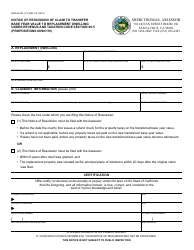

This version of the form is not currently in use and is provided for reference only. Download this version of

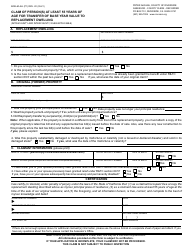

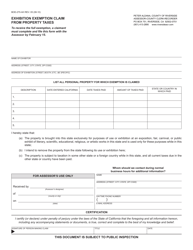

Form BOE-60-AH

for the current year.

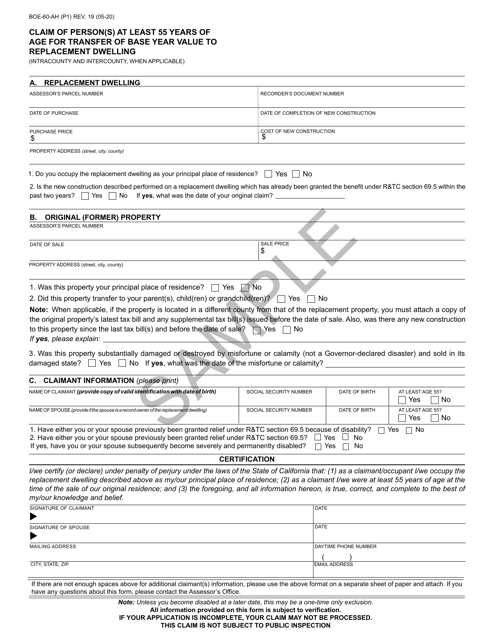

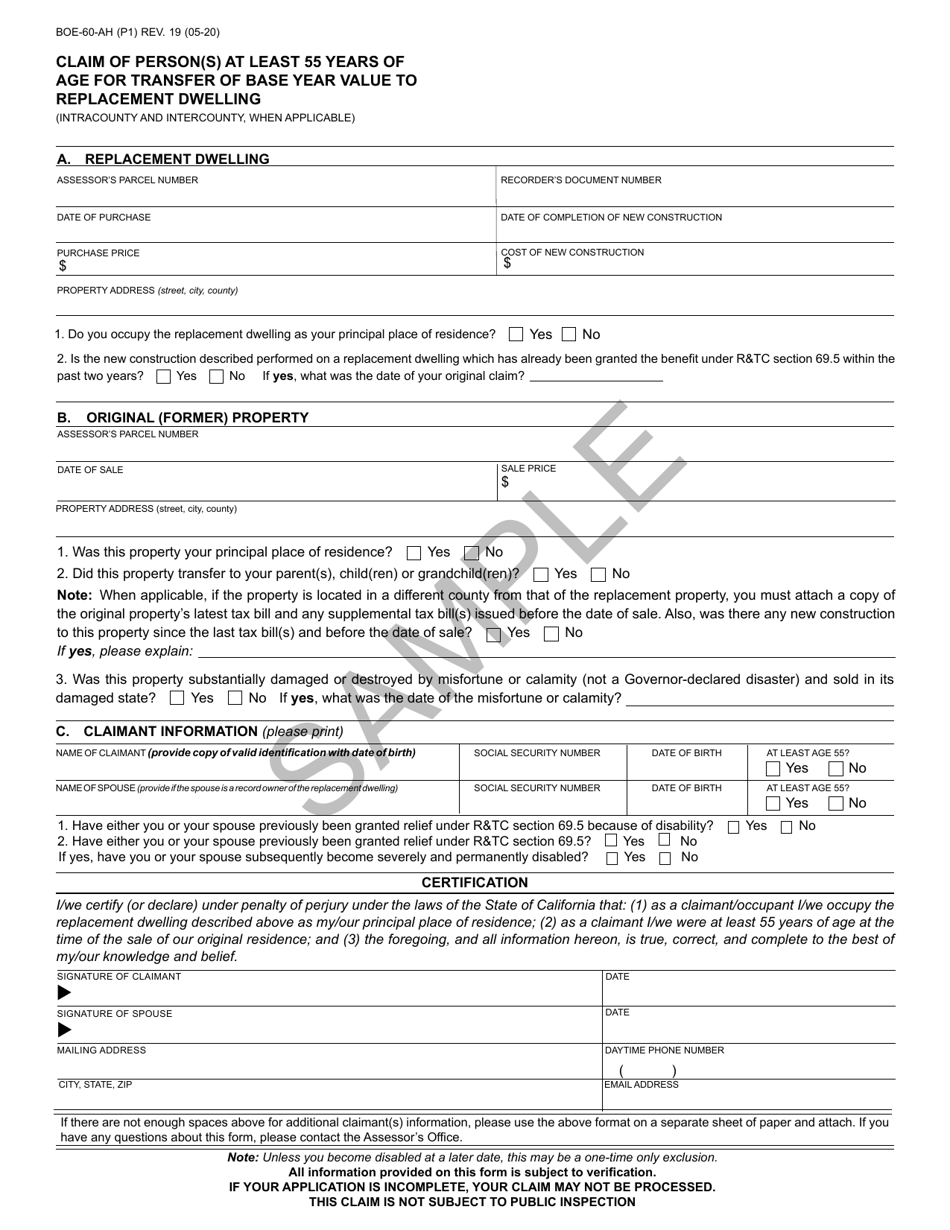

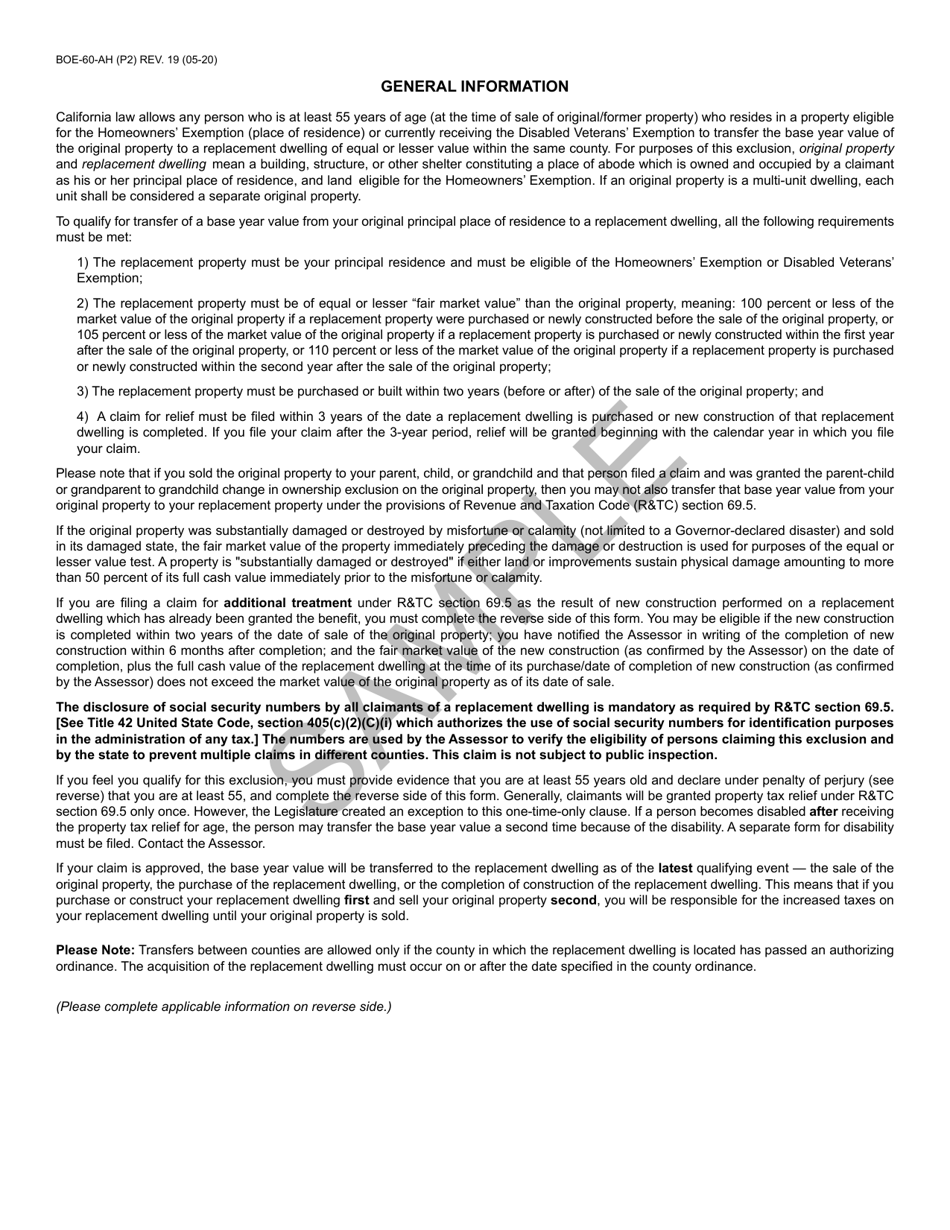

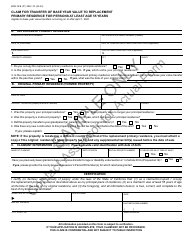

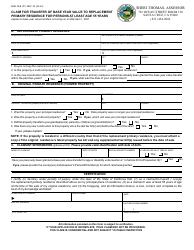

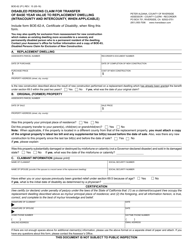

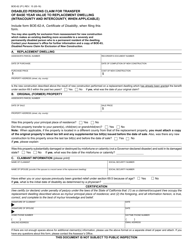

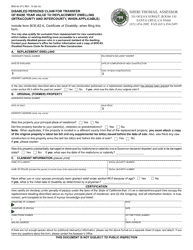

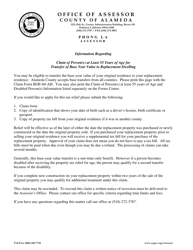

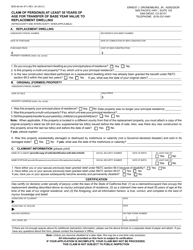

Form BOE-60-AH Claim of Person(s) at Least 55 Years of Age for Transfer of Base Year Value to Replacement Dwelling - California

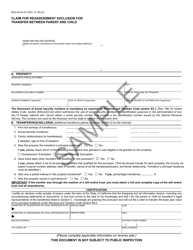

What Is Form BOE-60-AH?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-60-AH?

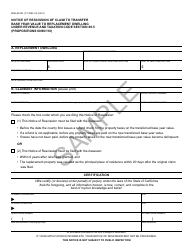

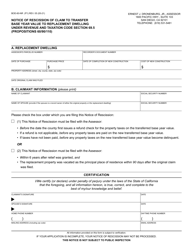

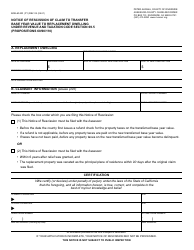

A: Form BOE-60-AH is a claim for transfer of base year value to a replacement dwelling in California.

Q: Who is eligible to use Form BOE-60-AH?

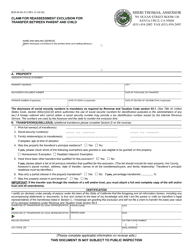

A: This form is for person(s) who are at least 55 years of age and meet other requirements for transferring the base year value.

Q: What is the purpose of Form BOE-60-AH?

A: The purpose of this form is to allow eligible individuals to transfer the base year value of their original property to a replacement dwelling.

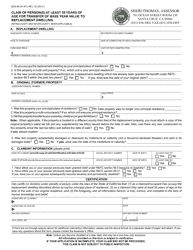

Q: What is the base year value?

A: The base year value is the assessed value of a property at the time of acquisition or construction, which is used for determining property taxes.

Q: What is a replacement dwelling?

A: A replacement dwelling is a new property that is purchased or newly constructed to replace the original property.

Q: Are there any requirements for transferring the base year value?

A: Yes, there are certain requirements such as being at least 55 years of age, selling the original property, and purchasing or constructing a replacement dwelling within a specific timeframe.

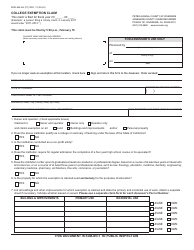

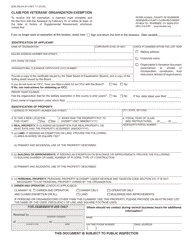

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-60-AH by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.