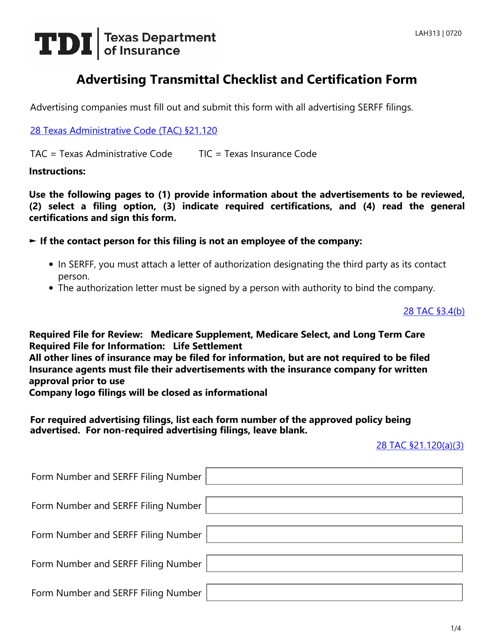

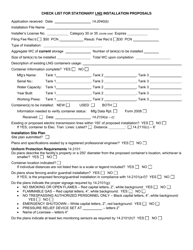

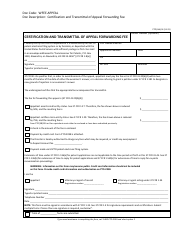

Form LAH313 Advertising Transmittal Checklist and Certification Form - Texas

What Is Form LAH313?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the LAH313 Advertising Transmittal Checklist and Certification Form?

A: The LAH313 Advertising Transmittal Checklist and Certification Form is a document used in Texas for advertising purposes.

Q: What is the purpose of the LAH313 form?

A: The purpose of the LAH313 form is to provide a checklist and certification for advertising materials.

Q: Who needs to use the LAH313 form?

A: Anyone who is involved in advertising in Texas may need to use the LAH313 form.

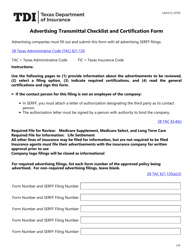

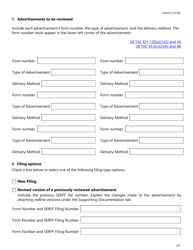

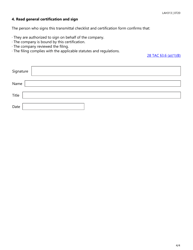

Q: How should I fill out the LAH313 form?

A: The LAH313 form should be filled out by providing the required information and checking off the items on the checklist.

Q: Is the LAH313 form mandatory?

A: The requirement for using the LAH313 form may vary depending on the specific advertising regulations in Texas. It is advisable to consult with the relevant authorities to determine if the form is mandatory.

Q: What happens after I submit the LAH313 form?

A: The submission and review process for the LAH313 form may vary depending on the regulatory agency. It is important to follow any instructions provided and comply with any additional requirements.

Q: Are there any fees associated with the LAH313 form?

A: The fees, if any, associated with the LAH313 form may vary depending on the specific advertising regulations in Texas. It is advisable to consult with the relevant authorities or review the official fee schedule.

Q: Can I make changes to the LAH313 form after submission?

A: The ability to make changes to the LAH313 form after submission may vary depending on the specific regulatory agency. It is advisable to contact the relevant authorities for guidance on making any necessary changes.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LAH313 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.