This version of the form is not currently in use and is provided for reference only. Download this version of

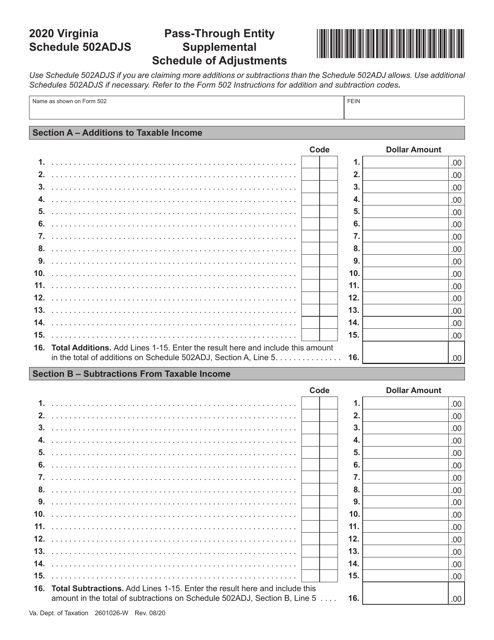

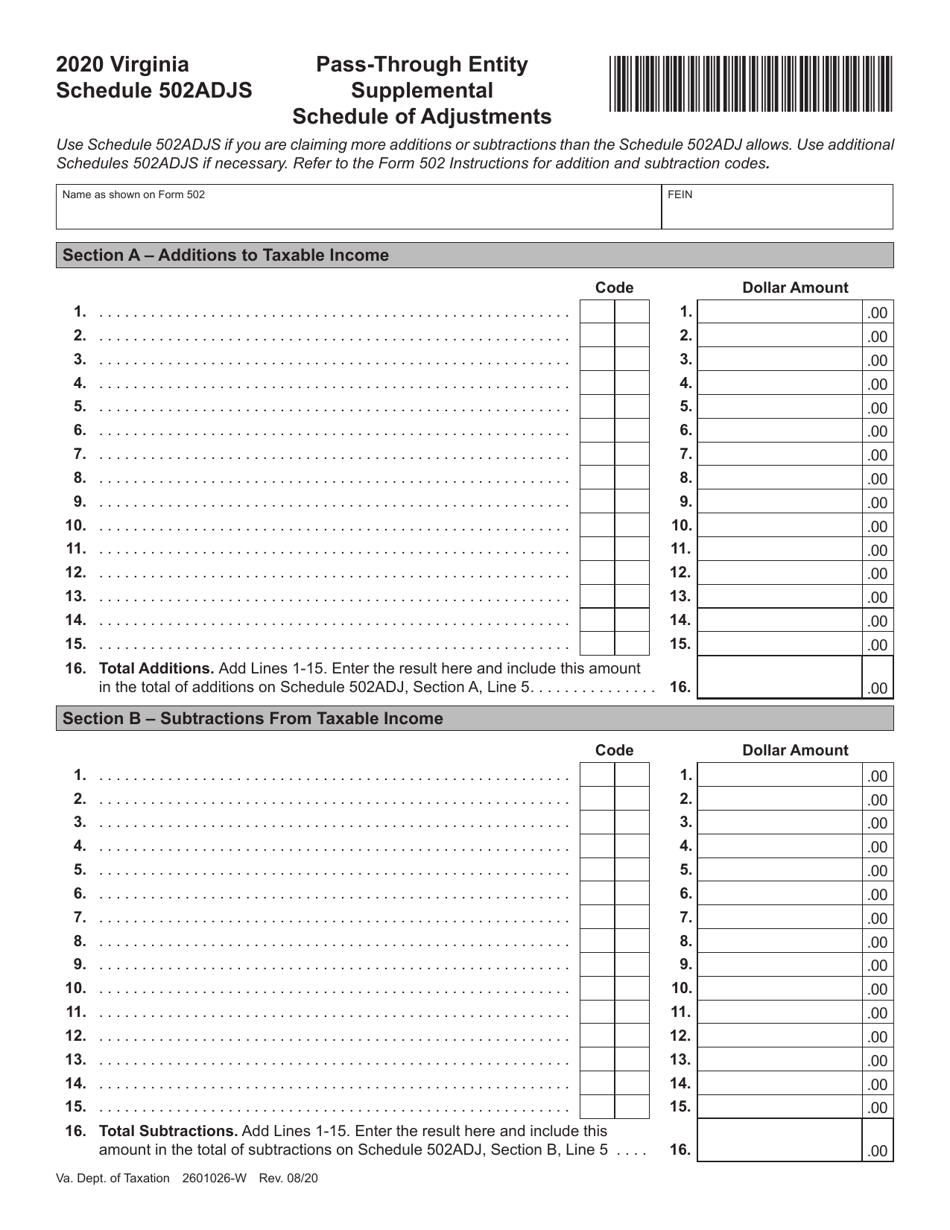

Schedule 502ADJS

for the current year.

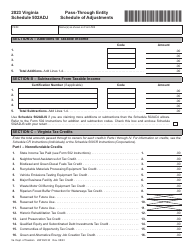

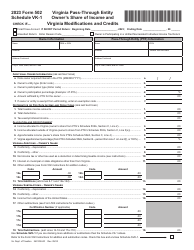

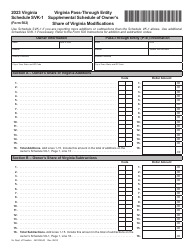

Schedule 502ADJS Pass-Through Entity Supplemental Schedule of Adjustments - Virginia

What Is Schedule 502ADJS?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 502ADJS?

A: Schedule 502ADJS is the Pass-Through Entity Supplemental Schedule of Adjustments for Virginia.

Q: Who needs to file Schedule 502ADJS?

A: Pass-through entities in Virginia need to file Schedule 502ADJS.

Q: What is the purpose of Schedule 502ADJS?

A: The purpose of Schedule 502ADJS is to report adjustments made on the federal level for pass-through entities.

Q: What kind of adjustments are reported on Schedule 502ADJS?

A: Schedule 502ADJS reports adjustments made to federal taxable income, deductions, and credits.

Q: Is Schedule 502ADJS a mandatory filing?

A: Yes, Schedule 502ADJS is a mandatory filing for pass-through entities in Virginia.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 502ADJS by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.