This version of the form is not currently in use and is provided for reference only. Download this version of

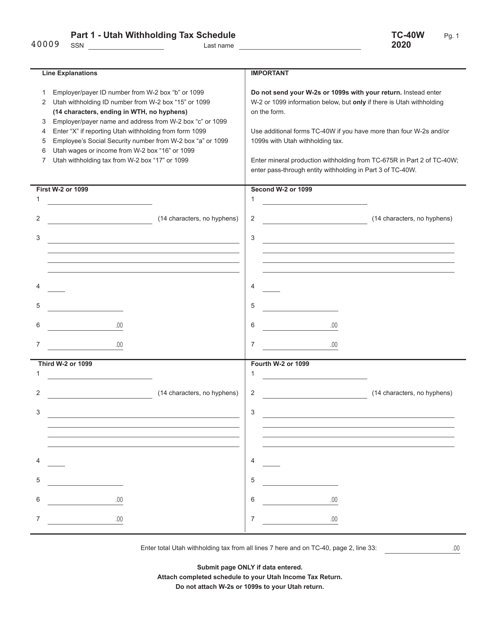

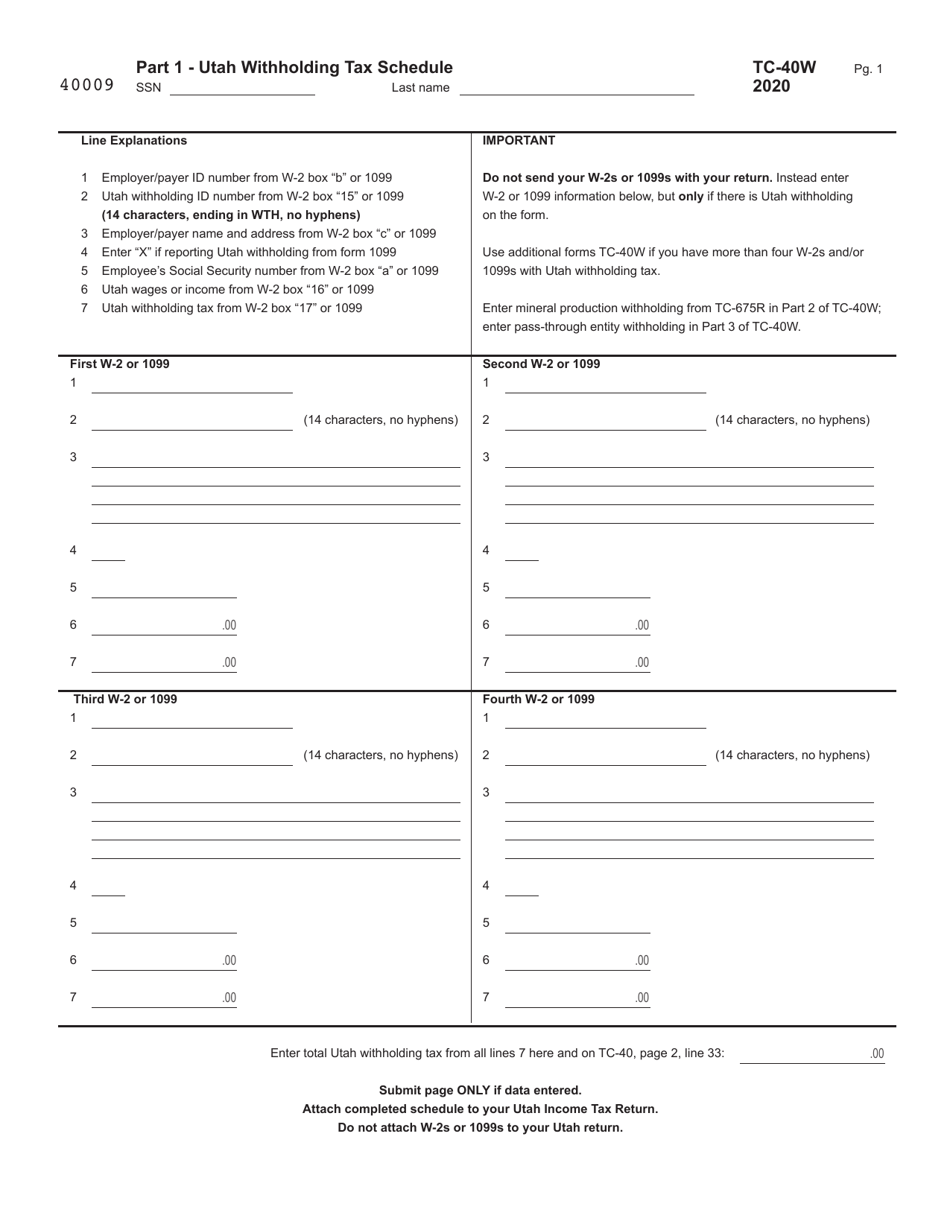

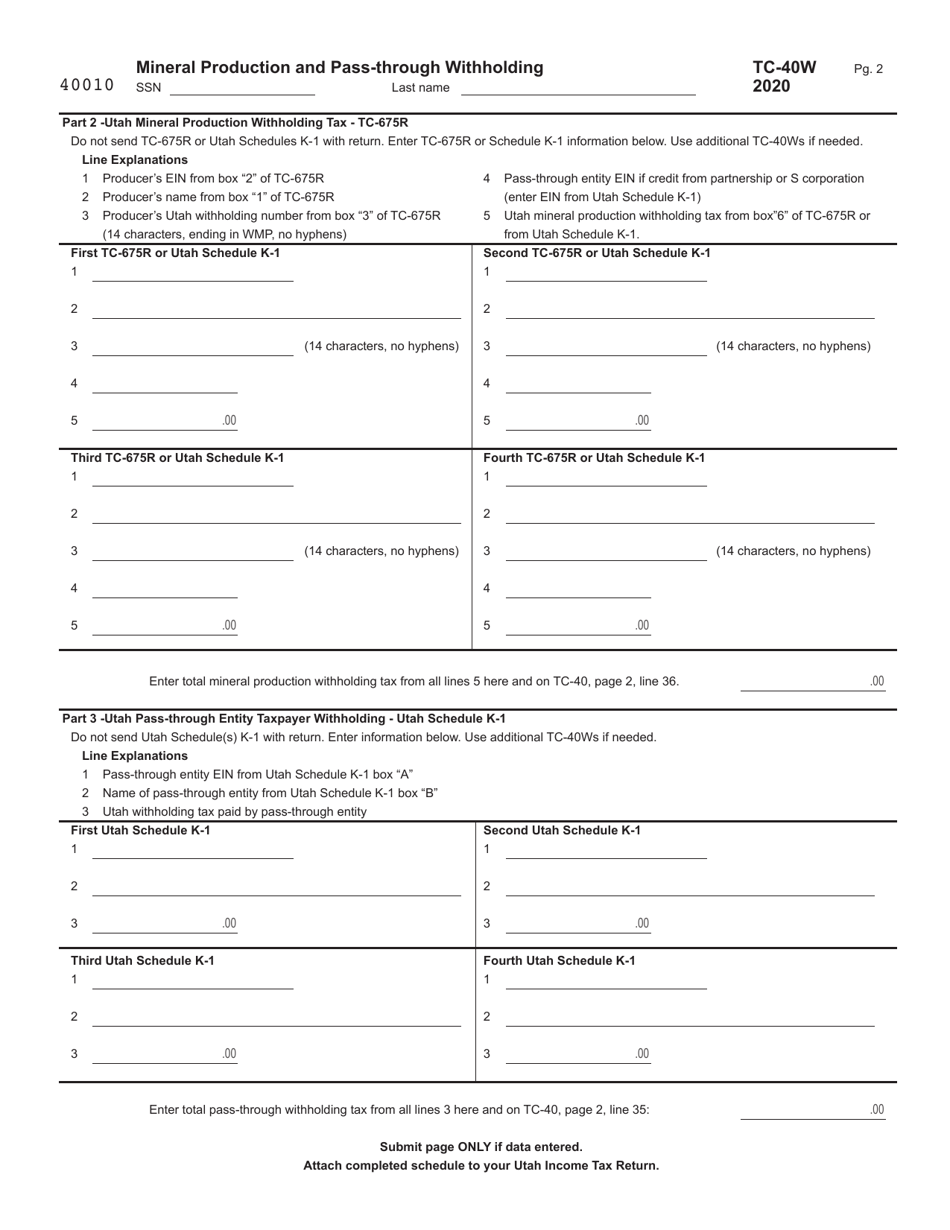

Form TC-40W

for the current year.

Form TC-40W Utah Withholding Tax Schedule - Utah

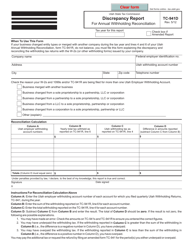

What Is Form TC-40W?

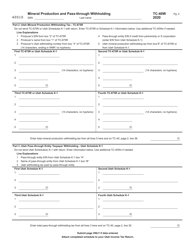

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TC-40W?

A: Form TC-40W is the Utah Withholding Tax Schedule.

Q: What is the purpose of Form TC-40W?

A: The purpose of Form TC-40W is to report and remit Utah withholding taxes.

Q: Who needs to file Form TC-40W?

A: Employers who have employees subject to Utah withholding tax must file Form TC-40W.

Q: When is Form TC-40W due?

A: Form TC-40W is due on a quarterly basis, with the due dates being April 30, July 31, October 31, and January 31.

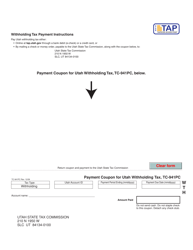

Q: How do I file Form TC-40W?

A: Form TC-40W can be filed electronically through the Utah Taxpayer Access Point (TAP) or by mailing a paper copy to the Utah State Tax Commission.

Q: What information is required on Form TC-40W?

A: Form TC-40W requires information such as the employer's name, address, and EIN, as well as details about the employees and their wages subject to Utah withholding tax.

Q: Are there penalties for not filing Form TC-40W?

A: Yes, there are penalties for not filing Form TC-40W, including fines and interest charges.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40W by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.