This version of the form is not currently in use and is provided for reference only. Download this version of

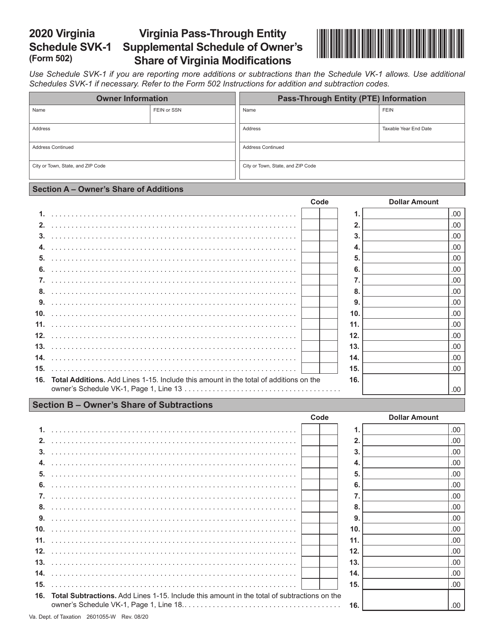

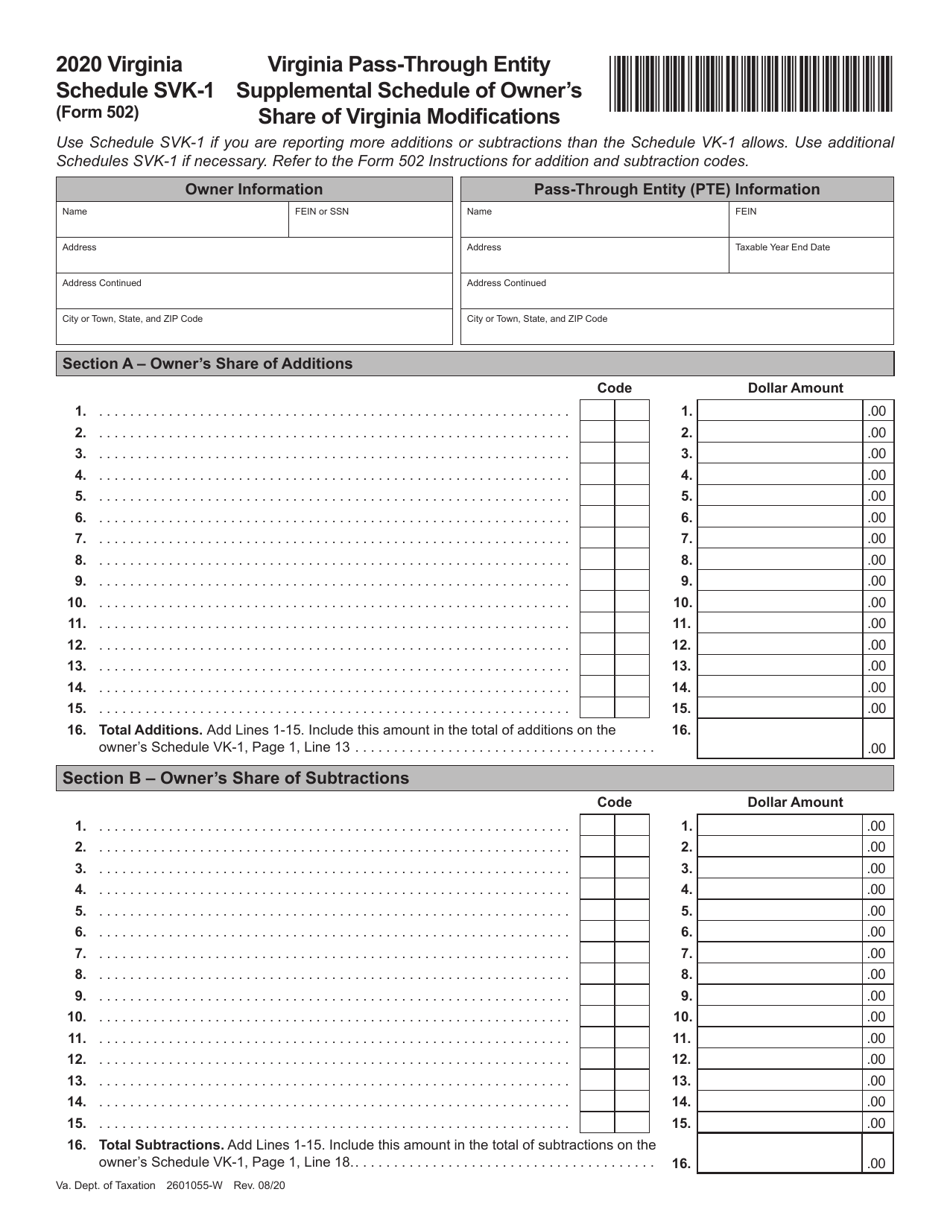

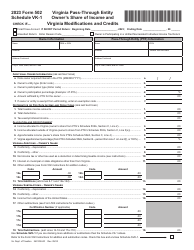

Form 502 Schedule SVK-1

for the current year.

Form 502 Schedule SVK-1 Virginia Pass-Through Entity Supplemental Schedule of Owner's Share of Virginia Modifications - Virginia

What Is Form 502 Schedule SVK-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form 502, Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502 Schedule SVK-1?

A: Form 502 Schedule SVK-1 is the Virginia Pass-Through Entity Supplemental Schedule of Owner's Share of Virginia Modifications.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that passes its income, losses, deductions, and credits through to its owners for tax purposes.

Q: What is the purpose of Form 502 Schedule SVK-1?

A: The purpose of Form 502 Schedule SVK-1 is to calculate and report the owner's share of Virginia modifications for a pass-through entity.

Q: What are Virginia modifications?

A: Virginia modifications are adjustments made to the federal taxable income of a pass-through entity to determine the Virginia taxable income.

Q: Who needs to file Form 502 Schedule SVK-1?

A: Pass-through entities operating in Virginia and their owners are required to file Form 502 Schedule SVK-1.

Q: When is the deadline to file Form 502 Schedule SVK-1?

A: The deadline to file Form 502 Schedule SVK-1 is the same as the deadline to file the pass-through entity's annual income tax return.

Q: Are there any penalties for not filing Form 502 Schedule SVK-1?

A: Yes, there are penalties for not filing Form 502 Schedule SVK-1, including fines and interest on unpaid taxes.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502 Schedule SVK-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.