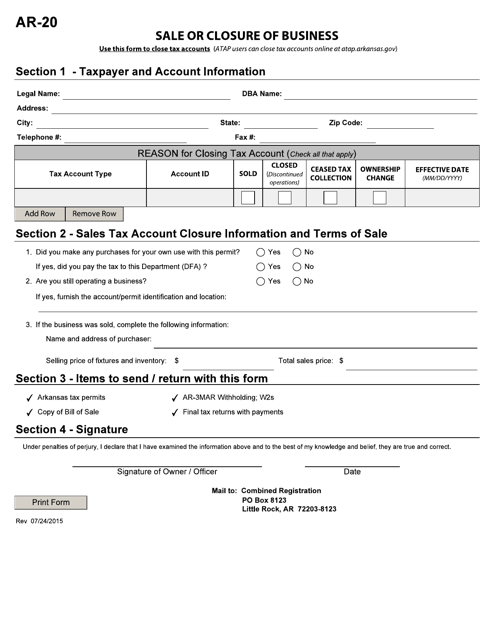

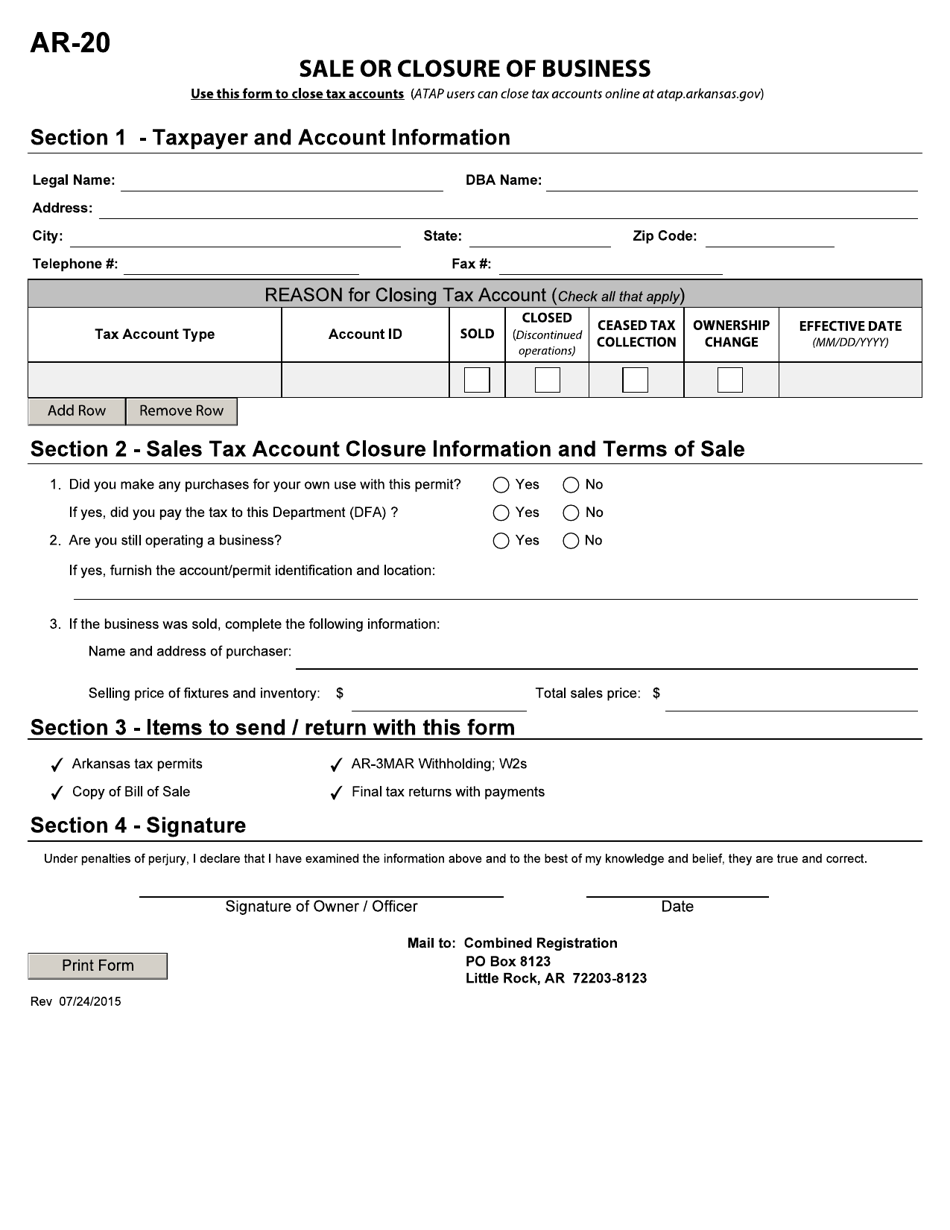

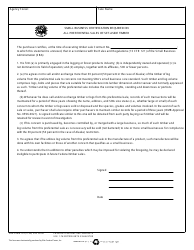

Form AR-20 Sale or Closure of Business - Arkansas

What Is Form AR-20?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AR-20?

A: Form AR-20 is a form used in Arkansas for reporting the sale or closure of a business.

Q: Who needs to file form AR-20?

A: Any business owner in Arkansas who is selling or closing their business needs to file form AR-20.

Q: What information is required on form AR-20?

A: Form AR-20 requires information such as the business name, address, contact information, and details about the sale or closure.

Q: Is there a fee for filing form AR-20?

A: Yes, there is a fee for filing form AR-20, which can vary depending on the circumstances.

Q: When should form AR-20 be filed?

A: Form AR-20 should be filed within 30 days of the sale or closure of the business.

Q: What happens if I don't file form AR-20?

A: Failure to file form AR-20 may result in penalties or fines.

Q: Can I get assistance in completing form AR-20?

A: Yes, the Arkansas Secretary of State's office can provide assistance in completing form AR-20.

Form Details:

- Released on July 24, 2015;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR-20 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.