This version of the form is not currently in use and is provided for reference only. Download this version of

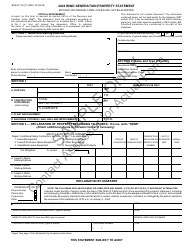

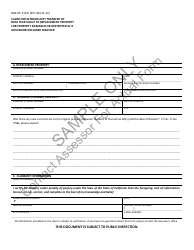

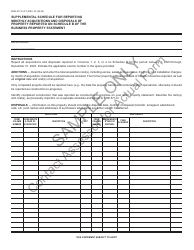

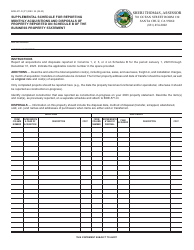

Form BOE-571-R

for the current year.

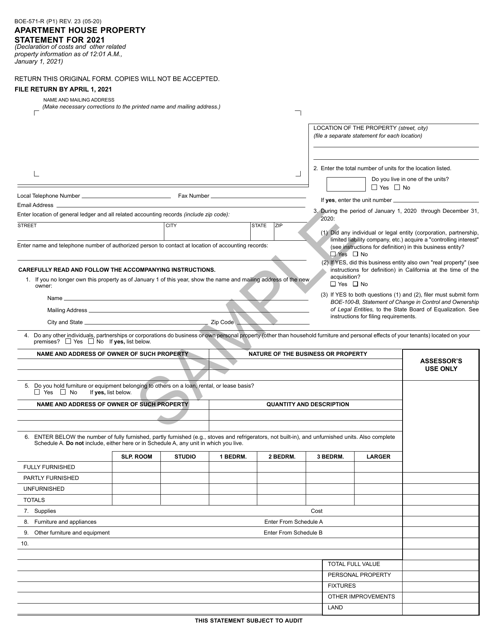

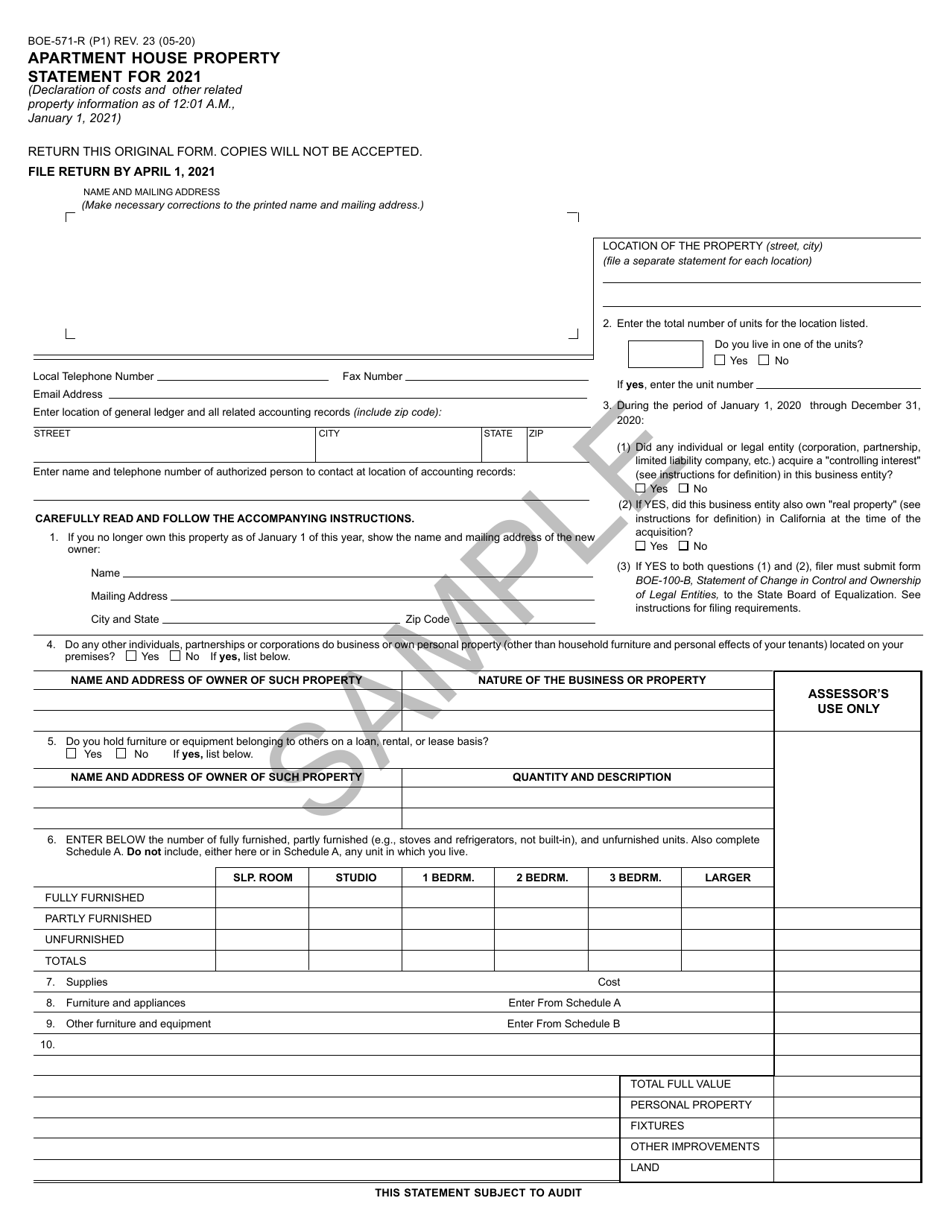

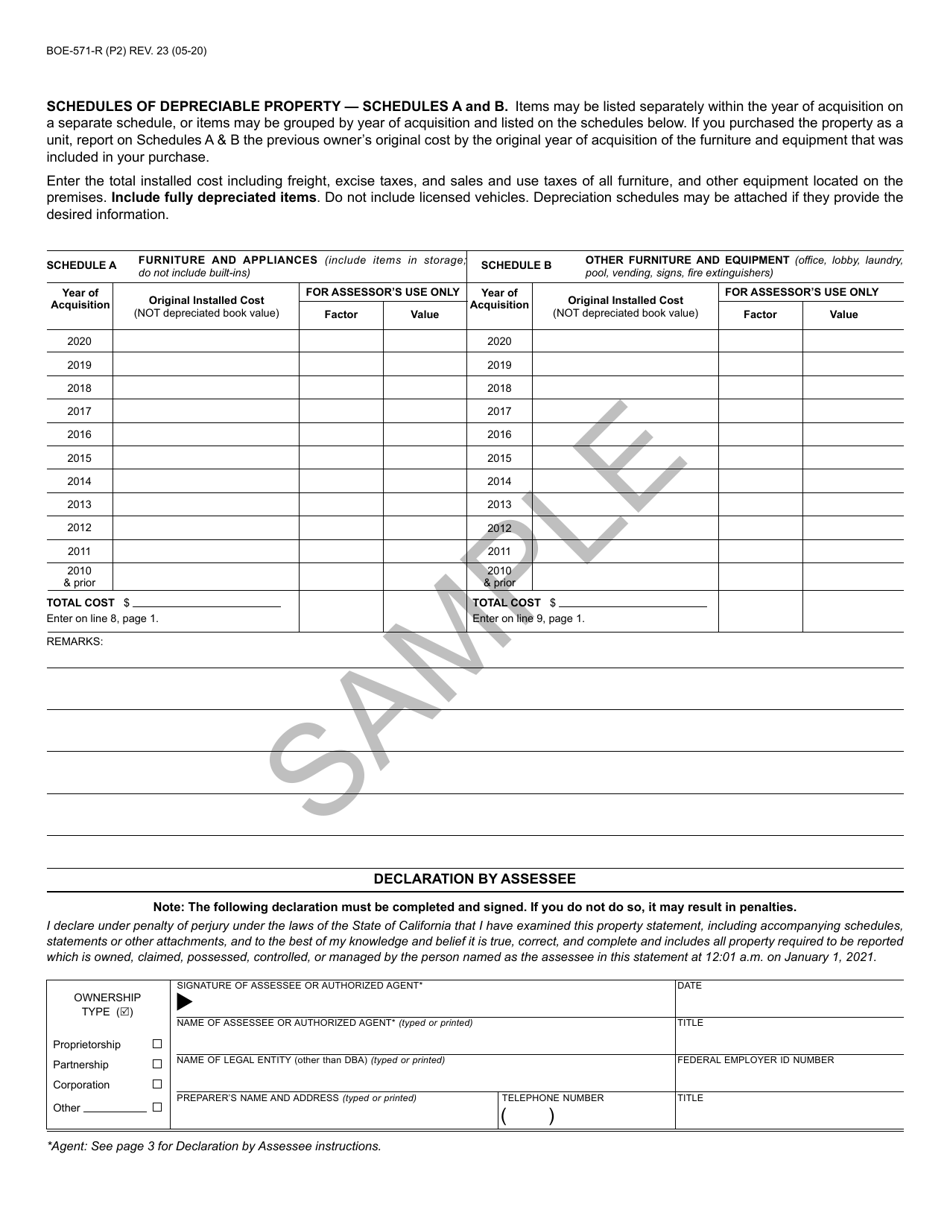

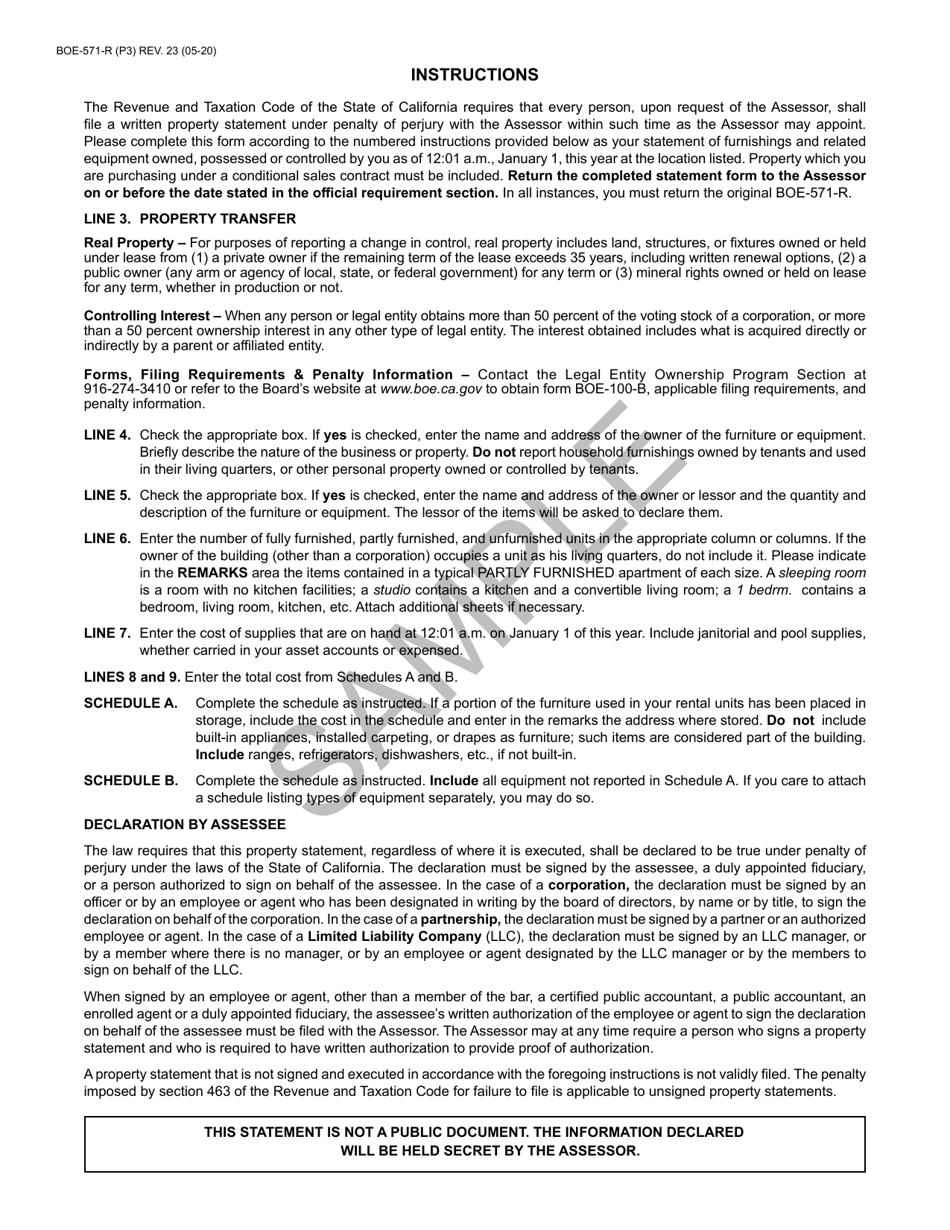

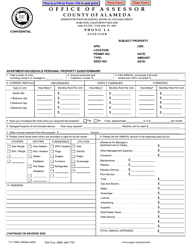

Form BOE-571-R Apartment House Property Statement - Sample - California

What Is Form BOE-571-R?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-571-R?

A: Form BOE-571-R is the Apartment House Property Statement used in California.

Q: Who needs to file Form BOE-571-R?

A: Owners of apartment buildings in California need to file Form BOE-571-R.

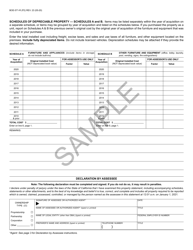

Q: What information is required on Form BOE-571-R?

A: Form BOE-571-R requires information about the property, its income and expenses, and other relevant details.

Q: When is the deadline to file Form BOE-571-R?

A: The deadline to file Form BOE-571-R varies in different counties in California, usually falling between March 1st and May 7th.

Q: What happens if Form BOE-571-R is not filed on time?

A: Failure to file Form BOE-571-R on time may result in penalties and fines.

Q: Are there any exemptions or exclusions for Form BOE-571-R?

A: There may be certain exemptions or exclusions available for specific types of properties, such as low-income housing.

Q: Can I file Form BOE-571-R electronically?

A: Some counties in California allow electronic filing of Form BOE-571-R, while others may require a physical copy.

Q: Do I need to provide supporting documentation with Form BOE-571-R?

A: It is advisable to provide supporting documentation, such as rent rolls, income statements, and expense records, along with Form BOE-571-R.

Q: Who should I contact for further assistance with Form BOE-571-R?

A: For further assistance with Form BOE-571-R, you should contact the County Assessor's office in your county.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-571-R by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.