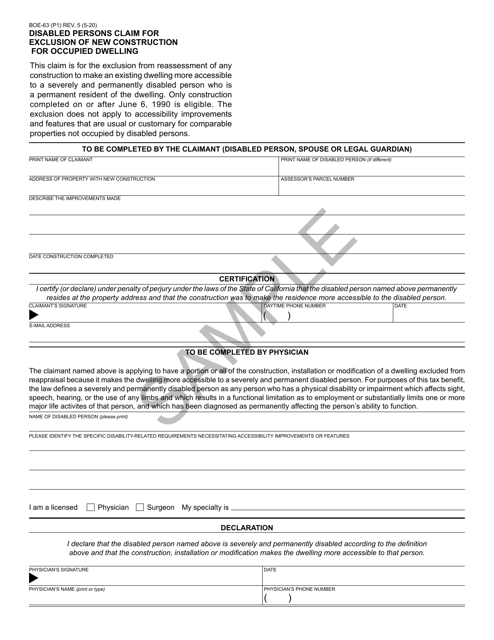

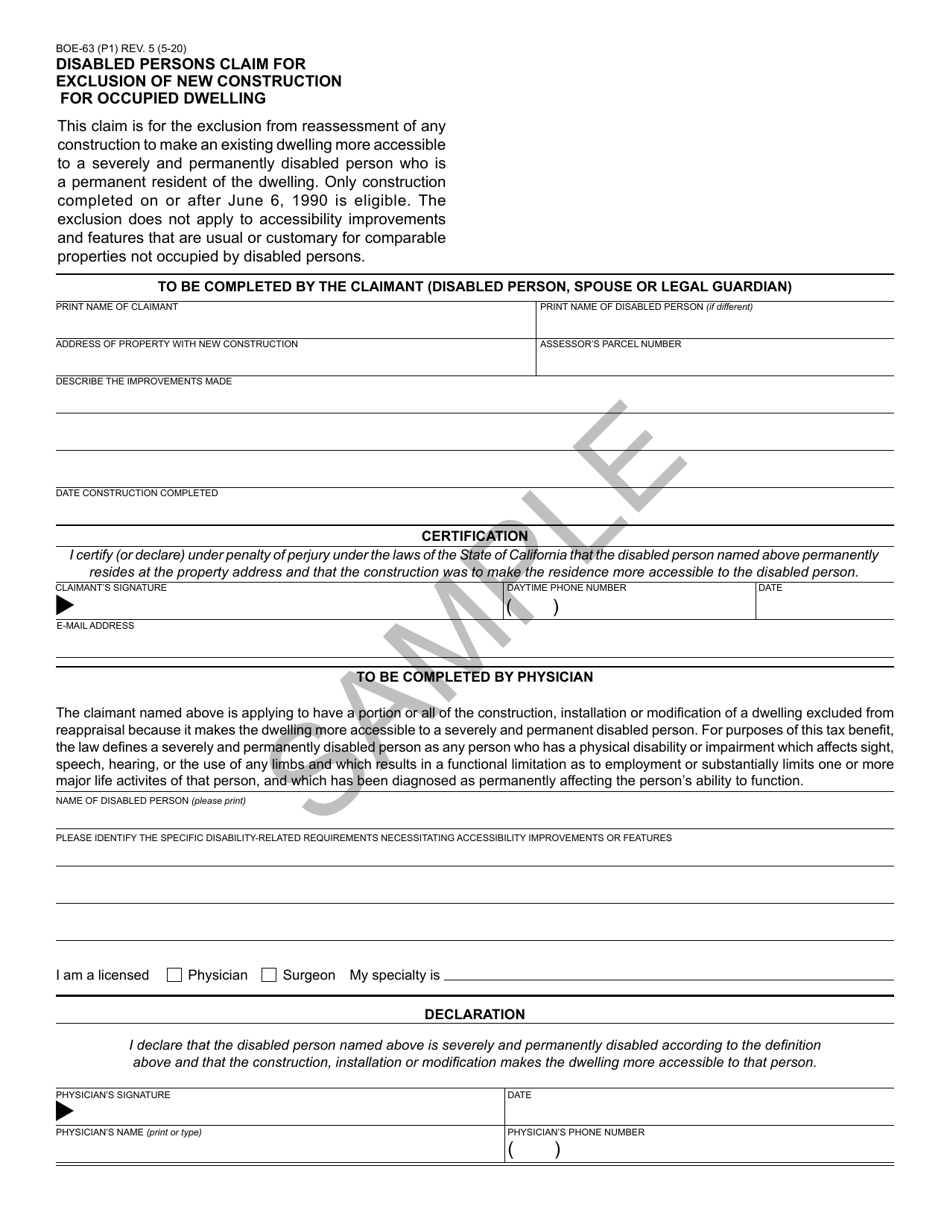

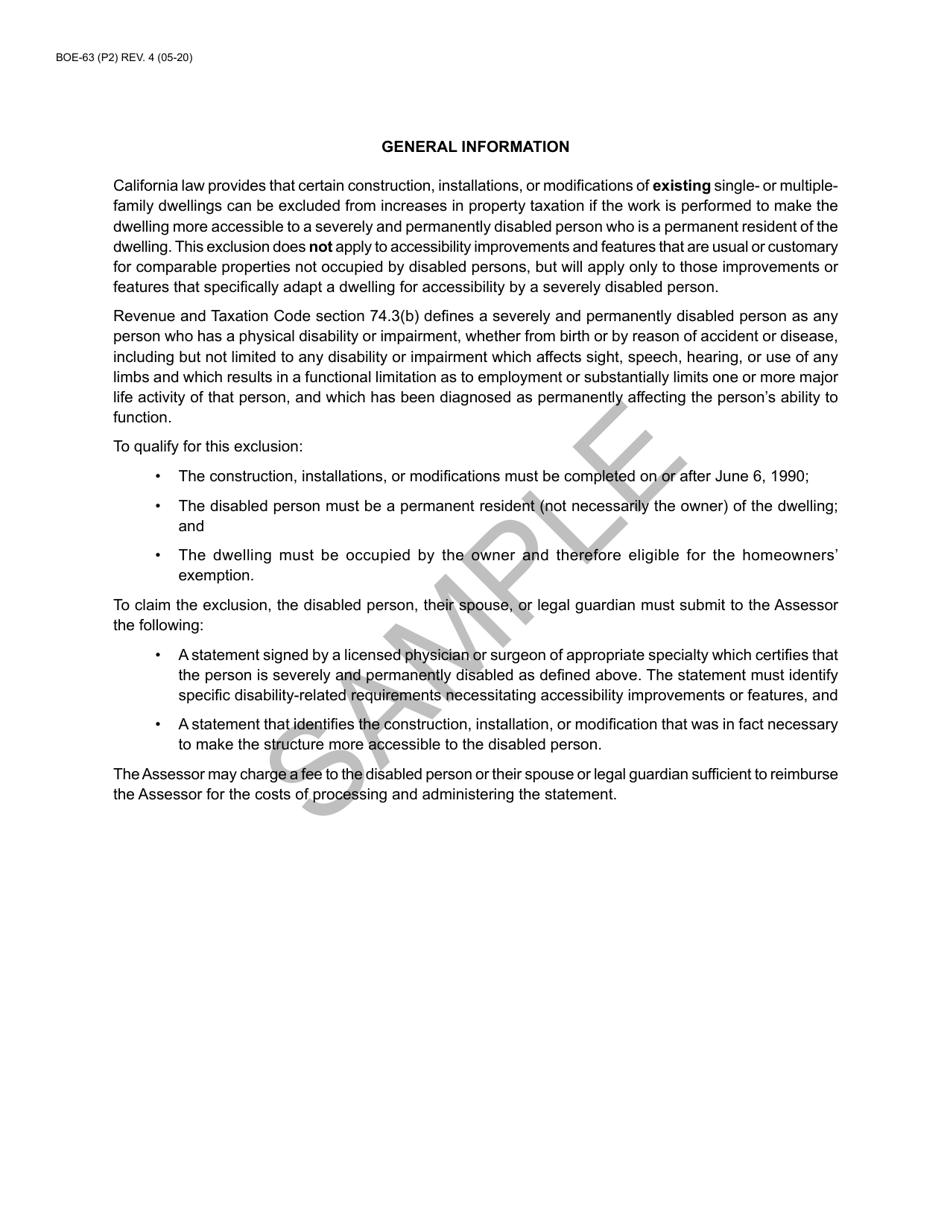

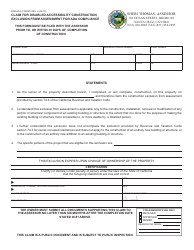

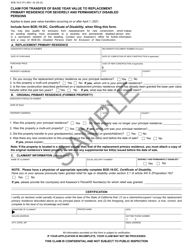

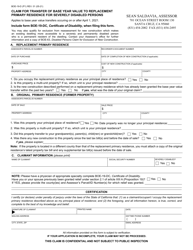

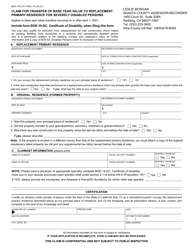

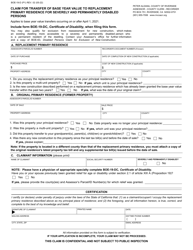

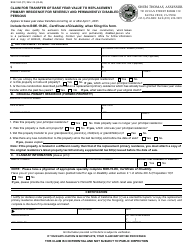

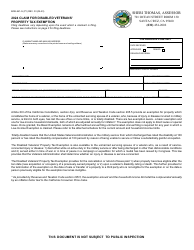

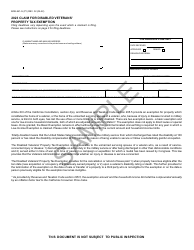

Form BOE-63 Disabled Persons Claim for Exclusion of New Construction for Occupied Dwelling - Sample - California

What Is Form BOE-63?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-63?

A: Form BOE-63 is a form used in California to claim an exclusion for new construction on an occupied dwelling for disabled persons.

Q: Who can use Form BOE-63?

A: Form BOE-63 can be used by individuals in California who are disabled and reside in a newly constructed dwelling.

Q: What is the purpose of Form BOE-63?

A: The purpose of Form BOE-63 is to allow disabled individuals in California to claim an exclusion from property tax assessment for new construction on their occupied dwelling.

Q: What information is required on Form BOE-63?

A: Form BOE-63 requires information such as the property owner's name, address, disability verification, and a description of the new construction.

Q: When should I file Form BOE-63?

A: Form BOE-63 should be filed within 30 days of completion of the new construction.

Q: Are there any fees for filing Form BOE-63?

A: No, there are no fees associated with filing Form BOE-63.

Q: What happens after I file Form BOE-63?

A: After filing Form BOE-63, the assessor will review your claim and determine if you qualify for the exclusion. If approved, your property tax assessment will be adjusted accordingly.

Q: Can I appeal if my claim is denied?

A: Yes, if your claim is denied, you have the right to appeal the decision with the Assessment Appeals Board in your county.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-63 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.