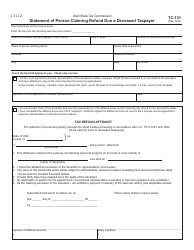

This version of the form is not currently in use and is provided for reference only. Download this version of

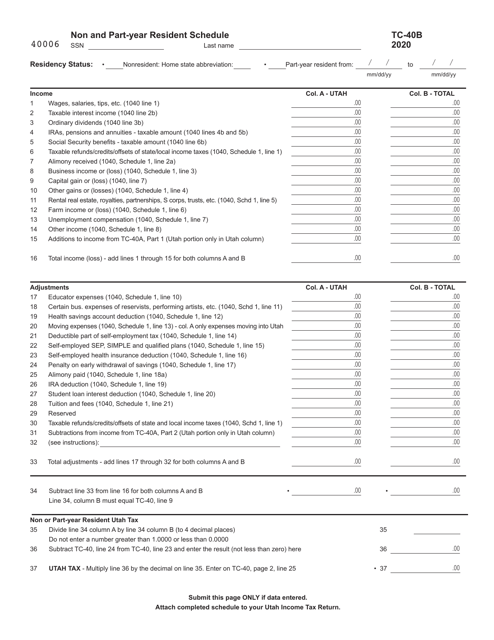

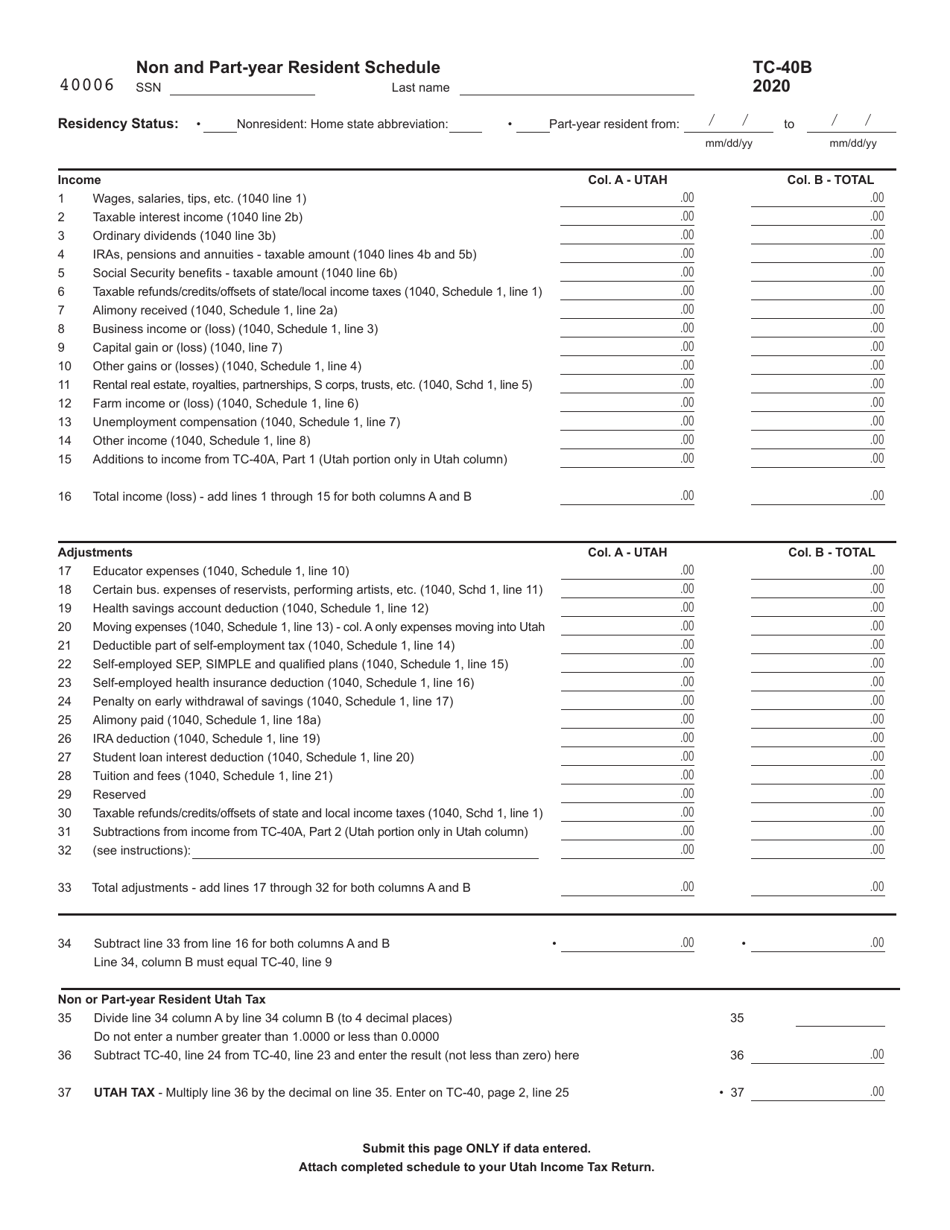

Form TC-40B

for the current year.

Form TC-40B Non and Part-Year Resident Schedule - Utah

What Is Form TC-40B?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form TC-40B?

A: Non-residents and part-year residents of Utah.

Q: What is the purpose of Form TC-40B?

A: To calculate and report incometax liability for non-residents and part-year residents of Utah.

Q: What information is required to complete Form TC-40B?

A: You will need to provide information about your income, deductions, and credits for the period you were a non-resident or part-year resident of Utah.

Q: Can I file Form TC-40B electronically?

A: Yes, you can file Form TC-40B electronically if you meet the eligibility requirements.

Q: When is Form TC-40B due?

A: Form TC-40B is generally due on the same date as your federal income tax return, which is usually April 15th.

Q: What if I need more time to file Form TC-40B?

A: You can request an extension to file Form TC-40B, but you must still pay any taxes owed by the original due date.

Q: Do I need to include a copy of my federal tax return with Form TC-40B?

A: No, you do not need to include a copy of your federal tax return with Form TC-40B.

Q: Can I make changes to my Form TC-40B after I have filed it?

A: Yes, you can file an amended Form TC-40B if you need to make changes to your original filing.

Q: What if I have questions or need help with Form TC-40B?

A: You can contact the Utah State Tax Commission for assistance with Form TC-40B.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40B by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.