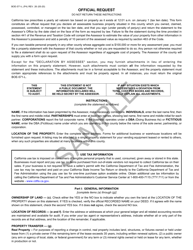

This version of the form is not currently in use and is provided for reference only. Download this version of

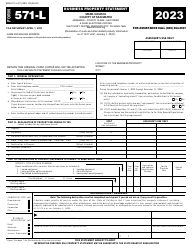

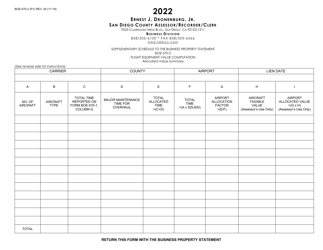

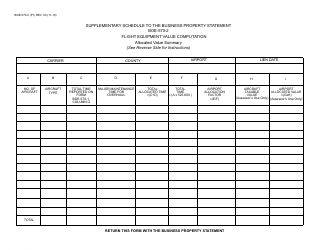

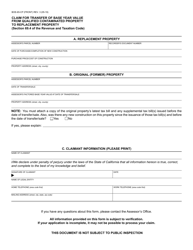

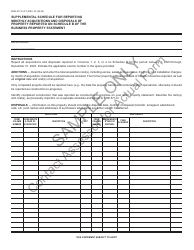

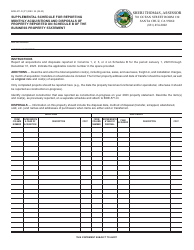

Form BOE-571-L

for the current year.

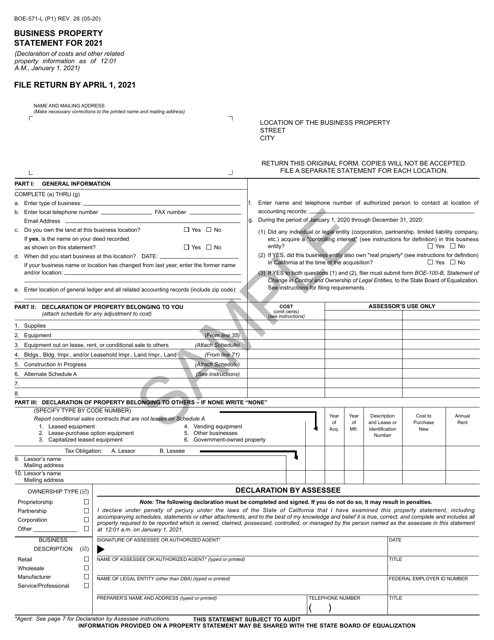

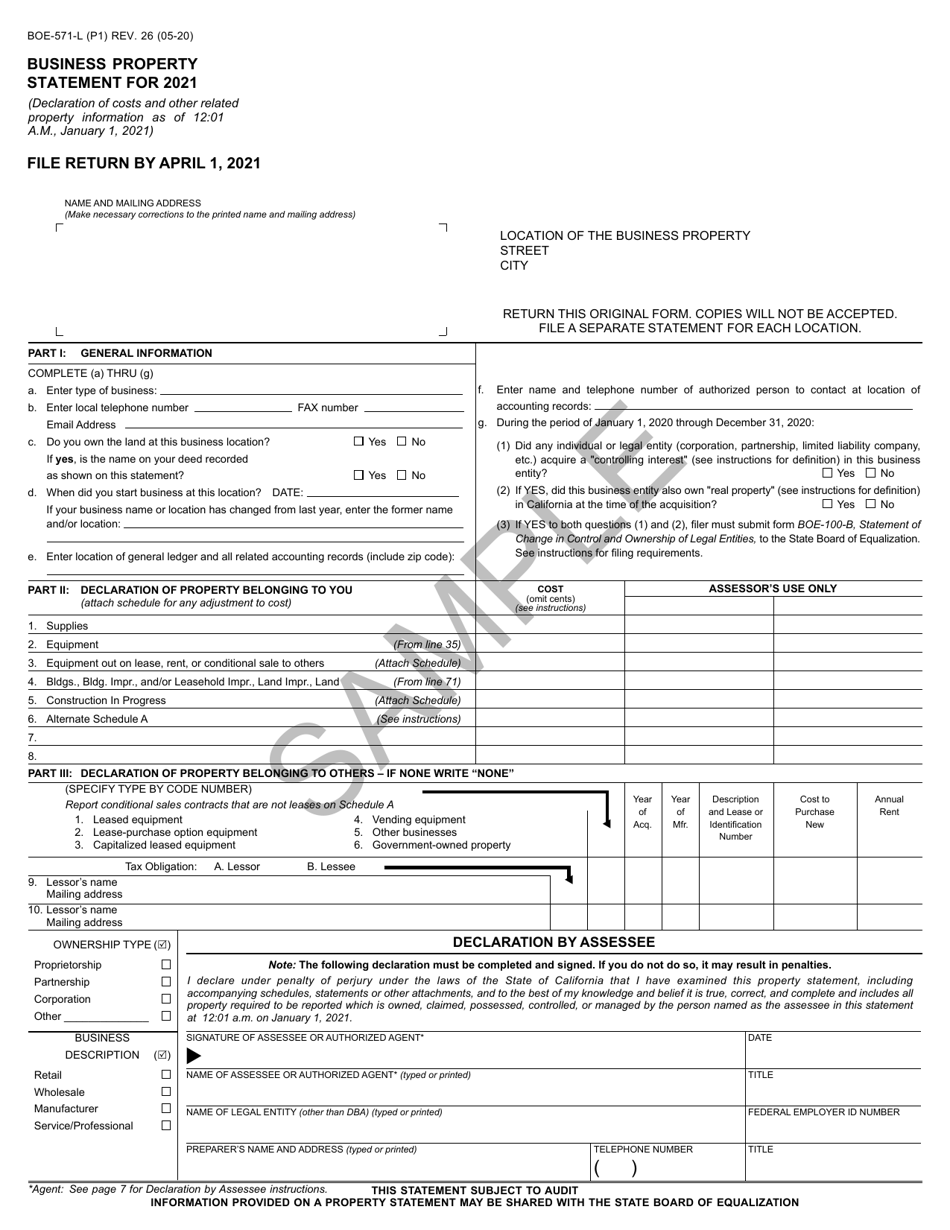

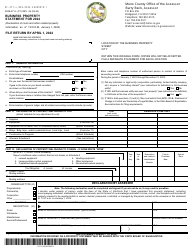

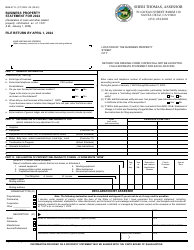

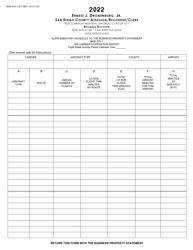

Form BOE-571-L Business Property Statement, Long Form - Sample - California

What Is Form BOE-571-L?

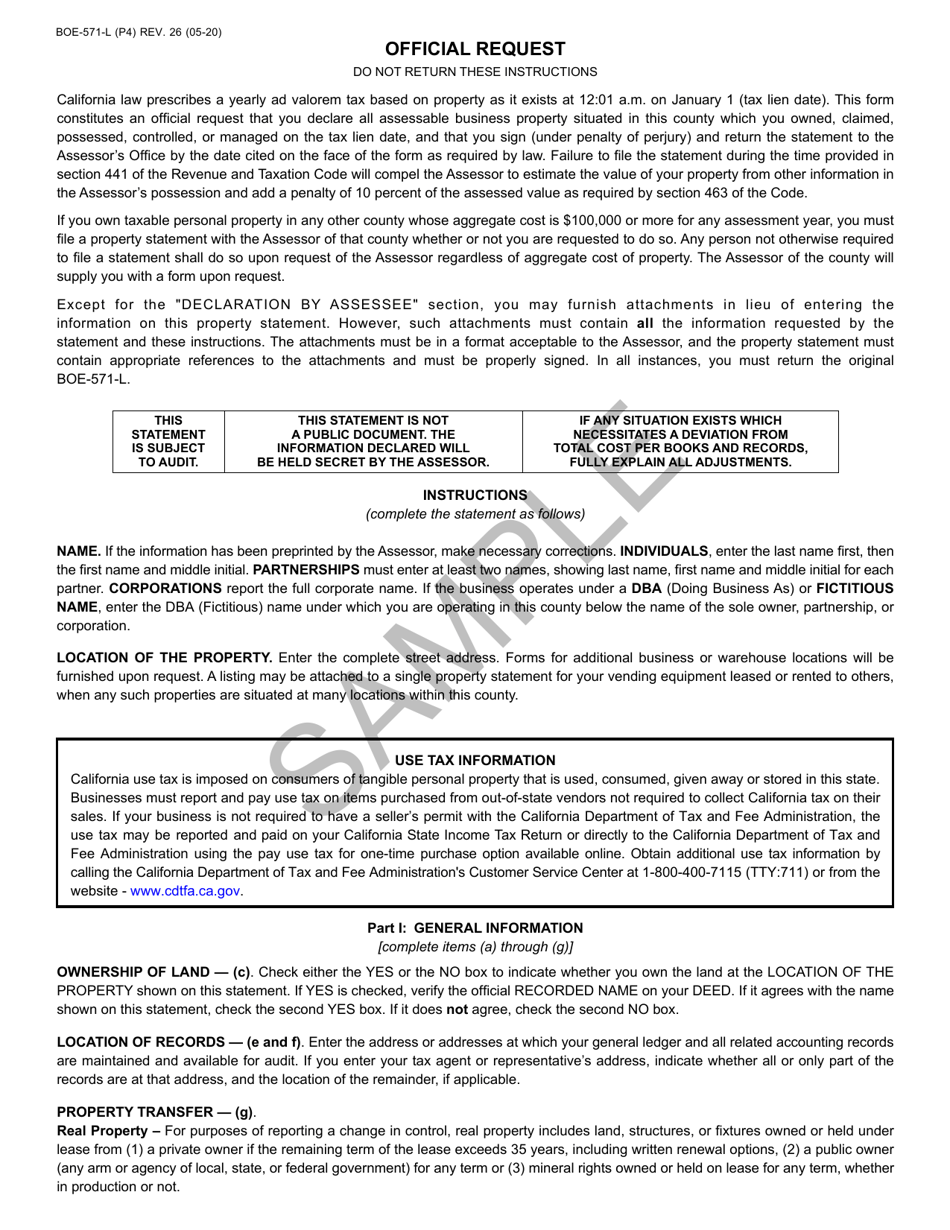

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-571-L?

A: Form BOE-571-L is the Business Property Statement, Long Form in California.

Q: Who needs to file Form BOE-571-L?

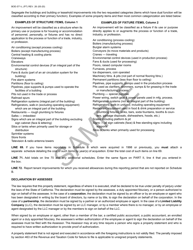

A: All businesses in California that owns or leases tangible personal property used in their business must file Form BOE-571-L.

Q: When is Form BOE-571-L due?

A: Form BOE-571-L is due on April 1st of each year.

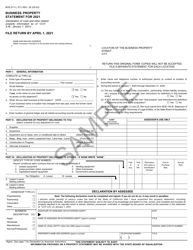

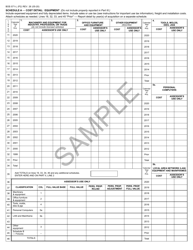

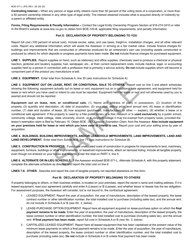

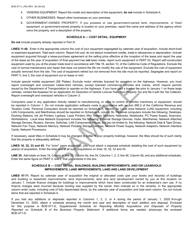

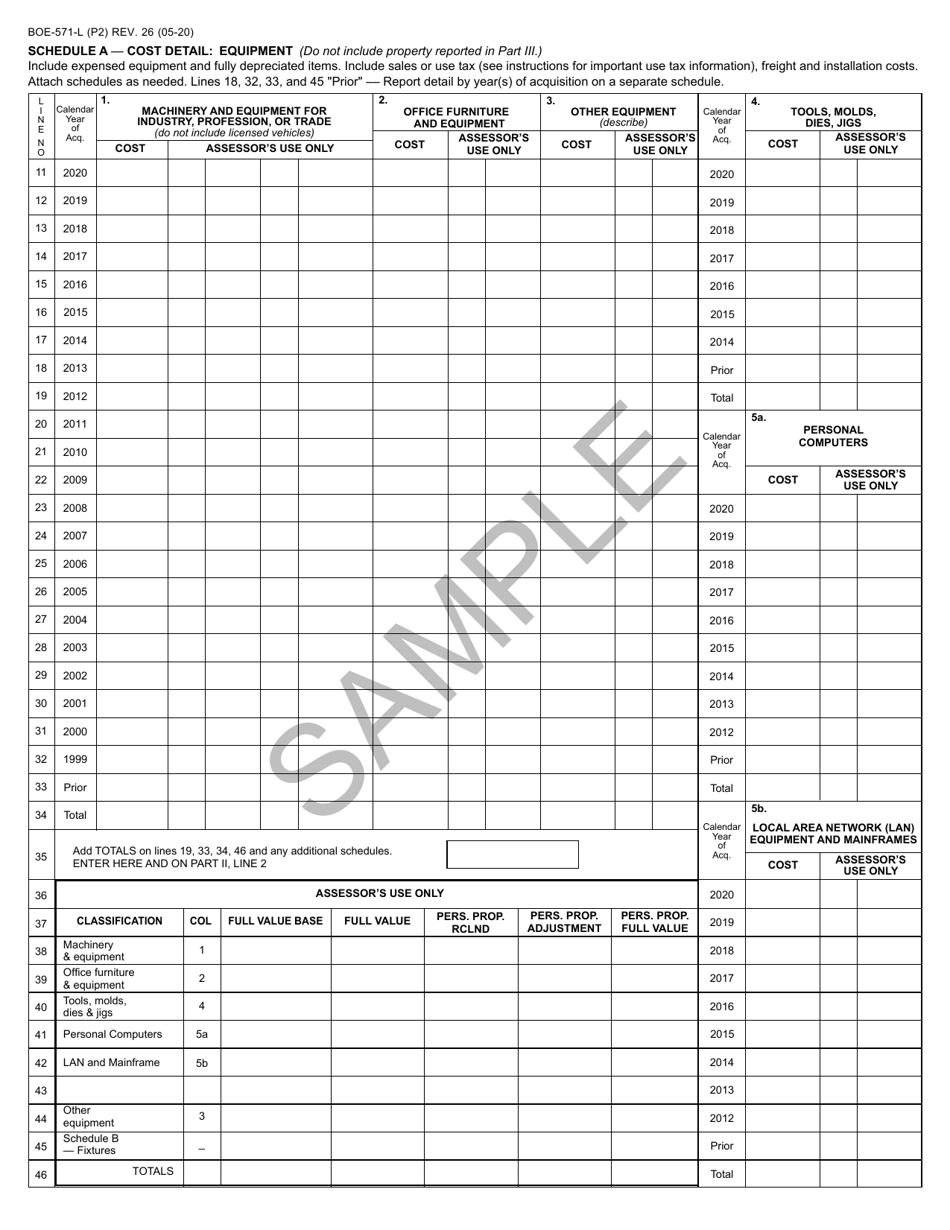

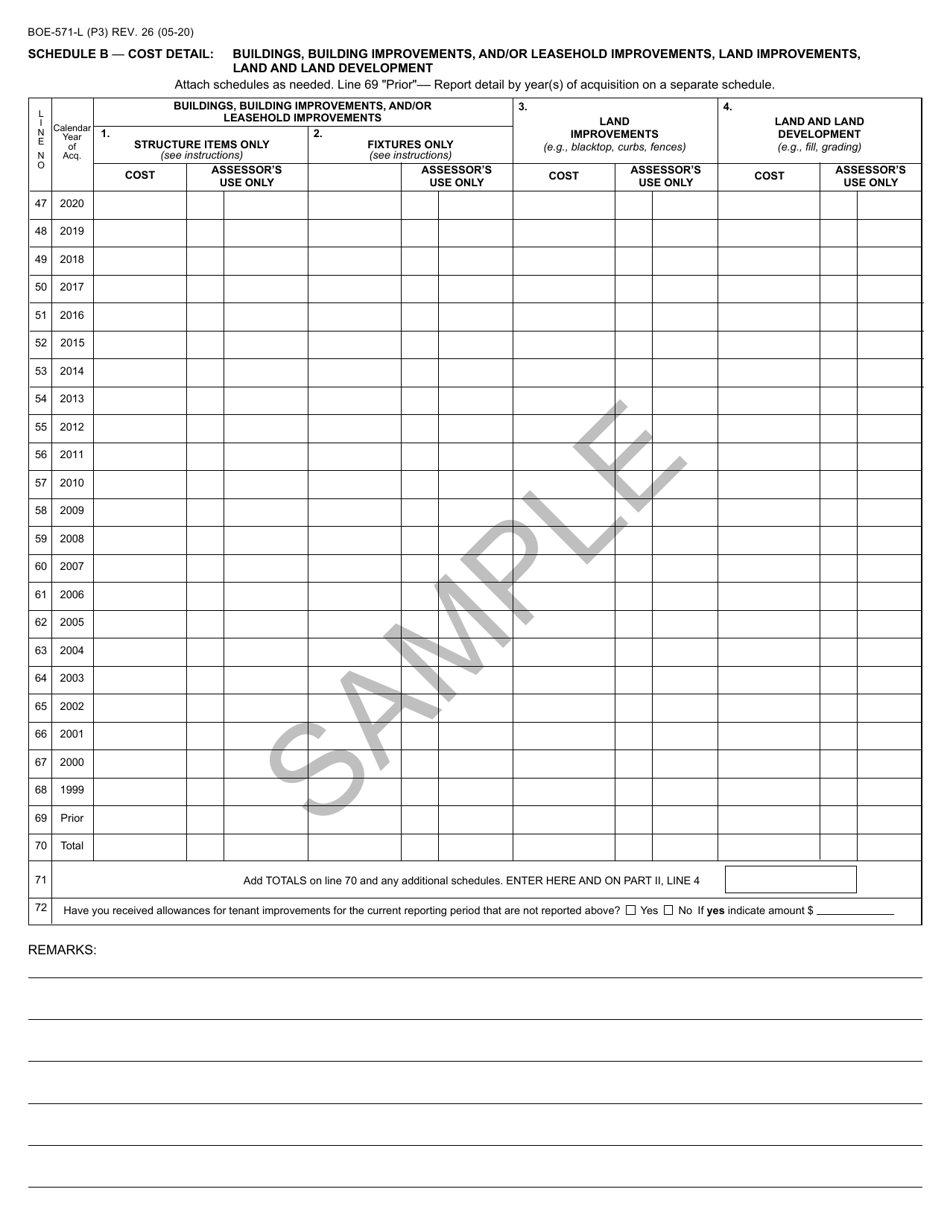

Q: What information is required on Form BOE-571-L?

A: Form BOE-571-L requires the business owner to provide details about their business property, including its description, acquisition date, cost, and other relevant information.

Q: Are there any penalties for not filing Form BOE-571-L?

A: Yes, there can be penalties for not filing Form BOE-571-L or filing it late. It is important to file the form on time to avoid penalties.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-571-L by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.