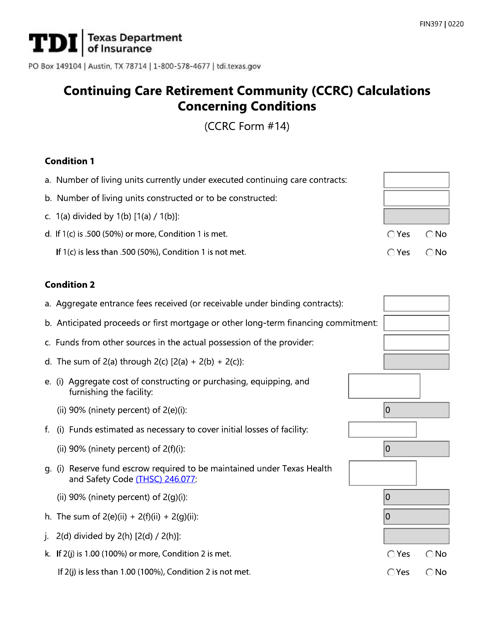

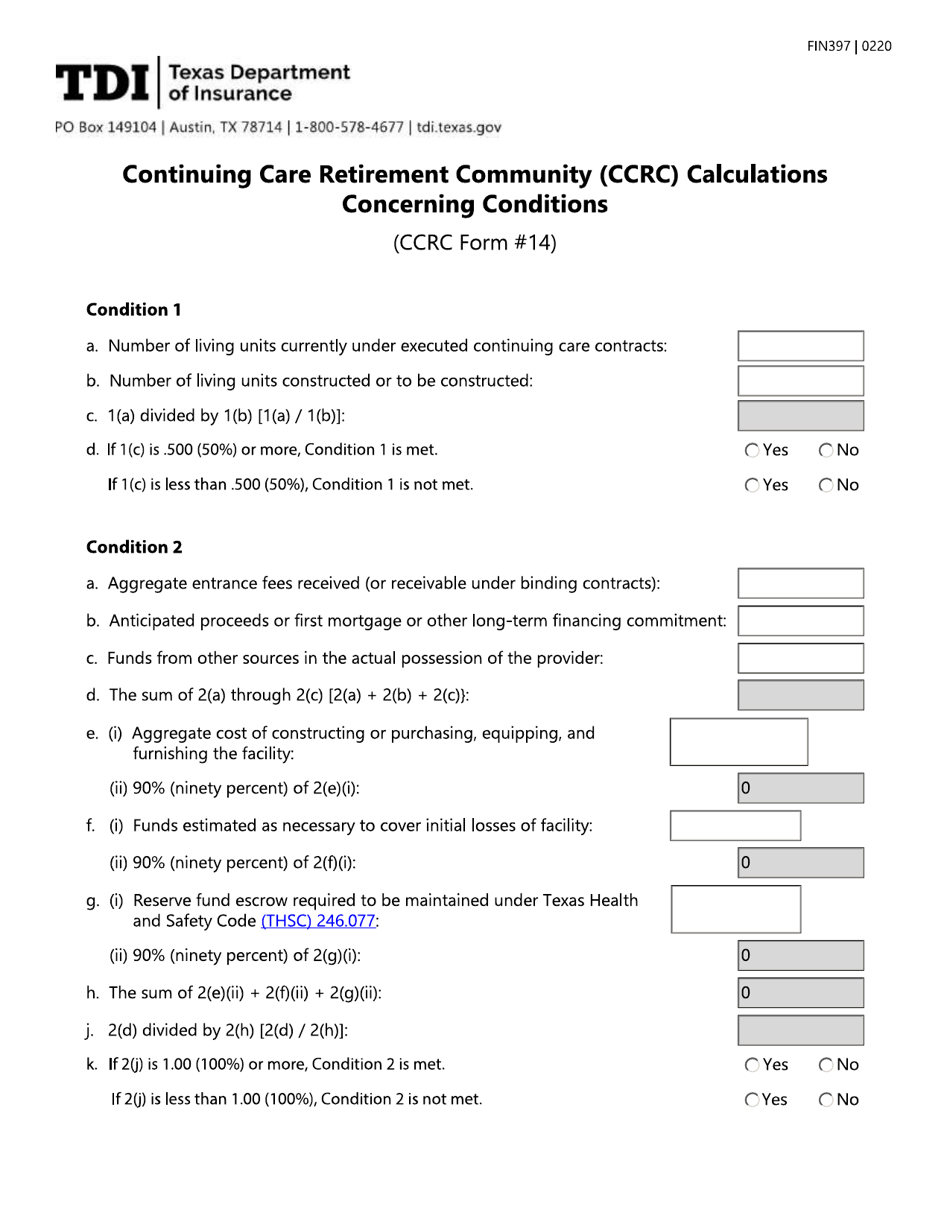

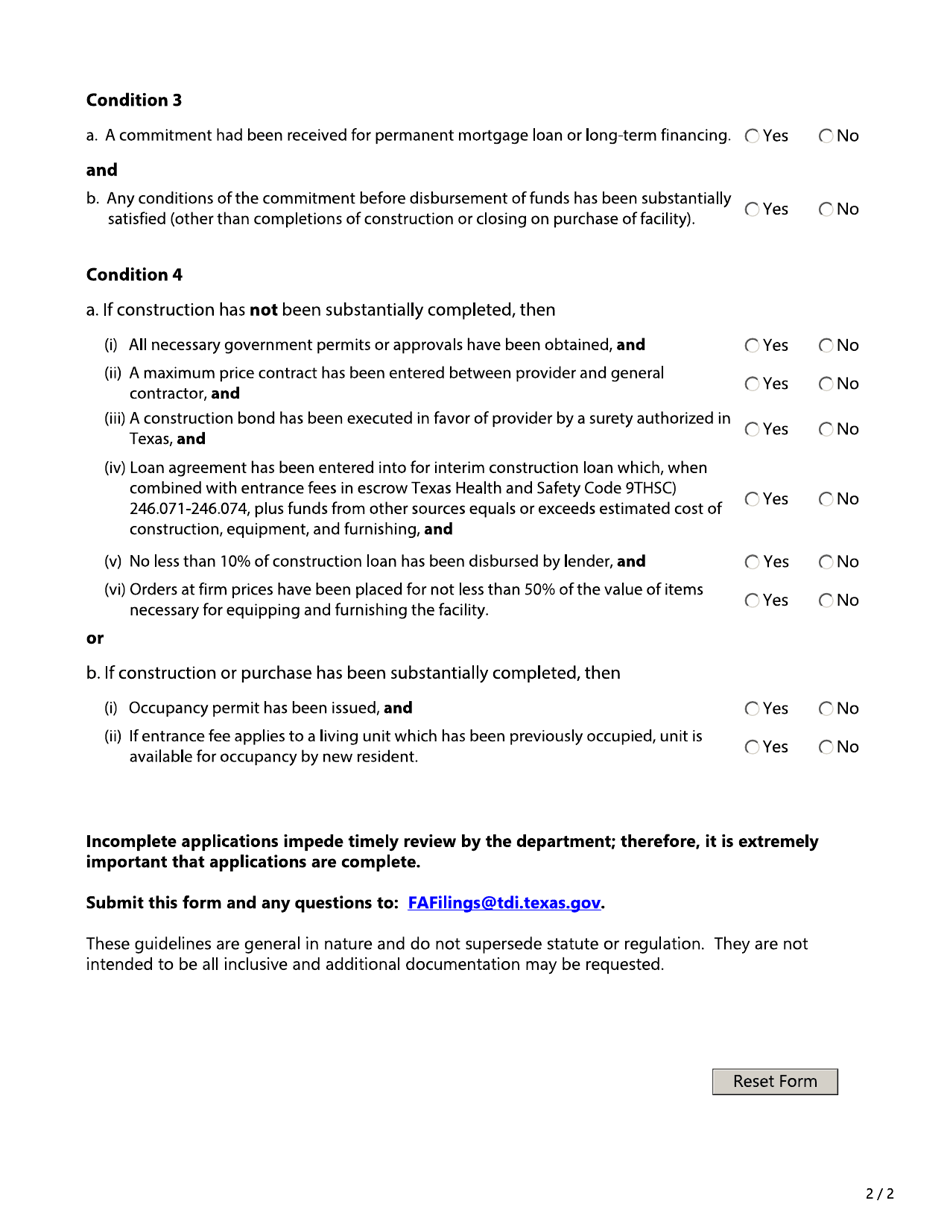

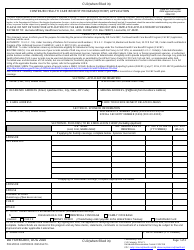

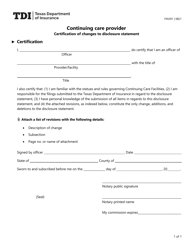

Form FIN397 (CCRC Form 14) Continuing Care Retirement Community (Ccrc) Calculations Concerning Conditions - Texas

What Is Form FIN397 (CCRC Form 14)?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIN397 (CCRC Form 14)?

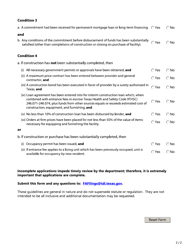

A: Form FIN397 (CCRC Form 14) is a document used in Texas for calculating conditions related to Continuing Care Retirement Communities (CCRCs).

Q: What are Continuing Care Retirement Communities (CCRCs)?

A: Continuing Care Retirement Communities (CCRCs) are residential communities that offer a range of living options and on-site healthcare services as residents' needs change over time.

Q: What is the purpose of Form FIN397 (CCRC Form 14)?

A: Form FIN397 (CCRC Form 14) is used to assess and calculate the financial conditions of CCRCs in Texas.

Q: Who uses Form FIN397 (CCRC Form 14)?

A: Form FIN397 (CCRC Form 14) is used by regulators and agencies in Texas responsible for overseeing CCRCs.

Q: What type of information is included in Form FIN397 (CCRC Form 14)?

A: Form FIN397 (CCRC Form 14) requires CCRCs to provide financial information such as revenue, expenses, and occupancy rates.

Q: Why is Form FIN397 (CCRC Form 14) important?

A: Form FIN397 (CCRC Form 14) allows regulators and agencies to evaluate the financial stability and viability of CCRCs.

Q: Are CCRCs regulated in Texas?

A: Yes, CCRCs in Texas are regulated to ensure consumer protection and financial stability.

Q: Are CCRCs common in Texas?

A: Yes, Texas has a significant number of CCRCs offering a range of housing and healthcare options for retirees.

Q: What should I do if I have concerns about a CCRC in Texas?

A: If you have concerns about a CCRC in Texas, you should contact the regulatory agency responsible for overseeing CCRCs in the state.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN397 (CCRC Form 14) by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.