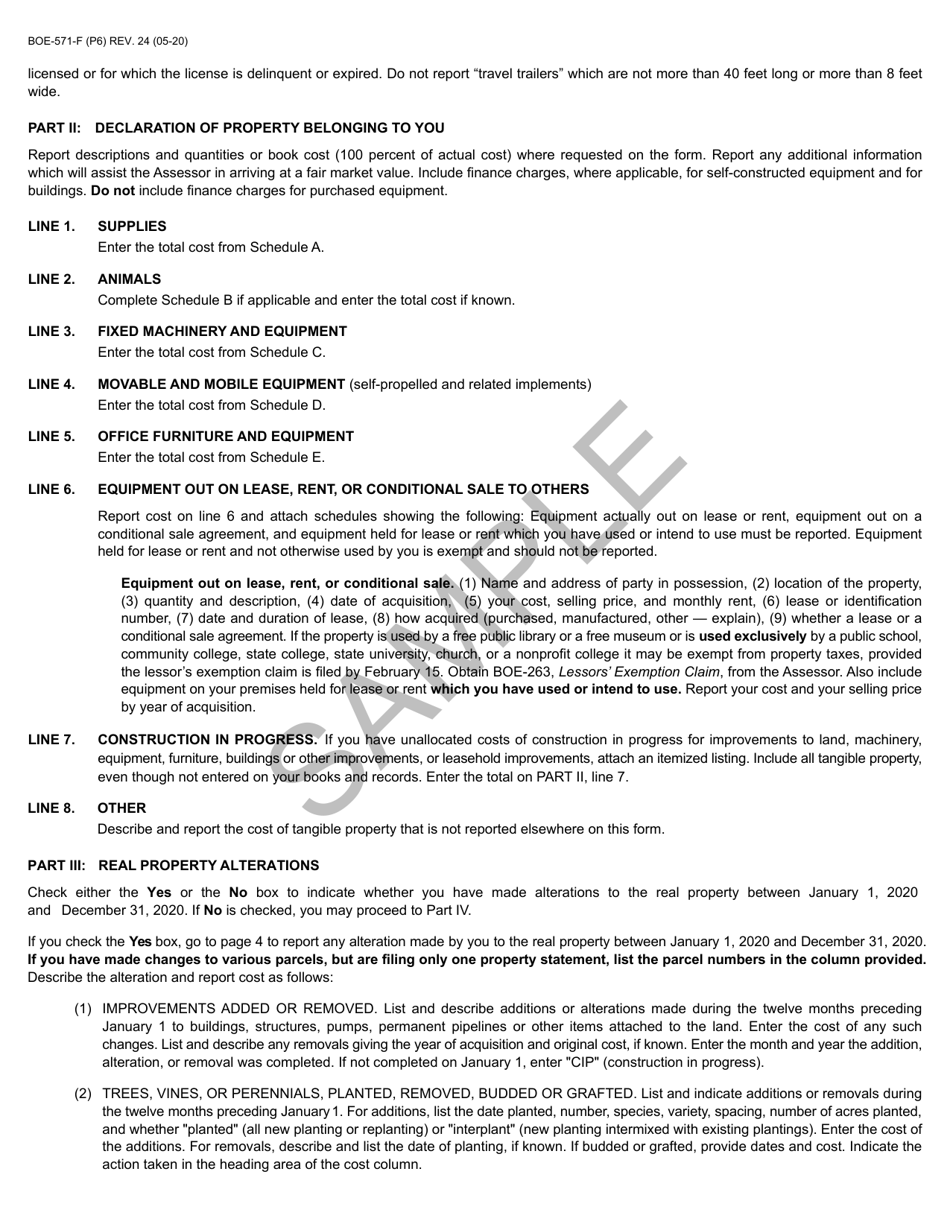

Q: What information is required on the BOE-571-F form?

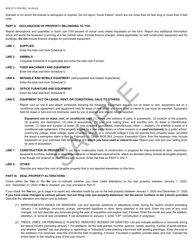

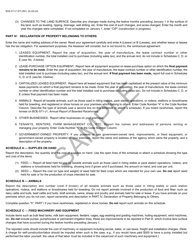

A: The BOE-571-F form requires information such as crop types, acreage, and income and expenses related to the agricultural property.

Q: Are there any penalties for not filing the BOE-571-F form?

A: Yes, there can be penalties for not filing the BOE-571-F form, including an estimate assessment and additional fees.

Q: Is the BOE-571-F form required every year?

A: Yes, the BOE-571-F form is required to be filed every year for agricultural properties in California.

Q: What happens after I file the BOE-571-F form?

A: After filing the BOE-571-F form, the county assessor will review the information and determine the assessed value of the agricultural property.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-571-F by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.