This version of the form is not currently in use and is provided for reference only. Download this version of

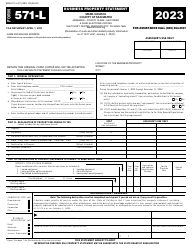

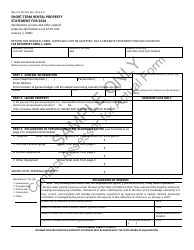

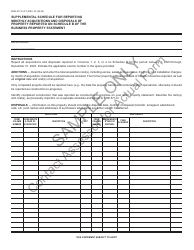

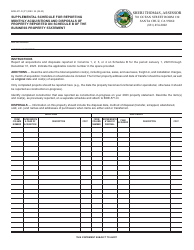

Form BOE-571-S

for the current year.

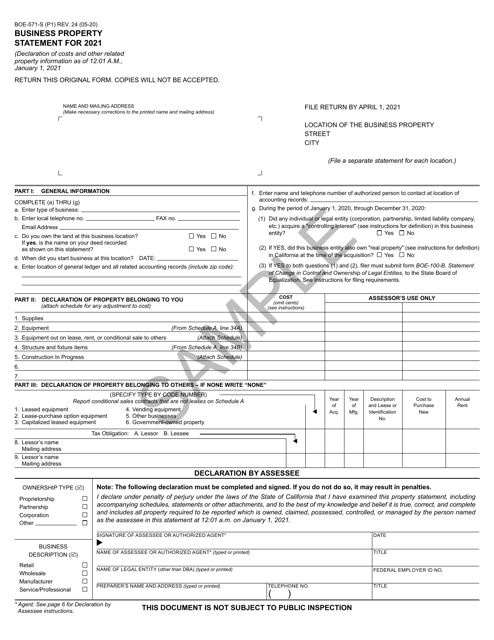

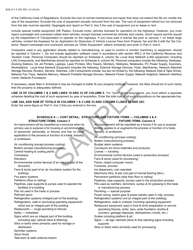

Form BOE-571-S Business Property Statement, Short Form - California

What Is Form BOE-571-S?

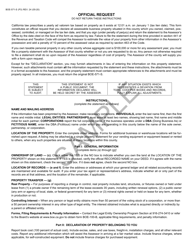

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

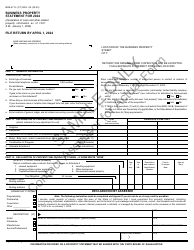

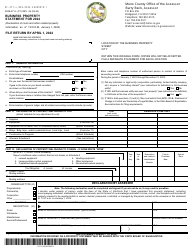

Q: What is a BOE-571-S?

A: The BOE-571-S is a short form Business Property Statement used to report property owned by businesses in California.

Q: Who needs to file a BOE-571-S?

A: All businesses in California that own business property with a total cost of $100,000 or less are required to file a BOE-571-S.

Q: When is the deadline to file a BOE-571-S?

A: The deadline to file a BOE-571-S is annually on April 1st.

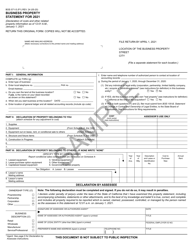

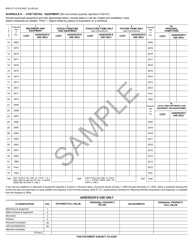

Q: What information is required on a BOE-571-S?

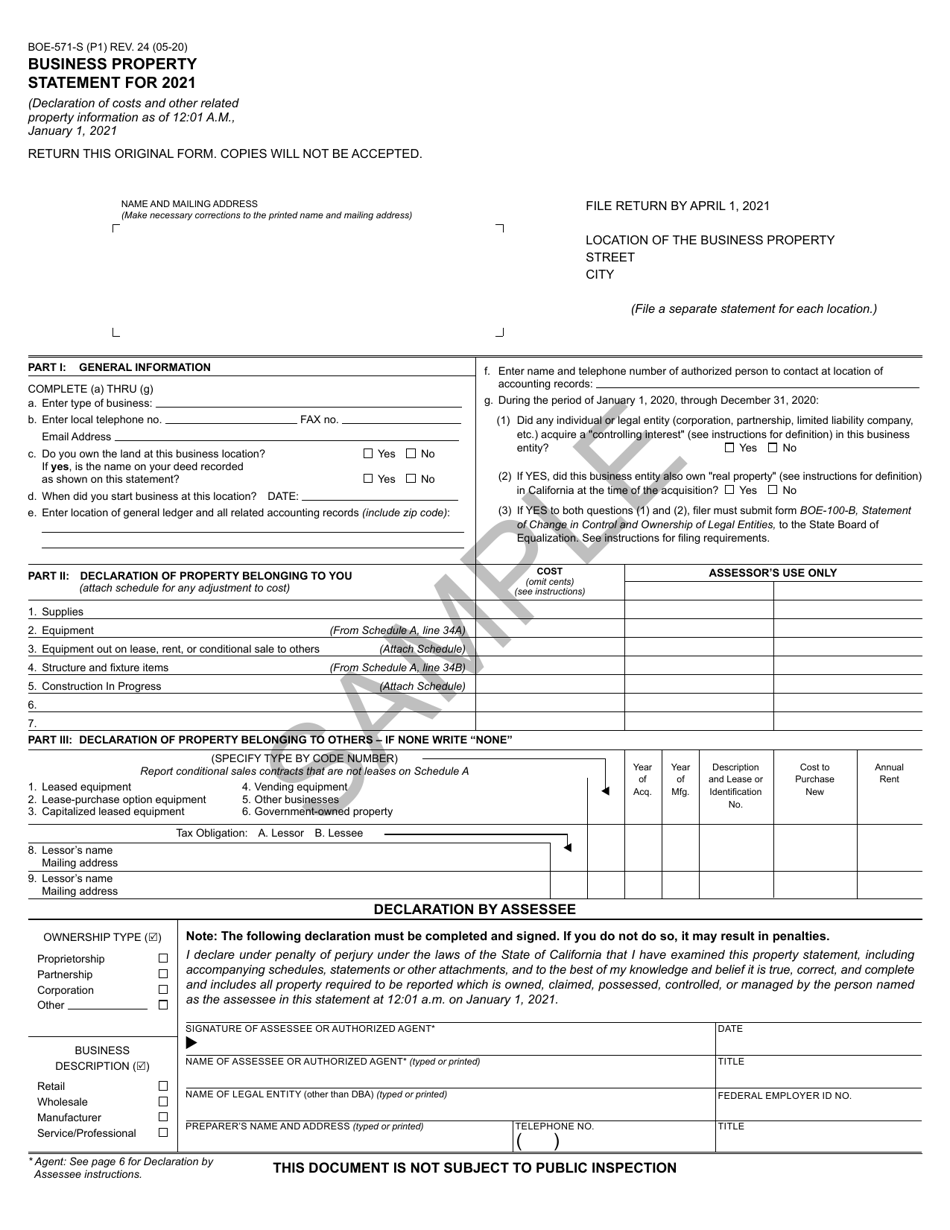

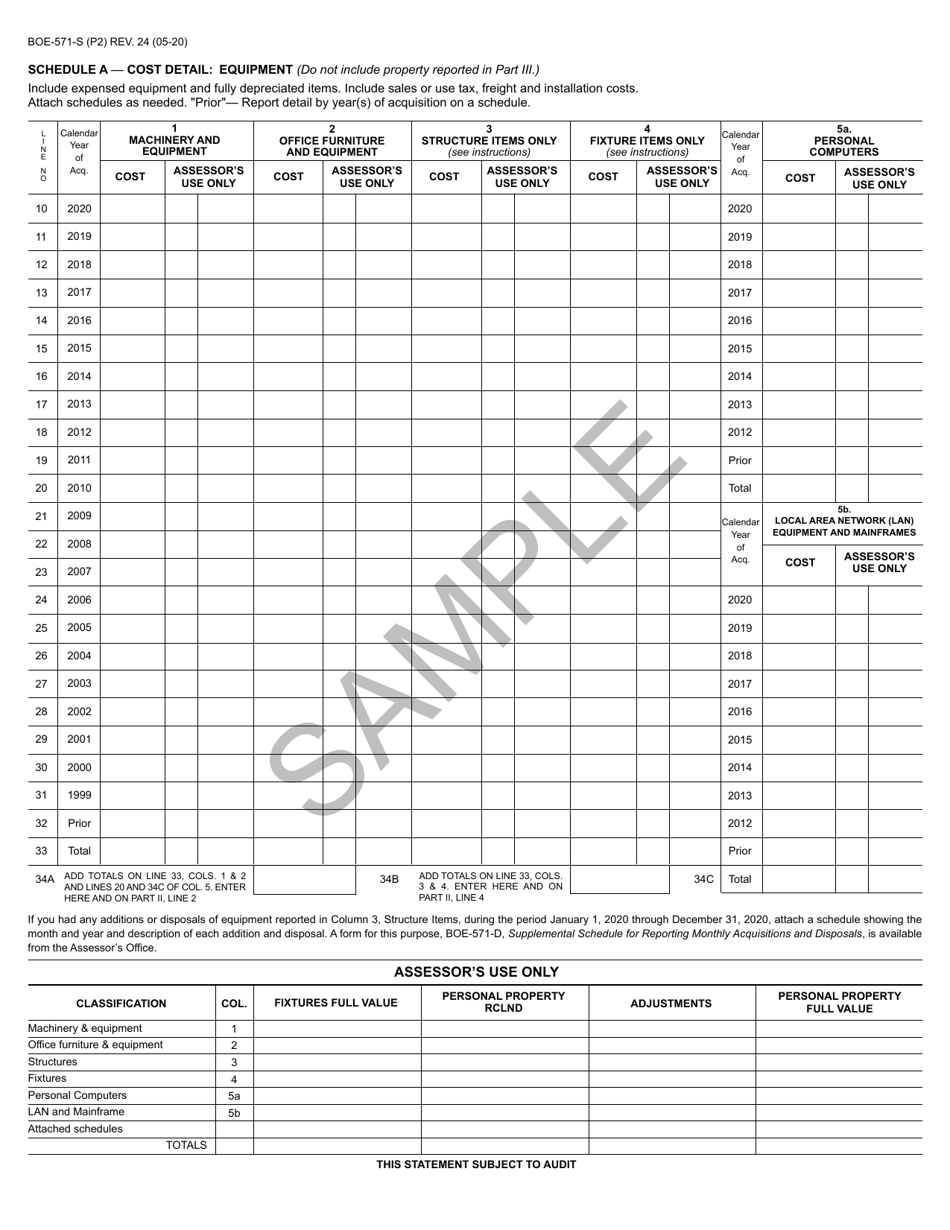

A: The BOE-571-S requires information such as the business name, property location, acquisition and purchase cost, and depreciation information.

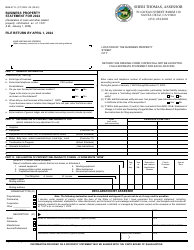

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-571-S by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.